Table of Contents

Introduction

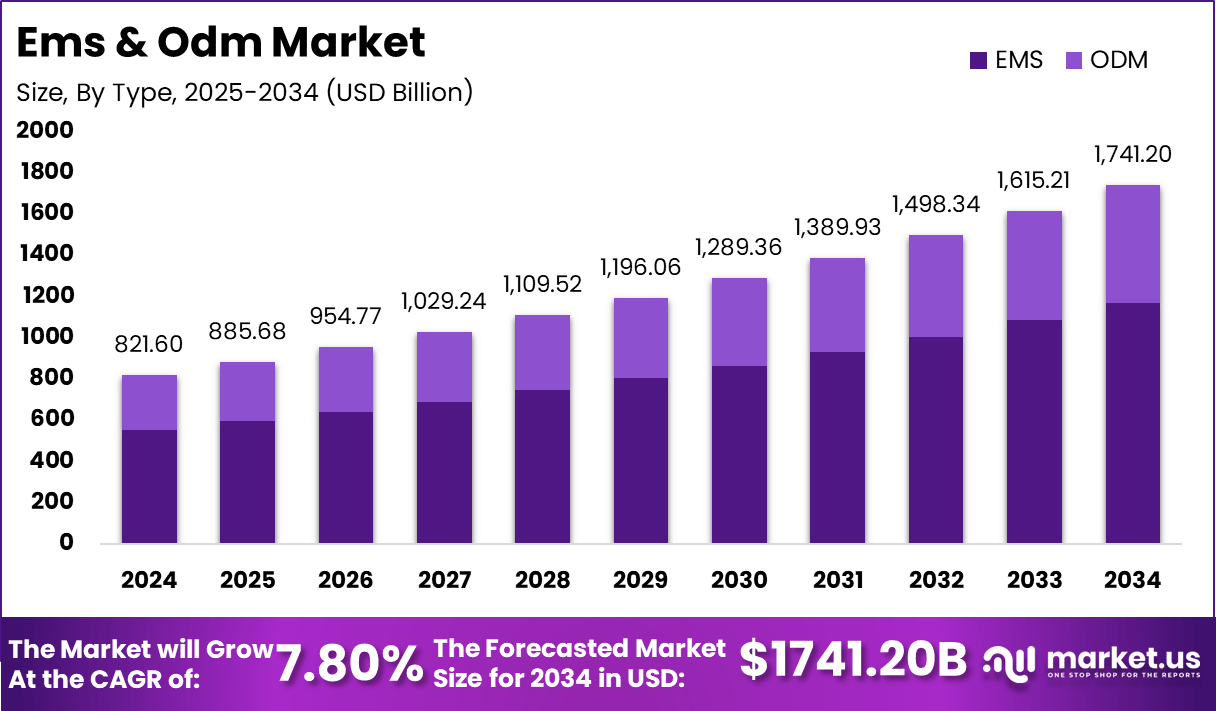

The global EMS & ODM market generated USD 821.6 billion in 2024 and is projected to reach USD 1,741.2 billion by 2034, expanding at a steady 7.80% CAGR. Growth is fueled by rising demand for consumer electronics, telecom infrastructure, automotive electronics, and industrial automation. Asia Pacific dominated with a 52.7% share (USD 432.9 billion) in 2024, supported by large-scale manufacturing ecosystems. China remains the central hub, valued at USD 259.8 billion in 2024, expected to climb to USD 607.2 billion by 2034 at an 8.86% CAGR. Increasing outsourcing, rapid prototyping, and design-led manufacturing are shaping industry expansion.

How Growth Is Impacting the Economy

The EMS & ODM industry plays a significant role in economic development by strengthening global supply chains, accelerating technology diffusion, and supporting industrial innovation. Rising demand for electronic systems boosts investments in semiconductors, printed circuit boards, robotics, and automated assembly lines. Countries benefit from increased export revenues, job creation in engineering and manufacturing, and expanded industrial clusters.

As companies outsource more design and production tasks, economies experience productivity gains and improved manufacturing competitiveness. Government-backed initiatives in digitalization, smart factories, and trade facilitation further enhance industrial output. The growth of EMS & ODM services also stimulates ancillary markets, including logistics, testing labs, and equipment suppliers. Overall, the sector drives economic diversification and elevates global competitiveness in high-tech manufacturing.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/ems-odm-market/free-sample/

Impact on Global Businesses

Businesses face rising costs due to advanced semiconductor shortages, higher wages in key manufacturing regions, and increased investment needs for automation. Supply chain shifts are accelerating as companies diversify production away from single-country dependence, pushing multi-region manufacturing strategies. Consumer electronics and telecom sectors experience faster time-to-market demands, requiring flexible design and prototyping cycles.

Automotive and industrial manufacturers increase reliance on EMS partners for EV components and smart automation systems. Medical device companies leverage ODM expertise for regulatory-compliant product development, while IoT and wearable-device producers depend heavily on outsourced assembly efficiency. These shifts require stronger coordination, risk management, and digital supply-chain visibility.

Strategies for Businesses

- Expand multi-country sourcing to minimize geopolitical and supply risks.

- Invest in automation-driven manufacturing partnerships to reduce long-term costs.

- Strengthen collaboration with design-centric ODM partners for faster prototyping.

- Adopt digital supply-chain tools for forecasting and real-time visibility.

- Focus on sustainability, material efficiency, and energy-optimized production systems.

Key Takeaways

- The market is expected to reach USD 1,741.2 billion by 2034.

- Asia Pacific remains the global manufacturing powerhouse.

- Strong growth driven by EVs, 5G, IoT, and consumer electronics.

- Supply-chain diversification is becoming critical.

- ODM-led innovation is accelerating time-to-market for brands.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=165566

Analyst Viewpoint

The current market trajectory is strong as brands increasingly favor design-led outsourcing to accelerate innovation and reduce manufacturing complexity. Present growth is supported by high-volume consumer electronics and expansion in automotive electronics. Prospects remain positive with rising demand for EV platforms, AI-enabled devices, and industrial automation. Digital factories, robotics, and smart supply chains will significantly enhance efficiency and speed, enabling EMS & ODM providers to deliver more integrated, value-added solutions. The industry is expected to become increasingly design-centric, resilient, and technologically advanced.

Use Case and Growth Factors

| Category | Details |

|---|---|

| Use Case | Outsourced manufacturing for smartphones, wearables, and consumer electronics |

| Use Case | ODM-led design and prototyping for automotive and industrial systems |

| Use Case | High-volume assembly for telecom, EV components, and IoT devices |

| Growth Factor | Surge in 5G, EVs, and IoT adoption |

| Growth Factor | Demand for cost-efficient, high-volume production |

| Growth Factor | Government incentives for electronics manufacturing |

| Growth Factor | Increasing preference for design-led outsourcing |

Regional Analysis

Asia Pacific dominates with a 52.7% share, anchored by China, Vietnam, Malaysia, and India’s expanding electronics ecosystems. China remains the core manufacturing hub, supported by advanced supply chains, skilled labor, and strong industrial policy. North America shows steady growth due to reshoring efforts and rising demand for automotive and semiconductor manufacturing. Europe benefits from increased outsourcing in industrial automation and medical devices. Emerging regions such as Latin America and Southeast Asia are gaining traction as alternative production bases due to competitive labor costs and supportive policy initiatives.

➤ Want more market wisdom? Browse reports –

- AI Interactive Display Market

- Smart Contracts In Trade Finance Market

- Brokers & Corporate Agents Market

- Earned Wage Access Providers Market

Business Opportunities

Major opportunities lie in EV electronics manufacturing, smart-home devices, 5G telecom equipment, industrial automation modules, and wearable technologies. ODM-driven innovation creates strong potential in product design, rapid prototyping, and customized electronics development. Robotics adoption opens opportunities in intelligent manufacturing lines and automated testing. Rising reshoring and friend-shoring strategies further boost demand for localized EMS capabilities. Companies offering advanced PCB design, power electronics integration, and AI-enabled manufacturing analytics will benefit significantly.

Key Segmentation

The EMS & ODM market spans electronic design services, PCB assembly, system integration, component sourcing, prototyping, and full-device manufacturing. Key application segments include consumer electronics, telecom equipment, automotive electronics, industrial machinery, medical devices, and IoT products. End-users include technology brands, automotive manufacturers, industrial OEMs, healthcare device companies, and telecom operators. Strongest growth is concentrated in EV platforms, connected devices, and advanced industrial electronics requiring rapid customization.

Key Player Analysis

Leading players focus on improving manufacturing automation, expanding global production footprints, and enhancing design-led services. Their strategies include strengthening supply-chain resilience, investing in smart factory technologies, and offering highly flexible, scalable production models. Emphasis is placed on value-added engineering capabilities, component sourcing efficiency, and lifecycle management. These companies continuously upgrade operational excellence, integrate digital manufacturing tools, and partner with technology brands to shorten product development cycles and support large-scale deployments.

- Foxconn

- Wistron Corporation

- Flex Limited

- Jabil

- CICOR

- Zollner Elektronik Ag

- EOLANE Group

- Lacroix Electronics

- Pegatron Corporation

- AEMTEC GMBH

- Katek Group

- Kappa Optronics GMBH

- Phoenix Contact

- Sanmina Corporation

- Compal Inc.

- New KIMPO Group

- Others

Recent Developments

- January 2025: A Major EMS provider expanded automated assembly lines across Southeast Asia.

- March 2025: New ODM platform launched for rapid IoT device prototyping.

- June 2025: A Large manufacturer invested in robotics-enabled smart factory systems.

- August 2025: New EV electronics assembly unit established in China.

- October 2025: A Global EMS firm partnered with a semiconductor supplier for optimized component sourcing.

Conclusion

The EMS & ODM market is entering a transformative decade, driven by electronics innovation, automation, and global supply-chain restructuring. With strong momentum in the Asia Pacific and rising design-led manufacturing, the industry is poised for sustained long-term expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)