Table of Contents

Introduction

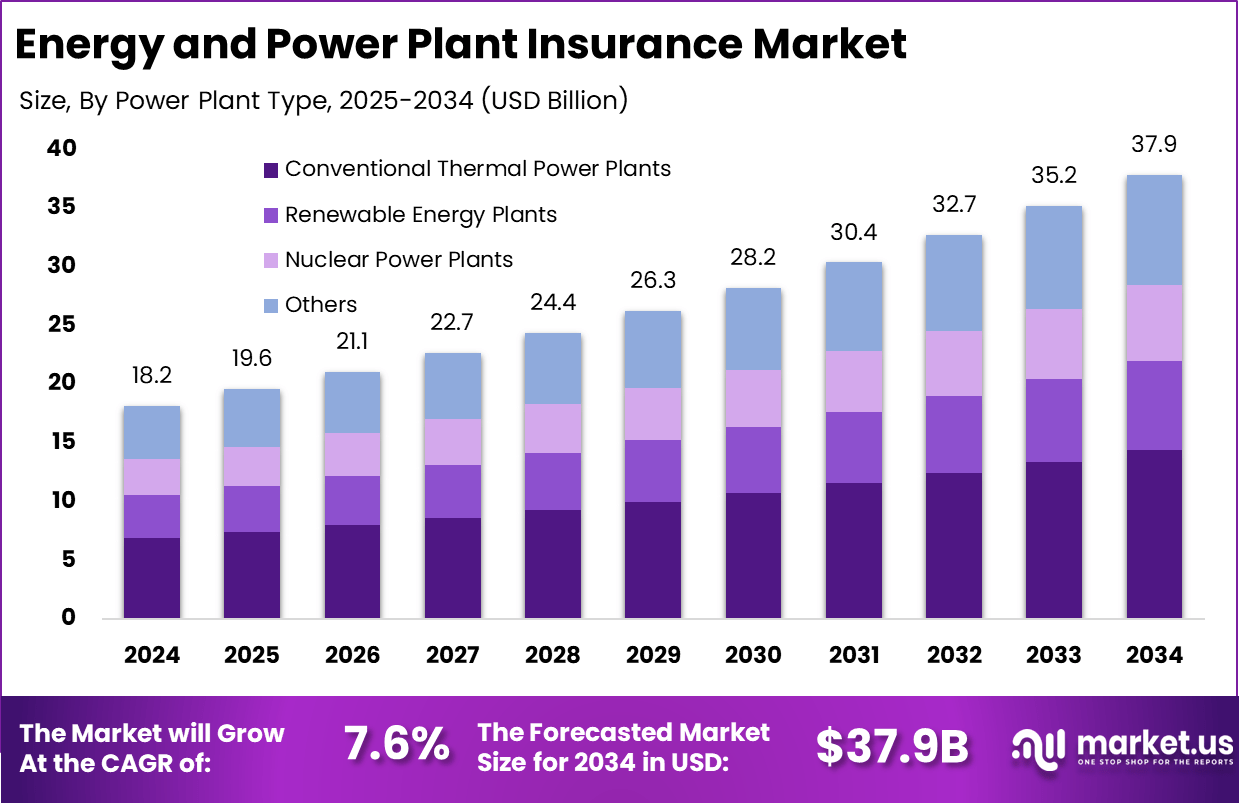

The Global Energy and Power Plant Insurance Market is projected to grow from USD 18.2 billion in 2024 to USD 37.9 billion by 2034, registering a CAGR of 7.6%. Rising investments in renewable infrastructure, increasing frequency of natural disasters, and expanding global power generation capacity drive this growth. Asia Pacific led the market in 2024 with a 39.6% share, generating USD 7.20 billion in revenue due to large-scale energy expansion and heightened risk-mitigation priorities across industrial economies.

How Growth Is Impacting the Economy

The steady expansion of energy and power plant insurance contributes directly to global economic stability by safeguarding high-value infrastructure and reducing financial exposure during operational disruptions. As governments upgrade grids, expand renewable capacity, and modernize thermal plants, insurers play a critical role in maintaining investor confidence.

This market reduces the macroeconomic impact of outages, extreme climate events, and equipment failures, ensuring a continuous electricity supply—a key driver of industrial productivity and GDP growth. Premium growth also enables broader capital allocation toward risk engineering, loss prevention, and technology upgrades, stimulating related employment across engineering, construction, and risk analytics sectors. Long-term market expansion supports resilience-building in emerging economies heavily reliant on energy infrastructure for industrialization.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/energy-power-plant-insurance-market/free-sample/

Impact on Global Businesses

Rising operational costs, volatile energy prices, and regulatory compliance pressures push companies to strengthen insurance coverage for assets, equipment, and transmission infrastructure. Supply chain shifts—especially delays in turbine components, transformers, solar modules, and high-voltage parts—heighten risk exposure, making comprehensive insurance essential for uninterrupted operations.

Sector-specific impacts are notable:

• Renewable plants require specialized coverage for wind turbine failures and solar farm weather events.

• Thermal plants face growing breakdown risks due to aging systems.

• Nuclear facilities prioritize liability and safety risk management.

• Industrial consumers depend on business interruption insurance to tide them over downtime from grid failures.

Strategies for Businesses

Businesses should adopt risk-based asset management programs, integrate predictive maintenance technologies, and align insurance planning with long-term sustainability goals. Enhancing cyber-resilience, improving compliance with emission and safety standards, and diversifying supplier bases reduce exposure. Renewable project developers should collaborate with insurers early in the design phase to optimize coverage. Leveraging digital twins, IoT monitoring, and advanced loss-prevention models enables companies to negotiate better premiums while ensuring higher reliability across operations.

Key Takeaways

- The global market is valued at USD 18.2 billion in 2024.

- Expected to reach USD 37.9 billion by 2034.

- CAGR stands at 7.6% from 2025–2034.

- Asia Pacific leads with 39.6% share and USD 7.20 billion revenue.

- Growth driven by renewable expansion and climate-related risks.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=166379

Analyst Viewpoint

The energy and power plant insurance sector is strengthening rapidly as global infrastructure modernization accelerates. Present trends indicate surging demand for coverage tailored to renewable assets, cyber-protection, and business interruption minimization. Looking ahead, insurers are expected to integrate real-time monitoring, AI-based risk modeling, and parametric products that improve payout speed and accuracy. This sector shows strong long-term potential supported by global decarbonization commitments, renewable project pipelines, and rising climate-risk awareness, creating a robust and positive future outlook.

Use Cases & Growth Factors

| Category | Details |

|---|---|

| Use Cases | Renewable project insurance, equipment breakdown coverage, cyber-risk protection, natural disaster loss coverage, business interruption insurance |

| Growth Factors | Renewable energy expansion, rising climate disasters, grid modernization, increasing asset values, stricter regulatory compliance |

Regional Analysis

Asia Pacific dominates due to rapid industrialization, renewable power capacity additions, and rising climate-driven risk exposure. North America sees consistent growth driven by aging grid infrastructure and increasing hurricane and wildfire events. Europe advances due to strong insurance penetration, decarbonization targets, and the modernization of offshore wind assets. The Middle East & Africa grow from expanding thermal and solar investments, while Latin America benefits from hydropower development and rising insurance adoption across emerging energy markets.

➤ Want more market wisdom? Browse reports –

- Barber Booking Apps Market

- AI Hiring Software Market

- Neural Processors Market

- Transient Protection Device Market

Business Opportunities

Major opportunities arise from renewable energy insurance, especially offshore wind, utility-scale solar, and battery storage systems. Cyber-insurance for smart grids and digitalized power plants continues to grow as cyberattacks intensify. Parametric insurance products create new revenue streams by offering faster payouts for climate-related events. Insurers can also expand into engineering risk advisory, predictive maintenance analytics, and tailored insurance programs for hybrid renewable-storage systems, strengthening their global footprint.

Key Segmentation

The market spans segments such as by insurance type (property insurance, liability insurance, business interruption insurance, cyber insurance, machinery breakdown insurance), by power plant type (thermal, renewable, nuclear, hydro), by risk type (natural disasters, operational failures, cyber risks), and by end user (utilities, IPPs, EPC companies). Renewable-focused insurance is expanding the fastest due to rising global clean-energy investments, while machinery breakdown insurance remains essential for aging thermal and hydro facilities.

Key Player Analysis

Leading participants strengthen their portfolios through the development of risk-engineering services, advanced climate-risk modeling tools, and sector-specific insurance products for renewable assets. They invest in digital platforms, IoT-based monitoring partnerships, and predictive analytics to lower claim ratios and improve underwriting efficiency. Expansion strategies include entering high-growth emerging markets, collaborating with EPC firms on early-stage project risk assessment, and designing modular insurance solutions tailored to hybrid and decentralized energy systems.

- Munich Re

- Swiss Re

- AIG

- Allianz SE

- Zurich Insurance Group

- Chubb

- AXA XL

- Liberty Mutual

- Berkshire Hathaway

- Travelers

- Generali

- Tokio Marine

- Sompo International

- RenaissanceRe

- Starr International

- Others

Recent Developments

- Introduction of parametric insurance products for extreme weather events.

- Launch of digital underwriting platforms for renewable energy assets.

- Expansion of cyber-insurance coverage for smart grids.

- Strategic partnerships with EPC firms for project-based risk advisory.

- New insurance frameworks supporting large-scale offshore wind deployments.

Conclusion

The Energy and Power Plant Insurance Market is expanding steadily as global energy systems modernize and climate risks intensify. Strong growth prospects, rising renewable investments, and digital risk-management tools position this market for continued long-term advancement.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)