Table of Contents

- Introduction

- Editor’s Choice

- Engineering Services Outsourcing (ESO) Market Overview

- Factors Driving the Demand for Engineering Services Outsourcing (ESO)

- Most Important Factors for Engineering and R&D Executives When Choosing an Outsourcing Provider

- Companies Share of Outsourced Engineering and R&D Activities

- Engineering and R&D Spending

- Challenges and Barriers to Engineering Services Outsourcing

- Regulations for Engineering Services Outsourcing

Introduction

According to Engineering Services Outsourcing (ESO) Statistics, Engineering Services Outsourcing (ESO) involves delegating engineering tasks to external providers, offering benefits such as cost savings, access to specialized skills, and enhanced flexibility.

ESO encompasses various mechanical and electrical engineering disciplines, with engagement models ranging from project-based to full-service outsourcing.

Companies can use a global delivery model and technological infrastructure to ensure effective communication and collaboration across distributed teams.

Quality assurance measures and risk management strategies are vital to maintain standards and mitigate inherent risks.

Overall, ESO enables companies to focus on core competencies, accelerate time-to-market, and expand their global reach through strategic partnerships and efficient resource utilization.

Editor’s Choice

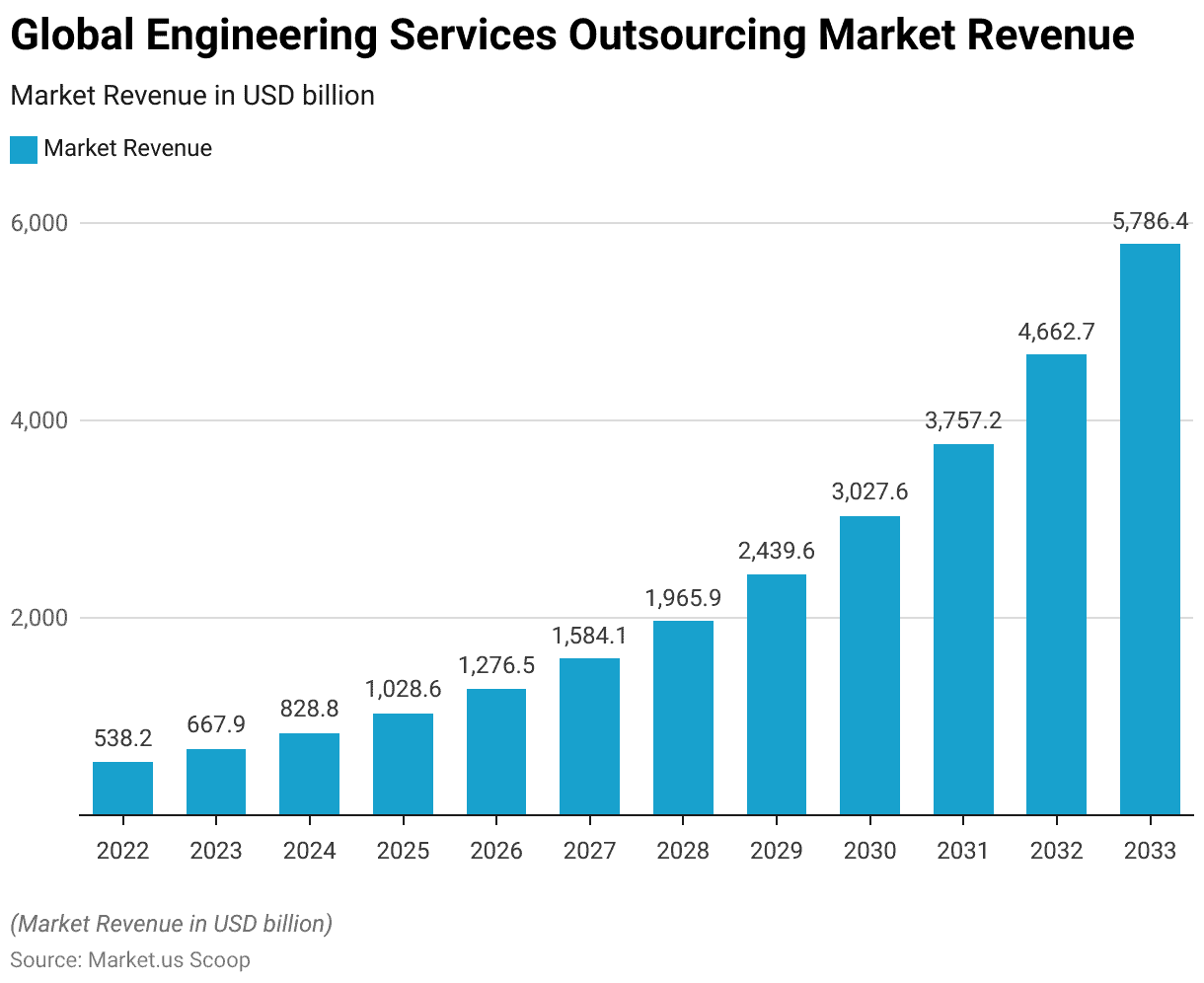

- The global engineering services outsourcing market revenue is expected to reach USD 5,786.4 billion by 2033.

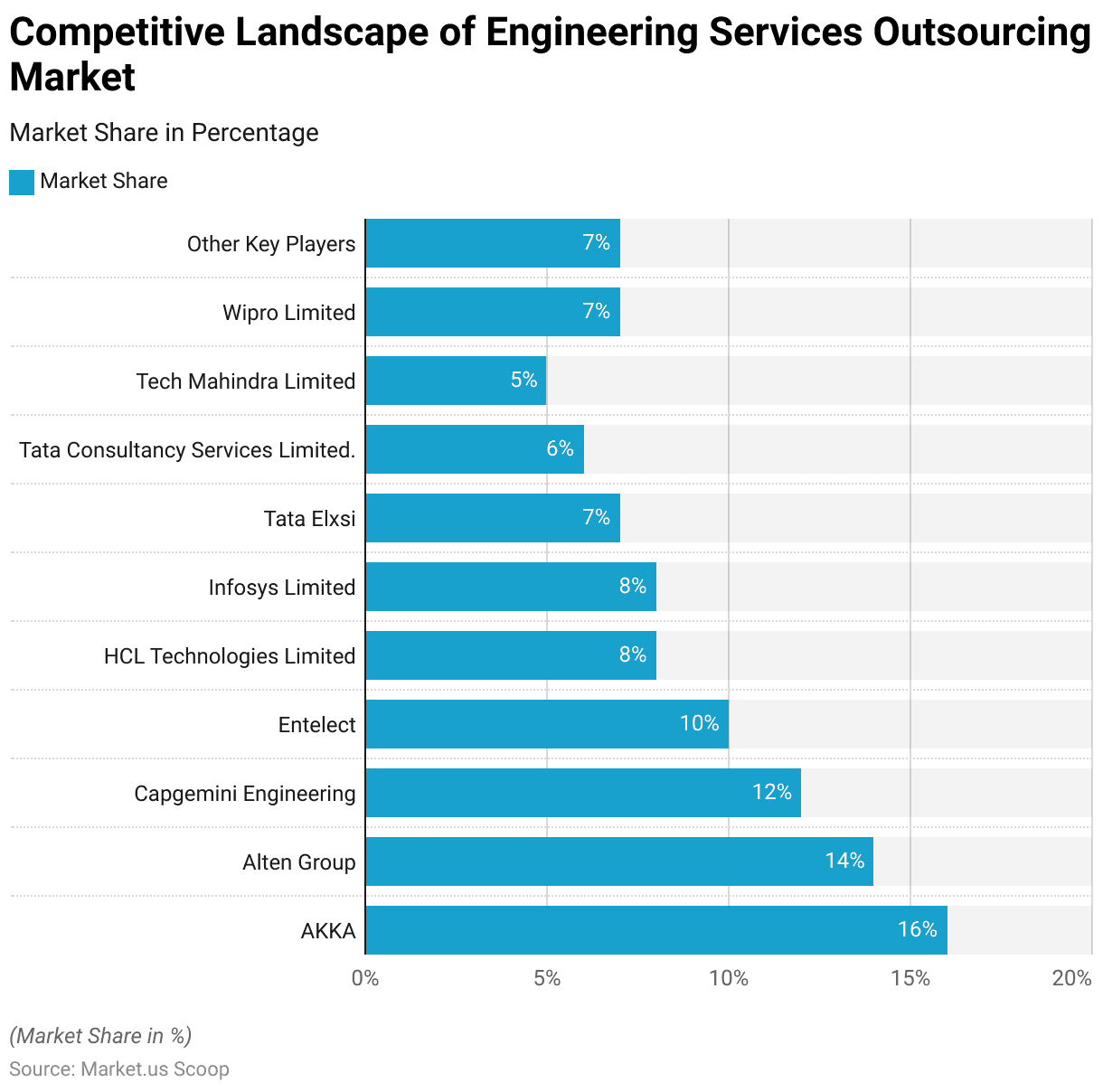

- In the global engineering services outsourcing market, AKKA holds the largest market share at 16%, showcasing its leading position in the industry.

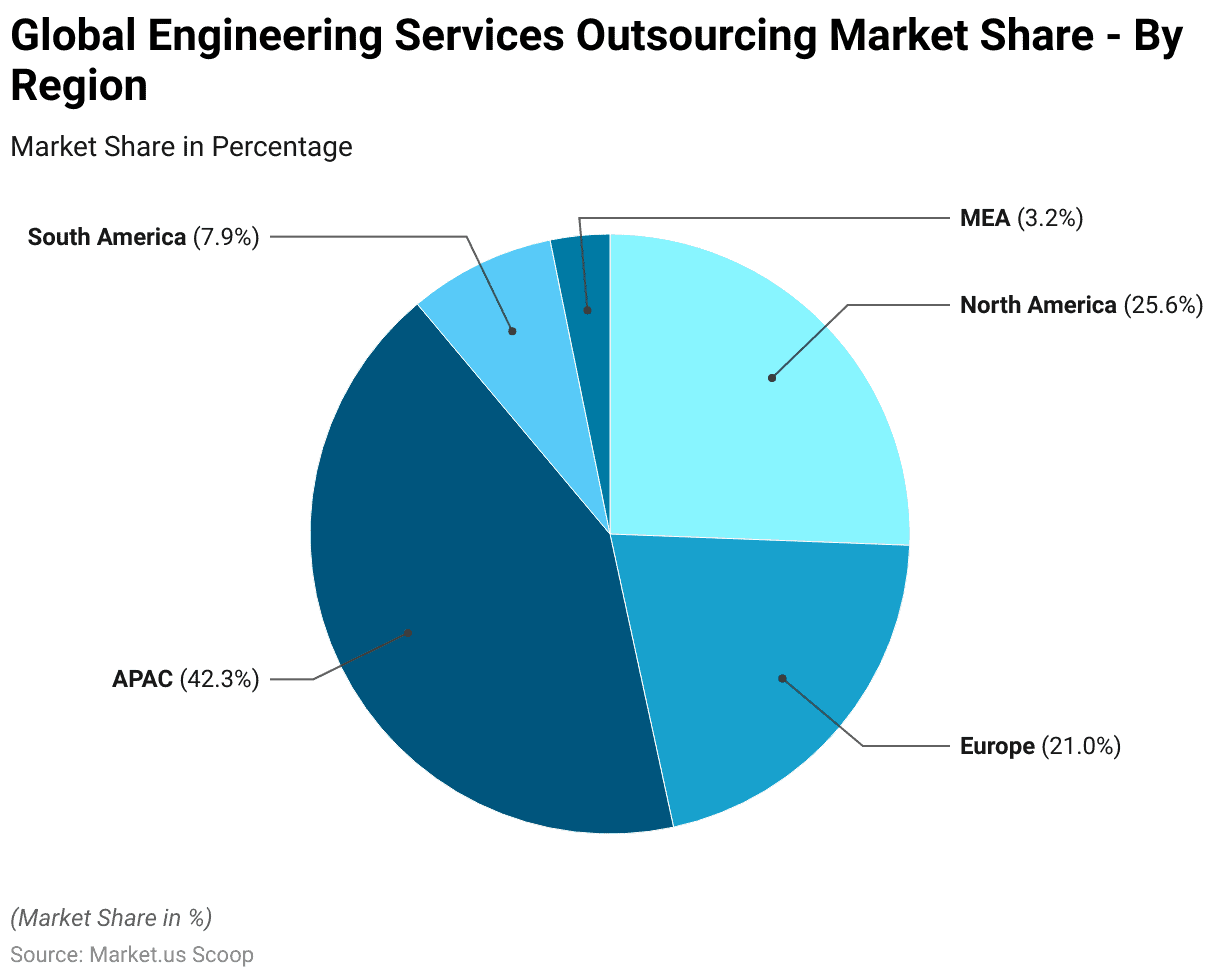

- The Asia-Pacific (APAC) region dominates with a substantial 42.3% market share, highlighting its major role in the industry.

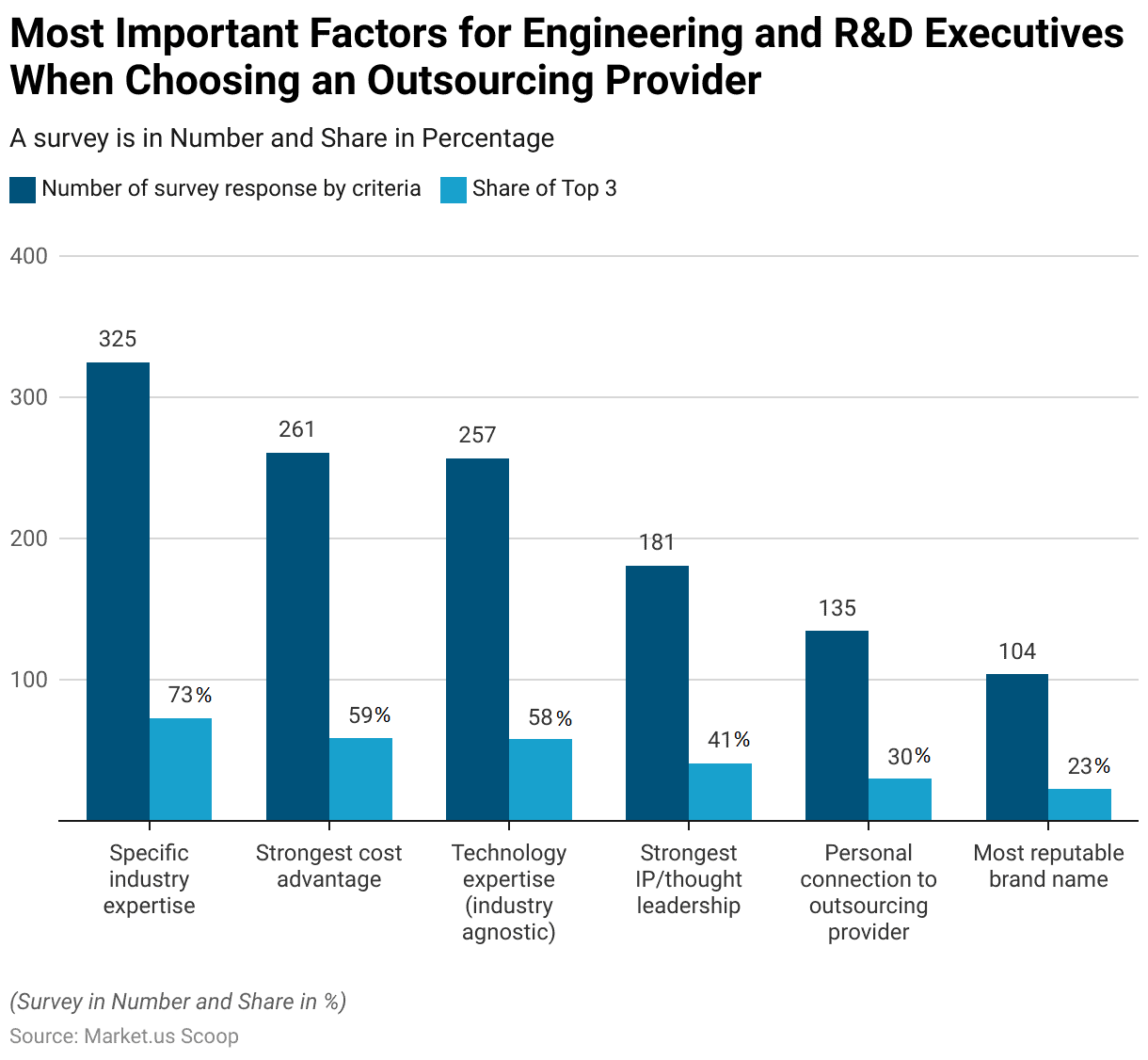

- When engineering and R&D executives select an outsourcing provider, several critical factors influence their decision-making. The most significant criterion is specific industry expertise, with 325 survey responses highlighting this aspect, representing a 73% share of the top three factors.

- When engineering and R&D executives select an outsourcing provider, several critical factors influence their decision-making. The most significant criterion is specific industry expertise, with 325 survey responses highlighting this aspect, representing a 73% share of the top three factors.

- Global engineering and R&D spending is projected to reach 2.719 billion euros in 2026, marking a 56% increase.

- Perceived barriers to Outsourcing R&D and product engineering (PE) services are varied, with several factors impacting organizations’ decisions. The most significant barrier, cited by 54% of respondents, is the fear of losing control over product development.

Engineering Services Outsourcing (ESO) Market Overview

Global Engineering Services Outsourcing (ESO) Market Size

- The Global Engineering Services Outsourcing Market has demonstrated significant growth over the past few years and is projected to continue on this upward trajectory at a CAGR of 24.1%.

- In 2022, the market revenue was recorded at USD 538.2 billion.

- Looking ahead, the market is projected to grow to USD 3,757.2 billion in 2031, USD 4,662.7 billion in 2032, and an impressive USD 5,786.4 billion by 2033.

Competitive Landscape of the Global Engineering Services Outsourcing (ESO) Market

- In the Global Engineering Services Outsourcing Market, AKKA holds the largest market share at 16%, showcasing its leading position in the industry.

- Alten Group follows closely with a 14% market share, indicating its significant influence.

- Capgemini Engineering commands a 12% share, reflecting its substantial presence in the market.

- Entelect, with a 10% share, also demonstrates a strong foothold.

- Both HCL Technologies Limited and Infosys Limited each hold an 8% market share, highlighting their competitive standing.

- Tata Elxsi and Wipro Limited each account for 7% of the market, illustrating their vital roles.

- Tata Consultancy Services Limited and Tech Mahindra Limited have market shares of 6% and 5%, respectively, contributing notably to the market dynamics.

- Other key players collectively hold a 7% share, indicating the diverse range of companies operating within this sector.

Regional Analysis of the Global Engineering Services Outsourcing (ESO) Market

- The regional distribution of the Global Engineering Services Outsourcing Market reveals significant variations in market share.

- The Asia-Pacific (APAC) region dominates with a substantial 42.3% market share, highlighting its major role in the industry.

- North America follows with a 25.6% share, indicating its strong presence.

- Europe holds a 21.0% share, reflecting its considerable participation in the market.

- South America accounts for 7.9% of the market share, showcasing its emerging influence.

- The Middle East and Africa (MEA) region has a 3.2% share, demonstrating its growing but relatively smaller contribution to the global market landscape.

Factors Driving the Demand for Engineering Services Outsourcing (ESO)

Lack of Availability of New Engineering Talent

- According to a recent BCG survey, 92% of global company leaders prioritize attracting and retaining talent, especially in engineering.

- The increasing scarcity of engineering talent poses a significant risk to vital industries. It could negatively impact the economy by nearly 40% of the projected GDP impact of all talent shortages in the US by 2030.

- According to the Bureau of Labor Statistics (BLS), there’s a projected growth of approximately 13% in demand for engineering skills from 2023 to 2031.

- Countries worldwide are grappling with engineering talent shortages. Japan’s Ministry of Economy forecasts a shortfall of more than 700,000 engineers by 2030, while the German Economic Institute highlights a current deficit of 320,000 STEM specialists in Germany as of April 2022.

Mismatch Between Available and In-Demand Skills

- The gap between new engineering positions and available engineers is significant, currently standing at about 133,000. However, the situation becomes even more concerning when further analysis of the data is needed.

- Over the next decade, the United States is expected to face a shortage of engineers, particularly in software, industrial, civil, and electrical engineering, with an estimated 186,000 job vacancies by 2031.

- Conversely, certain engineering fields like materials, chemical, aerospace, and mechanical engineering, which have historically been popular, are projected to have an oversupply of around 41,000 qualified candidates by the same year. Moreover, the skill requirements for these roles are evolving.

Most Important Factors for Engineering and R&D Executives When Choosing an Outsourcing Provider

- When engineering and R&D executives select an outsourcing provider, several critical factors influence their decision-making.

- The most significant criterion is specific industry expertise, with 325 survey responses highlighting this aspect, representing a 73% share of the top three factors.

- The strongest cost advantage is also highly valued, receiving 261 responses and accounting for 59% of the top three considerations.

- Technology expertise, regardless of industry, is another crucial factor, noted by 257 respondents, equating to 58%.

- Strong intellectual property and thought leadership are important for 181 executives, comprising 41% of the top three criteria.

- Personal connections to the outsourcing provider matter to 135 respondents, making up 30% of the top three factors.

- Lastly, the most reputable brand name is a significant consideration for 104 executives, representing 23% of the top three responses.

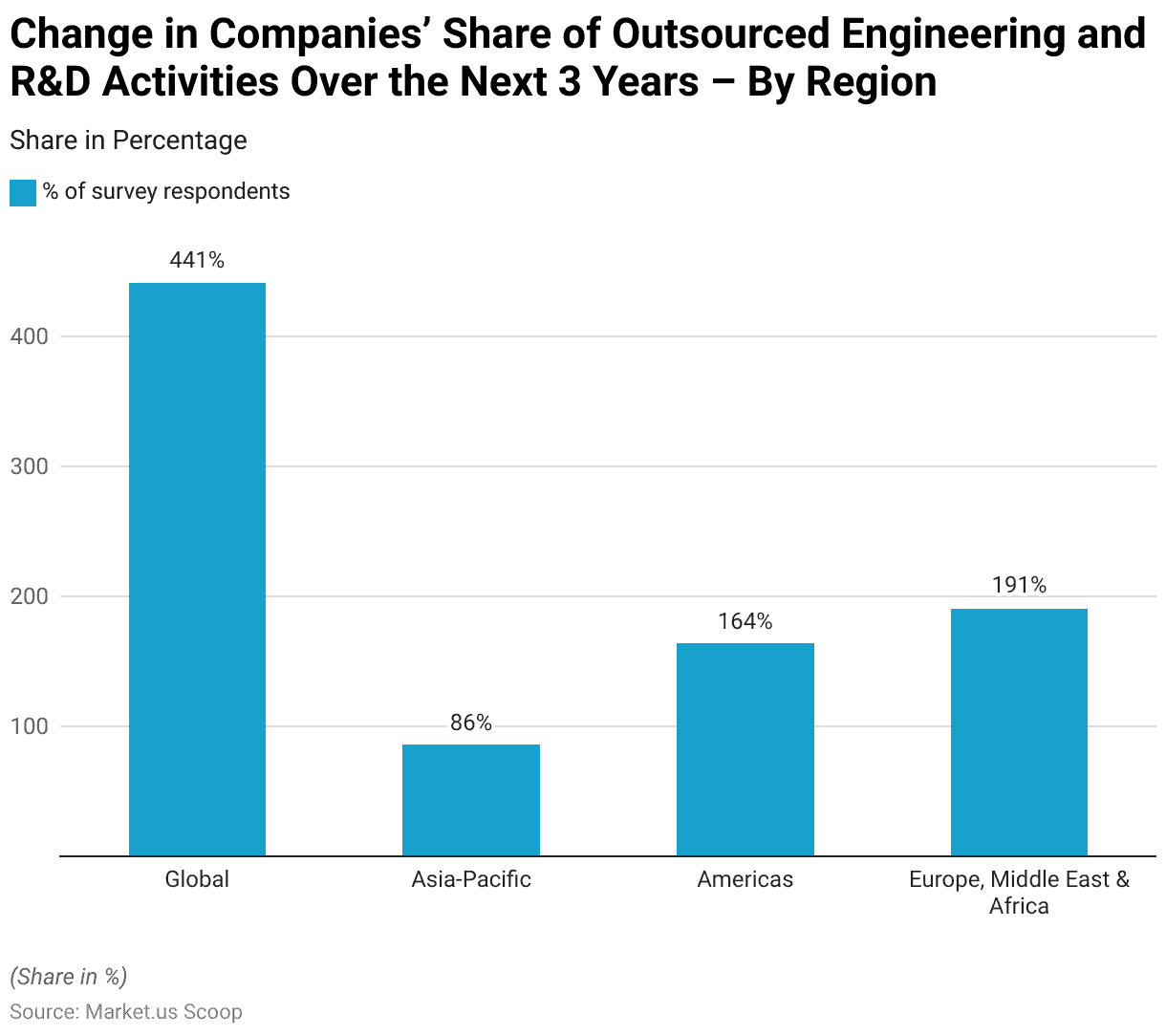

Change in Companies’ Share of Outsourced Engineering and R&D Activities – By Region

- Survey responses indicate a notable shift in companies’ share of outsourced engineering and R&D activities over the next three years, varying by region.

- Globally, 441 respondents anticipate changes in their outsourcing activities.

- In the Asia-Pacific region, 86 respondents foresee adjustments, reflecting the region’s growing influence in the outsourcing market.

- The Americas have 164 respondents predicting changes, indicating significant potential shifts in their outsourcing strategies.

- Europe, the Middle East, and Africa (EMEA) collectively have 191 respondents expecting alterations in their outsourced engineering and R&D activities, suggesting a dynamic landscape in these regions.

Change in Companies’ Share of Outsourced Engineering and R&D Activities – By Engineering Service

- Survey responses reveal expected changes in companies’ share of outsourced engineering and R&D activities across various engineering services over the next three years.

- Advanced manufacturing and services lead, with 112 respondents anticipating shifts, highlighting the growing trend in outsourcing within this sector.

- The automotive and mobility sector follows with 83 respondents, indicating significant expected changes.

- In the medical devices sector, 44 respondents foresee adjustments in their outsourcing strategies.

- The energy and natural resources sector has 72 respondents predicting changes, reflecting the dynamic nature of this industry. Aerospace and defense see 80 respondents expecting shifts, underlining the evolving landscape in these sectors.

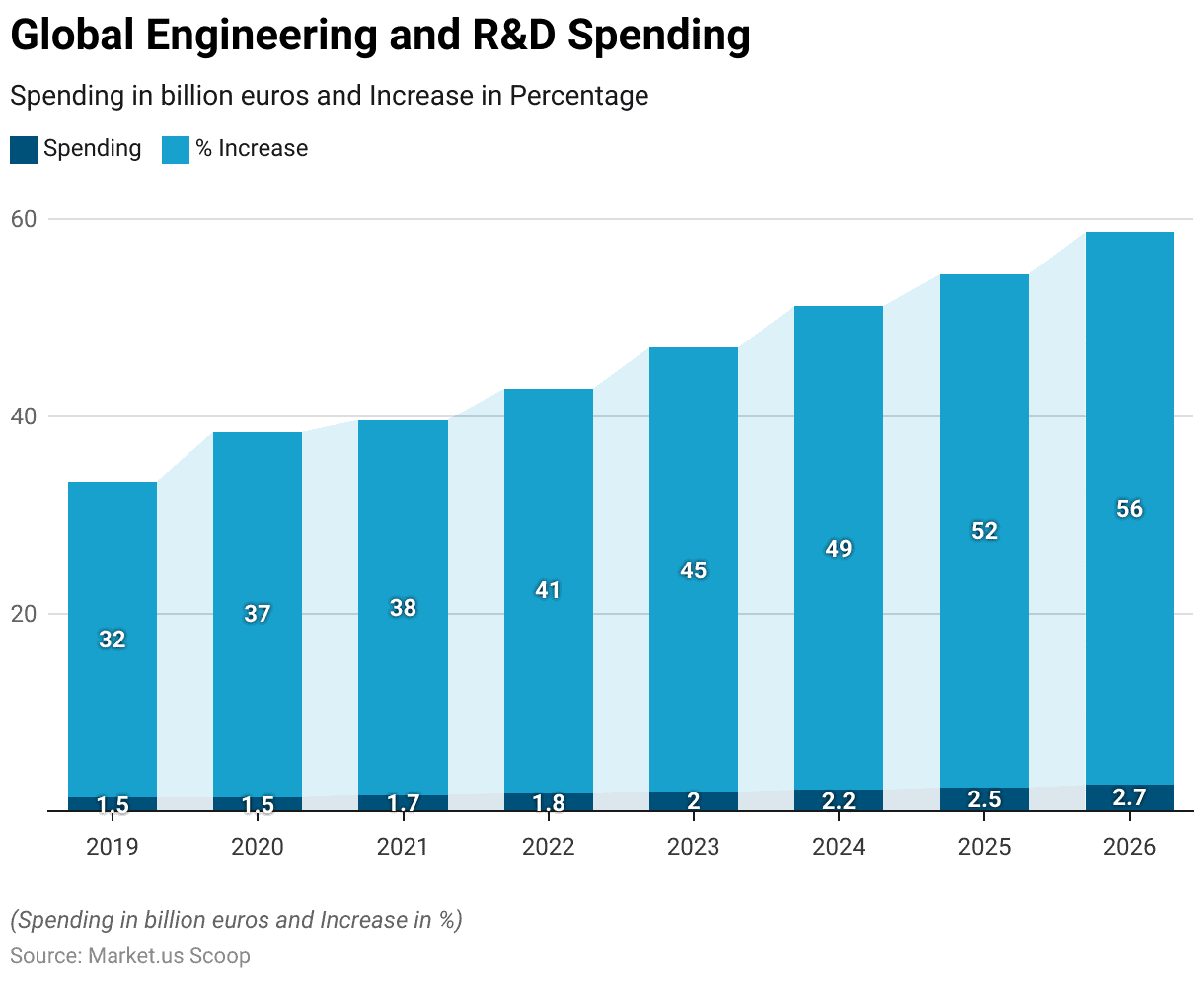

Engineering and R&D Spending

Overall Global Spending

- Global engineering and R&D spending has shown consistent growth from 2019 to 2026, reflecting a strong upward trend.

- In 2019, the spending was recorded at 1.457 billion euros, marking a 32% increase.

- This growth is expected to continue, reaching 2.460 billion euros in 2025, a 52% increase, and 2.719 billion euros in 2026, marking a 56% increase.

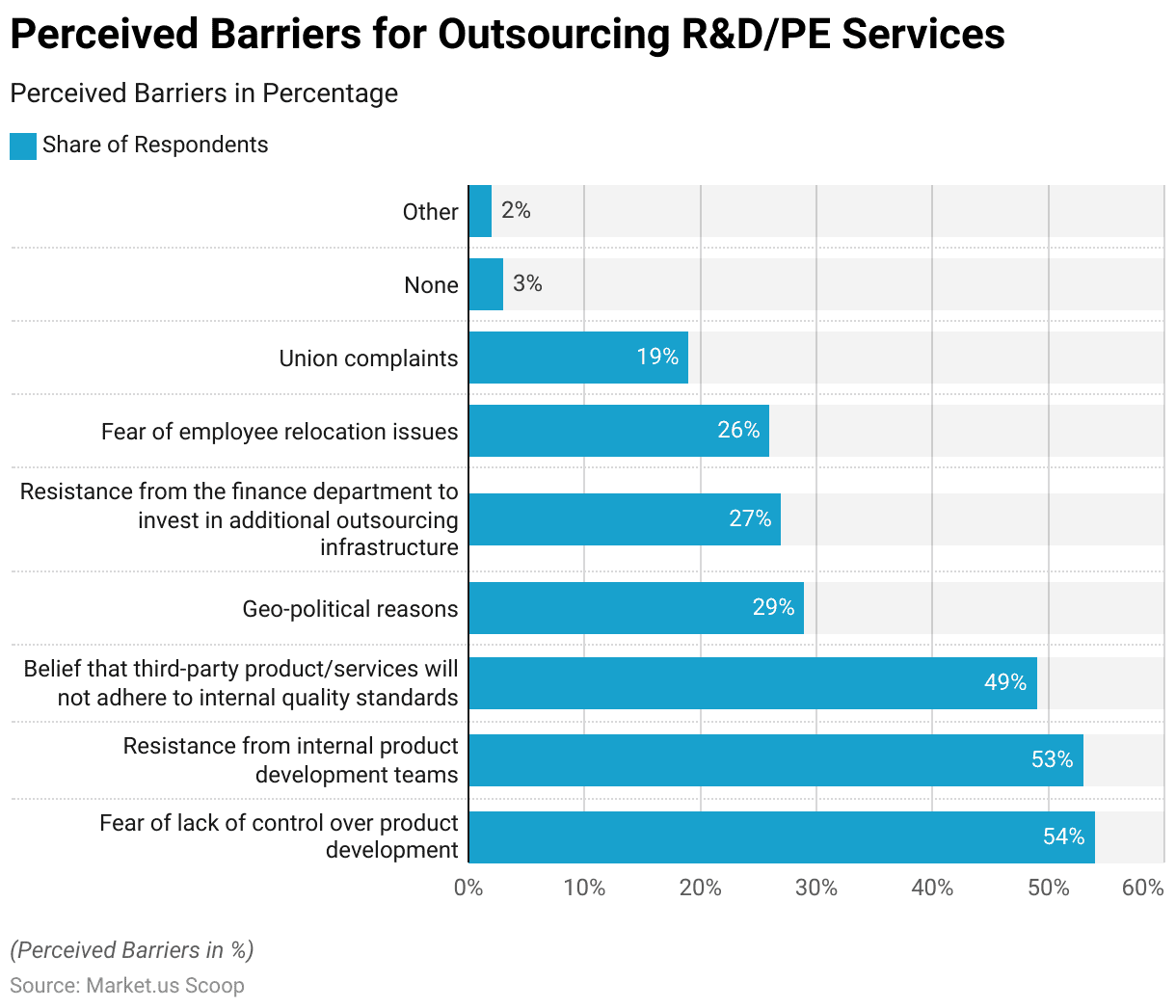

Challenges and Barriers to Engineering Services Outsourcing

- Perceived barriers to Outsourcing R&D and product engineering (PE) services are varied, with several factors impacting organizations’ decisions.

- The most significant barrier, cited by 54% of respondents, is the fear of losing control over product development.

- This is closely followed by resistance from internal product development teams, reported by 53% of respondents.

- Additionally, 49% of respondents believe that third-party products and services may not adhere to internal quality standards.

- Geo-political reasons are a concern for 29% of respondents, while 27% face resistance from their finance departments regarding investments in additional outsourcing infrastructure.

- Fear of employee relocation issues is a barrier for 26% of respondents, and 19% cite union complaints as a concern.

Regulations for Engineering Services Outsourcing

- Regulations for engineering services outsourcing vary significantly by country, influencing how companies manage their outsourcing operations.

- In the United States, companies must comply with federal laws such as the Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR), which control the export of technology and technical data.

- In Europe, the General Data Protection Regulation (GDPR) affects how personal data is managed during outsourcing.

- The European Union also emphasizes compliance with directives related to intellectual property and cross-border data transfers.

- In India, regulations like the Companies Act 2013 and data protection guidelines set by the Ministry of Electronics and Information Technology are crucial.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)