Table of Contents

Enterprise Agentic AI Market Size

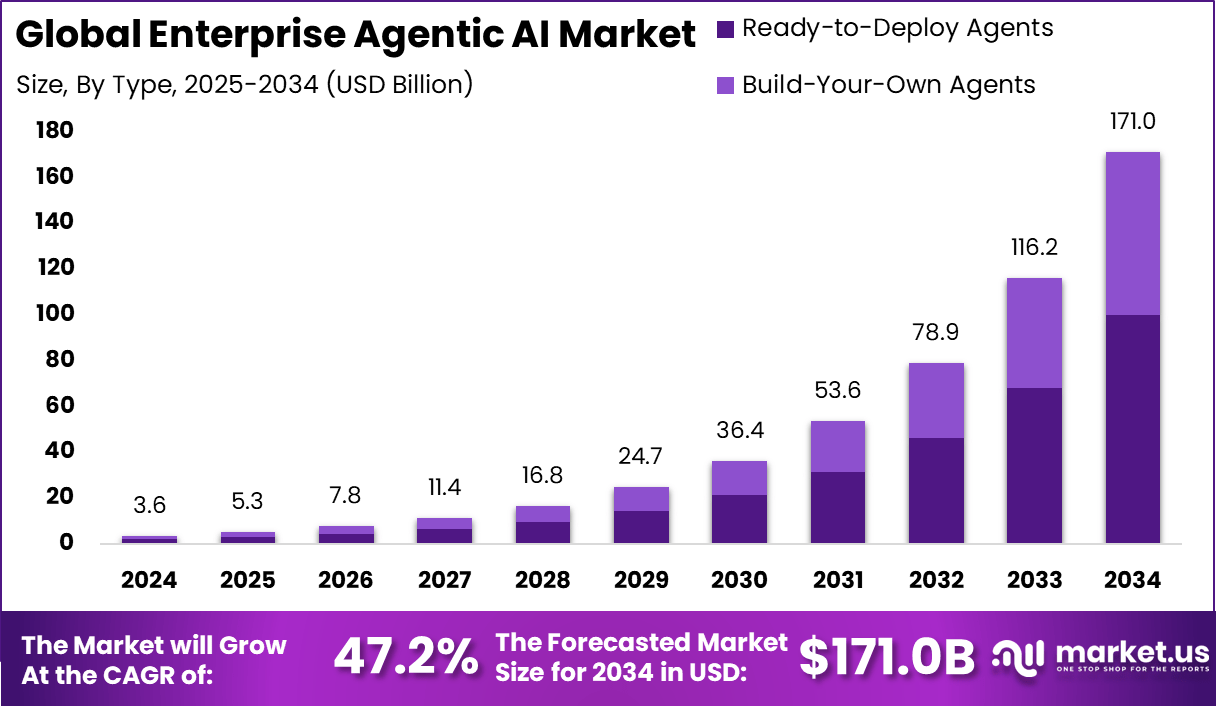

The Global Enterprise Agentic AI Market is forecasted to reach USD 171 billion by 2034, rising sharply from USD 3.6 billion in 2024, with a robust CAGR of 47.2% during 2025-2034. In 2024, North America emerged as the leading region, accounting for over 39.7% of the global market and generating approximately USD 1.4 billion in revenue. This dominance is attributed to the early adoption of autonomous AI systems across enterprise workflows, supported by strong digital infrastructure and enterprise innovation in the U.S. and Canada.

The Enterprise Agentic AI Market represents a significant transformation in how organizations approach automation, decision-making, and personalized experiences at scale. At its core, agentic AI enables systems within enterprises to act independently, pursue specific business goals, and coordinate complex tasks with minimal human supervision. Unlike traditional AI tools that rely on human prompts or scripted rules, agentic AI actively interprets objectives, adjusts to dynamic data, and continuously learns from its environment.

The top driving factors fueling adoption include the increasing intricacy of business operations and the urgent need for real-time, proactive responses. Enterprises require agile solutions that not only automate tasks but also anticipate challenges, adapt strategies, and optimize workflows on the fly. As companies grapple with more data, shifting markets, and heightened customer expectations, agentic AI serves as the backbone for operational resilience and innovation, making it a pivotal differentiator in today’s competitive landscape.

Buy this report directly from here: https://market.us/purchase-report/?report_id=154353

(𝙘𝙤𝙧𝙥𝙤𝙧𝙖𝙩𝙚 𝙢𝙖𝙞𝙡 𝙄𝘿 𝙥𝙧𝙚𝙛𝙚𝙧𝙧𝙚𝙙 𝙛𝙤𝙧 𝙩𝙤𝙥 𝙥𝙧𝙞𝙤𝙧𝙞𝙩𝙮)

Demand analysis reveals a strong and growing appetite for agentic AI across industries. Organizations implementing these solutions are experiencing process cycle times up to 40% faster, with error rates in complex operations falling by as much as 67%. The ability to manage vast workflows, process parallel tasks, and deliver instant insights is driving an uptick in enterprise deployments, especially in sectors like banking, retail, healthcare, and logistics. These markets see agentic AI as essential for scaling operations, boosting decision quality, and ensuring customer engagement around the clock.

According to Market.us, The Agentic AI Market is projected to expand from USD 5.2 billion in 2024 to approximately USD 196.6 billion by 2034, registering a robust CAGR of 43.8% during the forecast period. In 2024, North America led the market, capturing over 38% share with USD 1.97 billion in revenue. Within the region, the U.S. market alone accounted for USD 1.58 billion, reflecting its early adoption and continued investment in autonomous AI systems, supported by strong enterprise demand and advanced R&D infrastructure.

Market Size and Growth

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 3.6 Bn |

| Forecast Revenue (2034) | USD 171 Bn |

| CAGR(2025-2034) | 47.2% |

| Leading Segment | Ready-to-Deploy Agents: 58.5% |

| Largest Market | North America [39.7% Market Share] |

Key Insights

- The market is expected to grow from USD 3.6 billion in 2024 to USD 171 billion by 2034, reflecting a strong CAGR of 47.2% over the forecast period.

- In 2024, North America led the market with a 39.7% share, generating approximately USD 1.4 billion in revenue.

- Machine Learning was the leading technology, contributing to 29.9% of the market share due to its wide adaptability and integration capabilities.

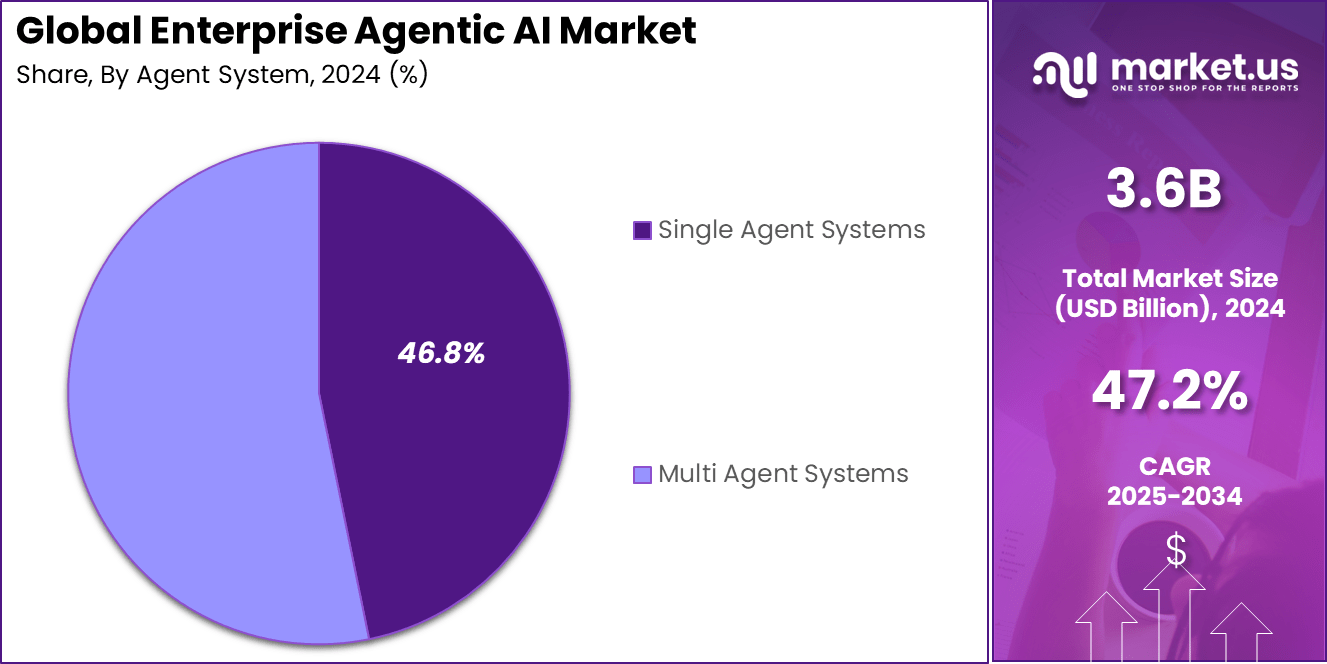

- Single Agent Systems dominated the agent architecture segment, accounting for 46.8%, as they offer focused task execution with simplified control.

- Among types, Ready-to-Deploy Agents held the largest share at 58.5%, as enterprises prefer faster implementation with minimal setup requirements.

- Customer Service & Virtual Assistants emerged as the largest application segment of 26%, contributing 26.9%, driven by automation in compliance, fraud detection, and risk analysis.

By Technology

In 2024, the Machine Learning segment accounted for 29.9% of the Enterprise Agentic AI Market. Machine learning serves as the foundational technology behind autonomous agent behavior, enabling systems to analyze data, learn from interactions, and refine responses over time. Enterprises deploy ML-powered agents to handle complex tasks such as workflow automation, predictive insights, and customer behavior analysis.

This segment’s strength is reinforced by its adaptability across various functions, including decision-making, anomaly detection, and continuous optimization. As enterprise data volumes grow, machine learning will remain central to driving the autonomy and intelligence of agentic AI systems.

By Agent System

The market was led by Single Agent Systems in 2024, reflecting a preference for streamlined, role-specific deployments. These agents are designed to perform focused tasks such as onboarding support, ticket resolution, or scheduling, making them easy to integrate within enterprise operations. Their modular nature enables businesses to deploy targeted solutions without overhauling entire systems.

Single agents also offer greater control, faster implementation, and simplified training processes. As enterprises test and validate agentic AI within isolated workflows, single agent systems continue to serve as a scalable entry point into more complex multi-agent architectures.

By Type

Ready-to-Deploy Agents captured a leading 58.5% share in 2024, driven by rising demand for low-code and plug-and-play AI solutions. These pre-trained agents are designed to execute common enterprise tasks such as data entry, user support, and CRM updates with minimal configuration. Their ability to be rapidly integrated into existing software ecosystems reduces the time-to-value and accelerates ROI.

Organizations prefer these agents for their ease of deployment, built-in compliance features, and reduced need for technical oversight. The growing availability of industry-specific ready agents – across healthcare, finance, and HR – has further boosted their adoption in enterprise environments.

By Application

The Customer Service & Virtual Assistants segment held a 26% share in 2024, reflecting the widespread use of agentic AI in improving client interactions. These agents support tasks such as real-time query handling, multi-channel communication, and sentiment analysis. Enterprises deploy them to enhance customer satisfaction, reduce response times, and lower support costs.

Virtual assistants are increasingly embedded in web portals, mobile apps, and enterprise collaboration platforms, providing consistent and personalized responses. Their round-the-clock availability and integration with backend systems position them as strategic assets in digital customer engagement initiatives.

Emerging Trend

Rise of Autonomous AI Decision-Making

A standout trend in the enterprise agentic AI sphere is the movement from merely reactive systems to agents that can make independent decisions and execute tasks with minimal oversight. These next-generation agents are now able to analyze complex business scenarios, weigh alternatives, and act proactively, rather than waiting for step-by-step human instructions. This evolution is deeply transforming areas like supply chain logistics, customer support, and financial operations, where AI-driven autonomy brings swifter responses and greater resilience to changing circumstances.

Driver Analysis

Growing Demand for Intelligent Automation

Businesses are increasingly seeking ways to offload repetitive and time-consuming processes, fueling the adoption of agentic AI. The technology is driven by the desire to improve operational efficiencies, allow employees to focus on high-value tasks, and accelerate innovation cycles. By leveraging these intelligent agents, companies can automate routine work, free up resources, and respond more dynamically to new business challenges—contributing to better productivity across teams and functions.

Restraint Analysis

High Implementation and Operational Costs

A major roadblock when it comes to embracing agentic AI at scale is the substantial investment required to deploy, integrate, and maintain these solutions. The initial outlay covers powerful computing infrastructure and sophisticated AI frameworks, but ongoing costs pile up with the need for specialized talent, continuous monitoring, and frequent updates. For many non-tech-centric organizations, these expenses hamper widespread adoption, especially when budgets are tight or returns are uncertain.

Opportunity Analysis

Emergence of Plug-and-Play Agent Marketplaces

A promising opening for enterprises is the development of curated marketplaces that offer ready-made, domain-specific AI agents. These platforms enable firms to quickly experiment with and deploy agentic solutions tailored to their needs, without having to build systems from scratch. This plug-and-play approach lowers technical barriers and speeds up digital transformation, empowering even smaller teams to harness AI for specialized tasks by simply integrating pre-configured agents as needed.

Challenge Analysis

System Integration and Data Readiness

Implementing agentic AI within existing enterprise systems is often a complicated endeavor. Many organizations still grapple with siloed or inconsistent data, outdated software, or incompatible communication protocols. Successful adoption hinges on having unified data pipelines, robust governance, and scalable infrastructure to support the constant demands of autonomous agents. Enterprises that overlook these foundational requirements may find that their AI agents misfire, underdeliver, or require frequent manual intervention to fix errors or fill informational gaps.

Key Market Segments

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Deep Learning

- Computer Vision

- Others

By Agent System

- Single Agent Systems

- Multi Agent Systems

By Type

- Ready-to-Deploy Agents

- Build-Your-Own Agents

By Application

- Customer Service and Virtual Assistants

- Robotics and Automation

- Healthcare

- Financial Services

- Security and Surveillance

- Gaming and Entertainment

- Marketing and Sales

- Human Resources

- Legal and Compliance

- Others

Top Key Players in the Market

- NVIDIA Corporation

- SAP SE

- Oracle

- Accenture

- OpenAI

- Capgemini

- Celonis

- Dataiku

- Shield AI

Explore More Reports