Table of Contents

- Introduction

- Editor’s Choice

- Global Enterprise Data Management Market Overview

- Amount of Data Generated Daily

- Global Enterprise Data Volume Statistics

- Challenges Driving the Demand for Effective Enterprise Data Management

- Data Management Strategies Employed by Enterprises

- Various Solutions Adopted by Enterprises for Effective Enterprise Data Management

- Average Response Time and Lifecycle in Data Breaches

- Data Management Platform Pricing

- Emerging Enterprise Data Management Technologies

Introduction

According to Enterprise Data Management Statistics, Enterprise Data Management (EDM) is essential for managing crucial business data through practical methods, processes, and tech frameworks, aiming at data accuracy, security, and consistency to aid decision-making and efficiency.

Critical aspects of EDM include data governance, quality, integration, security, master data management, and metadata management. Implementing EDM enhances decision-making, operational efficiency, compliance, and data visibility.

However, challenges like data silos, quality maintenance, change management, and technological complexity must be navigated. Despite obstacles, adopting EDM is crucial for companies to utilize data for a competitive edge, ensuring reliability and strategic insights.

Editor’s Choice

- The global Enterprise Data Management (EDM) market revenue is expected to rise from USD 97.5 billion in 2023 to USD 281.9 billion by 2033.

- The software segment, which constitutes a significant portion of the market, is projected to grow from USD 75.95 billion in 2023 to USD 219.6 billion by 2033.

- Large enterprises hold a substantial portion of the market, accounting for 69.50%, underscoring their significant investment in and reliance on EDM solutions to effectively manage vast amounts of data.

- Projections suggest that by 2020, each person will contribute to creating 1.7MB of data every second.

- Internally managed data centers increased from 297 terabytes in 2020 to 570 terabytes in 2022, marking the highest growth among the categories.

- The KPMG Real Estate Data Strategy Survey, which builds upon insights from the 2019 KPMG Global PropTech Survey, revealed that 57% of those surveyed have implemented a coordinated data strategy.

- Enterprises have embraced various solutions to enhance their enterprise data management practices. The most widely adopted solution, with 92% of enterprises implementing it, is data governance.

Global Enterprise Data Management Market Overview

Global Enterprise Data Management Market Size

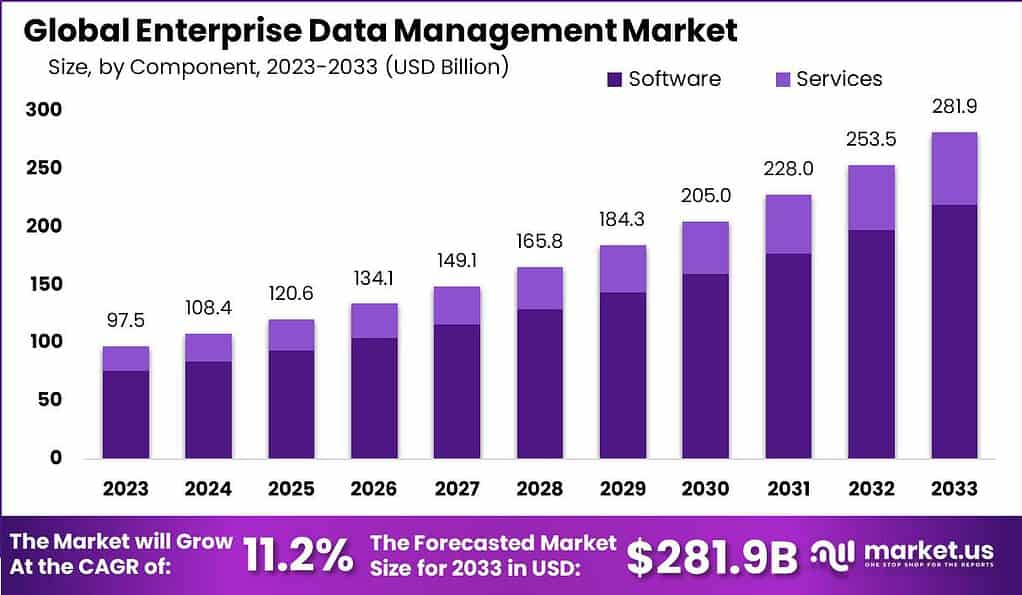

- The global Enterprise Data Management (EDM) market has demonstrated a strong growth trajectory, with revenue projections indicating a significant increase over the next decade at a CAGR of 11.2%.

- Starting from USD 97.5 billion in 2023, the market is expected to rise steadily, reaching USD 108.4 billion in 2024.

- The upward momentum is expected to carry forward into the next decade, with market revenues reaching USD 205.0 billion in 2030, USD 228.0 billion in 2031, USD 253.5 billion in 2032, and finally culminating at USD 281.9 billion by 2033.

Enterprise Data Management Market Size – By Component

- The Global Enterprise Data Management (EDM) Market has exhibited robust growth, with total market revenue expected to rise from USD 97.5 billion in 2023 to USD 281.9 billion by 2033. Both software and service components drive this growth.

- The software segment, which constitutes a significant portion of the market, is projected to grow from USD 75.95 billion in 2023 to USD 219.6 billion by 2033.

- Meanwhile, the services segment also shows strong growth, with revenues increasing from USD 21.55 billion in 2023 to USD 62.3 billion in 2033.

Global Enterprise Data Management Market Share – By Enterprise Size

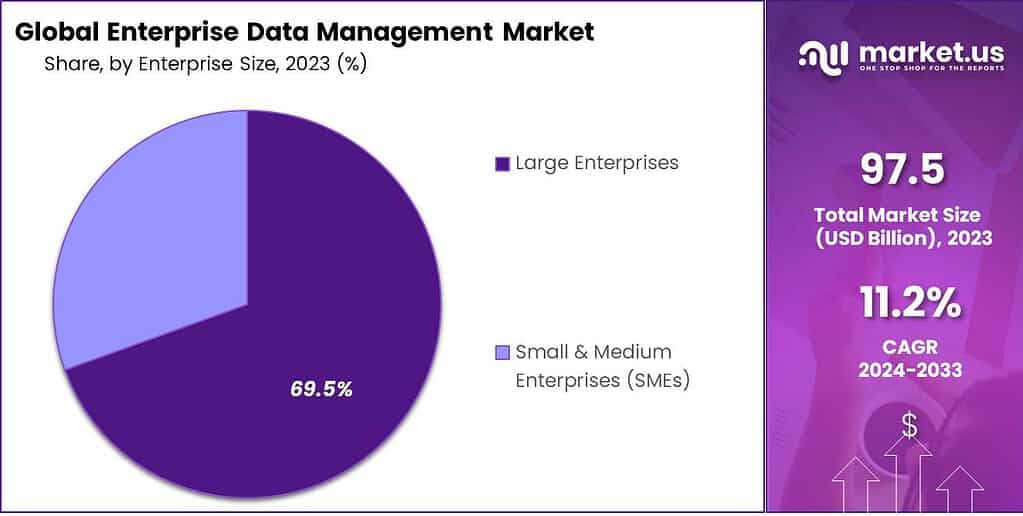

- In the Global Enterprise Data Management (EDM) market, a distinct distribution in market share by enterprise size is observed.

- Large enterprises hold a substantial portion of the market, accounting for 69.50%, underscoring their significant investment in and reliance on EDM solutions to effectively manage vast amounts of data.

- On the other hand, Small and Medium Enterprises (SMEs) represent 30.50% of the market share.

Amount of Data Generated Daily

- Every day, the world sees a massive influx of data across various platforms: 500 million tweets are posted, 294 billion emails are dispatched, and Facebook generates 4 petabytes of data.

- Each connected car contributes four terabytes of data, while WhatsApp sees 65 billion messages exchanged. Additionally, 5 billion searches are conducted daily.

- Looking ahead to 2025, it’s projected that the global daily data creation will reach 463 exabytes, equal to about 212.8 million DVDs each day.

- Studies indicate that over 2.5 quintillion bytes of data are generated daily, with this vast amount of information expanding rapidly.

- Projections suggest that by 2020, each person will contribute to creating 1.7MB of data every second.

Global Enterprise Data Volume Statistics

- Between 2020 and 2022, the total volume of enterprise data worldwide experienced significant growth across various locations, measured in terabytes.

- Internally managed data centers increased from 297 terabytes in 2020 to 570 terabytes in 2022, marking the highest growth among the categories.

- Cloud repositories, including public, private, and industry-specific clouds, also witnessed substantial growth, with data volumes expanding from 221 terabytes to 498 terabytes within the same period.

- Third-party data centers’ data volume grew from 201 terabytes to 407 terabytes, while data stored in edge and remote locations increased from 193 terabytes to 390 terabytes.

- Additionally, volumes in other locations rose from 89 terabytes in 2020 to 160 terabytes in 2022.

Challenges Driving the Demand for Effective Enterprise Data Management

- A 2004 Gartner report titled “CRM Demands Data Cleansing” surveyed 600 large enterprises in Australia, the UK, and the US, revealing substantial issues due to poor data quality.

- Three-quarters of those surveyed acknowledged facing severe challenges due to inaccurate data.

- Over half of the respondents experienced additional expenses from conducting internal reconciliations.

- Additionally, 33% encountered problems with billing or collecting payments, with a third of participants reporting some form of billing or collections issue attributable to substandard data.

- A significant 76% of those surveyed expressed difficulties in comprehending their data. In comparison, 82% of those responsible for data management decisions found managing and predicting data-related costs challenging.

- Approximately 80% cited the absence of data cataloging as a primary concern.

- Furthermore, as much as 82% of participants identified the complexity of data governance policies as a significant obstacle.

Data Management Strategies Employed by Enterprises

- The KPMG Real Estate Data Strategy Survey, which builds upon insights from the 2019 KPMG Global PropTech Survey, revealed that 57% of those surveyed have implemented a coordinated data strategy.

- However, only 28% of participants leverage data to enhance tenant experiences, a factor KPMG suggests is crucial for boosting customer satisfaction and should thus be a priority for real estate owners and operators.

- Interestingly, while 75% of respondents rely on Excel for analytics, 69% acknowledge an overdependence on the software.

- Around 30% of the survey participants outsource at least a portion of their data management, whereas 39% utilize a centralized data repository for storing and accessing data. This figure jumps to 60% among larger firms.

Various Solutions Adopted by Enterprises for Effective Enterprise Data Management

- Enterprises have embraced various solutions to enhance their enterprise data management practices. The most widely adopted solution, with 92% of enterprises implementing it, is data governance.

- This is followed by data stewardship and data quality management, both utilized by 67% of respondents, indicating a strong focus on maintaining data integrity and quality.

- Similarly, 67% of enterprises have adopted master reference data management to ensure consistency across their data assets.

- Data warehousing and business intelligence tools are employed by 46% of enterprises to support data analysis and reporting.

- Data preparation for business users and data discovery are adopted by 40% and 23% of respondents, respectively, highlighting the emphasis on making data accessible and understandable for non-technical users.

- Less common solutions include data warehouse automation (19%), data lakes (17%), and data integration (15%), which facilitate streamlined data processing and storage.

- Holistic data platforms and self-service analytics, each utilized by 10% of enterprises, reflect a trend toward empowering users with comprehensive data tools and autonomous analytical capabilities.

Average Response Time and Lifecycle in Data Breaches

- On a global scale, detecting a data breach typically requires about 204 days on average.

- Organizations employing threat intelligence detected threats approximately 28 days quicker than those not using it.

- Once identified, the average duration to effectively contain a breach spanned 73 days.

- Incidents involving stolen or compromised credentials were the most time-consuming to address, taking an average of 88 days to resolve, leading to a total data breach lifecycle of 328.

- Interestingly, breaches with a lifecycle shorter than 200 days incurred costs that were, on average, $1.02 million lower than those extending beyond 200 days.

Data Management Platform Pricing

- The cost of a Data Management Platform (DMP) largely hinges on its range of features and functionalities. DMPs assist marketers in gathering and organizing data, enabling them to make informed decisions that boost sales and conversion rates.

- In 2018, U.S. marketers allocated almost $5 billion towards data management solutions, marking a growth of over 25%.

- Additionally, 24% of marketers plan to dedicate their budgets to DMP investments in the coming year.

- Typically, a Data Management Platform (DMP) pricing begins at $1,100 and can escalate to $6,000 monthly or even higher.

Emerging Enterprise Data Management Technologies

- Companies adopting new technologies often grapple with the role of older, yet still valuable, legacy systems. Such systems, including enterprise resource planning (ERP) solutions like SAP or Oracle, may seem outdated but continue to support critical business functions.

- Many legacy systems provide extensive master data management (MDM) capabilities for cloud and on-premises implementations. Enterprises increasingly integrate these MDM tools into their data governance frameworks, recognizing their ongoing utility.

- The adoption of artificial intelligence (AI) and machine learning (ML) in data management, driven by the challenges of managing vast amounts of data amid a tech industry-wide staffing shortage, particularly in data-centric roles, continues to rise.

- AI/ML technologies are revolutionizing traditional manual and error-prone processes by automating foundational data management tasks like data identification and classification more efficiently and accurately.

- Enterprises leverage AI/ML for advanced data management functions, including data catalog, metadata management, data mapping, anomaly detection, metadata auto-discovery, and monitoring data governance controls.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)