Table of Contents

- Introduction

- Editor’s Choice

- Enterprise IoT Market Overview and Statistics

- Internet of Things (IoT) Revenue

- Internet of Things (IoT) Connections Over the Globe

- Share of Enterprise IoT Projects Worldwide – By Area Statistics

- Number of Edge-Enabled Internet of Things (IoT) Devices Worldwide – By Market

- Enterprise & Entire IoT Adoption Statistics

- Importance of and Investment Plan for IoT in Business Worldwide – By Industry

- IoT Spending Across Different Industries

- Challenges Around IoT Enterprise Integration Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Enterprise IoT Statistics – Enterprise IoT entails connecting devices, sensors, and software within an organization’s infrastructure to optimize operations and decision-making.

Components include sensors, connectivity, cloud platforms, analytics, and integration with existing systems. Use cases range from asset tracking to predictive maintenance and smart buildings.

Benefits include improved efficiency, decision-making, customer experience, and innovation. Challenges include security, interoperability, scalability, and data management.

Overall, enterprise IoT offers opportunities for organizations to enhance efficiency, innovation, and customer satisfaction. However successful implementation requires addressing challenges such as security and interoperability.

Editor’s Choice

- The global enterprise IoT market revenue rose to USD 600.8 billion in 2023.

- In 2032, the market is projected to reach USD 1,819.2 billion, with hardware revenues at USD 844.11 billion. Software and solutions at USD 611.25 billion, and services at USD 363.84 billion.

- In the global enterprise IoT market, small and medium-sized enterprises (SMEs) hold a significant majority. With 64% of the market share, underscoring their pivotal role in adopting IoT technologies.

- By the end of the decade, in 2030, IoT revenues are expected to surpass $621.6 billion.

- By 2021, consumer IoT connections rose to 8 billion, while enterprise IoT jumped to 7.5 billion.

- The healthcare industry leads with a significant 14.5% increase in IoT spending. Underscoring its growing reliance on connected technologies for enhanced patient care and operational efficiency.

- The most prevalent issue experienced by 53% of organizations was integrating IoT solutions with existing technology. Highlighting the complexity of meshing new systems with legacy infrastructures.

Enterprise IoT Market Overview and Statistics

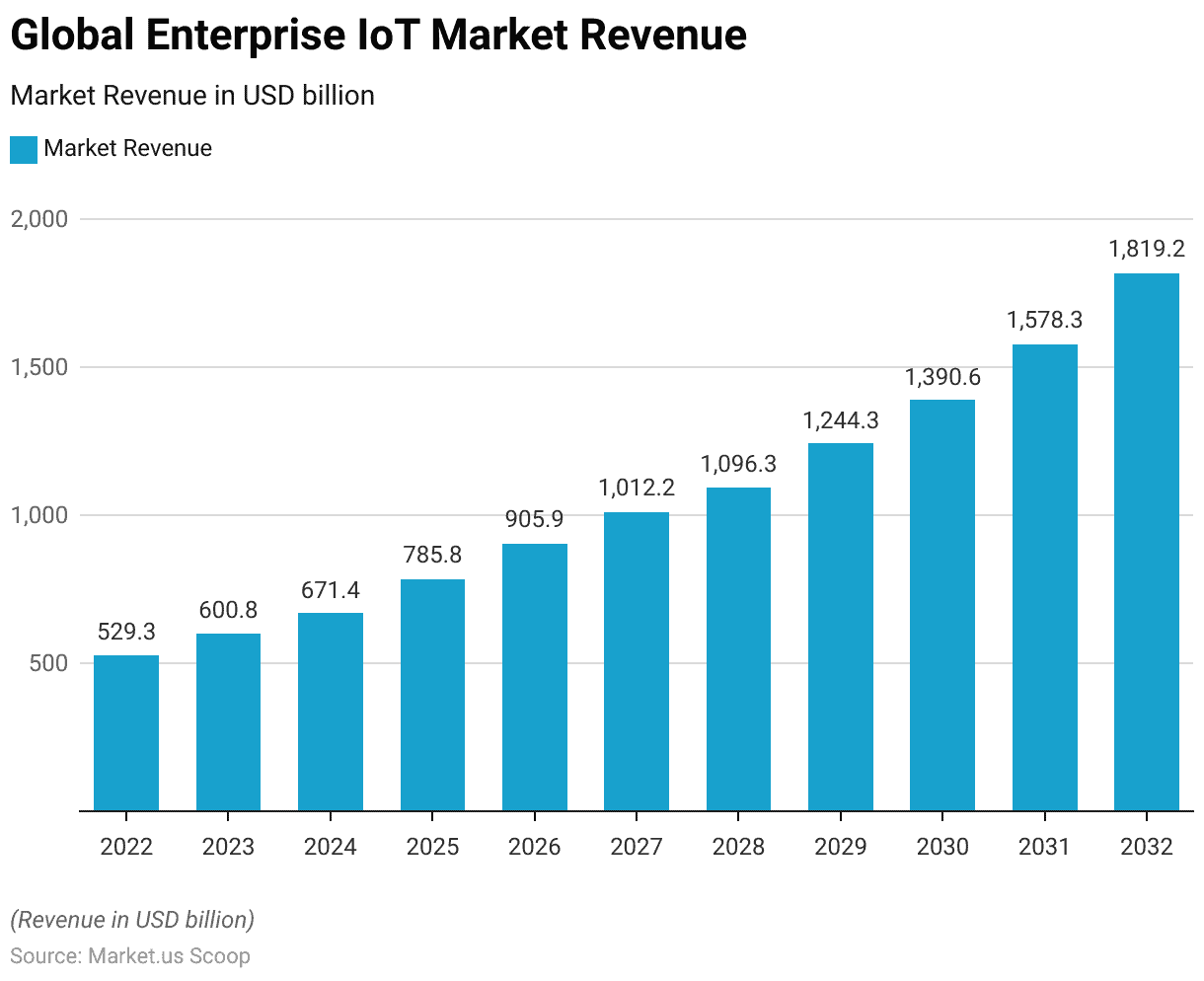

Global Enterprise IoT Market Size Statistics

- The global enterprise IoT market has shown substantial growth over the past decade, as evidenced by increasing revenue figures at a CAGR of 13.5%.

- In 2022, the market generated USD 529.3 billion. The following year, revenue rose to USD 600.8 billion, marking a significant year-on-year increase.

- This growth trajectory is expected to continue, with projections estimating the market to reach USD 671.4 billion in 2024.

- By 2025, the revenue is anticipated to significantly increase to USD 785.8 billion. Followed by a further rise to USD 905.9 billion in 2026.

- The growth momentum is expected to carry the market past the trillion-dollar mark to USD 1,012.2 billion in 2027.

- The following year, 2028, is forecasted to see revenues of USD 1,096.3 billion. With a more robust increase to USD 1,244.3 billion in 2029.

- The market is projected to continue expanding, reaching USD 1,390.6 billion in 2030 and surging to USD 1,578.3 billion in 2031.

- By 2032, the global enterprise IoT market is expected to attain USD 1,819.2 billion. Reflecting a sustained and robust growth pattern over the decade.

- This upward trend underscores the increasing integration and reliance on IoT technologies across various industries. Driven by continuous advancements and the expanding application scope of IoT solutions.

(Source: Market.us)

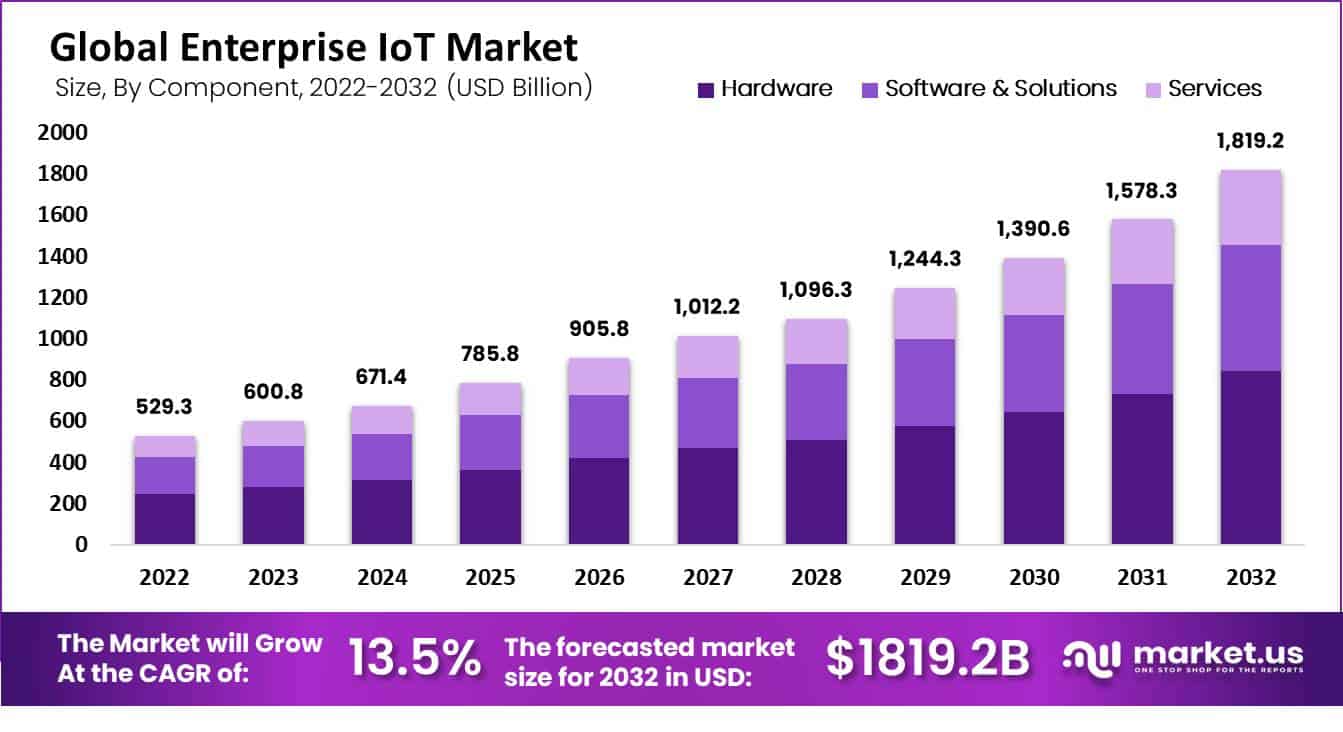

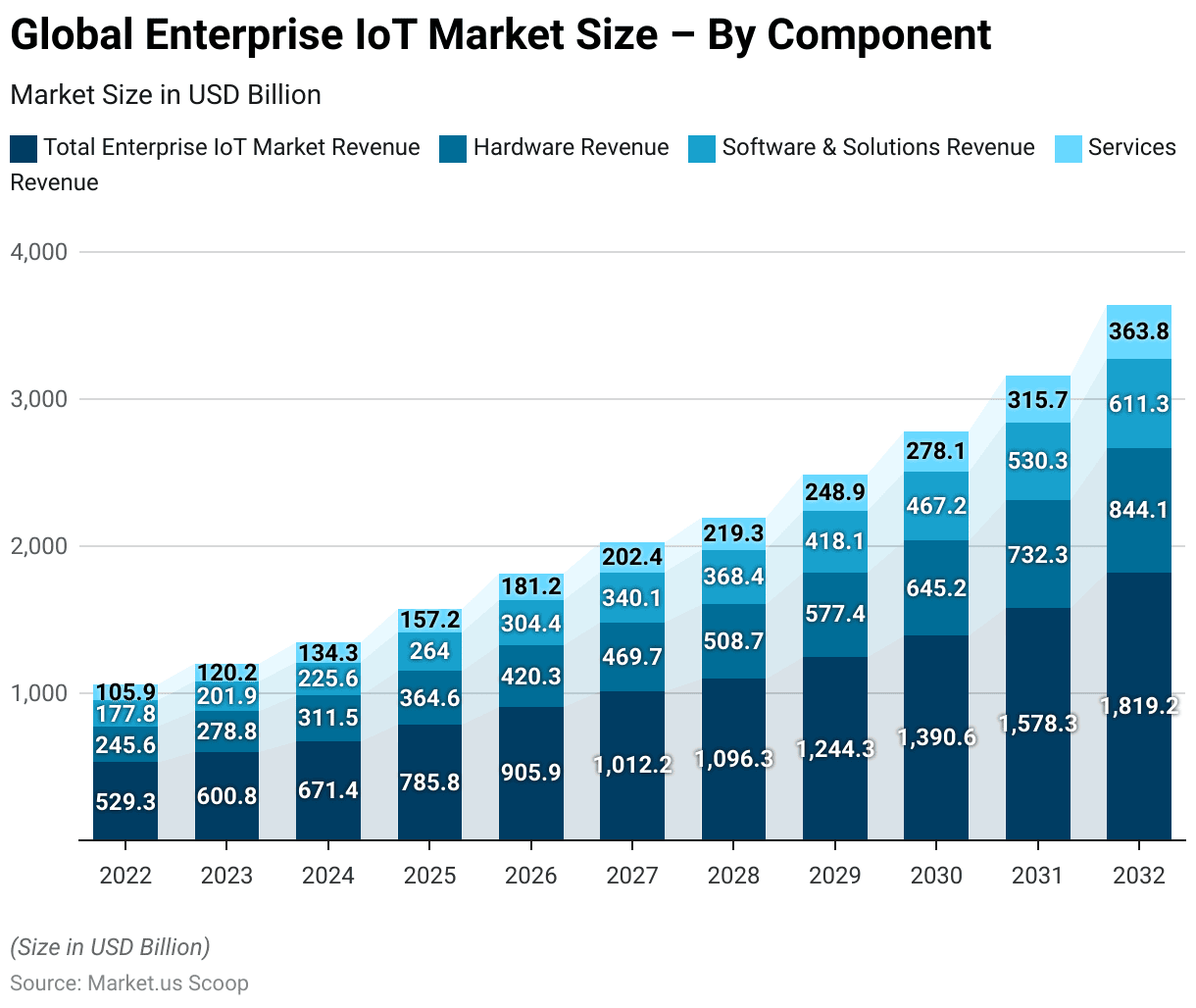

Global Enterprise IoT Market Size – By Component Statistics

- The global enterprise IoT market’s revenue segmentation by component from 2022 to 2032 highlights notable growth across hardware, software solutions, and services.

- In 2022, the total market revenue stood at USD 529.3 billion, distributed among hardware (USD 245.6 billion), software and solutions (USD 177.84 billion), and services (USD 105.86 billion).

- The upward trend continued into 2023, with total revenues increasing to USD 600.8 billion, comprising USD 278.77 billion from hardware. USD 201.87 billion from software and solutions, and USD 120.16 billion from services.

- By 2024, the market expanded further to USD 671.4 billion, with hardware revenue at USD 311.53 billion. Software and solutions at USD 225.59 billion, and services at USD 134.28 billion.

- The growth accelerated in 2025, reaching a total of USD 785.8 billion, split between USD 364.61 billion for hardware. USD 264.03 billion for software and solutions, and USD 157.16 billion for services.

- The trend continued robustly through the following years, with total revenues reaching USD 905.9 billion in 2026, USD 1,012.2 billion in 2027, and USD 1,096.3 billion in 2028. By 2029, total market revenues surged to USD 1,244.3 billion. Followed by USD 1,390.6 billion in 2030 and then an impressive USD 1,578.3 billion in 2031.

- In 2032, the market is projected to reach USD 1,819.2 billion, with hardware revenues at USD 844.11 billion, software and solutions at USD 611.25 billion, and services at USD 363.84 billion.

- This decade-long projection underscores a significant and steady increase in all components. Demonstrating the expanding influence and integration of IoT technologies in the enterprise sector.

(Source: Market.us)

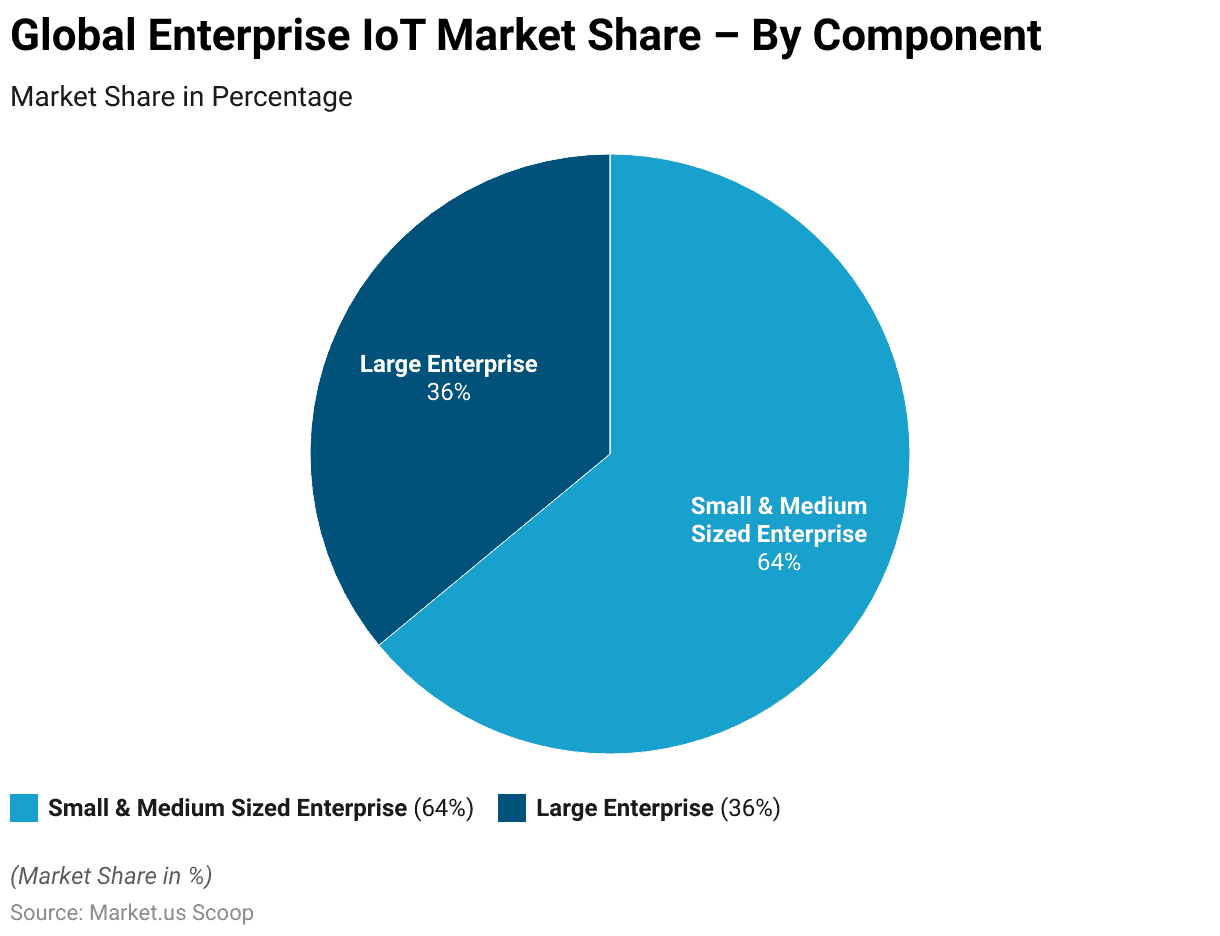

Global Enterprise IoT Market Share – By Component Statistics

- In the global enterprise IoT market, small and medium-sized enterprises (SMEs) hold a significant majority, with 64% of the market share, underscoring their pivotal role in adopting IoT technologies.

- In contrast, large enterprises account for 36% of the market share.

- This distribution indicates a robust involvement of SMEs in leveraging IoT solutions, possibly due to their flexibility and the scalability of IoT technologies that suit diverse business sizes and needs.

- This market dynamic highlights the widespread adoption of IoT across different enterprise scales, with SMEs leading the integration.

(Source: Market.us)

Internet of Things (IoT) Revenue

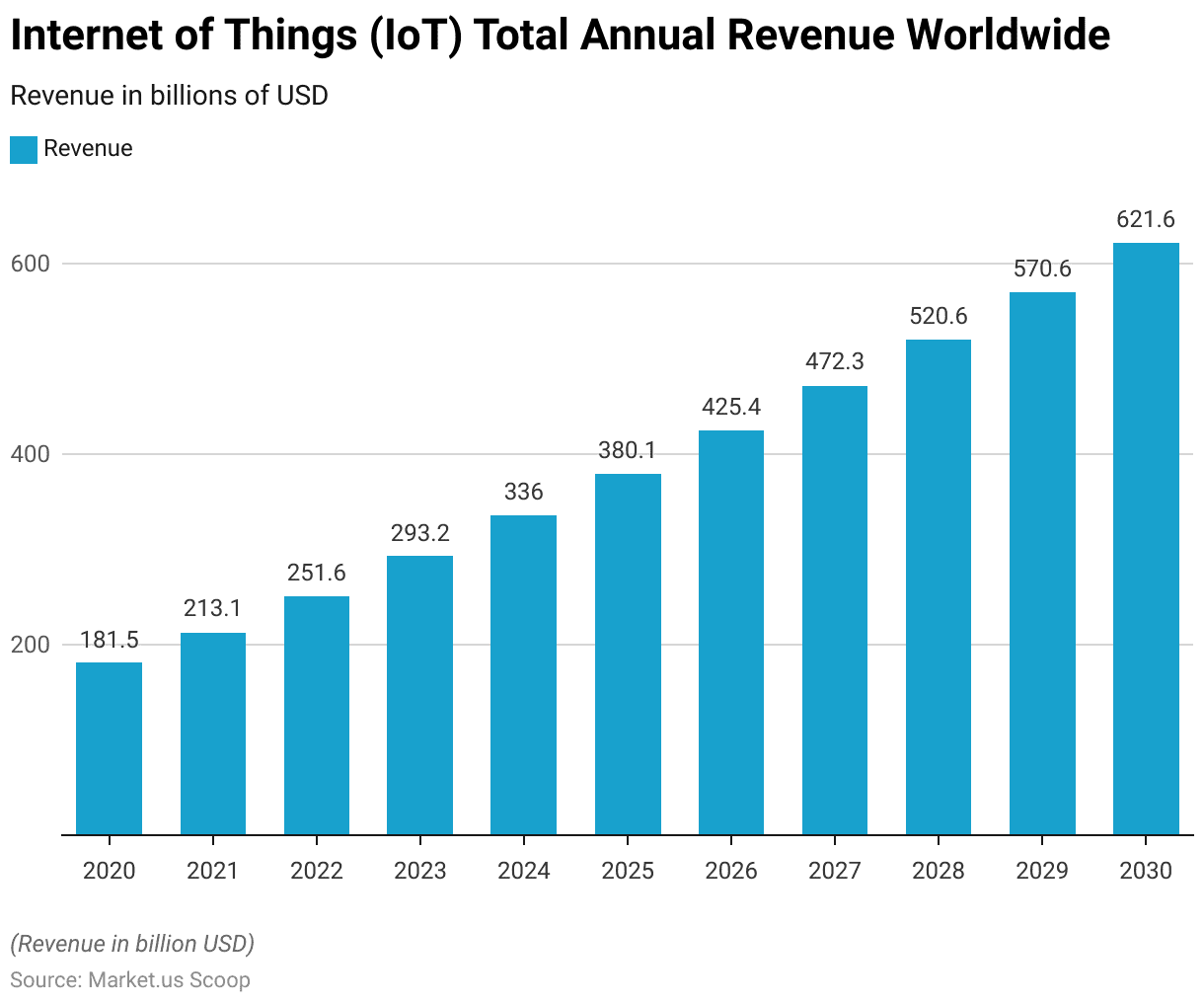

Internet of Things (IoT) Total Annual Revenue Worldwide

- From 2020 to 2030, the worldwide revenue generated from the Internet of Things (IoT) demonstrates a consistent upward trajectory.

- In 2020, the total annual revenue was recorded at $181.5 billion.

- This figure increased steadily, reaching $213.1 billion in 2021 and further rising to $251.6 billion in 2022.

- By 2023, IoT revenues climbed to $293.2 billion, and the growth continued. With revenues projected to hit $336 billion in 2024.

- Each subsequent year saw further increases: $380.1 billion in 2025, $425.4 billion in 2026, and $472.3 billion in 2027.

- The trend persisted, with revenues reaching $520.6 billion by 2028 and $570.6 billion by 2029. By the end of the decade, in 2030, IoT revenues are expected to surpass $621.6 billion.

- This consistent increase in annual revenue underscores the expanding influence and adoption of IoT technologies across various sectors globally.

(Source: Statista)

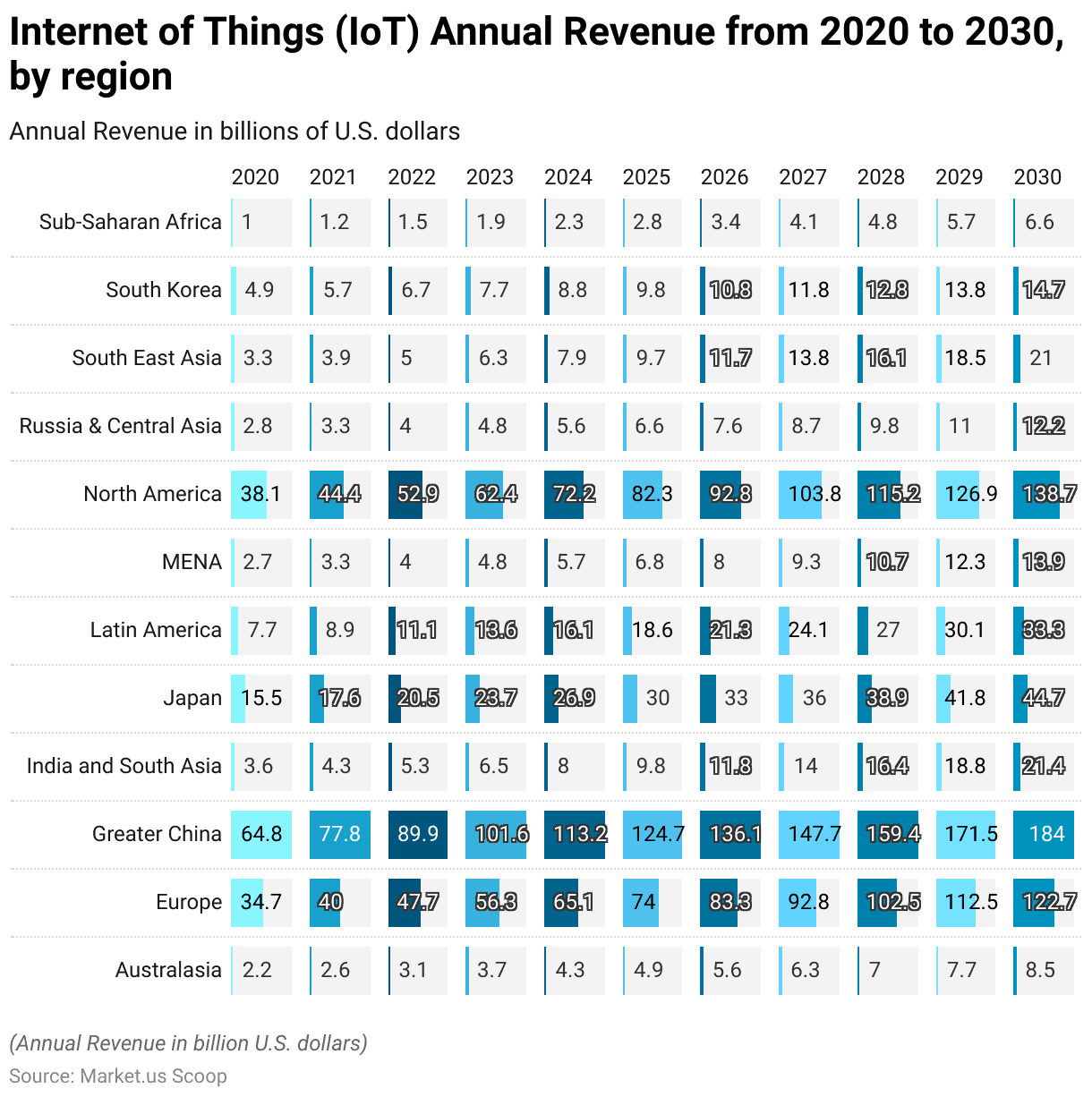

Internet of Things (IoT) Annual Revenue – By Region

- From 2020 to 2030, the annual revenue generated by the Internet of Things (IoT) exhibited robust growth across various global regions.

- In 2020, North America led with $38.1 billion, followed by Greater China at $64.8 billion and Europe with $34.7 billion.

- Over the decade, these regions continued to show substantial revenue increases. North America is projected to reach $138.7 billion by 2030, Greater China is expected to hit $184 billion, and Europe is anticipated to grow to $122.7 billion.

- Other regions also demonstrated significant growth trajectories. For instance, Latin America’s IoT revenue, which started at $7.7 billion in 2020, is forecasted to rise to $33.3 billion by 2030.

- Similarly, India and South Asia began at $3.6 billion in 2020 and are predicted to be more than quintuple to $21.4 billion by the end of the decade. IoT revenues in Japan and South Korea are also on the rise, expected to reach $44.7 billion and $14.7 billion, respectively, by 2030.

- Smaller markets showed notable percentage increases as well. Australasia’s revenue is set to nearly quadruple from $2.2 billion in 2020 to $8.5 billion in 2030.

- The MENA region is anticipated to grow from $2.7 billion to $13.9 billion, and Sub-Saharan Africa from $1 billion to $6.6 billion in the same period.

- This decade-long trend underscores the expansive growth of IoT technologies and their increasing integration across different regions. Highlighting both developed and emerging markets’ commitment to adopting IoT solutions.

(Source: Statista)

Internet of Things (IoT) Connections Over the Globe

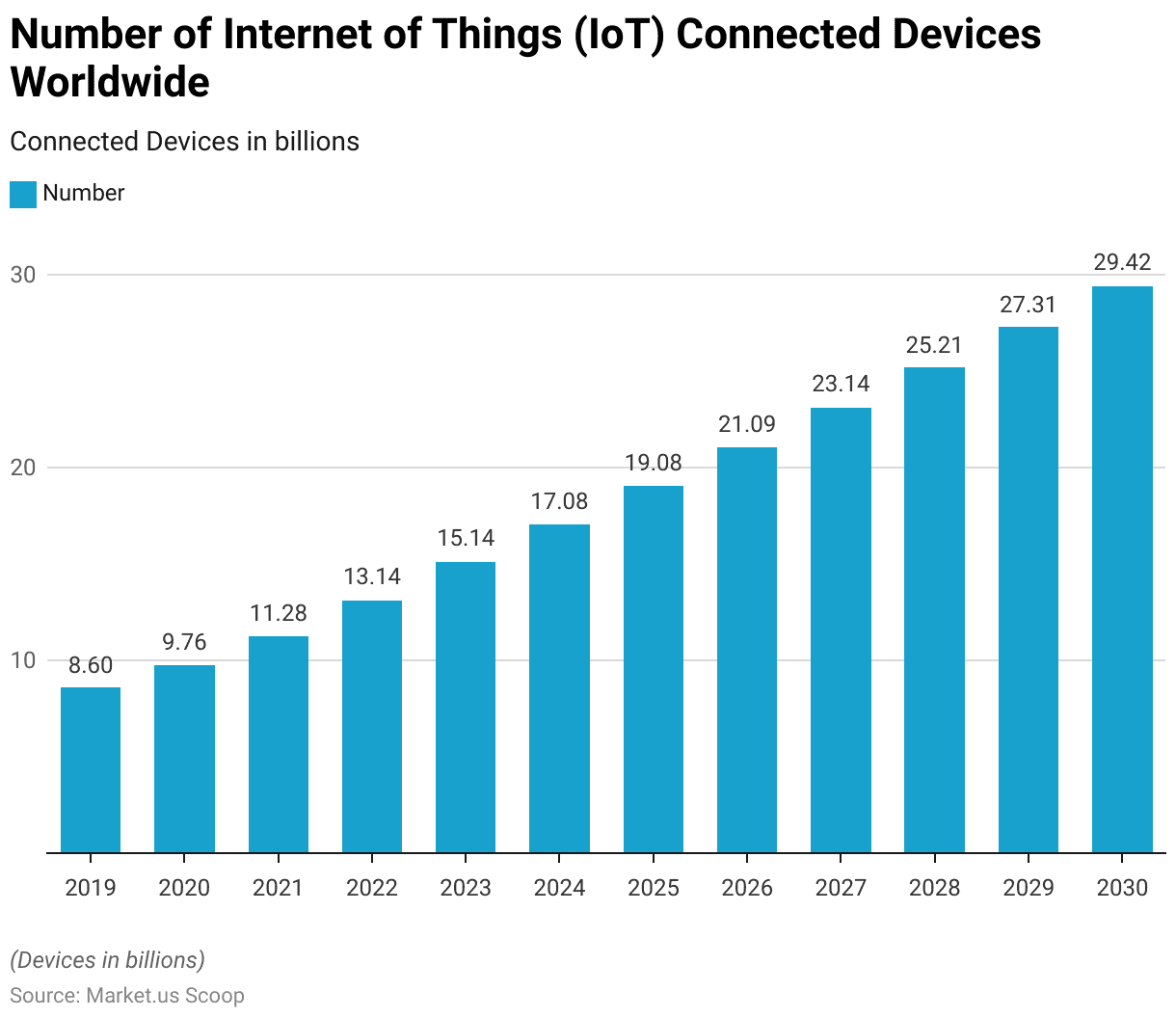

Number of Internet of Things (IoT) Connected Devices Worldwide Statistics

- From 2019 to 2023, the number of Internet of Things (IoT) connected devices worldwide has experienced significant growth. Increasing from 8.6 billion devices in 2019 to 15.14 billion by 2023.

- This upward trend is forecasted to continue through the end of the decade. In 2024, the total is expected to rise to 17.08 billion devices.

- By 2025, the number will further grow to 19.08 billion, and projections show a steady annual increase, reaching 21.09 billion by 2026.

- The growth trajectory remains consistent, with the count of IoT devices expanding to 23.14 billion in 2027 and 25.21 billion in 2028.

- By the end of the decade, in 2029 and 2030, the numbers are projected to reach 27.31 billion and 29.42 billion, respectively.

- This steady rise underscores the expanding integration of IoT technology across various sectors. Driven by the increasing demand for connected devices that enhance efficiency and data utilization.

(Source: Statista)

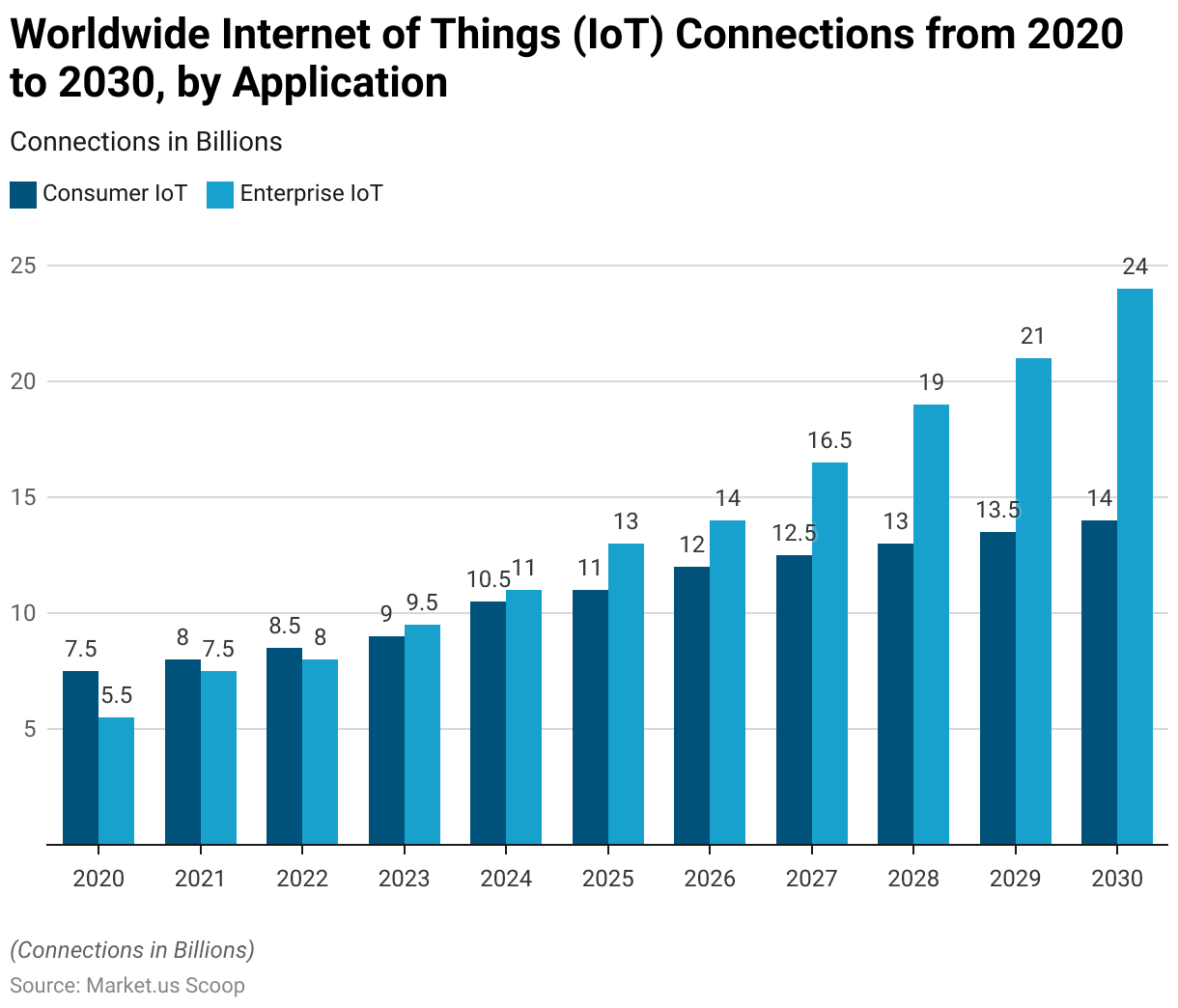

Worldwide Enterprise Internet of Things (IoT) Connections – By Application Statistics

- From 2020 to 2030, the number of worldwide Internet of Things (IoT) connections has shown a clear trend of growth across both consumer and enterprise applications.

- In 2020, there were 7.5 billion connections in the consumer segment and 5.5 billion in the enterprise sector.

- Over the years, these numbers have steadily increased. By 2021, consumer IoT connections rose to 8 billion, while enterprise IoT jumped to 7.5 billion.

- This upward trajectory continued, with consumer connections reaching 9 billion and enterprise connections growing to 9.5 billion by 2023.

- The gap between the two widened significantly by 2024, with enterprise IoT connections overtaking consumer IoT at 11 billion to 10.5 billion, respectively.

- By 2025, enterprise IoT connections expanded to 13 billion compared to 11 billion in consumer IoT.

- The trend accelerated, with enterprise IoT connections projected to reach 24 billion by 2030. Significantly outpacing consumer IoT connections, which are expected to hit 14 billion.

- This growth trajectory highlights the increasing reliance on IoT technologies in both consumer and enterprise settings, with a particularly sharp increase in enterprise applications.

(Source: Statista)

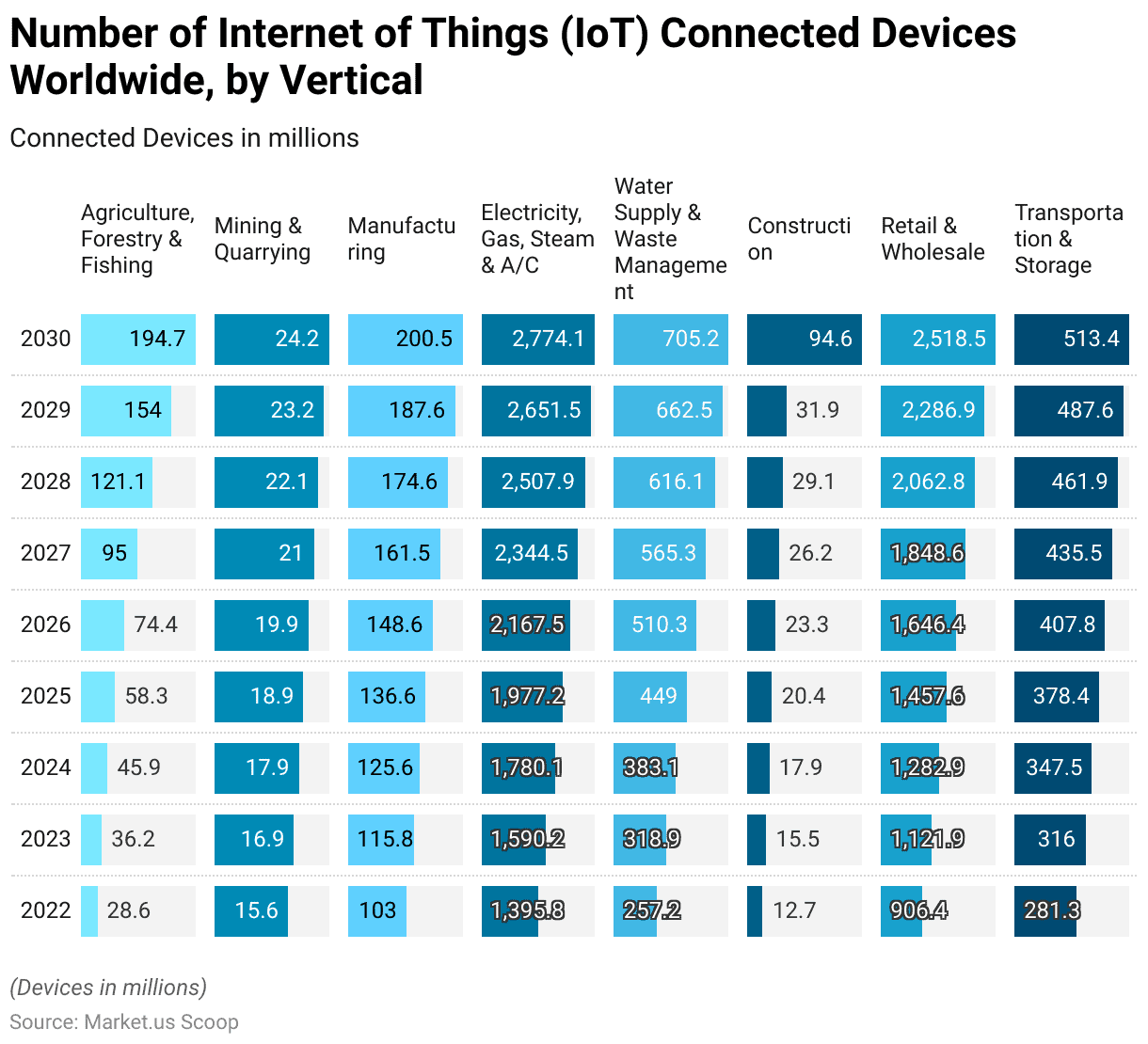

Number of Enterprise IoT Connected Devices Worldwide – By Vertical Statistics

- The distribution of Internet of Things (IoT) connected devices across various industry verticals shows notable growth from 2022 to 2030.

- In agriculture, forestry, and fishing, the number of devices is set to increase significantly from 28.6 million in 2022 to 194.7 million by 2030.

- The mining and quarrying sector sees a more modest rise, from 15.6 million to 24.2 million devices over the same period.

- Manufacturing devices will grow from 103 million in 2022 to 200.5 million by 2030.

- The most substantial increase is observed in the electricity, gas, steam, and air conditioning supply sectors. Where connected devices soar from 1,395.8 million in 2022 to 2,774.1 million in 2030.

- Water supply and waste management also experience significant growth, with numbers escalating from 257.2 million to 705.2 million devices.

- In the construction sector, IoT-connected devices are expected to increase from 12.7 million in 2022 to a substantial 94.6 million by 2030.

- The retail and wholesale sector shows robust growth, with the number of devices expanding from 906.4 million to 2,518.5 million.

- Lastly, in transportation and storage, the figures grow from 281.3 million to 513.4 million devices. Indicating a steady rise across nearly all sectors, reflecting the growing integration of IoT technology across diverse industries.

(Source: Statista)

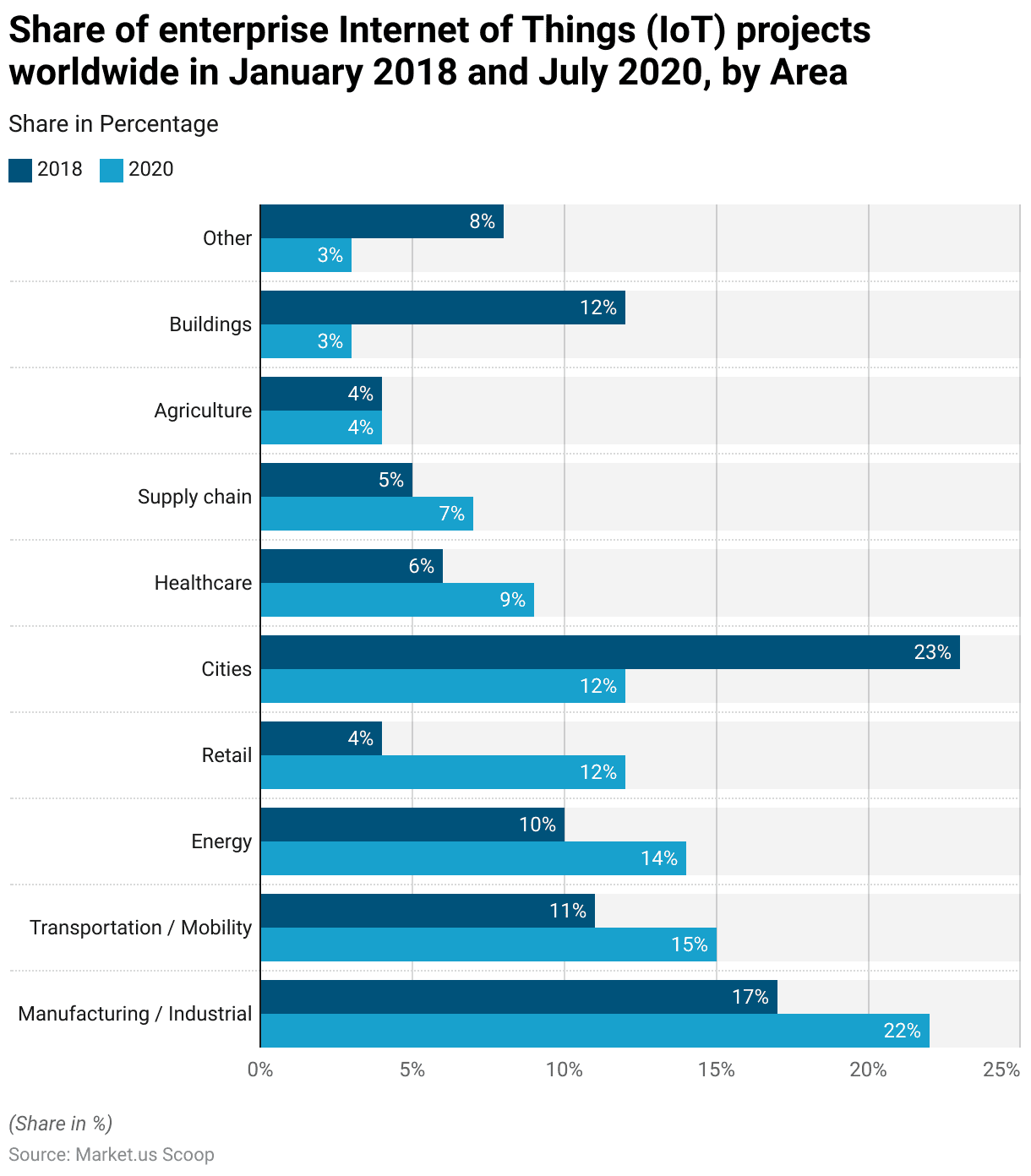

- In January 2018 and July 2020, the distribution of enterprise Internet of Things (IoT) projects across various sectors showed notable shifts.

- In the manufacturing and industrial sectors, the share of IoT projects increased from 17% in 2018 to 22% in 2020, reflecting growing adoption in these areas.

- Transportation and mobility also saw a rise, from 11% to 15%, while energy sector projects increased from 10% to 14%.

- Retail experienced a significant jump in IoT project share, going from 4% to 12%. Conversely, projects in cities decreased from a leading 23% in 2018 to 12% in 2020.

- Healthcare IoT projects grew modestly from 6% to 9%, and supply chain projects increased from 5% to 7%.

- Agriculture maintained a steady share of 4% across both years.

- However, IoT projects in buildings and other sectors saw a notable decline. With buildings dropping from 12% to 3% and other categories from 8% to 3%.

- These changes highlight evolving priorities and the dynamic nature of IoT deployment across different industries.

(Source: Statista)

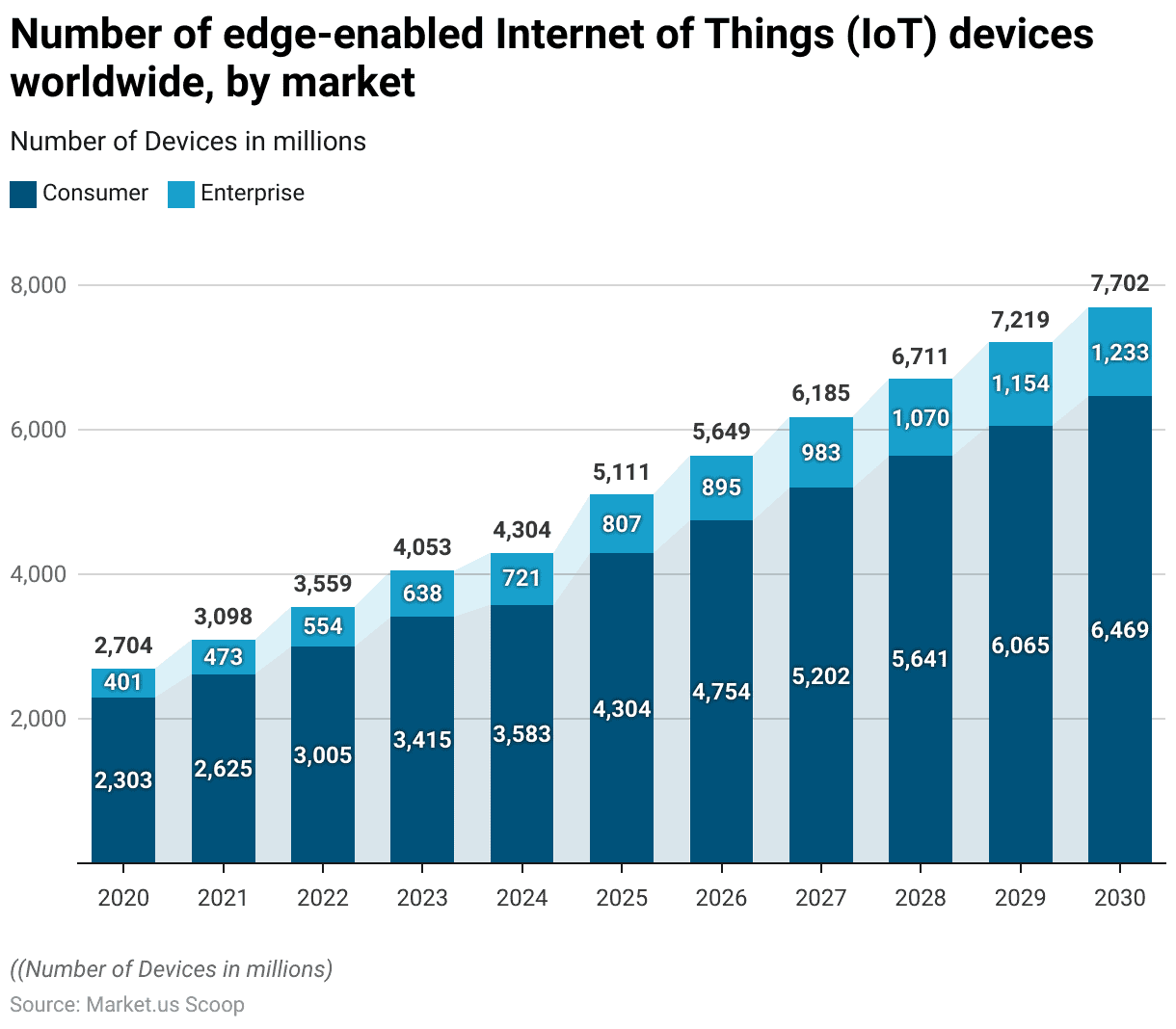

Number of Edge-Enabled Internet of Things (IoT) Devices Worldwide – By Market

- The number of edge-enabled Internet of Things (IoT) devices globally, spanning from 2020 to 2030, displays significant growth within both consumer and enterprise markets.

- Starting in 2020, the count was 2,303 million devices in the consumer segment and 401 million in the enterprise segment.

- This upward trend continued, with consumer devices reaching 2,625 million and enterprise devices 473 million by 2021.

- The growth accelerated through the following years, with consumer numbers increasing to 3,005 million and enterprise to 554 million by 2022, and then to 3,415 million and 638 million, respectively, in 2023.

- By 2024, there were 3,583 million consumer devices and 721 million enterprise devices. The surge in consumer devices became more pronounced. Reaching 4,304 million by 2025 and continuing to rise to 6,469 million by 2030.

- Similarly, enterprise devices also saw steady increases, reaching 807 million in 2025 and culminating at 1,233 million by 2030.

- This trend underscores the expanding integration and reliance on edge computing capabilities within IoT devices, highlighting significant growth. Especially in consumer markets, with enterprise markets also showing robust increases.

(Source: Statista)

Enterprise & Entire IoT Adoption Statistics

- From 2016 to 2030, the global landscape for Internet of Things (IoT) devices has seen and is projected to see remarkable growth in its installed base.

- In 2016, the total number of IoT units installed worldwide stood at approximately 6,382 million. This figure grew to 8,381 million in 2017 and further expanded to 11,197 million by 2018. By 2030, the installed base is expected to skyrocket to 125,000 million units.

- Consumer devices have consistently formed a significant portion of this total, increasing from 3,963 million units in 2016 to 5,244 million in 2017 and 7,036 million in 2018. With a projection of reaching 75,000 million by 2030. Throughout this period, consumer devices have represented about 60% to 63% of total IoT devices.

- The number of connected devices per person has remained steady at five over these years, indicating a consistent level of personal engagement with IoT technology.

- Notably, the IoT adoption rate has shown dramatic increases, starting at 11% in 2016, rising to 14% in 2017, and reaching 18% in 2018.

- By 2030, the adoption rate is projected to reach an unprecedented 176%, reflecting the anticipated deep penetration and ubiquity of IoT technologies in daily life and across various sectors by the end of the period.

(Source: DBS)

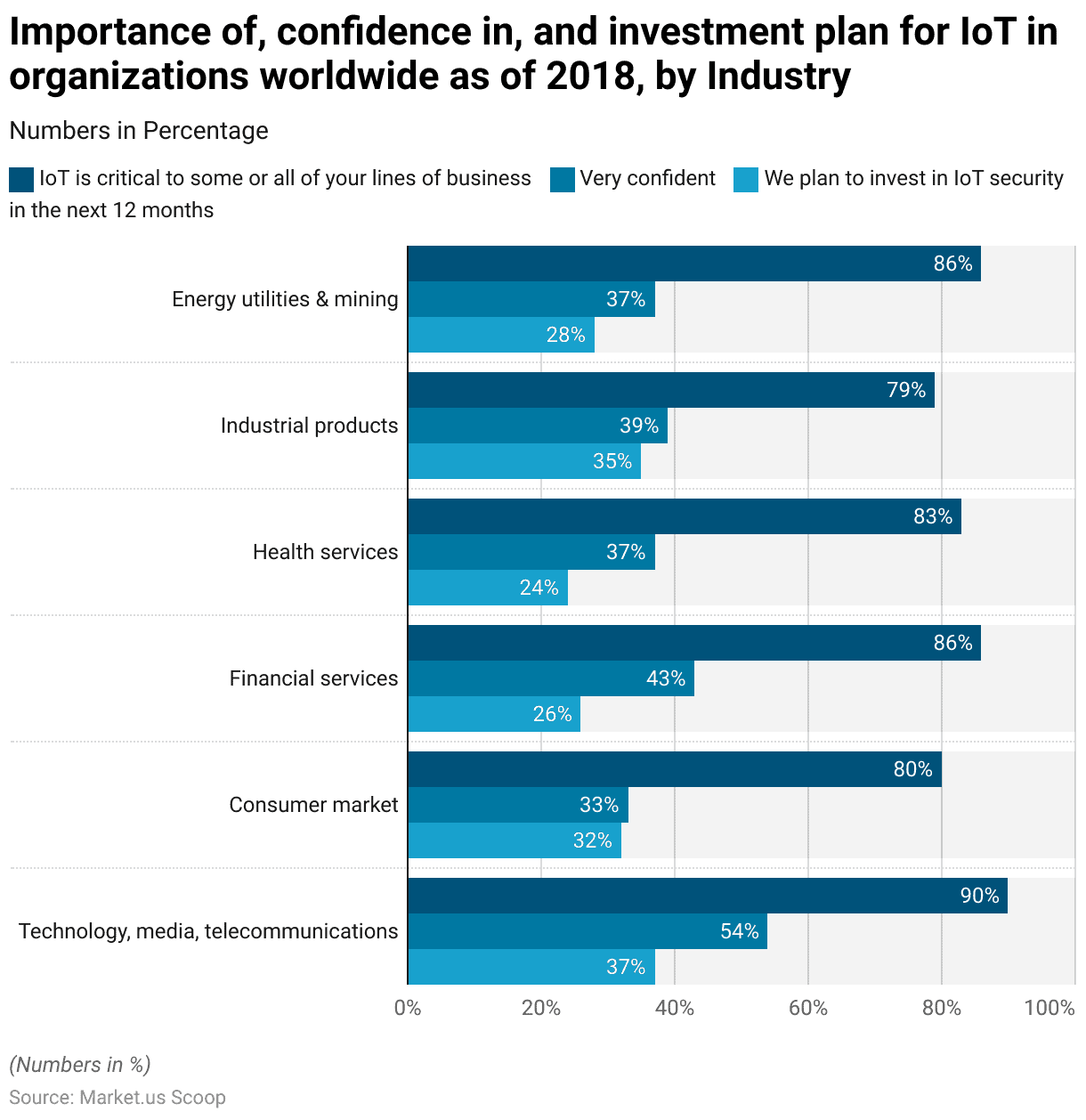

Importance of and Investment Plan for IoT in Business Worldwide – By Industry

- As of 2018, the significance of the Internet of Things (IoT) varied across industries, with a notable emphasis on its criticality. The confidence in building digital trust controls, and plans for future investment in IoT security.

- In the technology, media, and telecommunications industries, a high 90% of organizations viewed IoT as critical to some or all business lines. With 54% expressing strong confidence in their digital trust controls for IoT and 37% planning to invest in IoT security over the next 12 months.

- In the consumer market, 80% of entities recognized the critical nature of IoT, but only 33% were very confident about their digital trust controls, and 32% planned to invest in security.

- The financial services sector reported that 86% considered IoT essential. 43% were very confident in their digital trust controls, although only 26% intended to invest in IoT security soon.

- Health services showed that 83% of organizations saw IoT as critical, but just 37% had high confidence in their digital trust frameworks, and 24% planned on investing in security enhancements.

- In the industrial products sector, 79% found IoT critical, 39% had high confidence in their controls, and 35% were planning security investments.

- Energy utilities and mining also valued IoT highly at 86%, with 37% very confident in their controls and 28% planning to invest in security.

- This data underscores the varied perspectives and strategic priorities regarding IoT across different industries, reflecting differing levels of adoption, confidence, and investment plans in digital security measures.

(Source: Statista)

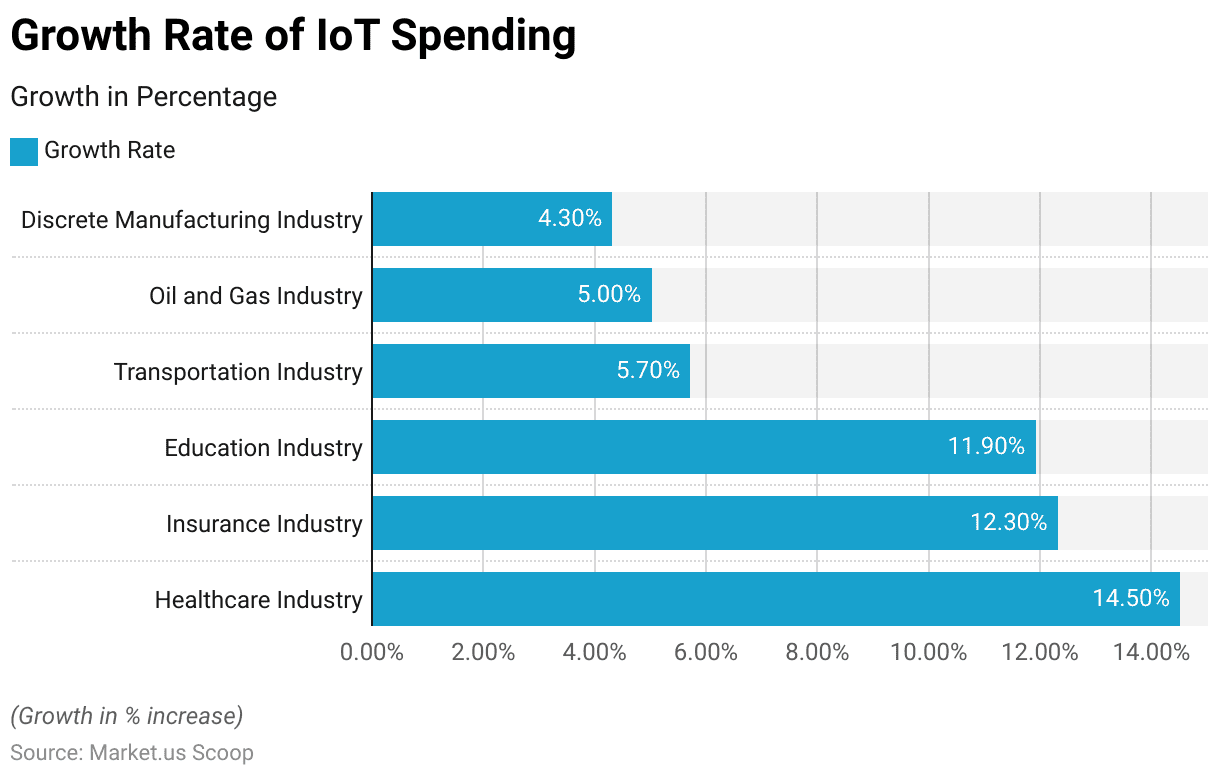

IoT Spending Across Different Industries

- In terms of the growth rate of IoT spending across various industries, there is a noticeable variance in how much each sector is investing in Internet of Things technologies.

- The healthcare industry leads with a significant 14.5% increase in IoT spending, underscoring its growing reliance on connected technologies for enhanced patient care and operational efficiency.

- Following closely, the insurance industry shows a 12.3% growth rate, leveraging IoT for risk assessment and management.

- The education industry also sees a notable increase, with an 11.9% rise in spending, reflecting its adoption of IoT for smarter, more connected educational environments.

- Conversely, the transportation industry, oil and gas industry, and discrete manufacturing industry are experiencing more modest growth rates in their IoT investments. The transportation industry’s spending is growing by 5.7%, potentially for advancements in logistics and fleet management.

- The oil and gas industry sees a 5% increase, likely focusing on IoT for operational efficiency and safety enhancements.

- Lastly, the discrete manufacturing industry is growing at a rate of 4.3%, indicating a steady, albeit slower, uptake of IoT technologies in manufacturing processes.

- These figures illustrate the varying levels of commitment and different strategic focuses across industries regarding IoT deployment and integration.

(Source: Help Net Security, 2020)

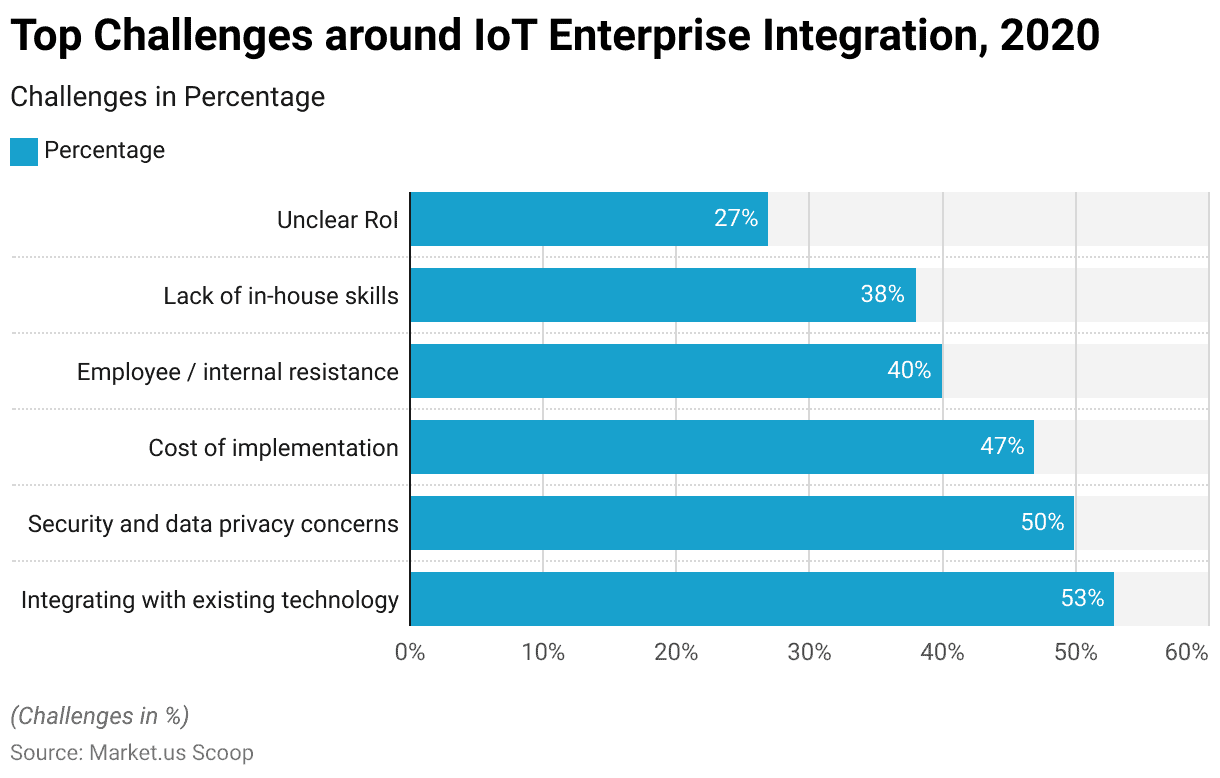

Challenges Around IoT Enterprise Integration Statistics

- In 2020, enterprises faced several significant challenges when integrating Internet of Things (IoT) technologies.

- The most prevalent issue experienced by 53% of organizations was integrating IoT solutions with existing technology, highlighting the complexity of meshing new systems with legacy infrastructures.

- Close behind, security and data privacy concerns were cited by 50% of the respondents, underscoring the critical importance of safeguarding data in increasingly connected environments.

- The cost of implementation was also a major hurdle for 47% of enterprises, indicating substantial financial implications associated with deploying IoT solutions.

- Additionally, 40% of organizations encountered resistance from employees or internal stakeholders, which could stem from concerns over changes to workflows or job roles.

- A lack of in-house skills was another significant barrier, mentioned by 38% of enterprises, reflecting a gap in IoT-related expertise necessary for effective implementation.

- Finally, unclear return on investment (RoI) troubled 27% of the companies, suggesting challenges in justifying IoT projects financially.

- These challenges collectively illustrate the multifaceted difficulties enterprises face when attempting to integrate IoT into their operations, spanning technical, financial, and human factors.

(Source: GSMA Intelligence, 2020)

Recent Developments

Acquisitions and Mergers:

- IBM acquired Turbonomic, a provider of Application Resource Management (ARM) and network performance management software, in a deal valued at approximately $1.5 billion. This acquisition aims to enhance IBM’s capabilities in optimizing workloads across hybrid cloud environments.

- Siemens Mobility acquired Sqills, a leading provider of sales and distribution software for public transport operators. The acquisition strengthens Siemens’ portfolio in digital mobility solutions, particularly in the area of ticketing and passenger information systems.

New Product Launches:

- Cisco introduced its Catalyst IE3x00 Rugged Series of Industrial Ethernet switches, designed to provide reliable connectivity and security for IoT deployments in harsh environments. The switches offer advanced features such as Time-Sensitive Networking (TSN) and Security Group Tagging (SGT) for enhanced industrial network performance and protection.

- Microsoft unveiled Azure IoT Edge 2.0, the latest version of its edge computing platform. Azure IoT Edge 2.0 offers improved scalability, security, and flexibility for deploying and managing IoT solutions at the edge, empowering organizations to process data closer to its source and drive real-time insights.

Funding Rounds:

- Soracom, a provider of IoT connectivity solutions, raised $120 million in Series D funding. The investment will support Soracom’s expansion efforts, including the development of new products and services to address the growing demand for secure and scalable IoT connectivity.

- Particle, a leading IoT platform provider, secured $40 million in Series C funding. The funding will fuel Particle’s product innovation and global expansion initiatives, enabling businesses to accelerate their IoT projects and drive digital transformation.

Strategic Partnerships:

- Verizon partnered with Honeywell to integrate Verizon’s 5G Ultra Wideband network with Honeywell’s IoT sensors and software solutions. This collaboration aims to enable advanced industrial automation and asset management capabilities, leveraging the high bandwidth and low latency of 5G technology.

- Bosch and Microsoft announced a strategic partnership to develop a software platform for managing and controlling IoT devices across various industries. The platform, built on Microsoft Azure, will enable seamless integration of Bosch’s IoT suite with Azure IoT services, empowering organizations to unlock new opportunities for innovation and efficiency.

Conclusion

Enterprise IoT Statistics – Enterprise Internet of Things (IoT) is rapidly growing and showing great promise across various sectors, such as manufacturing, healthcare, transportation, and energy.

Despite this, enterprises face significant challenges, including integrating IoT with existing systems, security risks, high implementation costs, internal resistance, and skill shortages.

Additionally, demonstrating a clear return on investment remains a substantial hurdle. Despite these challenges, the future of Enterprise IoT looks promising.

As organizations continue to refine their approaches and solutions, IoT adoption is expected to increase, driven by the need for greater connectivity and automation in an increasingly digital world.

Enterprises that successfully overcome these obstacles and leverage IoT’s potential stand to gain significant competitive advantages, driving innovation and growth.

FAQs

Enterprise IoT refers to the application of Internet of Things technology within commercial and industrial sectors to enhance operational efficiency, improve real-time decision-making, and foster innovation through interconnected devices and data analytics.

IoT offers numerous benefits to enterprises, including increased operational efficiency, enhanced data collection and analysis, improved safety and security, and the ability to make informed decisions quickly, leading to reduced operational costs and improved business outcomes.

Key challenges include integrating IoT with existing IT infrastructure, addressing security and privacy concerns, managing high implementation costs, overcoming resistance from employees, and dealing with the lack of in-house IoT expertise.

Manufacturing, healthcare, transportation, and energy sectors are among the most benefited, leveraging IoT for monitoring and optimization, predictive maintenance, asset tracking, and energy management.

IoT systems are vulnerable to various security risks, including unauthorized access, data theft, and network attacks. It’s crucial to implement robust security measures, such as encryption, secure device authentication, and regular software updates to mitigate these risks.