Table of Contents

- Introduction

- Editor’s Choice

- ERP Software Market Size Statistics

- ERP Software Features, Add-ons, and Customization Statistics

- The Benefits of ERP Projects

- Small and Medium Businesses ERP software statistics

- Adoption of ERP Software

- Deployment and Implementation of ERP Systems

- ERP ROI Statistics

- Most Popular ERP Software

- Company Expectations on ERP Software

- ERP Software Trends

- Recent Developments

- Conclusion

- FAQ’s

Introduction

ERP Software Statistics: Enterprise Resource Planning (ERP) software has become indispensable for businesses in today’s competitive landscape.

It simplifies complex operations and supports data-driven decision-making by integrating functions such as finance, HR, and inventory management into a single platform.

This integration boosts efficiency and productivity. ERP software is no longer a luxury but a necessity, enabling companies to enhance operational visibility, cut costs, and meet regulatory requirements.

Recent statistics show that the global ERP software market is steadily growing. The growing demand for digitization, automation, and scalability fuels this growth.

It is projected that the ERP market will reach a significant size by 2025. Cloud-based ERP solutions gaining traction due to their flexibility and cost-effectiveness.

Moreover, ERP software adoption is not limited to large enterprises anymore. Small and medium-sized businesses also recognize its value, contributing significantly to the Market’s expansion.

Editor’s Choice

- The ERP Software Market will grow at a CAGR of 10.5% from the year 2022 to 2032.

- 89% of buyers consider accounting the primary feature they seek in an ERP system.

- 33% to 48% of businesses request moderate levels of customization, with 10% to 19% explicitly requesting personalized ERP solutions.

- 67% of organizations describe their ERP implementation as “very successful” or “successful.” Only 2% describe their ERP projects as “not very successful.”

- More than 80% of small and medium-sized enterprises (SMEs) with an annual revenue of less than 50 million dollars rely on ERP systems.

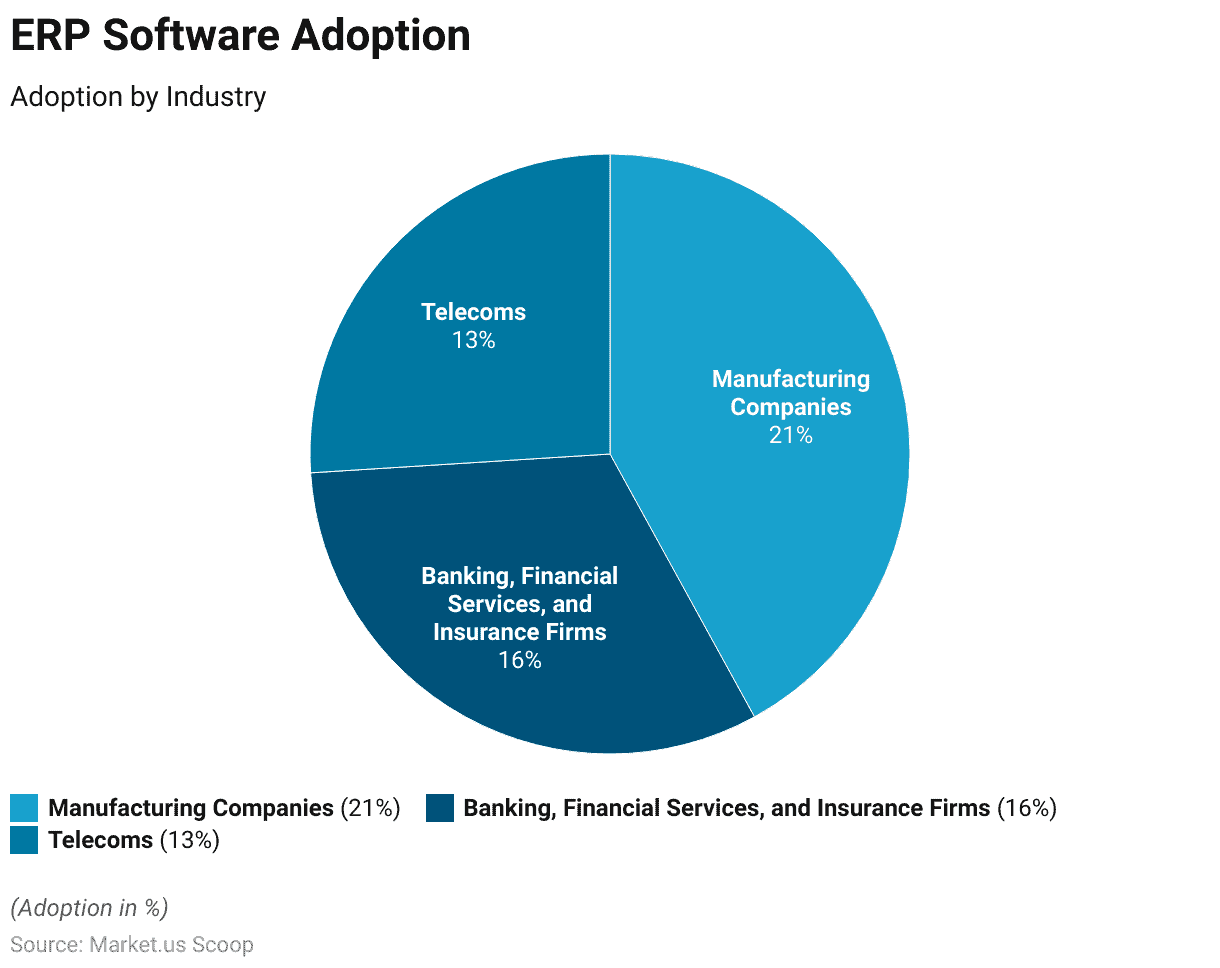

- According to experts in the field, ERP software is particularly favored. Like manufacturing companies (21%), followed by banking, financial services, and insurance firms (16%), as well as telecoms (13%).

- The pandemic has accelerated digital transformation efforts for 69% of private organizations. Including adopting ERP solutions, with an additional 43% planning their digital transformation strategies within the following year.

- In ERP solutions, 53.1% of companies have embraced cloud-based ERP solutions. While the remaining companies continue to rely on on-premise systems.

- Approximately 85% of organizations have expressed an urgent need for a new ERP system, recognizing its significance.

- AI, in particular, is driving enhanced automation and quicker outcomes in ERP systems, and a notable 65% of Chief Information Officers (CIOs) foresee the integration of AI into ERP by the year 2022.

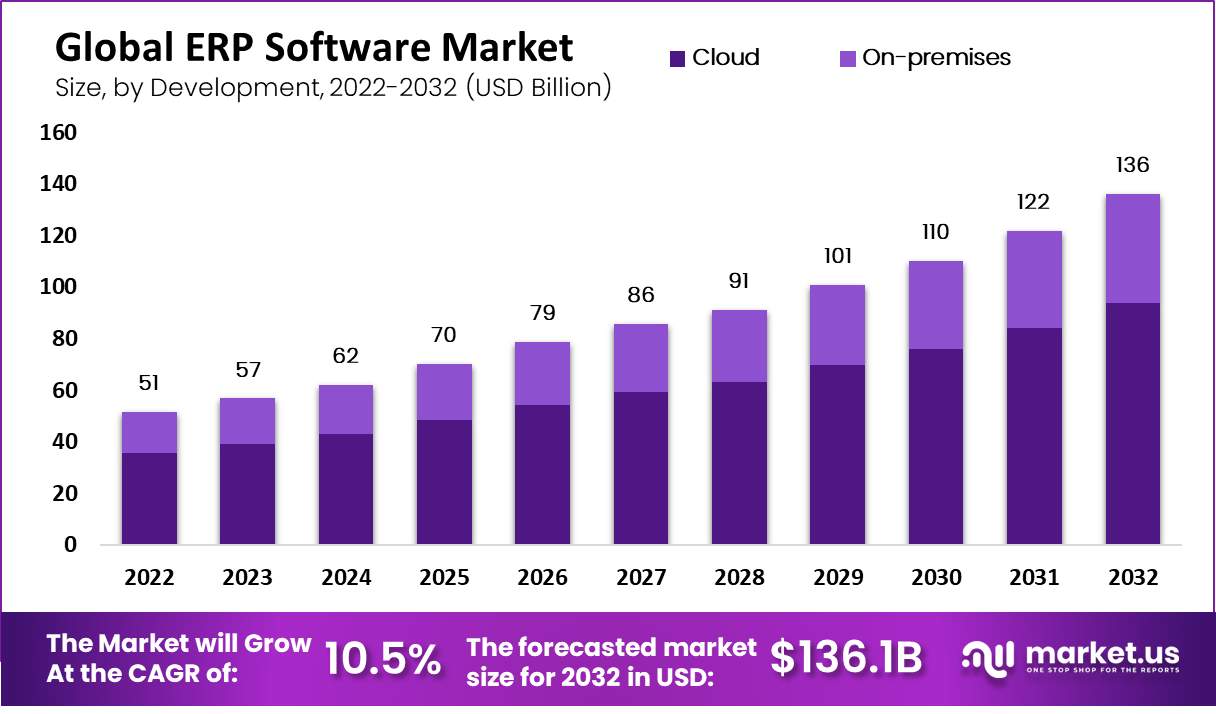

ERP Software Market Size Statistics

- The market size of ERP software has shown consistent growth in recent years. The figures reflect its increasing importance in the business world.

- The Market will grow at a CAGR of 10.5% from the year 2022-2032.

- In 2022, the market size stood at 51 billion.

- It saw a steady rise over the subsequent years, reaching 57 billion in 2023, 62 billion in 2024, and 70 billion in 2025.

- The momentum continued, with projections indicating further expansion. Reaching 79 billion in 2026, 86 billion in 2027, 91 in 2028, and a significant milestone of 101 in 2029.

- Looking ahead, the trend is expected to continue. The market size is forecasted to reach 110 billion in 2030, 122 billion in 2031, and a substantial 136 billion in 2032.

- These statistics underscore the growing significance of ERP software solutions across various industries as businesses increasingly recognize their value in enhancing efficiency and competitiveness.

(Source – Market.Us)

ERP Software Features, Add-ons, and Customization Statistics

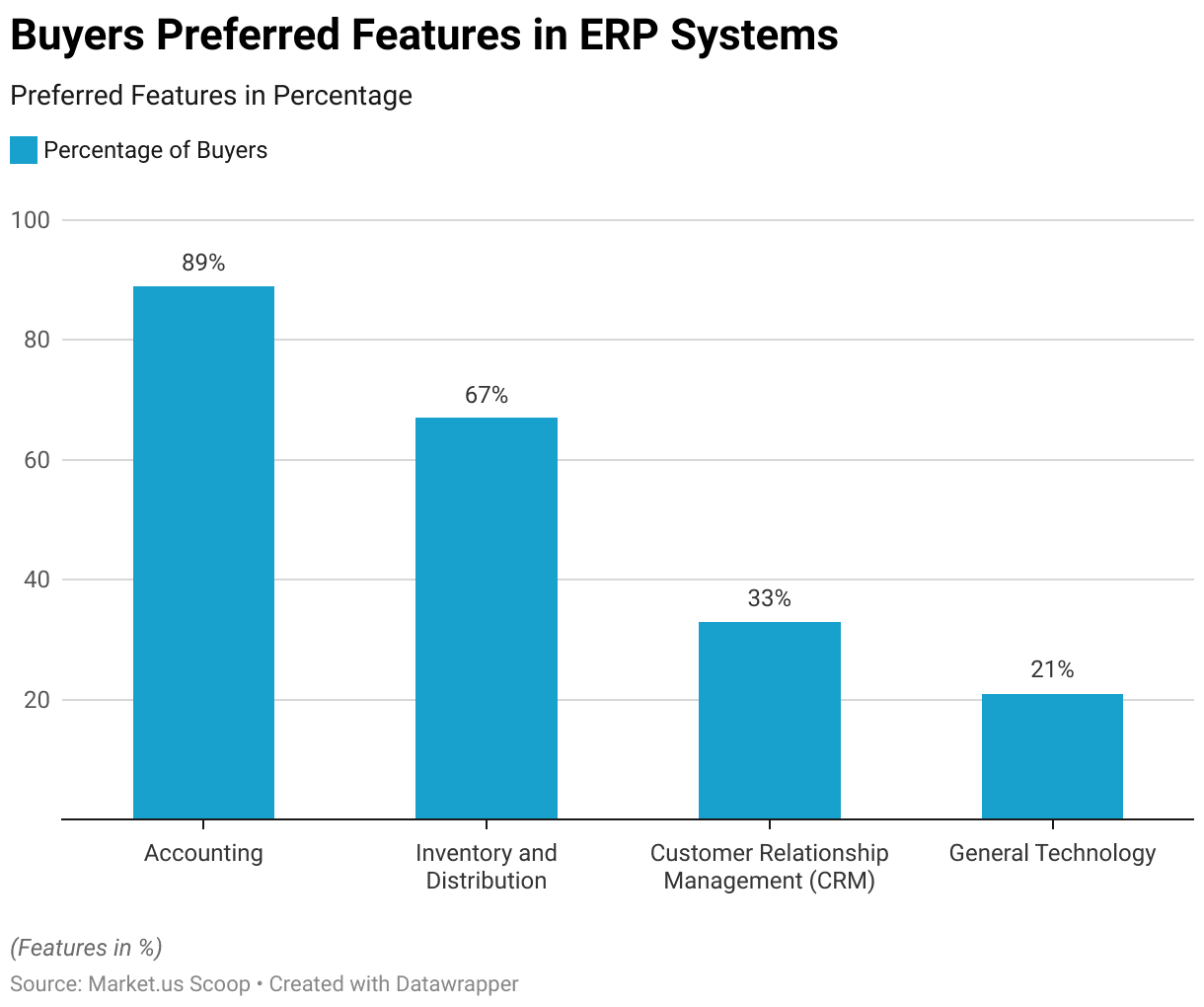

- According to a survey, 89% of buyers consider accounting as the primary feature they seek in an ERP system.

- Respondents also expressed interest in modules related to inventory and distribution (67%), customer relationship management (CRM) (33%), and general technology (21%).

- Only a mere 3% of companies rely on ERP systems with standard, out-of-the-box functionality. While the vast majority opt for some level of customization.

- Among those seeking customization, 33% to 48% of businesses request moderate levels of customization, with 10% to 19% explicitly requesting personalized ERP solutions.

(Source: Founderjar, Selecthub)

The Benefits of ERP Projects

- Around two-thirds (67%) of organizations consider their ERP implementation to be either “highly successful” or “successful,” while a mere 2% label their ERP projects as “not very successful”

- A significant majority (80%) of organizations achieve a return on investment (ROI) from their ERP implementation, whether it’s early, on schedule, or on time.

- However, only 9% of organizations report having realized an ROI since implementing ERP.

- According to 80% of organizations, the centralized data system offered by ERP enables effective collaboration on new applications.

- Approximately 38% of organizations believe ERP enhances their capacity to adapt to changing customer demands.

- For 75% of enterprises, ERP enables real-time customer engagement. Additionally, other benefits of ERP investments include data integration (74%). Improving data quality through enhanced datasets (73%), and delivering a seamless. Omnichannel customer experience across multiple devices (72%).

(Source: Ultraconsultant, Mint Jutras, Accenture)

Small and Medium Businesses ERP software statistics

- More than 80% of small and medium-sized enterprises (SMEs) with an annual revenue of less than 50 million dollars rely on ERP systems.

- Account payable is the most common ERP process adopted by small businesses (77%), followed by accounts receivable at 73%.

- The majority of small and medium-sized enterprises (SMBs) (55%) choose to implement a cloud-based enterprise resource planning (ERP) system due to its convenience (29%) and adaptability (27%).

(Source: Aberdeen)

Adoption of ERP Software

- According to experts in the field, ERP software is particularly favored by manufacturing companies (21%), followed by banking, financial services, and insurance firms (16%), as well as telecoms (13%).

- In the retail sector, more than 55% of companies are expected to opt for hybrid ERP system deployments.

- Regarding satisfaction levels, 31.6% of project team members and decision-makers express high satisfaction with their ERP systems. However 21.1% report dissatisfaction with their current ERP solutions.

- Around half of the companies surveyed in 2020 were either planning or already implementing an ERP system or upgrading their existing ones.

- The pandemic has accelerated digital transformation efforts for 69% of private organizations, including adopting ERP solutions. With an additional 43% planning their digital transformation strategies within the following year.

- When choosing an ERP solution, 25% of finance leaders prioritize capability fit. While other considerations include extensibility, user experience, and total cost of ownership.

(Source – PR Newswire, Deloitte, Technology Evaluation Centers, Panorama Consulting Group)

Deployment and Implementation of ERP Systems

- In ERP solutions, 53.1% of companies have embraced cloud-based ERP solutions. While the remaining companies continue to rely on on-premise systems.

- Furthermore, among cloud users, 46% opt for private cloud solutions, while 12% consider public cloud options.

- Within the domain of cloud deployment, the majority (76.5%) prefer hosted ERP solutions. While 23.5% favor the Software as a Service (SaaS) model.

- In contrast, companies utilizing on-premise ERP solutions predominantly host them internally. Accounting for 80% of cases, with the remainder opting for external infrastructure.

- Significantly, more than half of companies, at 53%, incorporate ERP deployment as an integral component of their broader digital business transformation initiatives.

- Regarding ERP implementation strategies, 32.1% of companies adopt the “big bang” approach. Deploying the entire system in a single project phase. Conversely, an equivalent number of companies opted for a hybrid approach. Combining elements of the Big Bang and phased deployment methods.

- Recognizing the critical role of expertise, companies acknowledge the significance of business transformation consultants or ERP experts. Hiring them primarily for their proficiency in ERP implementation (81%). As well as in areas such as business process management (42.9%). Organizational change management (33.33%), and project auditing (28.6%), among other vital functions.

(Source -Panorama Consulting Group, Accenture)

ERP ROI Statistics

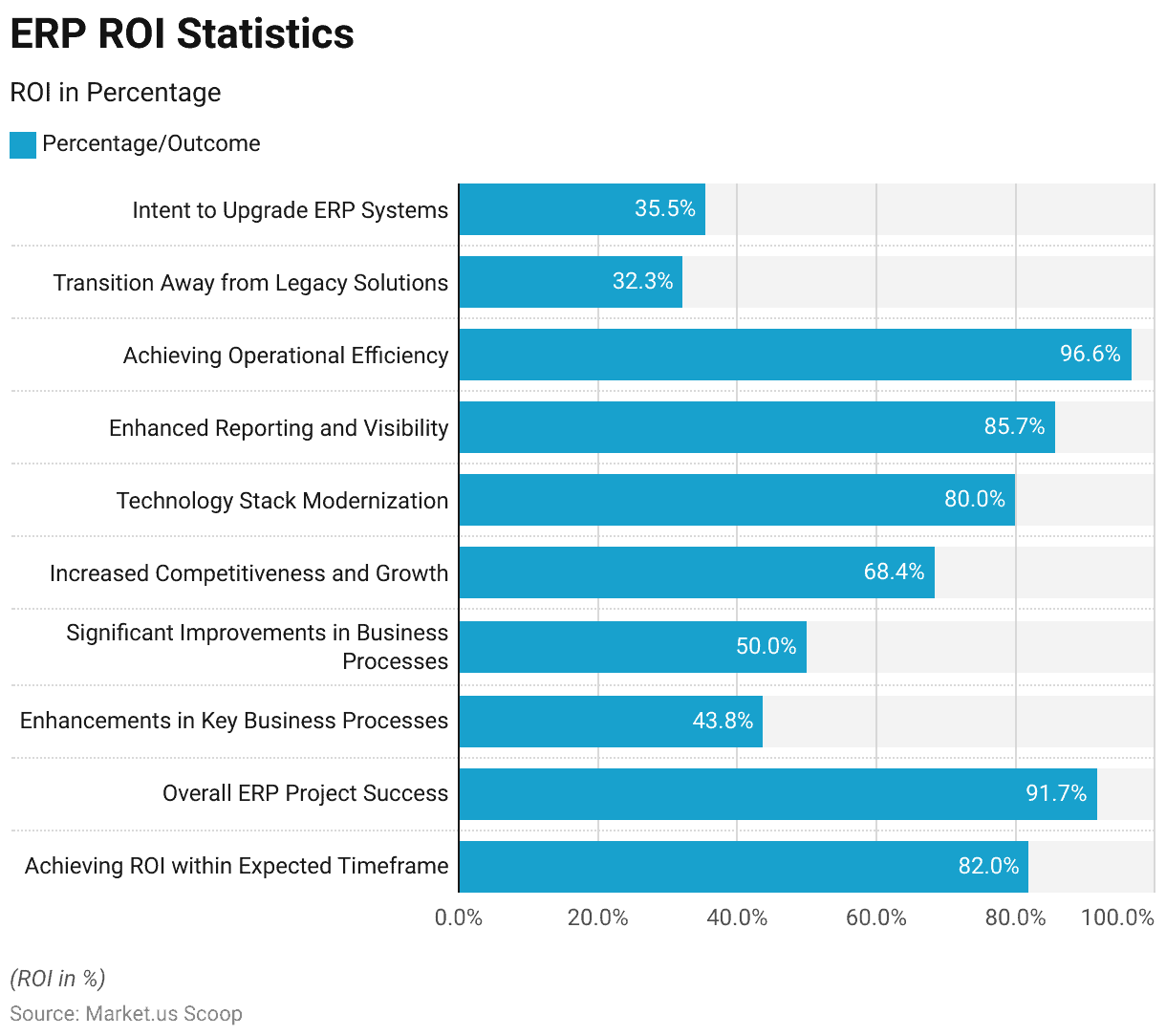

- A substantial portion of companies, totaling 35.5%, express intentions to upgrade their ERP systems. While an additional 32.3% are planning to transition away from legacy solutions.

- ERP solutions are proving highly effective for organizations. Helping them attain various goals, including operational efficiency (96.6%), enhanced reporting and visibility (85.7%), technology stack modernization (80%), and increased competitiveness and growth (68.4%).

- Impressively, 50% of organizations implementing ERP systems report significant improvements in most of their business processes. With another 43.8% noting enhancements in crucial business processes.

- Furthermore, 91.7% of enterprises that completed their ERP projects report overall success.

- Notably, companies implementing ERP systems typically achieve a return on investment (ROI) within an average of 2.5 years, with approximately 82% stating that they achieved ROI within the expected timeframe.

(Source – Panorama Consulting Group, The Parker Initiative)

Most Popular ERP Software

- The technical aspects of ERP system implementation are considered the least challenging, with only 8% of decision-makers encountering difficulties. Conversely, 33.3% of respondents identified the most formidable hurdle as managing organizational change, primarily involving the human element within their companies.

- Moreover, budget overruns during ERP software implementation are predominantly attributed to the necessity of acquiring additional technology, accounting for 50% of cases.

- Similarly, missed project milestones and deadlines often result from a combination of organizational issues (26.7%), project scope expansion (20%), and data-related challenges (20%).

- Alarmingly, nearly half of ERP projects encounter failure during their initial attempts, and roughly 30% take longer to complete than initially projected.

- Furthermore, these implementations frequently exceed their allocated budgets by three to four times. For small and medium-sized enterprises (SMEs), ERP projects have posed significant risks and challenges, including customization concerns (40%), training requirements (39%), upgrade costs (33%), and limited flexibility (28%).

- Notably, experts have identified several critical barriers to successful ERP implementation: resistance to change (82%), insufficient sponsorship (72%), unrealistic expectations (65%), and ineffective project management (54%).

- Lastly, a mere 8% of IT directors reported that their new ERP systems are user-friendly, highlighting the importance of enhancing user experience in ERP implementations.

(Source – Panorama Consulting Group, Technical Evaluation Center, Deloitte, Supply Chain Digital)

Company Expectations on ERP Software

- Approximately 85% of organizations have expressed an urgent need for a new ERP system, recognizing its significance.

- There’s a misconception among 40% of companies that adopting cloud ERP will automatically enhance their financial reporting, as revealed by Insight Software in 2021. Some of the perceived advantages of ERP systems include report automation (30%), reduced dependence on IT (25%), and improved report accuracy (21%).

- In anticipation of the end-of-life of SAP ECC in 2027, up to 53% of organizations are preparing.

- Moreover, 82% of companies hold positive expectations regarding the impact of their new ERP strategies on quality.

- While 48% of companies actively engage in cloud ERP projects, 33% are still transitioning from on-premise to the cloud.

- However, there remains uncertainty among 44% of stakeholders about their companies’ cloud ERP plans, with an additional 25% stating that there are no such plans in place.

(Source – The Bearing Point, Insight Software, The Bearing Point, Accenture, Insight Software)

ERP Software Trends

- AI, machine learning, IoT, and cloud-based ERP solutions are gaining significant traction in the business world.

- AI, in particular, is driving enhanced automation and quicker outcomes in ERP systems, and a notable 65% of Chief Information Officers (CIOs) foresee the integration of AI into ERP by the year 2022

- The rise of Intelligent ERP (ERP) is also expected shortly, indicating a growing trend toward more innovative, efficient systems.

- Furthermore, some companies have adopted a two-tiered approach to ERP, allowing them to strike a balance between specific functions.

- For instance, they might implement a new ERP system for financial purposes while retaining a familiar legacy system for HR needs. This demonstrates the evolving strategies in ERP system adoption.

(Source – Acumatica, Infosys Consulting, Selecthub)

Recent Developments

Acquisitions and Mergers:

- Microsoft acquires Suplari: In mid-2023, Microsoft acquired Suplari, an AI-driven spend management platform, for $180 million. This acquisition aims to enhance Microsoft Dynamics 365’s ERP capabilities by integrating advanced spend analysis and supplier management features.

- SAP acquires Signavio: SAP completed its acquisition of Signavio, a leader in business process management, for $1.2 billion in late 2023. This merger is expected to strengthen SAP’s ERP suite by providing comprehensive process management and optimization tools.

New Product Launches:

- Oracle Fusion Cloud ERP: In early 2024, Oracle launched an updated version of its Fusion Cloud ERP, featuring enhanced AI-driven analytics, improved user experience, and expanded industry-specific functionalities to support diverse business needs.

- Infor CloudSuite 2024: Infor introduced CloudSuite 2024 in mid-2023, offering new AI-powered capabilities, better integration with IoT devices, and enhanced cloud-native architecture designed to improve scalability and performance.

Funding:

- Acumatica secures $150 million: Acumatica, a cloud-based ERP provider, raised $150 million in a funding round in 2023 to expand its platform capabilities and enhance its global market presence, focusing on small and medium-sized enterprises.

- Workday raises $200 million: In early 2024, Workday secured $200 million to develop new features for its ERP software, particularly in the areas of financial management and human capital management, aiming to cater to large enterprises.

Technological Advancements:

- AI and Machine Learning Integration: ERP software providers are increasingly integrating AI and machine learning to improve predictive analytics, automate routine tasks, and enhance decision-making processes, leading to greater operational efficiency.

- Enhanced User Experience (UX): Advances in UX design are being applied to ERP systems to provide more intuitive interfaces, better accessibility, and streamlined workflows, improving user adoption and satisfaction.

Market Dynamics:

- Growth in ERP Software Market: The global ERP software market is projected to grow at a CAGR of 10.2% from 2023 to 2028, driven by the increasing need for operational efficiency. Digital transformation initiatives, and the adoption of cloud-based solutions.

- Increased Adoption in Manufacturing: The manufacturing sector is seeing significant adoption of ERP systems to streamline operations. Manage supply chains, and improve production efficiency, contributing to market growth.

Regulatory and Strategic Developments:

- Data Privacy Regulations: ERP providers are enhancing their solutions to ensure compliance with data privacy regulations such as GDPR and CCPA. Incorporating robust data protection and privacy features to meet regulatory requirements.

- US Cybersecurity Executive Order: The US government’s cybersecurity executive order issued in early 2024 emphasizes the importance of securing enterprise software. Driving ERP providers to adopt stringent security measures and best practices.

Research and Development:

- Cloud-Native ERP Solutions: R&D efforts are focusing on developing cloud-native ERP solutions that offer greater flexibility, scalability, and cost-efficiency, enabling businesses to adapt quickly to changing market conditions.

- IoT Integration: Researchers are exploring the integration of IoT technology with ERP systems to enable real-time data collection, monitoring, and analysis, enhancing operational visibility and decision-making.

Conclusion

ERP Software Statistics – The ERP software landscape is characterized by ongoing growth and transformation. Marked by a shift towards cloud-based solutions to meet the demands of an increasingly digitalized business world.

While ERP systems offer substantial benefits, such as cost reduction and enhanced operational efficiency. Their complex implementation process and integration challenges underscore the importance of careful planning and user satisfaction.

The future of ERP holds promise, with emerging technologies like AI, IoT, and blockchain poised to augment ERP capabilities and drive business optimization. However, data security and compliance, particularly in regulations like GDPR, remain paramount.

In summary, ERP software remains a pivotal tool for modern businesses, but realizing its full potential necessitates strategic planning and adaptability in a rapidly evolving technological landscape.

This report’s statistics and insights serve as a valuable resource for informed decision-making in ERP software.

FAQ’s

ERP software can streamline operations, improve efficiency, enhance data accuracy, facilitate better decision-making, and support overall business growth. It also helps in standardizing processes and reducing operational costs.

ERP software is versatile and can benefit many industries, including manufacturing, retail, healthcare, education, finance, etc. Each industry may have specific ERP solutions tailored to its needs.

ERP software can be deployed on-premises, in the cloud, or as a hybrid solution. The choice depends on budget, infrastructure, security, and scalability requirements.

The cost of ERP software varies widely depending on factors like the organization’s size. The complexity of the implementation, the vendor, and the chosen deployment method. Costs can range from thousands to millions of dollars.

The timeline for ERP implementation fluctuates based on the project’s intricacy and the organization’s size. Spanning from several months to a couple of years for a comprehensive rollout.