Table of Contents

ESG-Linked Insurance Market Size

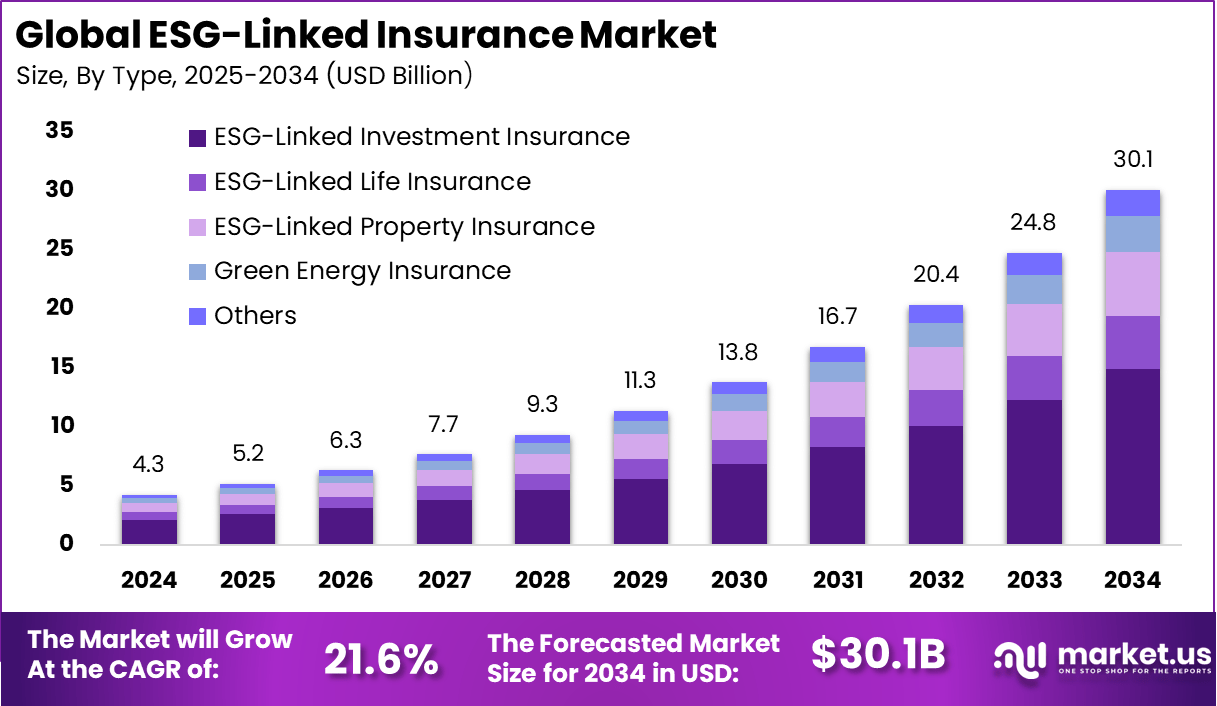

The Global ESG Linked Insurance Market generated USD 4.3 billion in 2024 and is projected to increase from USD 5.2 billion in 2025 to nearly USD 30.1 billion by 2034, supported by a CAGR of 21.6 percent across the forecast period. In 2024, North America held a dominant position with more than 45% share, contributing about USD 1.9 billion in revenue.

The ESG linked insurance market has expanded as insurers embed environmental, social and governance criteria into underwriting and pricing frameworks. Growth reflects rising global interest in responsible business practices, increased climate exposure and the need for organisations to demonstrate sustainable risk management. ESG considerations are now integrated into policies covering property, liability, infrastructure and corporate operations to reward responsible behaviour.

Top driving factors include increasing regulatory pressure on climate-related disclosures and demand for financial products aligned with ESG principles. Organizations want insurance solutions that match their sustainability goals and show responsible risk management. Strong interest in climate actions, ethical labor practices, and governance transparency is pushing insurance companies to develop products linked to ESG performance. The rise in ESG-linked investment insurance, which accounts for nearly 50% of the market, shows insurers’ commitment to responsible portfolio strategies and greener investments.

The demand analysis reveals growing interest from businesses seeking insurance to mitigate ESG-related operational and disclosure risks. This is especially prominent in sectors where compliance and sustainability reporting are critical. Direct sales channels dominate the market, accounting for over 70%, as companies prefer direct relationships with insurers for specialized ESG products. The integration of AI and advanced climate risk models helps insurers price risks more accurately, manage exposure, and provide dynamic underwriting tailored to ESG factors.

Quick Market Facts

- ESG-Linked Investment Insurance led with 49.6% share, reflecting strong demand for sustainability-tied insurance products and responsible investment strategies.

- Corporate ESG Compliance reached 37.2%, supported by rising regulatory expectations and the need to insure ESG-related operational and disclosure risks.

- Direct Sales channels dominated with 72.3%, indicating a clear preference for direct insurer engagement for specialized ESG solutions.

- North America accounted for 45% of global demand, driven by mature sustainability frameworks and advanced adoption of ESG-linked financial instruments.

- The U.S. market reached USD 1.73 billion in 2024, posting a strong 18.9% CAGR, supported by increasing corporate focus on sustainability and risk mitigation.

Key Statistics

Stakeholder and Regulatory Influence

- 79% of investors incorporate ESG risks into investment decisions, and almost half are willing to divest from companies that overlook ESG performance.

- 76% of consumers would stop buying from companies that harm workers, communities, or the environment.

- Global ESG regulations increased by 155% over the past decade, with bodies like NAIC and IRDAI implementing mandatory climate-risk disclosures aligned with TCFD guidelines.

Business Impact and Strategic Alignment

- 85% of global insurers state that ESG considerations will influence all areas of their operations, especially investments (91%), risk/internal audit (90%), and underwriting (88%).

- 44% of insurance CEOs believe ESG programs enhance financial performance.

- Only 35% of insurers report that their corporate strategies are fully aligned with all three ESG pillars, indicating room for deeper integration.

Emerging trends

Emerging trends in the ESG-linked insurance market include expanding product lines that reward sustainable behaviors through premium discounts or coverage incentives. Insurers are adopting advanced climate risk modeling, AI-driven analytics, and satellite data to better forecast natural disaster impacts. Growing focus on social responsibility and governance within underwriting decisions, alongside regulatory integration of ESG criteria, is pushing insurers to improve transparency and product offerings. Digital tools are increasingly used to track ESG risks and support compliance, helping insurers meet rising sustainability mandates.

Growth Factors

Looking forward, the market opportunity lies in developing outcome-based ESG insurance products that encourage measurable sustainability improvements. Companies are seeking insurance that supports emissions reduction, enhances governance, and improves social outcomes. This creates space for innovation in insurance linked to climate resilience, biodiversity risks, and workforce safety. The ESG-linked insurance market offers insurers a chance to differentiate through responsible risk management while helping clients meet evolving sustainability targets. Emerging markets and stricter regulations will continue to fuel growth, making ESG-linked insurance a core part of the digital and sustainable finance landscape.

Key Market Segments

By Type

- ESG-Linked Investment Insurance

- ESG-Linked Life Insurance

- ESG-Linked Property Insurance

- Green Energy Insurance

- Others

By Application

- Corporate ESG Compliance

- Green Investments

- Renewable Energy Projects

- Sustainable Supply Chains

- Others

By Distribution Channel

- Direct Sales

- Brokers and Agents

Top Key Players in the Market

- Allianz

- AXA

- Swiss Re

- Munich Re

- Zurich Insurance Group

- Generali

- Chubb

- AIG

- Liberty Mutual

- Hartford

- Sompo

- Tokio Marine

- SCOR

- Beazley

- RenaissanceRe

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 4.3 Bn |

| Forecast Revenue (2034) | USD 30.1 Bn |

| CAGR(2025-2034) | 21.6% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Explore More Reports

- AI Supercomputer Market

- Metaverse for Travel Market

- Pay‑As‑You‑Go Billing Market

- MarTech Data Platform Market

- Modern Card Issuing Platforms Market

- AI-Powered Fish Farming Market

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)