Table of Contents

Report Overview

According to Market.us, The Global eSIM Market is projected to experience significant growth in the coming years. In 2023, the market was valued at approximately USD 8.8 billion, with forecasts suggesting it will reach a remarkable USD 20.6 billion by 2032. This reflects a strong compound annual growth rate (CAGR) of 10.2% during the forecast period from 2023 to 2032. North America emerged as the leading region in 2022, holding a dominant 42.24% market share, translating to a revenue of around USD 3.37 billion. The region’s strong presence can be attributed to the widespread adoption of connected devices, advanced telecom infrastructure, and supportive regulations driving eSIM technology.

eSIM, or embedded Subscriber Identity Module, is a technology that represents a significant evolution from traditional physical SIM cards. Unlike the removable SIM cards, eSIMs are built directly into devices, enabling digital provisioning of mobile service without needing a physical SIM. This technology simplifies device setup by allowing users to activate a cellular plan from their carrier without an interchangeable card. The seamless switch between network providers and the potential for multiple profiles on a single device are among its standout features.

The eSIM market has experienced robust growth, driven by increasing adoption in consumer electronics like smartphones, tablets, and wearables, as well as in automotive applications such as connected cars. This market was valued significantly in recent years and is expected to continue expanding at a notable compound annual growth rate (CAGR). This growth trajectory is supported by the rising popularity of IoT (Internet of Things) devices and the ongoing global shift towards smarter, interconnected technologies.

Key drivers of the eSIM market include the growing demand for smart devices and IoT applications across various sectors, including automotive, consumer electronics, and industrial applications. The ability of eSIMs to support remote SIM provisioning and management simplifies operations for IoT deployments, making it a preferred choice for manufacturers and service providers aiming for global scalability and enhanced security.

The demand for eSIMs is primarily fueled by the consumer electronics sector, where the push for slimmer devices with more internal space is evident. Additionally, opportunities abound in the automotive industry, where eSIMs facilitate enhanced telematics, vehicle tracking, and in-car connectivity. The ongoing rollout of 5G technology also presents significant opportunities, as eSIMs are pivotal in enabling faster, more reliable mobile connectivity, essential for the next generation of digital services.

Technological innovations continue to propel the eSIM market forward. Recent advancements focus on enhancing the security features of eSIMs, improving the integration with mobile network operators, and expanding the eSIM infrastructure to support a broader range of devices and applications. Companies are also investing in new eSIM solutions that cater to emerging needs, such as wearables and health monitoring devices, further diversifying the market landscape.

Key Takeaways

- The global eSIM (embedded Subscriber Identity Module) market is experiencing significant growth, driven by the increasing adoption of connected devices across various industries. In 2023, the market was valued at approximately USD 8.8 billion and is projected to reach around USD 20.6 billion by 2032, reflecting a compound annual growth rate (CAGR) of 10.2% during the forecast period.

- Connectivity services constitute a substantial portion of the eSIM market, accounting for 89.48% of the market share. Mobile network operators are leveraging eSIM technology to offer diverse voice and data plans, Internet of Things (IoT) connectivity solutions, and remote management of eSIM profiles for devices equipped with eSIM chips.

- In terms of application, consumer electronics dominate the eSIM market. However, the automotive sector is anticipated to witness exponential growth due to the escalating demand for connected cars. The integration of eSIM technology in vehicles facilitates seamless connectivity, enhancing features such as real-time navigation, telematics, and in-car infotainment systems.

- Regionally, North America leads the eSIM market, accounting for 42.24% of global sales. This dominance is attributed to the region’s advanced technological infrastructure and the early adoption of eSIM technology.

eSIM Statistics

- Smartphone revenue reached USD 411.89 billion by the end of 2023, showcasing the immense growth and potential of the mobile technology sector.

- IoT annual revenue is expected to soar to USD 621.6 billion by 2030, driven by the rapid integration of smart devices and connectivity solutions.

- Among mobile network operators, 50% consider cost reduction an extremely important benefit of eSIM technology, underlining its financial advantages.

- Awareness about eSIM is growing, with 58% of respondents from the US, UK, and Australia familiar with the technology, reflecting a positive shift in consumer understanding.

- The environmental impact of eSIM is minimal, producing only 1g of CO2 emissions compared to 136g for physical SIM cards, making it a sustainable choice for the future.

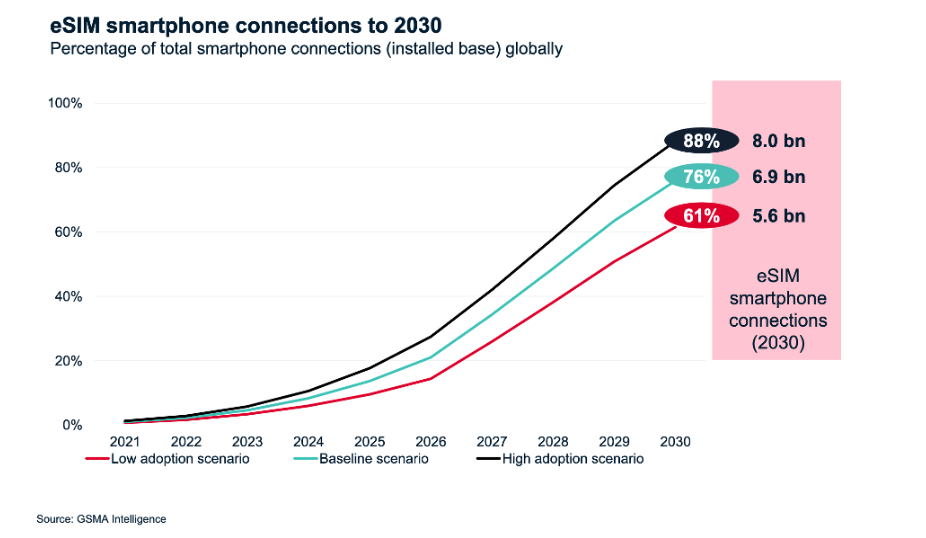

- By 2025, eSIM adoption is projected to reach 3.4 billion smartphone connections, with estimates ranging from 25% (low adoption) to 40% (high adoption) of all smartphone connections worldwide.

- eSIM technology offers significant cost efficiency, with the potential to reduce costs by an average of 15% over its lifetime.

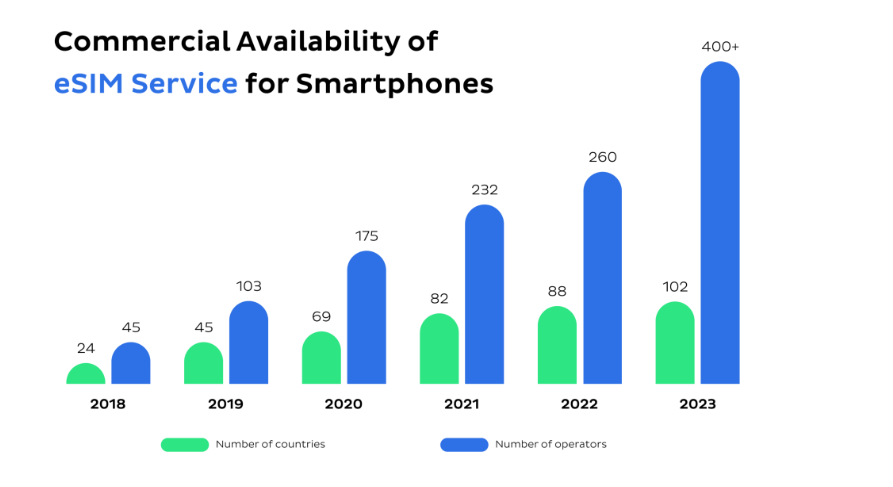

- Support for eSIM technology has expanded to 102 countries by early 2023, marking a 325% increase since 2018, with more regions expected to follow suit.

- North America is projected to lead global eSIM adoption, with 98% of smartphone connections expected to use eSIM by 2030, setting a benchmark for other regions.

- By 2030, 14 billion eSIM-capable devices are forecasted to be shipped globally, reflecting widespread integration across consumer electronics.

- 76% of smartphone connections (6.7 billion) are expected to use eSIM technology by 2030, highlighting its dominance in the mobile ecosystem.

- Drones and smartwatches are expected to achieve 100% eSIM penetration by 2030, showcasing their dependence on seamless connectivity.

- In 2023, the number of consumer devices supporting eSIM technology grew to 231, up 45% from the previous year, with 60% of these being smartphones.

- Nearly 400 network operators globally offer eSIM services, signaling strong industry-wide support for the technology.

- 89.8% of mobile network operators plan to offer eSIM by 2025, reflecting a near-universal adoption rate among industry players.

- Thales leads the eSIM provider rankings with a core rating of 182, solidifying its position as a market leader.

- eSIM adoption among smartphones is projected to range between 25% and 40% by 2025, surging to 76% by 2030, as consumer trust and demand grow.

- Adoption is particularly strong among younger users aged 18 to 24, with 24% already using eSIMs, while Apple leads smartphone brands with 22% adoption, closely followed by Samsung at 19%.

- The travel eSIM market is booming, with total expenditure forecasted to grow from $1.8 billion in 2024 to $8.9–$10.1 billion by 2028, reflecting its utility for international travelers.

- The switch to eSIMs results in an up to 80% decrease in SIM card costs, providing a significant financial incentive for both users and operators.

Source – mobiliseglobal.com

North America eSIM Market Size

In 2022, North America held a dominant market position, capturing more than a 42.24% market share with a revenue of approximately USD 3.37 billion in the global eSIM market. This leadership can be attributed to the region’s advanced digital infrastructure, early adoption of cutting-edge technologies, and a well-established ecosystem of telecom service providers. Major tech companies based in the US, including Apple, Google, and Qualcomm, have played a crucial role in driving eSIM adoption by embedding the technology into smartphones, tablets, and wearables.

The strong regulatory framework in the US and Canada has further encouraged telecom operators to integrate eSIM solutions into their service portfolios. With rising demand for IoT-enabled devices across industries like automotive, healthcare, and consumer electronics, North America has positioned itself as a frontrunner in the eSIM market. The surge in connected vehicles and smart city projects also supports the region’s robust growth.

Additionally, the widespread use of 5G technology has amplified eSIM deployment in North America. According to industry reports, 5G subscriptions in the US crossed 100 million in 2022, creating more opportunities for eSIM-based services. Leading telecom operators like AT&T, Verizon, and T-Mobile continue to invest heavily in eSIM platforms to offer seamless device connectivity and remote provisioning.

Emerging Trends

- 5G Integration: The synergy between eSIM technology and 5G networks is reshaping connectivity. This combination supports higher bandwidth and data capacity, crucial for advanced mobile applications and enhancing device performance.

- Automotive Applications: There is a significant surge in demand for eSIMs within the automotive industry. The ability to remotely update and manage eSIMs makes them ideal for connected vehicle technologies, fostering a new era of smart transportation.

- IoT Expansion: eSIM technology is increasingly being adopted in the Internet of Things (IoT) sector. Its compact size and remote configurability make it suitable for a wide range of IoT devices, from industrial sensors to home automation systems.

- Consumer Electronics: With the elimination of physical SIM cards, manufacturers are designing slimmer and more efficient consumer electronic devices. This trend is evident with recent smartphone releases that rely solely on eSIM technology.

- Security Enhancements: As cybersecurity becomes a growing concern, the eSIM industry is evolving to offer more secure solutions. Recent advancements include improved encryption and authentication processes that protect against unauthorized access and ensure user data privacy.

Top Use Cases for eSIM Technology

- Smartphones and Tablets: The shift to eSIM-only devices is accelerating, particularly in the smartphone market, where major manufacturers like Apple and Samsung are leading the way. This change simplifies network management and user connectivity on mobile devices.

- Wearable Technology: eSIM technology is crucial in wearable devices, allowing seamless connectivity without the need for a physical SIM. This technology is particularly beneficial for devices like smartwatches, health monitors, and fitness trackers, which require constant connectivity without bulkiness.

- Connected Vehicles: eSIMs are becoming a staple in modern vehicles, providing essential services such as real-time navigation, automatic emergency calls, and infotainment systems. These capabilities enhance the driving experience and improve vehicle safety.

- Smart Home Devices: From security systems to smart appliances, eSIM technology enables these devices to communicate and operate with greater efficiency within the connected home ecosystem. This integration helps in managing home systems remotely, boosting convenience and energy efficiency.

- Industrial IoT: In sectors like manufacturing and logistics, eSIMs facilitate robust machine-to-machine communication. This application is critical for tracking assets, managing supply chains, and automating production processes, thereby increasing operational efficiency and reducing costs.

Major Challenges

- Consumer Awareness: Despite the growing integration of eSIM technology, there is still a significant lack of awareness among consumers about what eSIMs are and the benefits they offer. This lack of knowledge can hinder adoption rates across various markets.

- Device Compatibility: As the transition from traditional SIM cards to eSIMs accelerates, a major challenge arises with device compatibility. Older devices that do not support eSIM technology require consumers to purchase new devices to take advantage of eSIM features, which can be a significant barrier.

- Regulatory Hurdles: Different countries have varied regulatory frameworks for telecommunications, which can complicate the widespread adoption of eSIM technology. These regulations may affect everything from eSIM activation and management to security and data privacy standards.

- Security Concerns: While eSIM technology offers enhanced security features, the potential for hacking and data breaches remains a critical concern. As eSIMs become more common, ensuring robust security measures and encryption standards is essential to protect user data and maintain trust.

- Integration Complexity: For network providers and device manufacturers, integrating eSIM technology poses technical challenges. These include the need for new infrastructure, systems for remote SIM provisioning, and compatibility with existing network operations, which can be costly and complex to implement.

Attractive Opportunities

- Global Connectivity Solutions: eSIM technology offers a significant opportunity for seamless global connectivity. For travelers and multinational corporations, eSIMs provide a way to switch carriers and manage multiple profiles without the need for multiple physical SIM cards, enhancing connectivity and convenience.

- IoT and Smart Devices Growth: The expansion of IoT and smart devices presents a substantial opportunity for eSIM technology. As more devices become connected, the demand for integrated, efficient, and small-scale connectivity solutions like eSIMs is expected to rise, driving further growth in the IoT sector.

- Innovation in Wearable Technology: eSIMs are particularly well-suited for wearable technology due to their compact size and flexibility. As the market for wearables grows, eSIMs enable these devices to remain connected without relying on a tethered smartphone, opening up new avenues for innovation and application.

- Automotive Industry Transformation: With the automotive industry increasingly focusing on connected and autonomous vehicles, eSIM technology can play a pivotal role. It allows for better integration of connectivity solutions, real-time updates, and enhanced telematics services, which are essential for modern vehicles.

- Enhanced Customer Experiences: By enabling easier carrier switching and offering better plans tailored to user needs without the need for physical store visits, eSIM technology can significantly enhance the customer experience. This can lead to higher customer satisfaction and loyalty, providing a competitive edge to carriers and device manufacturers.

Recent Developments

- In May 2023, Lonestar Cell MTN, a South African telecom giant, introduced eSIM technology to Liberia. This innovation allows users to switch to eSIM-compatible devices effortlessly by scanning a QR code provided at any service center, removing the need for physical SIM cards. A significant step toward making connectivity more convenient in the region.

- In March 2023, Gcore launched its Zero-Trust 5G eSIM Cloud platform, aimed at enhancing global organizational connectivity. With its software-defined eSIM, companies can securely connect remote devices and corporate resources via regional 5G carriers. This offering ensures fast, reliable, and secure networking solutions tailored for modern business needs.

- In February 2023, Amdocs partnered with Drei Austria to roll out a fully digital eSIM experience through the “up” app. Customers can now enjoy a seamless SIM journey powered entirely by Amdocs’ technology. This app-based solution sets a new benchmark for simplicity and ease in adopting eSIM technology.

Conclusion

The eSIM market is positioned for robust growth as it intersects with key technological advancements and evolving consumer demands for seamless, flexible connectivity. Driven by the adoption of IoT, M2M communications, and the proliferation of 5G technology, eSIMs are becoming a cornerstone of modern connectivity across various industries, including automotive, consumer electronics, and telecommunications.

Emerging trends, such as the integration of eSIMs in smart devices and connected cars, reflect a broader shift towards digital transformation and smarter, interconnected systems. These advancements offer substantial business benefits, including reduced operational costs, enhanced global device deployment capabilities, and improved customer experience. Despite challenges such as regulatory hurdles and standardization issues, the continued innovation and strategic collaborations in the industry indicate a positive trajectory for the eSIM market, making it a critical enabler of the next wave of technological evolution.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)