Table of Contents

Introduction

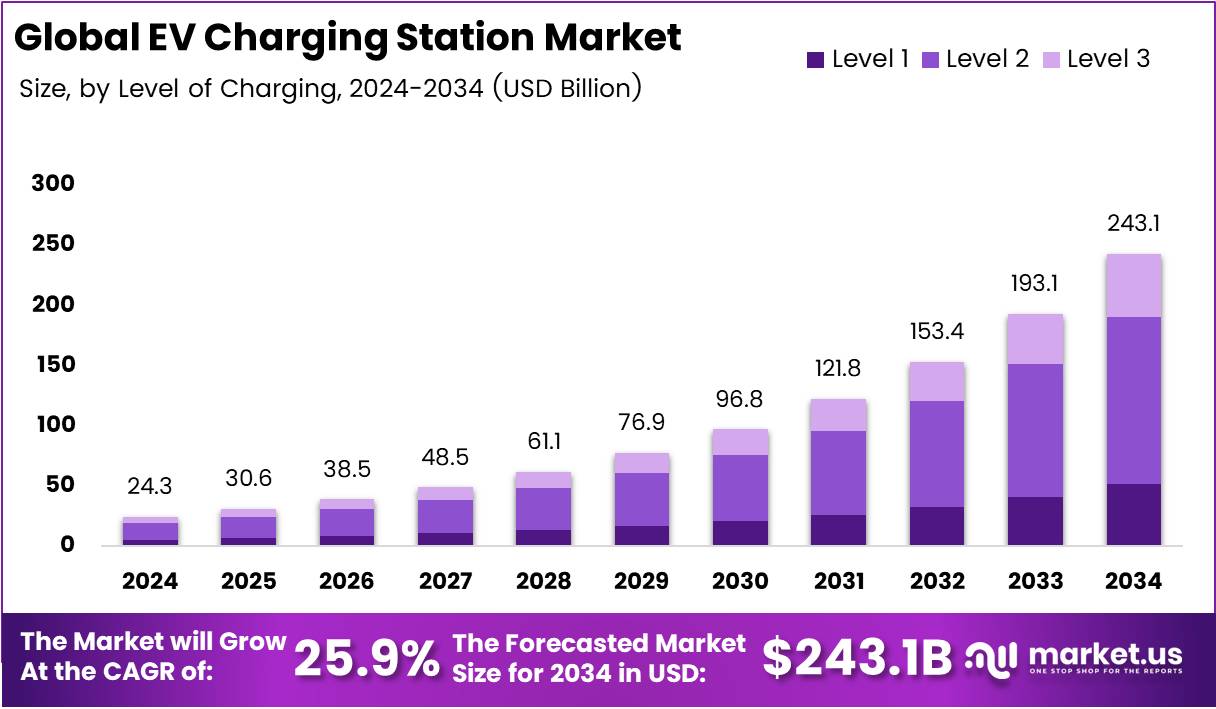

The Global EV Charging Station Market is on a strong growth trajectory, expected to be worth around USD 243.1 Billion by 2034, up from USD 24.3 Billion in 2024. This remarkable expansion reflects a robust CAGR of 25.9% during 2025–2034, fueled by rising electric vehicle (EV) adoption, supportive government policies, and rapid technological advancements in charging solutions. As sustainability becomes a global priority, EV charging stations are increasingly seen as the backbone of the clean mobility revolution.

Key Takeaways

- The EV charging station market will reach USD 243.1 Billion by 2034, growing at a 25.9% CAGR.

- Level 2 charging stations dominate with a 57.3% market share due to faster and more convenient charging.

- AC charging stations account for 67.7% of the market, driven by cost-effectiveness and infrastructure availability.

- 11KW–50KW chargers lead with 48.5% share, offering speed-efficiency balance.

- Passenger cars represent the largest segment with 51.2% share, reflecting mass adoption.

- Fixed installations dominate with 78.4% share, preferred for reliability and scalability.

- Normal charging connectors account for 41.9%, valued for compatibility.

- Asia Pacific leads the market with 41.2% share, valued at USD 10.0 Billion in 2024.

Market Segmentation Overview

The EV charging station market is segmented by Level of Charging, Charging Station Type, Power Output, Vehicle Type, Installation Type, Connector Type, and End User.

- Level of Charging: Level 2 dominates with 57.3% share, ideal for residential and commercial use, while Level 3 fast charging is rising in high-density EV regions.

- Charging Station Type: AC stations hold 67.7% market share, while DC fast chargers serve critical highway and urban needs.

- Power Output: Chargers in the 11KW–50KW range lead with 48.5%, balancing cost and efficiency.

- Vehicle Type: Passenger cars make up 51.2%, while commercial vehicles are steadily gaining ground.

- Installation Type: Fixed installations hold 78.4% share, favored for reliability, while mobile charging is emerging in remote and event-based use cases.

- Connector Type: Normal charging leads with 41.9%, while fast-charging connectors grow alongside highway networks.

- End User: Commercial charging dominates with 56.6%, as malls, businesses, and public spaces expand accessibility.

Drivers

- Government Incentives and Policies: Global governments are introducing tax rebates, subsidies, and infrastructure investments. The U.S., for instance, allocated nearly USD 50 million in Q2 2024 to expand charging access, targeting 500,000 public ports by 2030.

- Technological Advancements: A 7.4% rise in U.S. DC fast charging ports in Q2 2024 highlights the growing shift toward faster, more efficient charging.

- Rising EV Adoption: Passenger EV demand surged globally, with Tesla, Nissan, and Chevrolet leading the charge.

- Environmental Concerns: Global efforts to curb emissions are accelerating the transition toward sustainable transportation.

Use Cases

- Residential Charging: With installation costs averaging USD 1,700 in the U.S., home charging is gaining traction among EV owners.

- Public & Commercial Spaces: Shopping malls, workplaces, and parking facilities deploy stations to enhance customer services and meet regulatory requirements.

- Highway Infrastructure: Level 3 fast chargers enable long-distance travel, reducing range anxiety for EV owners.

- Fleet Charging: Commercial fleets are increasingly electrified, driving demand for large-scale, fixed charging installations.

Major Challenges

- High Initial Costs: Installation ranges between USD 800 and USD 2,500 per home charger, while large-scale networks require millions in infrastructure and land costs.

- Maintenance and Upgrades: Ongoing expenses for modernization and technical support limit participation from smaller players.

- Lack of Standardization: Variations in connector types and regional infrastructure create complexity and raise costs.

- Uneven Adoption: While Asia Pacific and Europe surge ahead, parts of Africa and Latin America still face limited infrastructure deployment.

Business Opportunities

- Emerging Markets: Nations like India, Brazil, and South Africa are set to expand their charging networks as EV adoption accelerates.

- Integration with Renewable Energy: Solar and wind-powered stations reduce costs and enhance sustainability, particularly in rural areas.

- Smart Charging & IoT: Connected stations that optimize charging schedules are gaining demand in both commercial and residential settings.

- Fleet Electrification: With logistics and delivery firms transitioning fleets to EVs, dedicated charging hubs will see significant growth.

Regional Analysis

- Asia Pacific: Leads with 41.2% share, valued at USD 10.0 Billion in 2024, powered by aggressive investments in China, Japan, and India.

- North America: Strong U.S. policies and funding drive expansion, particularly in fast-charging infrastructure.

- Europe: Growth is fueled by strict emission targets and widespread green energy adoption in Germany, France, and the UK.

- Middle East & Africa: UAE and GCC countries are spearheading infrastructure investments, though adoption remains nascent.

- Latin America: Brazil and Mexico are emerging hotspots, supported by international partnerships and government subsidies.

Recent Developments

- April 2025: NHEV acquires 4.7-acre site to build a 3G EV charging station along the Kanyakumari–Madurai Electric Highway.

- April 2025: ACCIONA Energía acquires Cable Energía, expanding networks in Spain and Portugal.

- August 2025: Blink Charging resolves Envoy acquisition liabilities, strengthening its financial stability.

- August 2025: ZAPI GROUP acquires Stercom Power Solutions, expanding product portfolio in EV infrastructure.

- January 2025: AGL acquires Everty to enhance EV charging and clean energy management.

- July 2025: Blink Charging acquires Zemetric to boost fleet EV charging operations.

Conclusion

The global EV charging station market is entering a transformative decade, with projections reaching USD 243.1 Billion by 2034 at a remarkable 25.9% CAGR. While high infrastructure costs remain a restraint, opportunities in renewable integration, emerging markets, and fleet electrification provide strong growth pathways. With Asia Pacific leading adoption and Europe and North America investing heavily in fast-charging networks, the industry is poised to become a cornerstone of global sustainable transportation.