Table of Contents

Report Overview

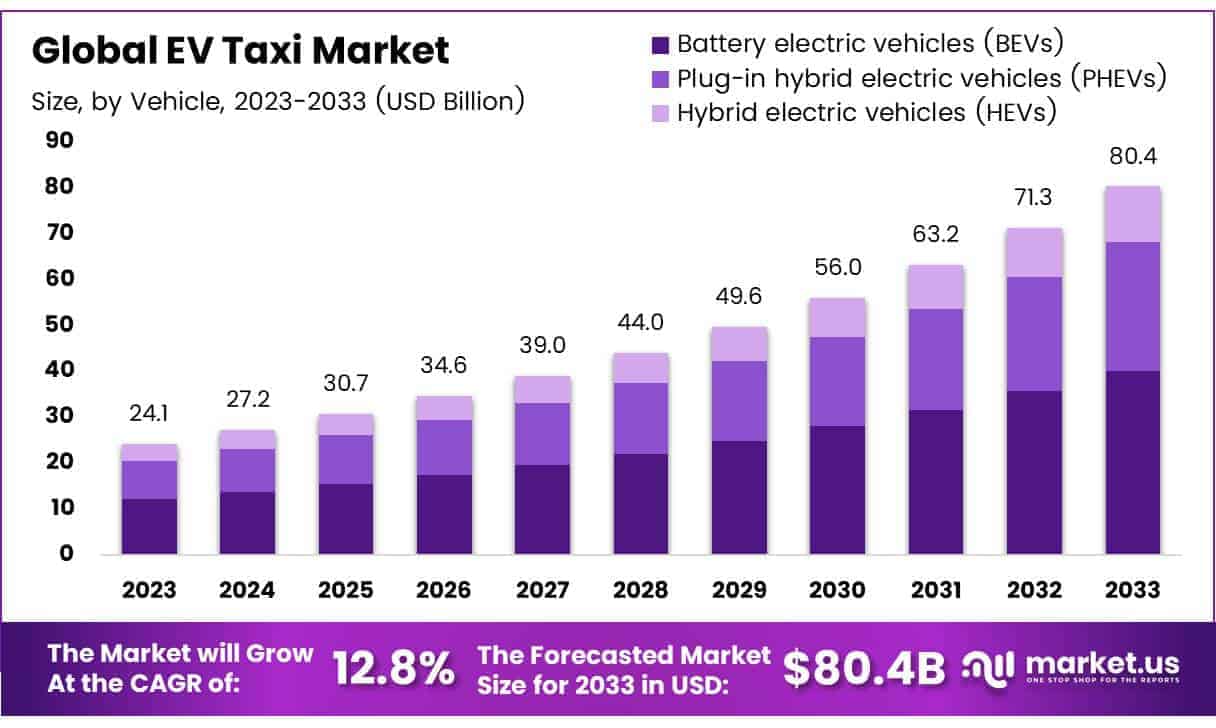

The Global EV Taxi Market size is expected to be worth around USD 80.4 Billion by 2033, from USD 27.2 Billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034.

The electric vehicle (EV) taxi market is witnessing robust growth fueled by rising environmental awareness and urban pollution concerns. According to electrive, 88% of all new taxis purchased in Norway in 2023 were fully electric, demonstrating rapid adoption. This trend signals a clear shift toward sustainable urban transport solutions globally.

Moreover, significant opportunities lie in integrating innovative mobility options. According to honeywell, nearly 98% of US airline passengers would consider using electric vertical take-off and landing (eVTOL) vehicles as part of their journey, reflecting growing consumer openness to electric mobility alternatives beyond traditional cabs.

Government investments and favorable regulations further accelerate this transition. Cities like Hamburg and Dublin lead the electric taxi revolution; Hamburg boasts over 600 fully electric taxis out of 3,000, with 85% accessible on the FREENOW platform, as per cities-today. This exemplifies how policy support and digital platforms enable wider EV taxi adoption, encouraging clean transportation and reducing carbon footprints.

Key Takeaways

- The Global EV Taxi Market is projected to reach USD 80.4 Billion by 2033, growing from USD 27.2 Billion in 2024 at a CAGR of 12.8% from 2024 to 2033.

- In 2023, Battery Electric Vehicles (BEVs) dominated the market by vehicle type, driven by eco-friendly adoption and strict emission regulations.

- Short-range EV taxis held a 56.3% market share in 2023, reflecting their suitability for urban, short-distance trips.

- Company-owned fleets led the ownership model segment with a 64.2% share in 2023, benefiting from better control and operational efficiencies.

- Fast charging infrastructure accounted for 64.9% of the market in 2023, boosting EV taxi operational efficiency through reduced charging times.

- Asia Pacific leads regionally with a 43% market share worth USD 10.3 billion, supported by heavy investments and government backing in China, Japan, and South Korea.

Top Use Cases

- Urban Commuting: EV taxis provide eco-friendly and cost-effective transportation for daily city commuters, reducing pollution and traffic emissions.

- Airport Transfers: Electric taxis offer reliable, low-emission rides for passengers traveling to and from airports, enhancing sustainable travel options.

- Corporate Fleet Services: Companies use EV taxi fleets for employee transportation, promoting green initiatives and reducing operational costs.

- Ride-Hailing Platforms: EV taxis integrated with ride-hailing apps deliver quick, efficient, and environmentally friendly ride services to urban customers.

- Tourism and Sightseeing: Electric taxis serve tourists in cities by offering quiet, clean, and comfortable rides, supporting sustainable tourism efforts.

Market Segmentation

Vehicle Analysis

In 2023, Battery Electric Vehicles (BEVs) led the EV taxi market due to their zero emissions and cost-saving benefits, making them the top choice for taxi fleets focused on sustainability. Plug-in Hybrid Electric Vehicles (PHEVs) and Hybrid Electric Vehicles (HEVs) also held important shares, with PHEVs offering flexible fueling and HEVs providing better fuel efficiency without needing external charging. Together, these electric options are transforming urban taxi services, supported by better batteries, government incentives, and rising environmental awareness.

Range Analysis

Short-range EV taxis dominated in 2023 with a 56.3% market share, mainly because they fit well with city taxi operations that involve shorter trips. These vehicles cost less upfront and have lower maintenance, making them popular in busy urban areas. Although long-range EV taxis make up a smaller part of the market, they are growing as they serve longer routes and inter-city travel. As charging stations improve and battery technology advances, long-range EVs are expected to gain more ground.

Ownership Model Analysis

Company-owned EV taxi fleets led the market in 2023, controlling 64.2% of the share. This model allows companies to manage operations more efficiently, maintain consistent service, and reduce costs through economies of scale. Individually-owned taxis, though smaller in number, still play an important role by offering personalized service and local expertise but face challenges like higher costs and limited funding. The rise of company-owned fleets points to industry consolidation and opportunities in fleet management technologies.

Charging Infrastructure Analysis

Fast charging was the dominant method in 2023 with a 64.9% share, thanks to its quick recharge times that keep taxis on the road longer. Wireless charging is slowly gaining popularity because of its convenience and potential for easy city integration. Slow charging remains vital for overnight or extended parking situations where cost efficiency is key. Overall, improvements in charging technology continue to shape the EV taxi market, with fast charging leading due to the need for quick turnaround in urban transport.

Key Market Segments

By Vehicle

- Battery electric vehicles (BEVs)

- Plug-in hybrid electric vehicles (PHEVs)

- Hybrid electric vehicles (HEVs)

By Range

- Short-range EV taxis

- Long-range EV taxis

By Ownership Model

- Company-owned

- Individually-owned

By Charging Infrastructure

- Fast charging

- Wireless charging

- Slow charging

Major Challenges

One of the biggest challenges in the EV taxi market is range anxiety. Many taxi operators worry that electric taxis cannot travel as far on a single charge compared to traditional gas vehicles. This concern, combined with longer charging times, leads to more downtime and less availability for customers, which can hurt taxi operators’ earnings. Improving battery technology and charging speed is crucial to overcome these barriers and encourage more operators to switch to electric taxis.

Top Opportunities

The growth of the EV taxi market is strongly supported by the expansion of charging infrastructure. More charging stations reduce range anxiety and make electric taxis a practical choice for more operators. Using renewable energy to power these stations can also lower operating costs and increase environmental benefits. Additionally, partnerships with tech companies to develop better fleet management and routing tools can make EV taxi operations smoother and more efficient, driving further market growth.

Emerging Trends

Ride-hailing apps are playing a key role in boosting electric taxi adoption as consumers increasingly prefer greener transport options. These platforms are actively promoting EVs to meet demand for cleaner rides. Advances in autonomous driving technology also add value by potentially lowering driver costs and improving service safety. Together, these trends are helping electric taxis become a regular part of urban transportation, supporting global efforts toward sustainable and eco-friendly travel.

Regional Analysis

In 2023, Asia Pacific emerged as the dominant player in the EV taxi market, holding a 43% share valued at USD 10.3 billion. This leadership is driven by heavy investments in EV technology and infrastructure in countries like China, Japan, and South Korea. Rapid urbanization and growing air pollution concerns have prompted governments to actively promote electric mobility, boosting the adoption of electric taxis across the region.

Report Development

- In May 2025, Evera Cabs began the repossession of 500 electric cabs that were previously operated by BluSmart, marking a significant move in their fleet management strategy.

- In May 2025, Evera Cabs placed strong confidence in BluSmart’s electric vehicles, projecting to generate Rs 100 crore revenue in the fiscal year 2026 through this partnership.

- In March 2024, BluSmart signed a major agreement to expand its electric fleet by adding 4,000 Citroën ë-C3 EVs, aiming to strengthen its position in the electric mobility market.

Conclusion

In conclusion, the global electric vehicle (EV) taxi market is poised for significant growth driven by increasing environmental awareness, supportive government policies, and rapid advancements in technology. The widespread adoption of battery electric vehicles, expansion of fast charging infrastructure, and integration with digital ride-hailing platforms are transforming urban mobility toward cleaner and more efficient solutions.

Despite challenges like range anxiety and charging time, ongoing improvements in battery performance and growing investments in renewable energy-powered charging networks are set to overcome these barriers. Regional leadership, particularly in Asia Pacific, alongside rising consumer openness to innovative electric mobility options such as eVTOLs, further underscore the market’s promising future as a key contributor to sustainable transportation worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)