Table of Contents

Introduction

The factoring market, also known as accounts receivable financing, plays a crucial role in providing liquidity to businesses by allowing them to convert their outstanding invoices into immediate cash. This market has witnessed significant growth in recent years, driven by various factors and presenting numerous opportunities for businesses.

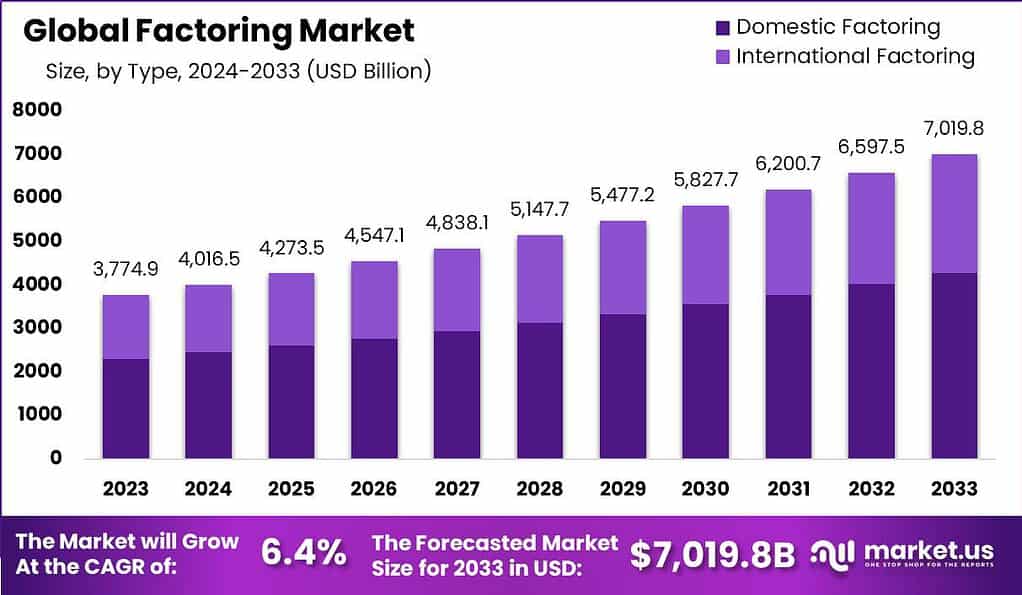

According to Market.us, The Factoring Market is expected to reach a significant valuation of USD 7,019.8 billion by 2033, with a projected Compound Annual Growth Rate (CAGR) of 6.4% from 2024 to 2033. Market.us Analysts identify several driving factors behind the growth of the factoring market. Firstly, the increasing need for working capital and cash flow optimization has led businesses to explore alternative financing options beyond traditional bank loans. Factoring offers a quick and accessible solution, allowing companies to unlock the value of their receivables and maintain a healthy cash flow.

Additionally, the globalization of trade and the expansion of supply chains have created a demand for flexible financing solutions. Factoring provides businesses with the ability to finance their international trade transactions, mitigate risks, and bridge the gap between invoicing and payment cycles. Furthermore, the rise of small and medium-sized enterprises (SMEs) has contributed to the growth of the factoring market. SMEs often face challenges accessing traditional financing due to limited collateral or credit history. Factoring offers a viable alternative, as it relies on the creditworthiness of the debtor rather than the borrower, making it more accessible to SMEs.

Key Takeaways

- Domestic Factoring Dominance: In 2023, domestic factoring held a dominant market position, capturing over 61.0% share due to increasing demand from SMEs seeking immediate liquidity solutions within their home countries.

- Manufacturing Sector: The manufacturing sector accounted for more than 25% share in 2023, highlighting its extensive need for working capital and reliance on factoring services.

- Banks Dominate: Banks held a dominant market position in 2023, with over 48% market share, attributed to their trustworthiness, reliability, and comprehensive services.

- Europe’s Dominance: In 2023, Europe held a dominant market position, capturing more than 35% share, driven by a well-established financial infrastructure and widespread adoption of factoring services among SMEs.

- Increased Demand for Alternative Financing: Traditional bank loans may not be accessible or suitable for all businesses, driving the demand for alternative financing options like factoring.

- Global Trade Expansion: With the expansion of global trade, businesses face longer payment terms and financial complexities, necessitating solutions like factoring to manage cash flow effectively.

- Technological Advancements: Technological innovations have streamlined the factoring process, making it more efficient and accessible for businesses of all sizes.

- In 2023, the total factoring volume in India reached approximately 484 million Indian rupees.

- The adoption of factoring services among small and medium-sized enterprises (SMEs) grew by over 25% in 2023, as businesses sought to improve cash flow management.

- The use of online factoring platforms and digital solutions increased by over 40% in 2023, driven by the need for faster and more efficient financing processes.

- In 2023, over 60% of factoring companies reported offering additional services such as credit protection and accounts receivable management to their clients.

- The adoption of factoring services in the healthcare industry grew by over 30% in 2023, as medical practices sought to improve cash flow and manage accounts receivable more effectively.

- In 2023, the average factoring fee ranged from 1% to 5% of the invoice value, depending on the industry, client creditworthiness, and other factors.

- The adoption of blockchain technology in factoring solutions grew by over 20% in 2023, as companies sought to improve transparency, security, and efficiency in the factoring process.

- Over 70% of factoring companies reported offering online portals and mobile applications in 2023, allowing clients to access real-time data and manage their accounts remotely.

- The adoption of factoring services in the staffing industry grew by over 15% in 2023, as staffing firms sought to manage cash flow and mitigate the risk of non-payment.

- In 2023, over 50% of factoring companies reported using advanced analytics and machine learning to assess client creditworthiness and detect fraud.

- The adoption of invoice financing and factoring services among freelancers and gig workers grew by over 30% in 2023, as they sought to improve cash flow and manage their finances more effectively.

- Key factors driving growth include expansion into emerging markets, technological advancements in digitizing factoring processes, collaboration with financial institutions, and integration with supply chain finance.

- Challenges in the factoring market include regulatory compliance, economic conditions affecting default risks, competition from alternative financing options, and the complexity of international factoring.

Top 4 Trends

- Technological Advancements: The factoring market is witnessing significant technological advancements, with the adoption of online platforms, digital solutions, and automation. These advancements are streamlining the factoring process, making it faster, more efficient, and user-friendly. Online portals and mobile applications are becoming increasingly common, allowing clients to access real-time data, manage their accounts remotely, and submit invoices seamlessly.

- Integration of Blockchain Technology: Blockchain technology is gaining traction in the factoring market, offering enhanced security, transparency, and efficiency. By leveraging blockchain, factoring companies can create immutable and auditable records of transactions, minimizing the risk of fraud and improving trust between parties. Smart contracts powered by blockchain enable automated and secure invoice verification and payment processes.

- Expansion into Emerging Markets: Factoring services are expanding into emerging markets, driven by the growth of small and medium-sized enterprises (SMEs) and the need for working capital. These markets present significant opportunities for factoring companies to tap into underserved sectors and provide accessible financing solutions to businesses that may face challenges in obtaining traditional bank loans.

- Collaboration with Financial Institutions: Factoring companies are increasingly partnering with financial institutions, such as banks and non-banking financial companies (NBFCs), to leverage their expertise, resources, and distribution networks. These collaborations enable factoring companies to access a wider client base, offer more competitive financing rates, and provide comprehensive financial solutions beyond factoring, such as supply chain finance and credit protection.

Major Challenges

- Regulatory Compliance: The factoring market is subject to various regulations and legal frameworks, which vary across jurisdictions. Compliance with these regulations, including anti-money laundering (AML) and know your customer (KYC) requirements, can be a complex and resource-intensive process for factoring companies. Staying updated with changing regulations and ensuring strict adherence is crucial to operate within the legal framework.

- Economic Conditions and Default Risks: The factoring market is sensitive to economic conditions, and economic downturns can increase the risk of defaults by debtors. Factors need to assess the creditworthiness of debtors and manage the risk of non-payment effectively. Economic uncertainties, industry-specific challenges, and geopolitical factors can impact the credit quality of receivables, requiring robust risk management strategies and processes.

- Competition from Alternative Financing Options: The factoring market faces competition from alternative financing options, such as peer-to-peer lending platforms, crowdfunding, and online lenders. These alternatives often provide quick and accessible financing solutions, attracting businesses that may have traditionally considered factoring. Factoring companies need to differentiate themselves by offering value-added services, competitive rates, and a seamless customer experience.

Broader Benefits of Factoring

- Improved Cash Flow: Factoring enables businesses to convert their outstanding invoices into immediate cash, improving cash flow and providing working capital for day-to-day operations, growth initiatives, and investment opportunities. This liquidity injection helps businesses manage their expenses, pay suppliers promptly, and seize growth opportunities without waiting for customers to pay their invoices.

- Risk Mitigation: Factoring companies often offer credit protection services, which protect businesses against the risk of non-payment or insolvency of their customers. By providing credit insurance or assuming the risk themselves, factors help businesses mitigate the impact of bad debts, enhancing financial stability and reducing the need for businesses to set aside provisions for potential losses.

- Access to Expertise: Factoring companies possess expertise in credit analysis, risk management, and accounts receivable management. Businesses can benefit from the knowledge and experience of factors, who assess the creditworthiness of debtors, provide insights on market trends, and offer guidance on optimizing accounts receivable processes. This expertise can help businesses improve their financial management practices and make informed decisions.

Recent Developments

- In 2023, HSBC: Launched a new digital factoring platform in Hong Kong in July 2023, aimed at streamlining the process for small and medium-sized enterprises (SMEs).

- In 2023, Deutsche Bank: Launched a new supply chain finance solution integrated with its existing factoring services in October 2023.

- In 2023, CIT Group: Launched a new online portal for its factoring services in June 2023, allowing for easier access and management for clients.

- In 2023, Citibank: Launched a new digital trade finance platform in July 2023, aiming to streamline the trade finance process for businesses, including potential benefits for factoring activities.

- In 2023, JPMorgan Chase: Announced a partnership with IBM in September 2023 to develop blockchain-based solutions for trade finance, which could potentially improve efficiency and transparency in the factoring marke

Conclusion

In conclusion, the factoring market is experiencing growth due to factors such as the need for working capital, globalization of trade, and the rise of SMEs. This market presents opportunities for businesses to optimize their cash flow, mitigate risks, and access immediate funding. Factors and financial institutions can capitalize on this market by offering innovative solutions and leveraging technology to provide efficient and tailored factoring services. With the continued evolution of the business landscape and the increasing demand for flexible financing options, the factoring market is expected to thrive in the foreseeable future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)