Table of Contents

Introduction

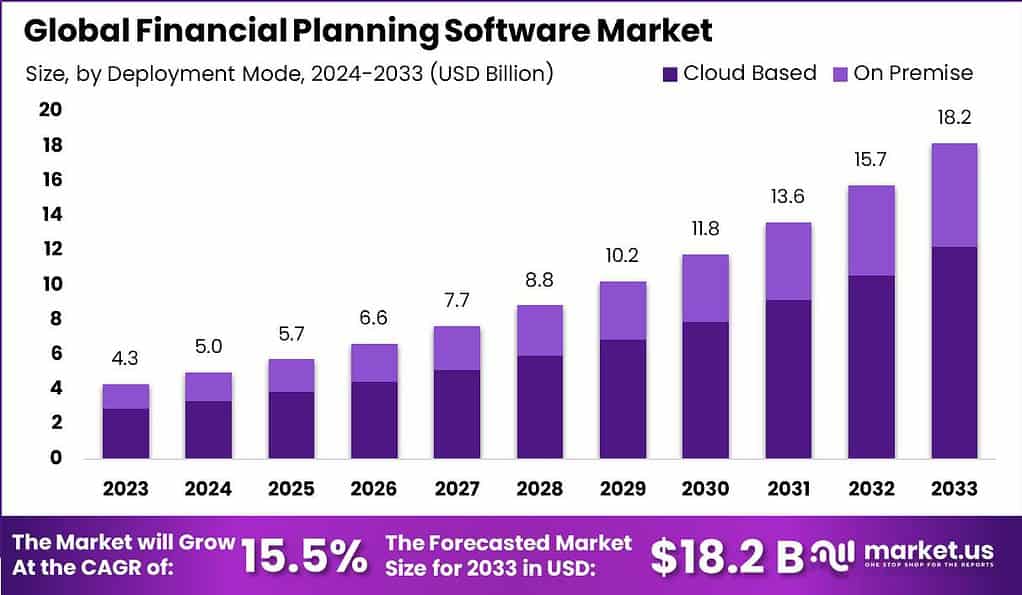

According to Market.us’s latest study, The Global Financial Planning Software Market experienced a valuation of USD 4.3 billion in 2023, and it is projected to surge to USD 18.2 billion by 2033. This represents a growth trajectory with a CAGR of 15.5% over the forecast period. A significant contribution to this market’s size is attributed to North America, which held a commanding 37.5% market share, translating to revenues of approximately USD 1.6 billion.

Financial planning software serves as a powerful tool designed to assist financial advisors and individuals in managing personal budgets, investments, and financial decisions more efficiently. These tools often integrate various financial functions such as budgeting, portfolio management, retirement planning, and tax planning within a single platform. There is a robust demand for financial planning software, propelled by the widespread recognition of financial planning’s importance in achieving long-term financial objectives. The aging population, particularly in developed countries, and the growing focus on retirement planning continue to drive the demand.

Additionally, younger generations are beginning to utilize financial planning services earlier in life, expanding the customer base for this software. Financial planning software has gained popularity due to its ability to provide detailed and customizable financial advice. The popularity of these tools is further enhanced by the digital transformation in finance, where more consumers and advisors seek digital solutions for financial management. The integration of these tools with mobile devices has also increased accessibility, making it more popular among tech-savvy users.

The Financial Planning Software market has been expanding due to the increasing complexity of financial operations and the need for efficient tools to manage personal and business finances. This software provides comprehensive solutions for budgeting, forecasting, and financial planning, catering to individual consumers, financial advisors, and corporate users. The widespread adoption of cloud-based technologies and the emphasis on digital transformation in financial services have further boosted the market growth. Financial planning software not only helps streamline financial operations but also provides real-time financial data analysis, improving decision-making processes for users.

Key growth factors driving the Financial Planning Software market include the rising demand for automated solutions to enhance financial decision-making and the growing financial awareness among consumers. As individuals and businesses become more proactive in managing their finances, the need for software that offers detailed analytics and forecasting capabilities increases. Additionally, regulatory changes and the need for compliance in financial operations have made financial planning software an indispensable tool for many companies. The integration of artificial intelligence and machine learning has also refined the capabilities of financial planning software, making predictions more accurate and financial planning more intuitive.

The Financial Planning Software market is ripe with opportunities, particularly in developing economies where digital financial management practices are still being adopted. As more businesses and individuals recognize the benefits of organized financial planning, the demand for these software solutions is expected to rise. Another significant opportunity lies in the ongoing development of more user-friendly platforms that can cater to non-expert users, thus expanding the market base. Moreover, with the increasing trend towards mobile-based solutions, providing robust mobile applications for financial planning can open new avenues for growth in this sector.

Key Takeaways

- The Global Financial Planning Software Market exhibited a substantial market valuation of USD 4.3 billion in 2023 and is projected to ascend to USD 18.1 billion by 2033. This growth trajectory corresponds to a Compound Annual Growth Rate (CAGR) of 15.5% over the forecast period.

- Deployment Mode Insights: The cloud-based segment asserted dominance in the market landscape, securing a significant portion with a 67.1% share in 2023. This dominance underscores a strong preference for cloud-based solutions, attributed to their scalability, reduced operational costs, and ease of integration.

- Application Insights: Within the application categories, the investment planning segment was predominant, commanding a 28.4% share of the market in 2023. This segment’s leading position highlights its critical role in streamlining asset management and optimizing investment strategies.

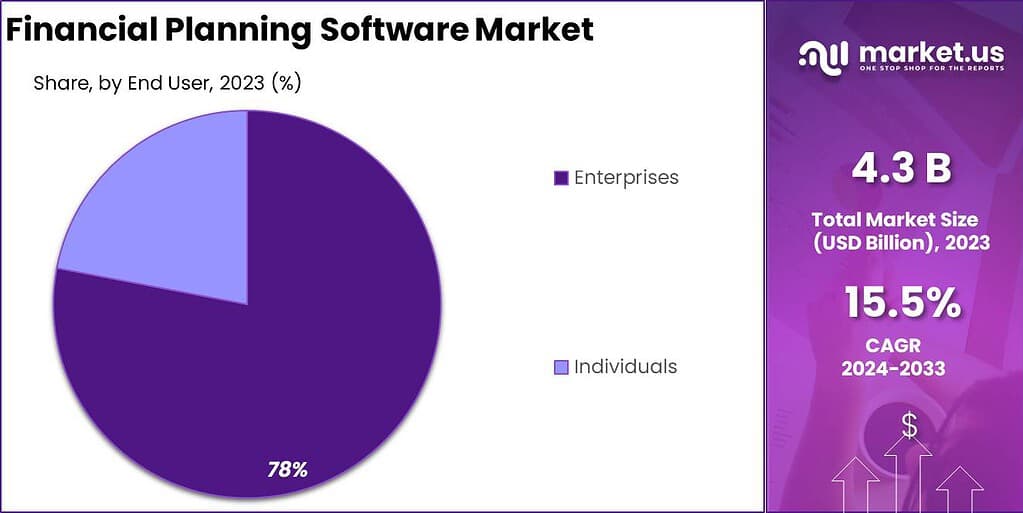

- End-User Insights: The enterprise segment significantly led the end-user categories, capturing a 78% market share in 2023. This substantial share is indicative of the robust adoption of financial planning software within large organizations aiming to enhance financial decision-making processes.

- Regional Dominance: North America maintained a commanding presence in the global market, holding a 37.5% share in 2023. This leading position is supported by advanced technological infrastructure and the early adoption of innovative financial planning solutions across industries.

Financial Planning Software Statistics

- The Global Generative AI in Financial Services Market size is expected to reach USD 10,403.3 million by 2033, up from USD 847.5 million in 2023, growing at a CAGR of 28.2% during the forecast period from 2024 to 2033.

- The U.S. has over 283,000 financial advisors, reflecting the scale of the financial advisory sector.

- 35% of the population in the U.S. uses financial advisory services, indicating the demand for personalized financial planning.

- The personal financial advisor market is expected to witness a 13% job growth, driven by rising demand for financial guidance and planning services.

- 80% of financial advisors in the U.S. are white, highlighting the demographic composition of the profession.

- California employs the highest number of personal financial advisors, indicating its leadership in the financial advisory sector.

- The financial advisory services market is projected to be valued at approximately USD 146.9 billion by 2032, driven by increasing demand for personalized financial solutions.

- By 2024, assets under management (AUM) by financial advisors are expected to reach USD 62.62 trillion, underscoring the sector’s growing influence.

- 60% of financial advisors are employed by private companies, reflecting the dominance of private firms in the advisory market.

- The Global Financial Management Software Market is projected to grow from USD 17.9 billion in 2023 to USD 49.9 billion by 2033, at a CAGR of 10.8% during the forecast period.

- The Global AI in Financial Wellness Market is forecasted to expand from USD 12.8 billion in 2023 to USD 189.1 billion by 2033, growing at a CAGR of 30.9%.

- 72% of senior finance executives consider FP&A a strategic partner in decision-making, according to a survey by the Association for Financial Professionals.

- By 2024, 70% of new FP&A initiatives will incorporate AI and machine learning, improving forecasting accuracy and operational efficiency.

- Over 80% of businesses now integrate business intelligence (BI) tools with FP&A software to enhance decision-making speed and accuracy.

- Job postings for FP&A positions have surged, with a 15% annual growth rate, as per LinkedIn economic data, reflecting the increasing need for financial planning professionals.

- A survey by BPM Partners reveals that over 80% of businesses leverage BI tools alongside FP&A systems to improve decision-making processes.

Top 8 Financial Planning and Analysis Software

1. Anaplan

Anaplan is a cloud-based platform designed for connected financial planning and analysis. Its strength lies in real-time modeling and scenario planning, enabling businesses to simulate potential outcomes and make quick decisions based on predictive analytics. It integrates data across finance, supply chain, HR, and sales departments, providing a holistic view of the business. Anaplan’s Hyperblock™ engine allows for complex multi-dimensional analysis, making it ideal for large enterprises. However, it can be expensive, and the learning curve may require significant training for users.

2. NetSuite Planning and Budgeting

NetSuite’s FP&A tool focuses on improving planning, budgeting, and forecasting efficiency. The platform enables companies to manage financial and operational data in one place, automating time-consuming processes like consolidations. NetSuite’s seamless integration with its other ERP tools is a major advantage, particularly for companies already using NetSuite. Its real-time collaboration features allow users to work together on budgets and forecasts, making it a go-to tool for mid-sized businesses. The interface, while powerful, can feel complex for smaller teams.

3. OneStream

OneStream is a unified platform for corporate performance management (CPM), including budgeting, forecasting, and financial consolidation. It’s particularly known for handling large volumes of data and integrating with multiple systems, which is helpful for enterprises dealing with complex operations. Its built-in reporting and analysis tools make it an excellent choice for managing finance across departments. OneStream is a flexible, scalable solution, though the implementation process can be lengthy.

4. Oracle Cloud EPM Planning

Oracle Cloud EPM is a comprehensive financial planning solution, offering strong capabilities in scenario modeling, strategic forecasting, and predictive analytics. It helps organizations streamline operations by integrating across departments, from finance to HR and beyond. Its major advantage lies in its scalability and extensive support for custom integrations, making it suitable for large enterprises. However, the complexity of the pricing model and potential hidden costs can be a challenge for new users.

5. Prophix Financial Performance Management Platform

Prophix is known for its ease of use, making it a favorite among mid-sized companies looking to improve their financial processes without extensive technical overhead. It automates budgeting, planning, and reporting, while offering user-friendly dashboards for real-time insights. Prophix’s strong customer support and relatively straightforward implementation make it a good choice for companies looking to streamline processes without complex customization requirements.

6. SAP Analytics Cloud

SAP Analytics Cloud offers an integrated solution for planning, budgeting, and analysis, built to leverage the power of SAP’s vast ecosystem. It’s especially strong in predictive analytics and data visualization, making it a powerful tool for companies already using SAP ERP systems. While its integration with SAP S/4HANA is seamless, it has limited third-party connector options, which might be a limitation for companies that don’t rely solely on SAP products.

7. Vena Complete Planning

Vena is a popular FP&A tool because of its Excel-based interface, which makes it user-friendly and familiar to financial professionals. It allows for collaborative planning, budgeting, and reporting, and its Excel integration enables users to leverage existing knowledge without learning a new system. Vena is highly customizable and fits the needs of mid-sized businesses looking for flexible planning solutions.

8. Workday Adaptive Planning

Workday Adaptive Planning is highly regarded for its ease of use and strong integration with Workday’s suite of HR and financial products. It offers predictive analytics and planning tools that make it easier for businesses to build financial models, forecast revenues, and collaborate across departments. Workday’s focus on scalability makes it suitable for organizations of all sizes, though some users find its predictive analytics could be enhanced further.

Report Segmentation

Deployment Mode Analysis

The Financial Planning Software Market is segmented into two deployment modes: Cloud-Based and On-Premise solutions. In 2023, the cloud-based segment dominated the market, accounting for 67.1% of the total share. This dominance can be attributed to several factors, including the increasing adoption of cloud technology due to its flexibility, cost-efficiency, and scalability.

Cloud-based solutions allow users to access the software from anywhere with an internet connection, making it highly suitable for businesses that require real-time data and collaboration across geographically dispersed teams. Moreover, the need for minimal IT infrastructure and the ability to scale resources as needed make cloud-based deployments highly attractive, especially for small to medium-sized enterprises (SMEs). Additionally, the subscription-based pricing model of cloud solutions tends to be more affordable, which appeals to companies looking to minimize upfront costs.

On the other hand, On-Premise solutions, while still in use, are generally more common among large enterprises with stringent data security and privacy concerns. These businesses prefer to keep their financial data on-site to maintain control over their systems, but this deployment mode requires higher upfront investment in hardware, software licenses, and ongoing maintenance.

Application Analysis

Within the Financial Planning Software Market, the Investment Planning segment held a leading position in 2023, capturing over 28.4% of the market share. Investment planning tools are crucial for organizations and individuals seeking to optimize their investment portfolios and achieve long-term financial goals.

This segment’s strong performance is driven by the growing demand for software that provides detailed forecasting, risk analysis, and scenario planning for investments. The rise of financial advisory services and the increasing complexity of managing multiple asset classes (such as stocks, bonds, and real estate) have also contributed to the segment’s growth.

End User Analysis

In 2023, the Enterprises segment dominated the Financial Planning Software Market, capturing more than 78.0% of the market share. This segment encompasses large corporations and businesses that require comprehensive financial planning solutions to manage their operations across multiple departments and geographies.

Enterprises invest heavily in financial planning software to streamline budgeting, forecasting, and reporting processes. These tools help in aligning financial strategies with corporate goals, optimizing resource allocation, and ensuring compliance with regulations. The scalability of these solutions, combined with advanced analytics and integration capabilities, allows enterprises to handle complex financial data and make informed decisions.

Moreover, the growing trend of digital transformation within enterprises has accelerated the adoption of financial planning software, particularly cloud-based solutions, enabling real-time data access and collaboration. The emphasis on cost reduction, improved accuracy in forecasting, and the need for better risk management further drive the demand for these solutions in the enterprise sector.

Emerging Trends

- Increased Complexity and Diversification: The financial planning industry is evolving to handle more complex client needs, which demands innovative software solutions that provide comprehensive service capabilities including tax optimization and estate planning.

- AI and Automation Integration: Emerging AI tools and automation are revolutionizing financial planning by enhancing efficiencies, streamlining processes, and enabling real-time scenario analysis and data-driven decision-making.

- Demand for Integrated Business Planning: There’s a growing need for integrated business planning that combines various financial functions within a single platform, enhancing the cohesion and efficiency of financial operations.

- Tailored Client Solutions: There is a trend towards providing more personalized financial planning services, utilizing AI to tailor recommendations based on individual client data, thereby enhancing client satisfaction and engagement.

- Focus on Efficiency and Cost Management: Financial services are increasingly focused on operational efficiency, reducing costs through technology, and optimizing business processes to improve overall performance and profitability.

Top Use Cases

- Comprehensive Client Management: Software that provides a holistic view of client portfolios, facilitating management across various financial aspects such as investments, savings, insurance, and retirement plans.

- Risk Management and Compliance: Leveraging software to automate compliance checks and manage risk through advanced analytics and real-time data monitoring.

- Scenario Planning and Forecasting: Utilizing software for detailed scenario planning and forecasting to prepare for various financial conditions and market fluctuations, thus enhancing strategic planning capabilities.

- Automated Workflow Processes: Implementation of AI-driven tools to automate routine tasks, report generation, and data analysis, which significantly reduces manual labor and increases accuracy and efficiency.

- Integrated Business Planning (IBP): Using financial planning software to integrate and synchronize data across various business functions, providing a unified view that supports better strategic decisions and operational adjustments.

Major Challenges

- Increasing Landscape Complexity: As financial planning becomes more complex, there is a growing demand for software to manage intricate client needs such as tax optimization, estate planning, and retirement strategies. This puts pressure on advisors and software providers to evolve their offerings continuously.

- Technology Limitations: Despite advancements, financial planning software often struggles to keep pace with the broadening scope of financial services, leading to advisors sometimes resorting to manual processes or supplemental tools, which can introduce errors and inefficiencies.

- Adaptation to Market Changes: The financial landscape is prone to sudden changes due to economic shifts, policy changes, or unforeseen events like the COVID-19 pandemic, making it challenging for businesses to maintain accurate long-term financial plans.

- Consumer Behavior Uncertainty: Predicting consumer behavior is a major challenge. Economic uncertainty and market volatility can significantly affect consumer spending and financial decisions, impacting financial plans and necessitating real-time adjustments.

- Integration with Existing Systems: Many financial planning tools need to better integrate with other business systems, which complicates data management and can hinder the performance of financial analytics and real-time decision-making.

Top Opportunities

- Diversification of Tech Stack: The increasing complexity of client needs is creating opportunities for the integration of specialized tools alongside mainstay financial planning software. This approach allows for more tailored and comprehensive financial management solutions.

- AI and Personalization: Leveraging AI to offer personalized financial advice and management solutions can significantly enhance client satisfaction by providing customized insights and financial strategies based on individual goals and circumstances.

- Enhanced Data Analytics: With the increasing volume of financial data, software that can provide deeper analytics and insights offers significant opportunities for growth. This includes capabilities for predictive analytics and scenario planning to better manage financial uncertainties.

- Expansion into Emerging Markets: As regions like Asia-Pacific show rapid growth in financial planning software adoption, there are substantial opportunities for market expansion and development of region-specific solutions.

- Regulatory Compliance and Security: As financial regulations continue to evolve, there is a growing need for software that can ensure compliance while protecting sensitive financial data, presenting a critical opportunity for developing secure, compliant financial planning platforms.

Conclusion

In conclusion, the Financial Planning Software market is positioned for continued growth, driven by the increasing demand for automated financial management solutions and the integration of advanced technologies like AI and machine learning. The sector is expected to benefit significantly from the digitalization trends and regulatory demands that require more rigorous financial oversight and compliance.

Opportunities for expansion into emerging markets and the development of mobile applications present viable pathways for further market penetration. As businesses and individuals alike seek more sophisticated, user-friendly, and comprehensive financial planning tools, the market is likely to see sustained growth and innovation, making it a critical component in the landscape of financial technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)