Table of Contents

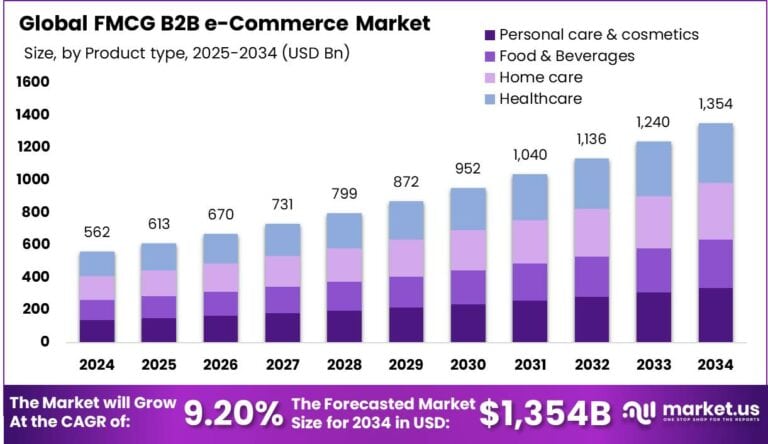

In 2024, the global FMCG B2B e-commerce market reached approximately USD 561.7 billion and is projected to achieve USD 1,354 billion by 2034, expanding at a CAGR of 9.20% from 2025 to 2034. North America accounted for 38.7% of global revenue, generating USD 217 billion, with the U.S. market contributing USD 195.6 billion and forecasted to grow at a CAGR of 7.8%.

The sector is being driven by digital procurement platforms, streamlined logistics, and demand for faster replenishment cycles. However, macroeconomic pressures, particularly trade tariffs, are influencing the cost structure and international operations of FMCG suppliers and distributors.

How Tariffs Are Impacting the Economy

Tariffs imposed on imported goods, particularly those from China, have caused widespread ripple effects across the U.S. economy. As of 2024, tariffs on over US$550 billion worth of goods have led to increased costs for raw materials and packaging—key inputs for the FMCG industry. The result is a rise in operating expenses for manufacturers and distributors. For example, aluminum tariffs have driven up packaging costs for beverages and personal care items.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/fmcg-b2b-e-commerce-market/free-sample/

These tariffs also limit price competitiveness in global markets, thereby reducing export opportunities for U.S.-based FMCG suppliers. Additionally, tariff uncertainty has delayed procurement decisions, increased inventory stockpiling, and forced companies to renegotiate supplier contracts. The combined effect is reduced consumer purchasing power and suppressed profit margins, especially for small and mid-sized businesses that lack negotiation leverage or alternate sourcing networks.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: Tariffs have led FMCG businesses to reassess global supply chains. Companies are moving sourcing and manufacturing from tariff-affected regions to lower-tariff alternatives such as Vietnam, Mexico, and Eastern Europe. These transitions require capital investments and retraining, temporarily elevating operational expenses.

Sector-Specific Impacts:

- Packaged Foods: Input costs for grain and dairy imports have surged due to retaliatory tariffs.

- Personal Care: Tariffs on raw materials like essential oils and plastics are affecting pricing structures.

- Household Goods: Increased transportation and logistics costs are hurting distribution efficiency.

- Beverages: Tariffs on aluminum and steel used in can production are squeezing profit margins.

Strategies for Businesses

To mitigate the effects of tariffs, FMCG B2B enterprises are adopting proactive strategies:

- Supplier Diversification to reduce dependency on tariffed regions.

- Digital Procurement Platforms to enhance sourcing agility.

- Inventory Optimization for better cost control.

- Strategic Nearshoring to maintain supply continuity.

- Automation and AI to drive operational efficiency and reduce labor dependency.

These strategies help businesses preserve competitiveness and ensure long-term resilience in volatile trade conditions.

Key Takeaways

- FMCG B2B e-commerce is projected to reach USD 1,354 billion by 2034 at a 9.20% CAGR.

- The U.S. market hit USD 195.6 billion in 2024, driven by supply chain digitization.

- Tariffs are inflating production and distribution costs, pressuring profit margins.

- Global businesses are realigning supply chains to neutral zones.

- Tech-driven procurement and inventory strategies are proving essential.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148372

Analyst Viewpoint

Currently, the FMCG B2B e-commerce market is facing pressure from macroeconomic factors, yet businesses investing in supply chain transformation and digital tools are emerging stronger. Analysts believe present challenges are accelerating structural improvements, leading to future cost efficiencies and operational transparency. Looking ahead, the market is expected to capitalize on localized sourcing, predictive analytics, and AI procurement tools, which will enable more scalable, sustainable growth amid global uncertainty.

Regional Analysis

In 2024, North America led the global FMCG B2B e-commerce market with 38.7% share, supported by widespread digitization and robust fulfillment infrastructure. The Asia-Pacific region is seeing rapid adoption of mobile-based B2B platforms and is forecasted to grow significantly due to rising urbanization and improved digital infrastructure. Europe maintains stable growth, driven by eco-conscious procurement and automated warehousing. Meanwhile, Latin America and Middle East & Africa are witnessing increased B2B platform penetration through investments in logistics networks and SME engagement programs.

➤ Discover More Trending Research

Business Opportunities

Growing digital penetration and changing global trade flows are unlocking new opportunities in the FMCG B2B space. Companies that embrace AI-driven procurement, real-time inventory tracking, and dynamic pricing models are better positioned for growth. Opportunities are especially ripe in cross-border wholesale, direct manufacturer-to-retailer sales, and subscription-based replenishment models. SMEs can leverage online B2B marketplaces to scale globally without traditional infrastructure. There’s also rising demand for eco-packaging suppliers and compliance-focused trade platforms, reflecting both regulatory shifts and buyer sentiment.

Key Segmentation

The global FMCG B2B e-commerce market is segmented based on product category, platform type, end-user, and region.

- Product Category: Food & Beverages, Personal Care, Household Products, Health & Wellness, Others

- Platform Type: Web-based, Mobile App

- End-User: Wholesalers, Retailers, Distributors, Institutions

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

This segmentation helps businesses tailor their operational strategies and marketing approaches to specific consumer demands and regional dynamics.

Key Player Analysis

Key companies in this space are focusing on logistics automation, AI-powered demand forecasting, and integrated B2B sales platforms. They are enhancing user experience through seamless payment systems, real-time order tracking, and personalized pricing engines. Innovation is being driven by strong R&D, strategic partnerships, and vertical integration. These players are also exploring blockchain to improve transparency in procurement and are investing in carbon-neutral fulfillment to align with ESG goals. The ability to adapt and invest in scalable digital infrastructure remains a core differentiator.

Recent Developments

Recent innovations include integration of machine learning in procurement, expansion of on-demand warehousing, and the launch of AI-based product recommendation engines in B2B marketplaces. These developments aim to enhance buying efficiency and reduce procurement cycles.

Conclusion

Tariffs continue to reshape global FMCG B2B e-commerce dynamics. However, businesses adopting digital transformation, agile sourcing, and localized strategies are well-positioned for sustainable long-term growth amid shifting trade landscapes.