Table of Contents

Report Overview

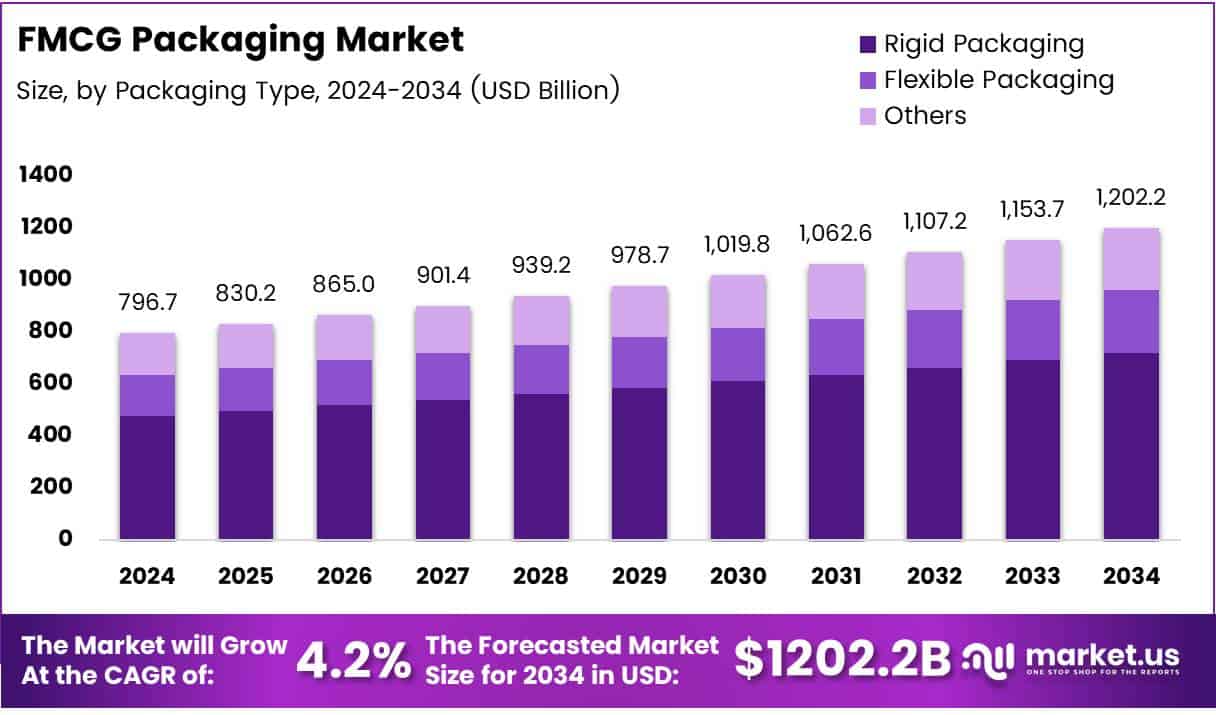

The Global FMCG Packaging Market size is expected to be worth around USD 1202.2 Billion by 2034, from USD 796.7 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034.

This growth trajectory is fueled by evolving consumer preferences, rapid urbanization, expanding e-commerce, and increased demand for sustainable and intelligent packaging solutions. The FMCG packaging sector has evolved into a strategic pillar for brand identity, environmental responsibility, and logistics efficiency, transforming how brands connect with consumers across the globe.One of the most significant trends shaping the market is the growing demand for sustainable packaging.

Consumers are increasingly environmentally conscious, with studies showing that 82% are willing to pay a premium for eco-friendly packaging. In the Asia-Pacific region, this sentiment is even more pronounced, where 90% of consumers prefer sustainable products, often influenced by packaging. These insights are pushing companies to adopt biodegradable, compostable, and recyclable materials such as bioplastics and paper-based alternatives, while also implementing circular economy models focusing on reuse and recyclability.

Overall, the global FMCG packaging market is undergoing a transformational shift. With increasing investments in R&D, regulatory pressures, and consumer demand for sustainable and smart packaging, the industry is expected to witness steady and innovation-driven growth over the next decade.

Key Takeaways

- The Global FMCG Packaging Market is projected to reach USD 1202.2 Billion by 2034, growing from USD 796.7 Billion in 2024 at a CAGR of 4.2%.

- Rigid Packaging held the largest share in 2024 at 62.9%, driven by its strength and protection for food, beverages, and personal care products.

- Plastic was the leading material in 2024, accounting for 43.6% of the market due to its lightweight and cost-effective nature.

- The Food and Beverages segment dominated end-use in 2024 with a 41.8% share, driven by rising demand for packaged and shelf-stable products.

- Asia Pacific led the regional market in 2024 with a 36.8% share valued at USD 294.7 Billion, supported by urbanization, a growing middle class, and booming e-commerce in China and India.

Key Market Segment

Packaging Type

Rigid Packaging leads with 62.9% share in 2024 due to its strength and product protection, ideal for food, beverages, and personal care. Flexible Packaging is growing fast for its lightweight, cost-efficiency, and convenience. Eco-friendly and hybrid options in the “Others” category are gaining traction in premium niches.

Material

Plastic dominates with 43.6% share thanks to its low cost and mass production ease. Paper use is rising as a sustainable choice, especially where plastic use is restricted. Metal and glass are used in premium or long-shelf-life products, while bioplastics and composites are slowly entering the mainstream.

End Use

Food and Beverages lead demand with 41.8% share, driven by packaged and ready-to-eat goods. Cosmetics and Personal Care follow, focusing on design and hygiene. Household and healthcare items in the “Others” segment see steady growth with rising consumer spending.

Drivers

- Consumer demand for convenience: Portable, resealable, and user-friendly designs are becoming essential, especially in on-the-go food and personal care products.

- Booming e-commerce: Online retail is accelerating the need for tamper-proof, durable, and shock-resistant packaging.

- Urbanization and rising incomes: Growing middle-class populations in Asia and Africa are increasing demand for packaged goods.

- Sustainability pressure: 82% of global consumers are willing to pay more for eco-friendly packaging, pushing brands to innovate.

Major Challenges

- Volatile raw material prices: Costs for plastic, paperboard, and metals fluctuate due to geopolitical and supply chain disruptions.

- Tightening regulations: Bans on single-use plastics and increasing compliance requirements demand investment in alternative materials and technologies.

- Cost burden on small firms: Smaller manufacturers often struggle to keep up with innovation and compliance mandates, impacting competitiveness.

- Business Opportunities

Amid the challenges, numerous opportunities await market players: - Eco-friendly materials: Plant-based plastics, paper solutions, and reusable formats open new product lines and customer segments.

Regional Analysis

Asia Pacific Leads the FMCG Packaging Market

The Asia Pacific region is the top player in the global FMCG packaging market, holding a strong 36.8% market share. The total market value in this region is around USD 294.7 billion, making it the largest contributor worldwide.This leadership is mainly due to high demand from highly populated countries like China and India. These countries are seeing fast urban growth, rising incomes among the middle class, and a major increase in shopping through retail and online platforms—all of which boost the need for FMCG packaging.

The region’s growth is also powered by more people moving to cities, greater spending power, and the rapid rise of e-commerce. These changes increase the demand for packaged goods, creating more business opportunities for packaging companies.Governments in Asia Pacific are encouraging eco-friendly packaging, which is pushing companies to come up with new and greener solutions. This trend is driving innovation and helping the market grow even more through sustainable practices.

Recent Developments

- In Jun 2025, a new sustainable packaging solution led to over 90% less energy use, up to 70% reduction in plastic consumption, 30% lighter cardboard, and up to 70% lower carbon emissions. This breakthrough supports both environmental goals and cost efficiency in packaging operations.

- In Nov 2024, Rathna Packaging invested significantly in cutting-edge equipment from Windmöller & Hölscher, enhancing production capabilities. The expansion includes the installation of two advanced W&H machines, aiming to boost efficiency and product quality.

- In Jun 2025, DHL Group announced an investment exceeding EUR 500 million in the Middle East to strengthen its footprint.

The focus is on capitalizing on the region’s fast-growing logistics demand, especially across Gulf countries. - In Jul 2025, logistics stocks gained attention after a firm secured ₹30 Cr worth of contracts from a leading infrastructure company.

This company, known for offering end-to-end supply chain solutions, is poised for growth across transport, warehousing, and 3PL segments.

Conclusion

The global FMCG packaging market is entering a transformative decade marked by eco-conscious innovation, digital integration, and design-led consumer engagement. As global trends shift toward sustainability, functionality, and personalization, industry players are investing in smarter, greener, and more efficient packaging strategies. From smart sensors to circular packaging systems, the future of FMCG packaging is not just about wrapping goods—it’s about wrapping value, trust, and experience.