Table of Contents

Introduction

According to Fraud Detection and Prevention Statistics, Fraud Detection and Prevention (FDP) is a critical focus for organizations, involving strategies and technologies to thwart deceptive activities aimed at financial gain. Fraud encompasses various forms, from identity theft to cybercrimes, and effective FDP is crucial for minimizing financial losses, preserving reputation, adhering to legal obligations, and safeguarding data.

Key components include data collection, statistical analysis, machine learning, fraud prevention measures, regulatory compliance, and integrating emerging technologies like AI and blockchain. Continuous improvement is vital in this dynamic field to stay ahead of evolving fraud tactics.

Editor’s Choice

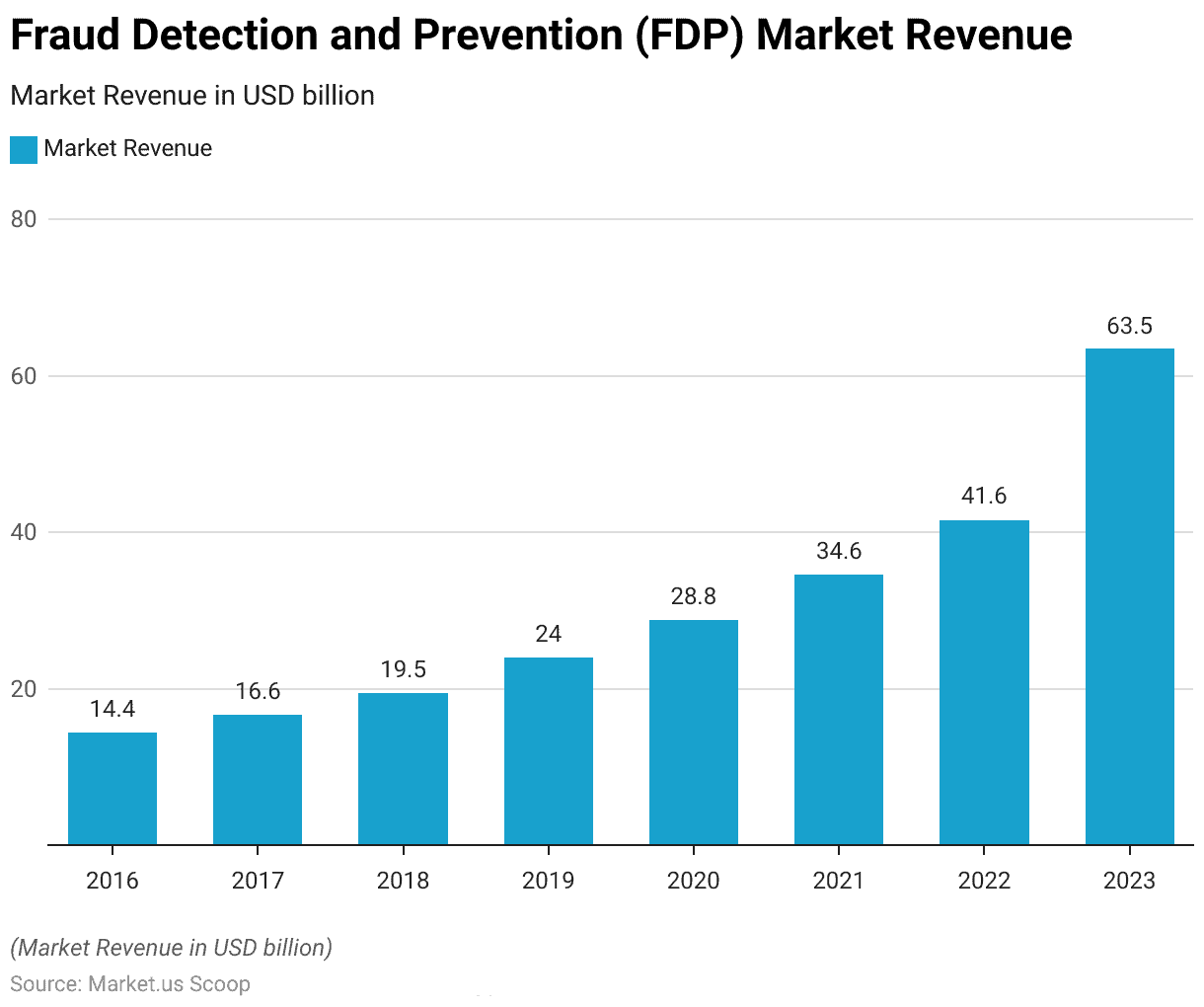

- The Fraud Detection and Prevention (FDP) market has witnessed significant growth in recent years, with its revenue steadily increasing from 14.37 billion USD in 2016 to 63.50 billion USD in 2023.

- In 2022, Credit Card Fraud saw an increase in 440,666 reported cases, marking a 13% rise from 2021.

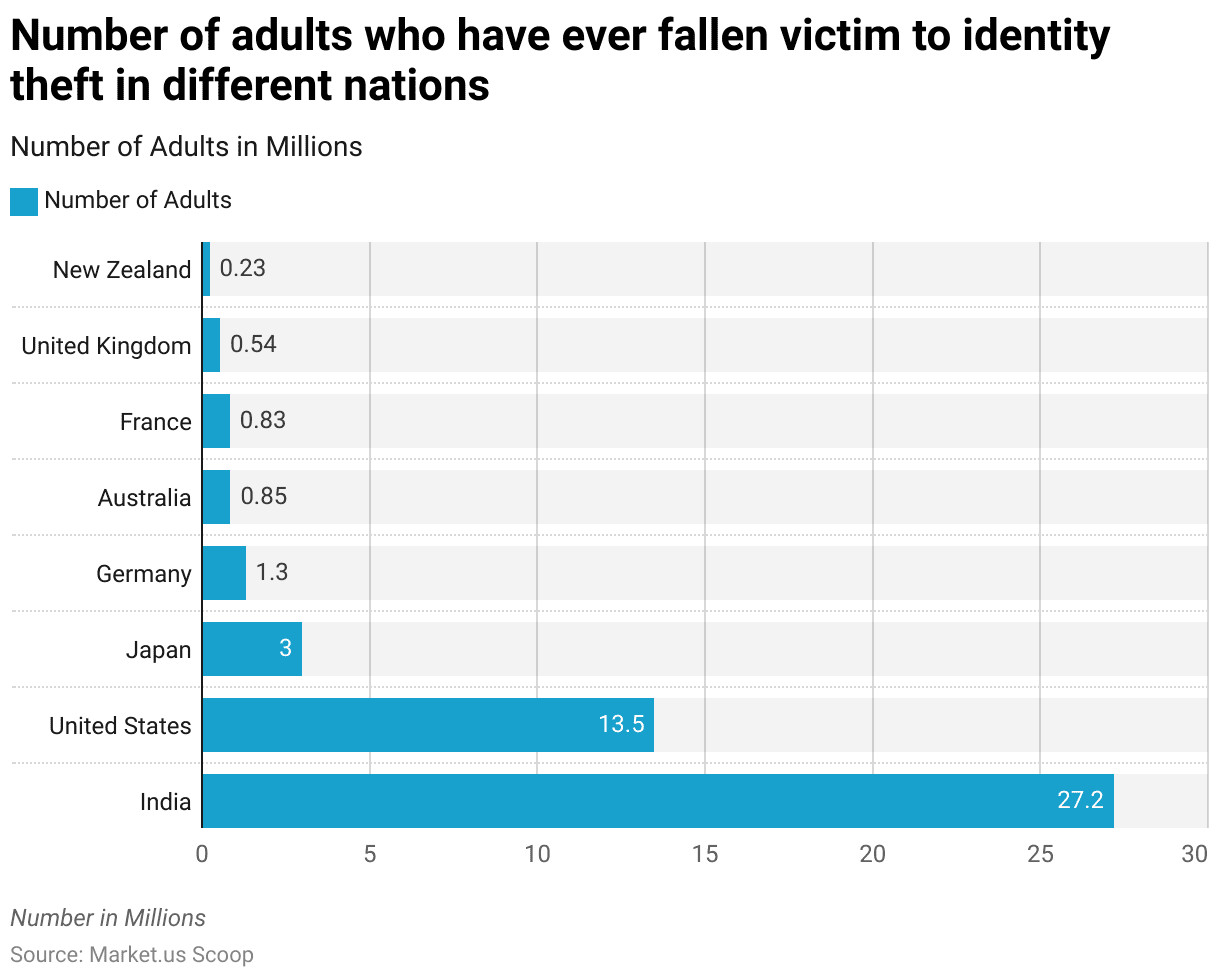

- India, with a staggering 27.2 million adults, has the highest number of individuals who have fallen victim to identity theft.

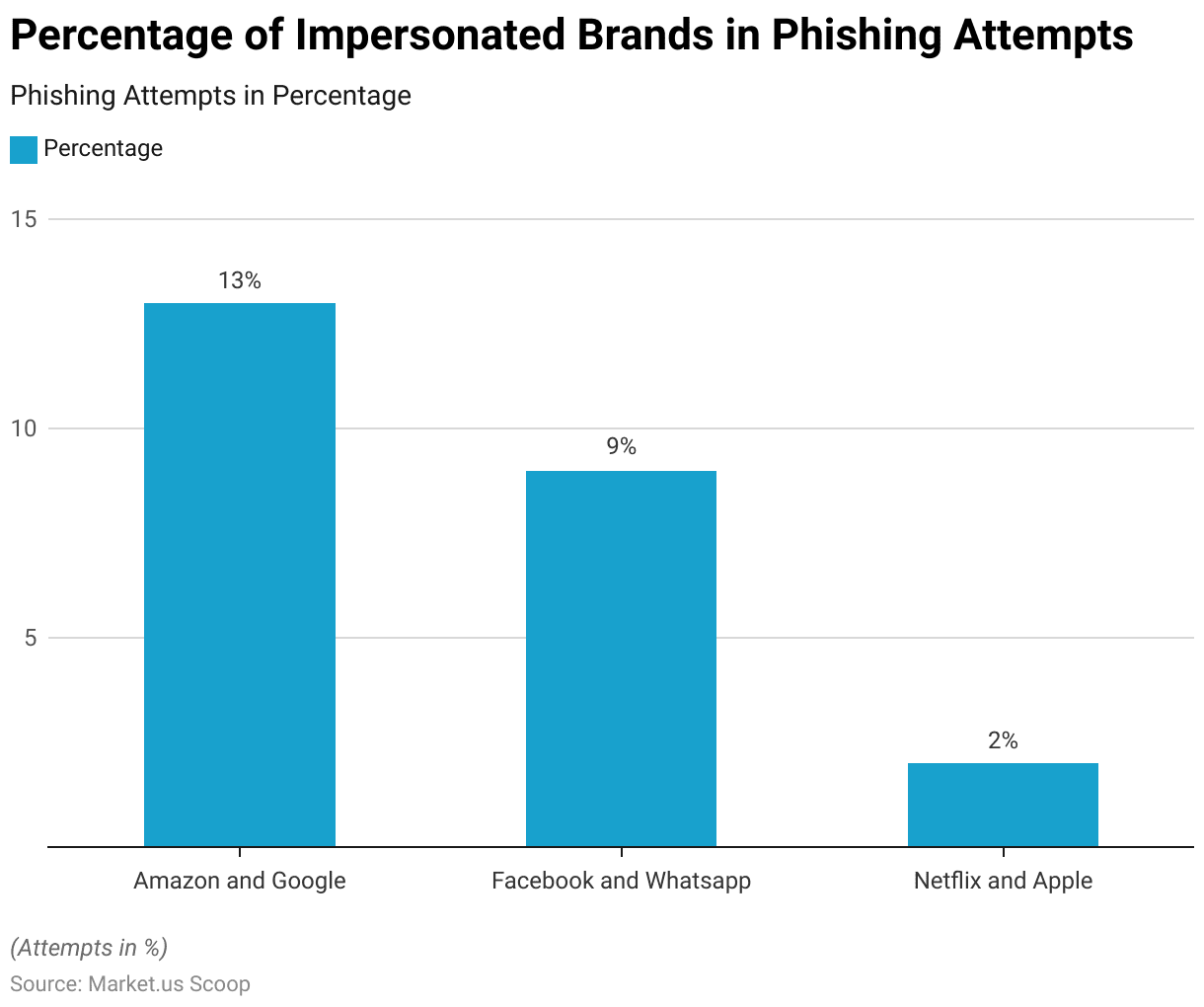

- The most commonly impersonated brands in phishing attempts are Amazon and Google, accounting for 13%, followed by Facebook and Whatsapp at 9%, and Netflix and Apple at 2%.

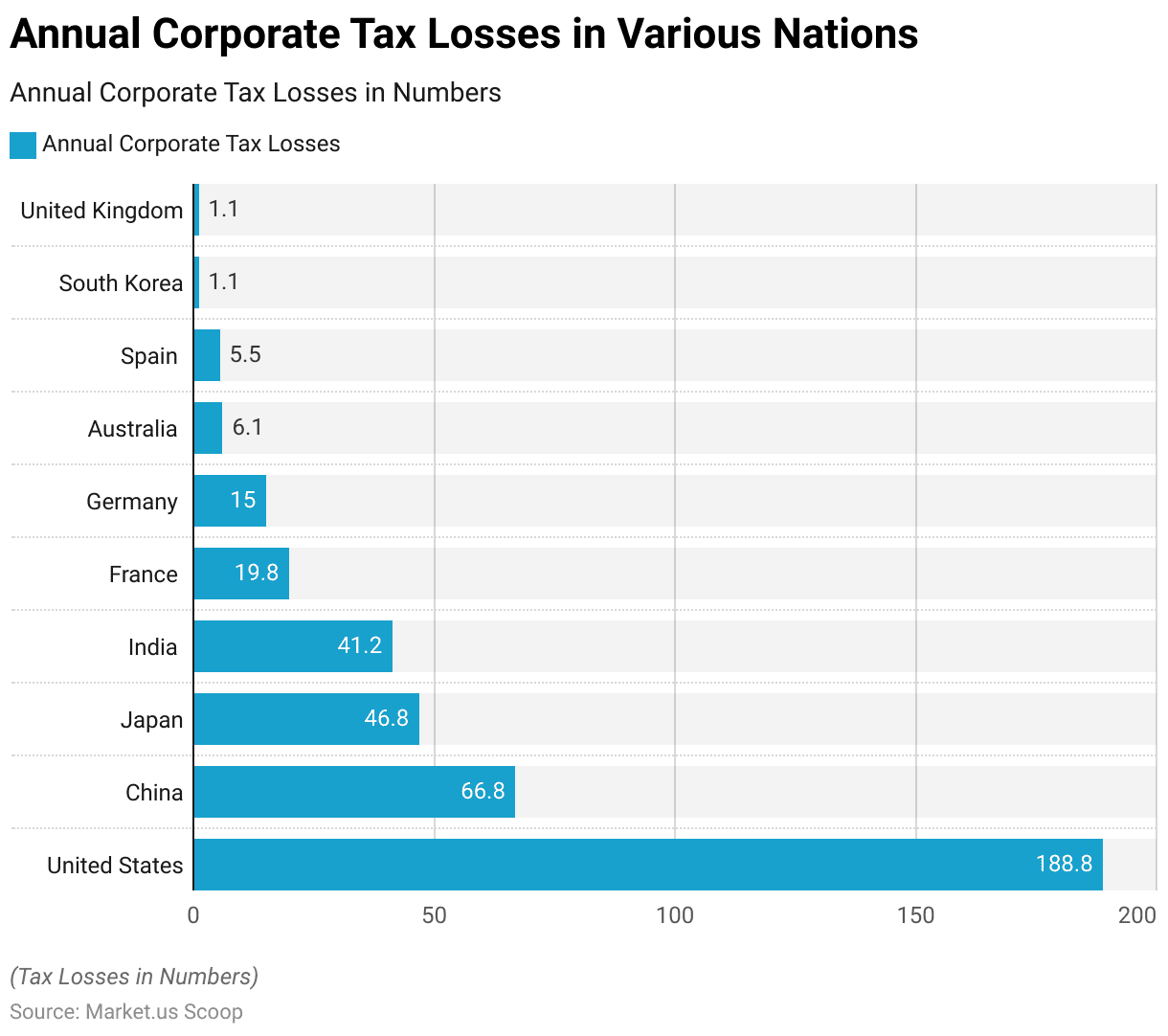

- The United States tops the tax evasion list with a substantial 188.8 billion USD in corporate tax losses, reflecting the scale of its economy.

- The retail sector has experienced a substantial increase, with a suspected fraud attempt rate of 10.60%, marking a significant 183% rise.

- According to research conducted in 2022, credit card verification services are the leading choice for fraud detection among online merchants worldwide, with 55% employing this approach.

Fraud Detection and Prevention (FDP) Market Overview

Global Fraud Detection and Prevention (FDP) Market Size

- The Fraud Detection and Prevention (FDP) market has witnessed significant growth in recent years, with its revenue steadily increasing from 14.37 billion USD in 2016.

- This remarkable growth trajectory reflects the growing importance of safeguarding businesses and financial institutions against fraudulent activities.

- The year 2019 saw a substantial increase to 24.00 billion USD, emphasizing the escalating threat of fraud in various sectors.

- The year 2023 is projected to be particularly significant, with the market expected to soar to 63.50 billion USD, underlining the growing awareness of the need for robust fraud protection measures in an increasingly digitized world.

Different Types of Frauds

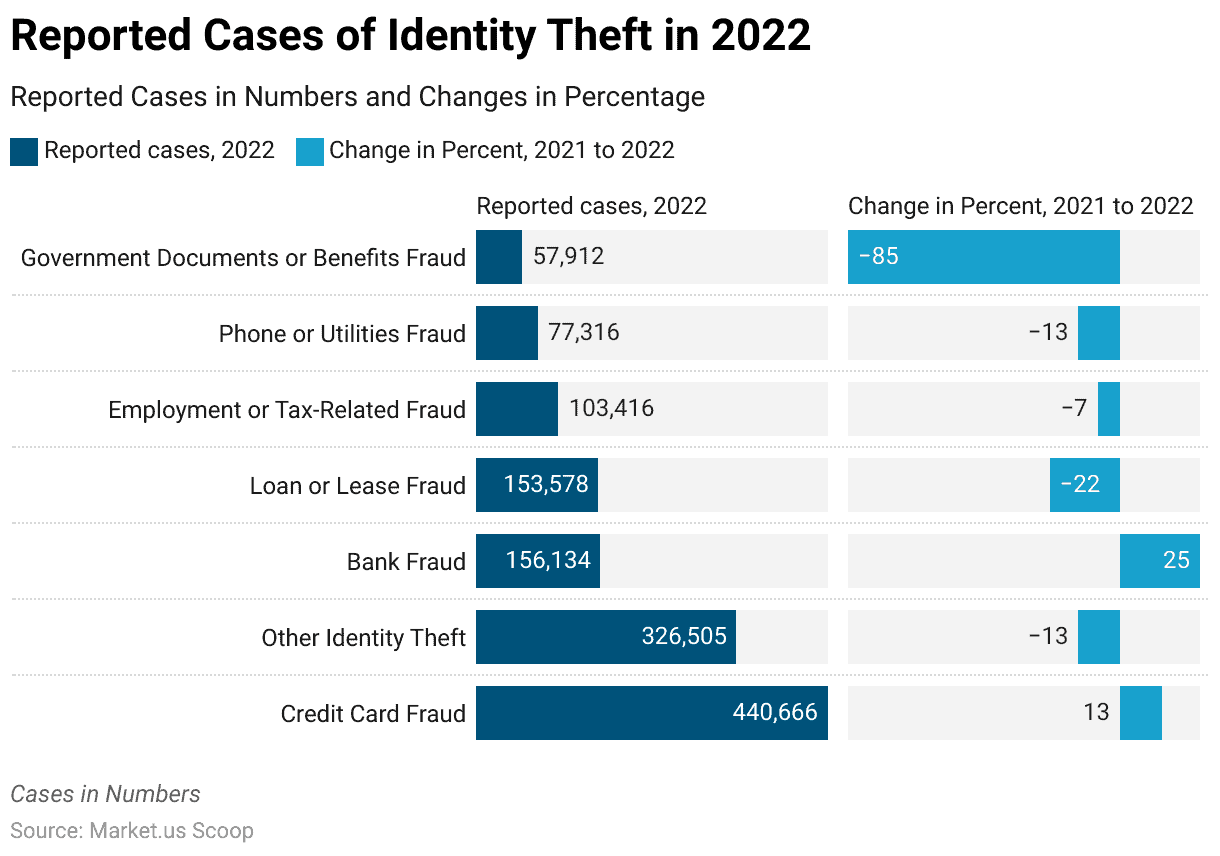

- In 2022, various types of fraud were reported, each showing distinct trends in reported cases compared to the previous year.

- Credit Card Fraud increased with 440,666 reported cases, marking a 13% rise from 2021.

- Other Identity Theft reported 326,505 cases, reflecting a 13% decrease.

- Bank Fraud showed a significant surge, with 156,134 cases, representing a 25% increase.

- In contrast, Loan or Lease Fraud experienced a decline, with 153,578 cases, down by 22%.

- Employment or Tax-Related Fraud also decreased, reporting 103,416 cases, a 7% drop.

- Phone or Utilities Fraud decreased by 13%, reporting 77,316 cases.

- The most notable change was observed in Government Documents or Benefits Fraud, with a substantial 85% decrease and 57,912 reported cases.

Identity Theft

- Recent statistics reveal that around one-third (33%) of Americans have experienced identity theft at least once in their lifetimes. This percentage is more than twice the global average.

- Each year in the United States, there are more than 50,000 reported cases of identity theft and an equal number of personal data breaches. However, it is believed that many similar crimes go unreported.

- In 2022, identity theft has significantly impacted adults in various countries.

- India, with a staggering 27.2 million adults, has the highest number of individuals who have fallen victim to this crime.

- The United States follows closely with 13.5 million affected adults, highlighting the widespread nature of identity theft in one of the world’s largest economies.

- In Japan, approximately 3 million adults have experienced identity theft, while in Germany, 1.3 million individuals have been affected.

Credit Card Fraud

- During 2021, the Federal Trade Commission (FTC) received nearly 390,000 reports related to credit card fraud, indicating its prevalence in the United States.

- In December 2022, the Nilson Report, an industry payment monitor, predicted that the U.S. would suffer losses of $165.1 billion due to card fraud over the next ten years, affecting people of all age groups and across every state.

- Specifically, a specific type of credit card fraud, referred to as card-not-present fraud, which encompasses online, phone, and mail-order transactions, led to approximately $5.72 billion in losses in the U.S. in 2022, as disclosed.

- In 2021, credit card fraud was the second most frequent form of identity theft in the United States, coming after fraud linked to government benefits or documents, as reported by the FTC.

Phishing

- According to the F5 Labs Phishing and Fraud Report from 2020, over half (55%) of phishing websites employ recognizable brand names to obtain sensitive information easily.

- In the United States, 84% of organizations have reported that regular security awareness training has effectively reduced employees’ susceptibility to phishing attacks.

- In Australia, 92% of organizations fell victim to successful phishing attacks, marking a significant 53% increase compared to 2021.

- The most commonly impersonated brands in phishing attempts are Amazon and Google, accounting for 13%, followed by Facebook and Whatsapp at 9%, and Netflix and Apple at 2%.

- According to IBM’s 2022 Data Breach Report, breaches resulting from phishing attacks took the third-longest amount of time to both identify and contain, averaging 295 days.

Tax Evasion

- The punctuality rate for tax payments among Americans stands at 85%.

- The tax gap in the United States amounts to $496 billion, with the net tax gap, which considers late payments, totaling $428 billion.

- Underreporting is the primary method of tax evasion and contributes to 80.24% of the overall gross tax gap.

- Approximately 63.3% of individuals in tax fraud cases received prison sentences.

- The typical duration of imprisonment for tax fraud perpetrators averaged 14 months.

- The average age of those involved in tax fraud cases is 52 years.

- The annual corporate tax losses in various countries showcase a significant range of figures. The United States tops the list with a substantial 188.8 billion USD in corporate tax losses, reflecting the scale of its economy.

- China follows with 66.8 billion USD in tax losses, underlining its economic prominence.

- Japan reports 46.8 billion USD in annual corporate tax losses, while India closely follows with 41.2 billion USD.

Online Frauds

- New research commissioned by Ofcom in the UK reveals that a significant majority, approximately 87% of online adults, have encountered content they suspected might be a scam or fraud.

- Of those surveyed, nearly half, or 46%, admitted to personally falling for an online scam, while 39% knew someone who had been a victim of such scams.

- Among those who encountered online scams, 25% reported losing money; notably, 21% had been scammed out of £1,000 or more.

- Furthermore, the study found that approximately 34% of all victims experienced an immediate negative impact on their mental well-being, and this figure increased to nearly 63% among those who had suffered financial losses.

- Looking at the data, it’s evident that certain groups are more vulnerable to encountering suspicious online content.

- Men, numbering 89%, along with younger adults aged 18 to 34, at 92%, and households with children, at 93%, seem to come across such content more frequently, surpassing the overall average of 87%.

Fraud Attempts by Industry

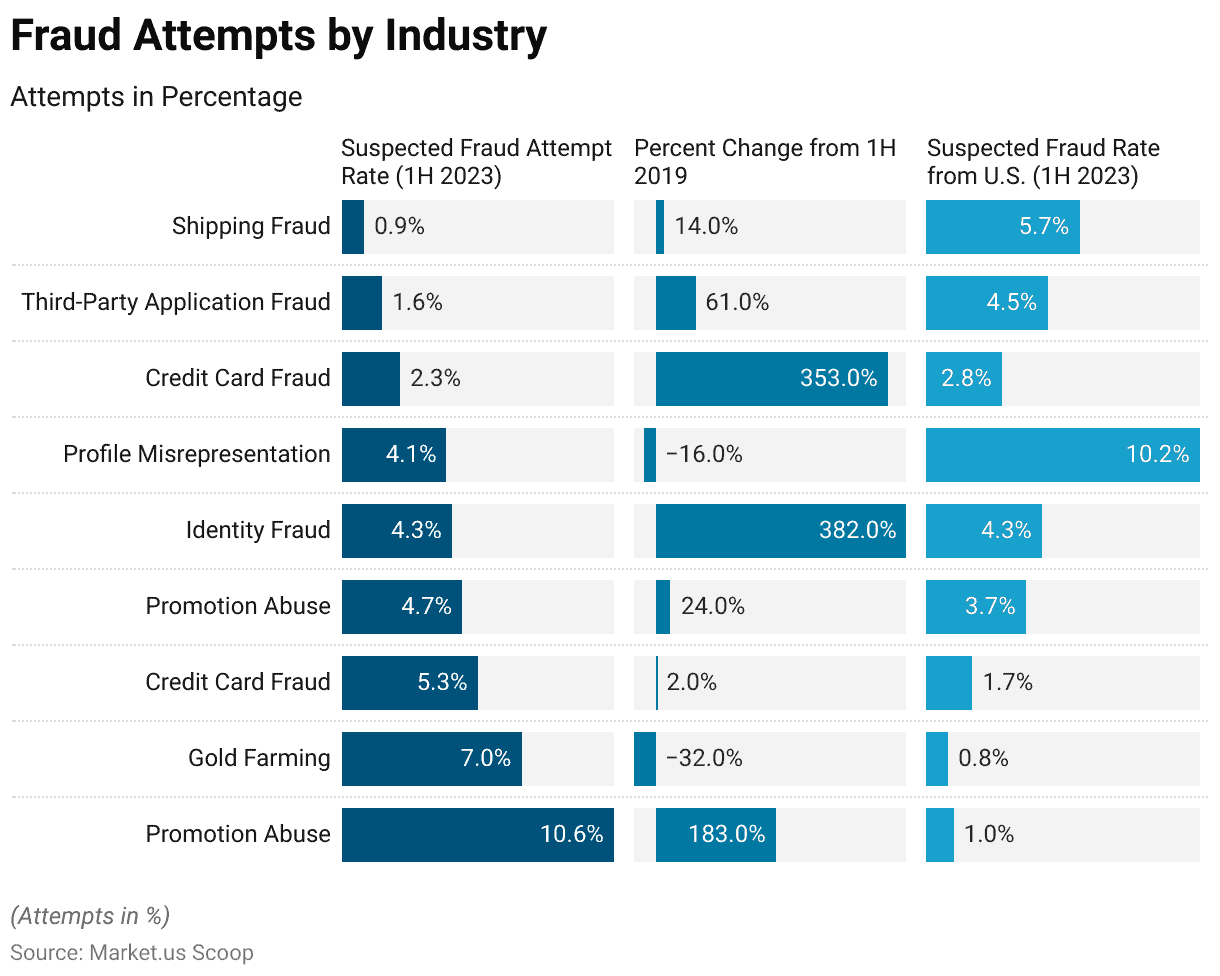

- In the first half of 2023, synthetic fraud attempts varied across different industries, with notable trends in suspected fraud attempt rates and changes compared to the first half of 2019.

- Retail experienced a substantial increase with a suspected fraud attempt rate of 10.60%, marking a significant 183% rise.

- Video games, on the other hand, saw a decline of 32% in fraud attempts, registering a rate of 7.00%.

- Telecommunications witnessed a slight 2% increase, reaching a rate of 5.30%, mainly due to credit card fraud.

- Gaming, particularly in the online gambling sector, displayed a 24% uptick, with a rate of 4.70%, primarily driven by promotion abuse.

- The financial services sector encountered a remarkable 382% surge in fraud attempts, equaling a rate of 4.30%, primarily attributed to identity fraud.

- Communities, which encompass online dating and forums, experienced a 16% decrease in fraud attempts, resting at a rate of 4.10%, primarily involving profile misrepresentation.

FDP Software and Technologies

- According to research conducted in 2022, credit card verification services are the leading choice for fraud detection among online merchants worldwide, with 55% employing this approach.

- Coming in second place is utilizing identity verification and validation services, adopted by half of all e-commerce businesses.

- Furthermore, 44% of online merchants employ two-factor telephone authentication to prevent fraud.

- In 2022, MaxMind and Signifyd emerged as dominant players in the global fraud detection and prevention sector, holding substantial market shares of around 22.78% and 19.07%, respectively.

Fraud Detection Efforts

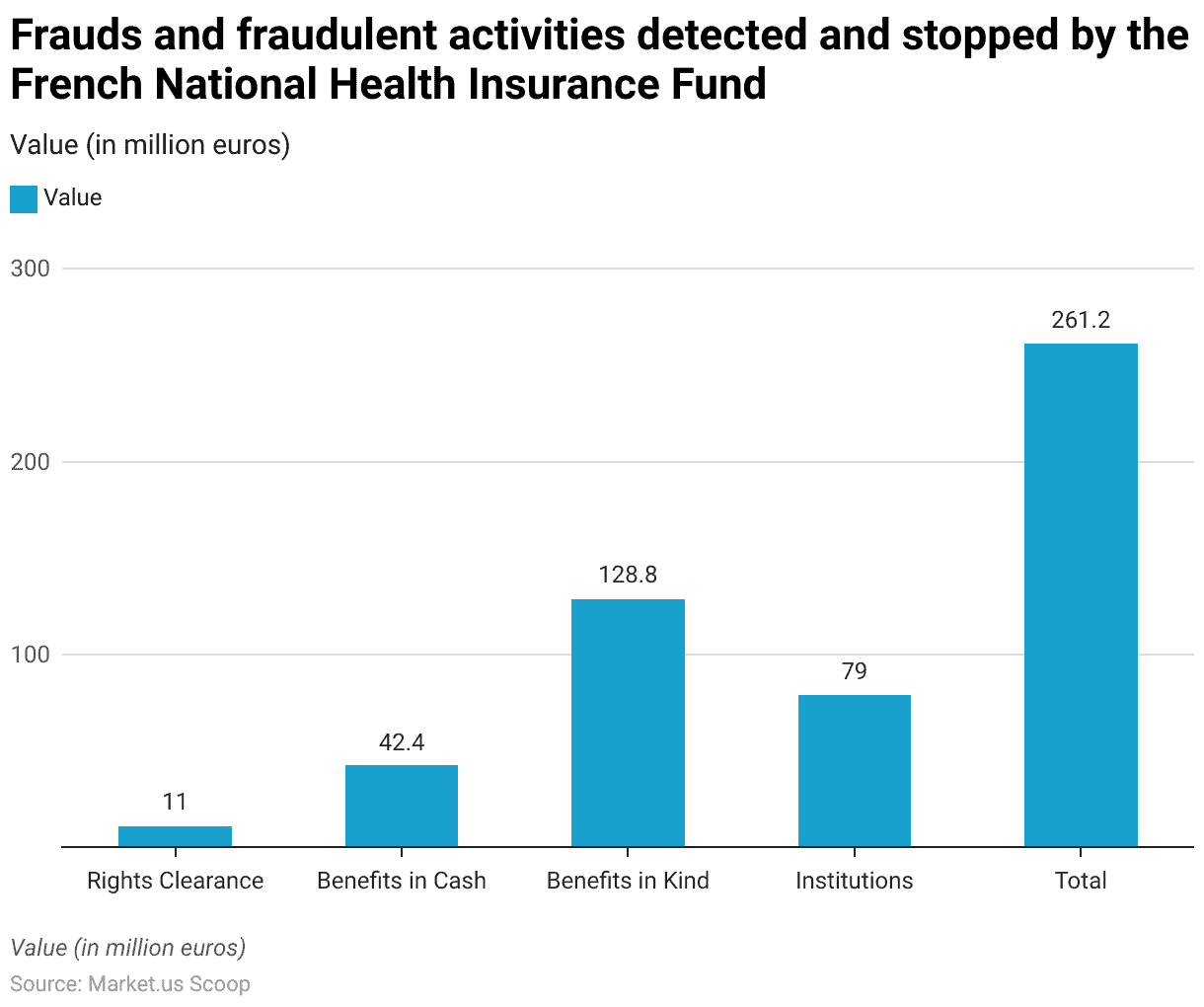

- In 2018, the French National Health Insurance Fund demonstrated a significant commitment to combating fraudulent activities within the healthcare system.

- They successfully detected and prevented various types of fraud, with a total value of 261.2 million euros.

- This substantial effort encompassed multiple categories of services, with the highest fraud detected in “Benefits in Kind,” amounting to 128.8 million euros.

- “Benefits in Cash” saw a significant sum of 42.4 million euros attributed to fraudulent activities, while “Institutions” accounted for 79 million euros in detected fraud.

- Additionally, “Rights Clearance” services contributed to the effort by uncovering and stopping fraudulent activities worth 11 million euros.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)