Table of Contents

Market Overview

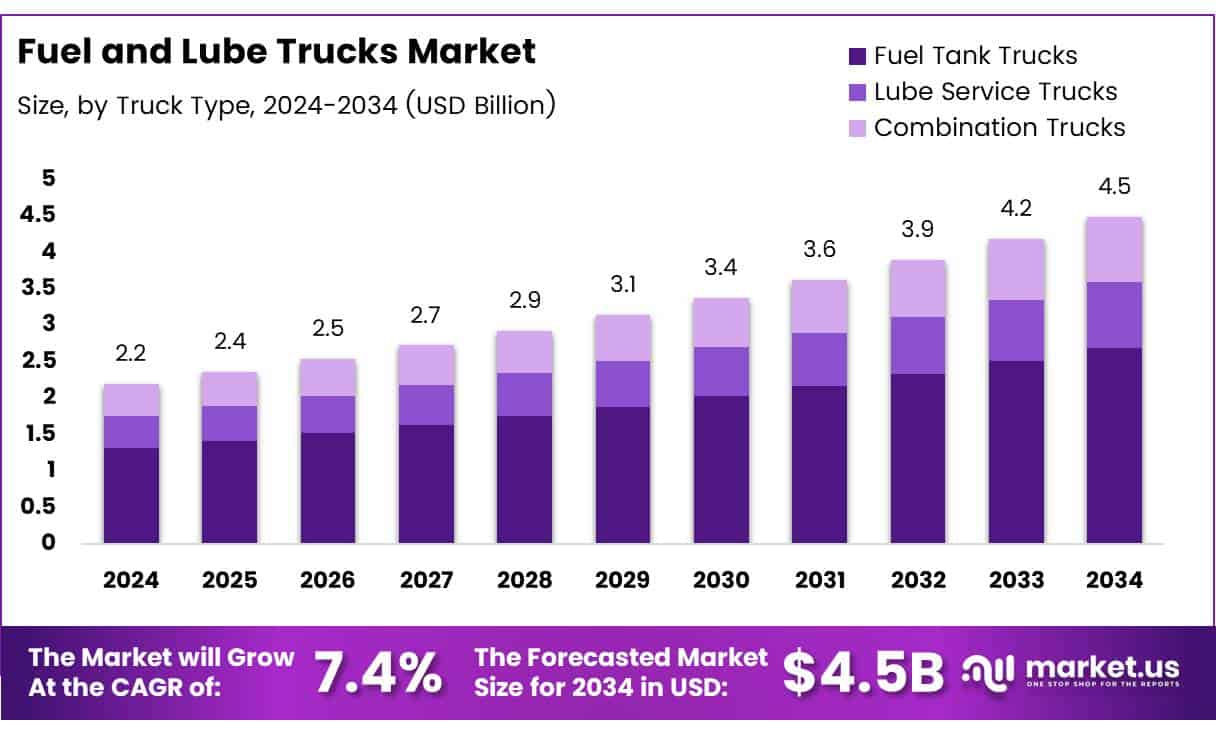

The Global Fuel and Lube Trucks Market size is expected to be worth around USD 4.5 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 7.4% during the forecast period.

The Fuel and Lube Trucks Market is growing with rising industrial needs. These trucks serve mining, construction, and logistics sectors. They provide on-site fueling and lubrication for heavy equipment. Fuel use in diesel trucks makes up 50% of total operating costs. On-site service reduces downtime and boosts efficiency. Companies use these trucks to cut fuel waste and save time. Developing regions drive strong demand for these trucks. Infrastructure and mining projects are increasing. Businesses need mobile solutions for fast fueling and maintenance.

Governments invest in roads, energy, and mining sectors. This boosts demand for fuel and lube service fleets. Public and private sectors need reliable mobile support. New laws focus on fuel safety and emission control. Trucks must meet strict environmental and safety standards. Makers now offer trucks with low-emission engines and spill-proof systems. Smart tracking tools help manage fuel use and service logs. Digital control improves safety and lowers fuel costs. These features are now standard in modern trucks.

The market has high growth potential worldwide. Firms offering advanced, eco-ready trucks will lead. Fuel and lube trucks are key for safe, low-cost operations. This market will expand as industries demand smarter mobile fueling.

Key Takeaways

- The Fuel and Lube Trucks Market is projected to grow from USD 2.2 Billion in 2024 to USD 4.5 Billion by 2034, at a CAGR of 7.4%.

- Fuel Tank Trucks led the truck type segment in 2024 with a 60.2% share, essential for varied terrain transport.

- The 15,000 to 25,000 kg capacity segment dominated in 2024 with 40.6%, offering optimal load and mobility.

- Construction and Infrastructure Development was the top application in 2024, capturing a 38.5% market share.

- North America led the regional market in 2024 with a 35.8% share, backed by infrastructure growth and tech upgrades.

Market Drivers

Rising Demand in Mining and Construction– Fuel and lube trucks are indispensable in mining and construction sectors, where heavy machinery operates in isolated areas. These trucks reduce equipment downtime by delivering essential fluids on-site, enabling continuous operations.

Growth in Infrastructure Projects– Governments and private sectors around the world are investing heavily in infrastructure development roads, bridges, dams, and smart cities which increases the need for fuel logistics support on large construction sites.

Advancement in Fleet Management– Modern fuel and lube trucks come equipped with advanced telematics, GPS, fluid monitoring, and remote diagnostics. These upgrades enhance route optimization, reduce fuel loss, and improve fleet utilization, making them attractive to industrial operators.

Operational Efficiency and Cost Savings– On-site fuel and lube delivery eliminates the need to transport heavy equipment to distant refueling stations, significantly reducing machine idle time, fuel wastage, and labor costs.

Rising Military and Emergency Services Applications– Defense forces and disaster management agencies rely on fuel and lube trucks for mobile fueling during missions, rescue operations, or remote deployments, contributing to growing government demand.

Market Challenges

High Initial Investment- Fuel and lube trucks require a significant upfront investment due to the complexity of integrated tanks, pumping systems, and monitoring tools. This can be a deterrent for small operators.

Stringent Emission Norms- Regulatory compliance concerning vehicle emissions and fuel handling is becoming more stringent across regions. Manufacturers must continuously innovate to meet evolving standards.

Maintenance and Skill Requirements- Operating and maintaining fuel and lube trucks demands technical knowledge and regular servicing. Improper use may lead to leaks, contamination, or environmental hazards.

Volatile Fuel Prices and Supply Chain Issues- Fluctuations in fuel prices and disruptions in global supply chains can impact operational costs, making long-term planning more difficult for fleet operators.

Product Segmentation

Truck Type Analysis

In 2024, Fuel Tank Trucks led with 60.2% market share due to their role in transporting fuel across regions. Lube Trucks supported field maintenance, reducing downtime. Combination Trucks offered dual services, ideal for remote sites.

Capacity Analysis

Trucks in the 15,000–25,000 kg range held a 40.6% share in 2024. They offered a good mix of capacity and mobility. Smaller trucks were used in tight spaces, while heavier ones served large operations like mining.

Application Analysis

Construction and Infrastructure dominated in 2024 with a 38.5% share, driven by rising projects. Transport, mining, and agriculture also relied on these trucks to keep machinery running efficiently.

Regional Insights

North America

North America leads the market with 35.8% share worth USD 0.7 billion, driven by strong infrastructure, mining, and construction sectors. Tech adoption and strict green rules boost demand for efficient trucks.

Europe

Europe follows with a focus on eco-friendly trucks due to strict emission norms and support for renewable energy projects. Sustainability drives innovation in the region.

Asia Pacific

Asia Pacific is growing fast with rising industrial and construction activities in China and India. High infrastructure investment is fueling strong demand for fuel and lube trucks.

Middle East & Africa

Growth here is led by the oil & gas sector and large infrastructure projects. The region needs high-capacity, durable trucks for tough environments.

Latin America

Latin America is smaller but growing, especially in Brazil and Chile. Mining and infrastructure development are creating new demand for trucks.

Global Outlook

North America leads now, but Asia Pacific is set to grow fastest and may soon reshape the global market.

Competitive Landscape

- Product Innovation: Manufacturers are focusing on multi-functional trucks, digital fuel meters, spill-proof tanks, and eco-friendly materials.

- Strategic Partnerships: Collaborations with industrial clients and governments for long-term supply and maintenance contracts.

- Aftermarket Services: Offering value-added services such as equipment leasing, fleet management tools, and on-site servicing to attract clients.

- Sustainability Initiatives: Development of hybrid or electric-powered trucks and low-emission fuel systems to align with environmental goals.

Future Outlook

The future of the fuel and lube trucks market looks promising, driven by industrial growth, smart fleet technologies, and the rising demand for mobile servicing in remote and critical applications. As sustainability becomes a key priority, the industry is likely to see innovations in emission controls, electric drivetrains, and recyclable materials.

Growing digitalization, remote diagnostics, and telematics integration will further optimize fleet efficiency and safety. Companies that adapt to evolving regulatory norms and invest in modular, scalable truck systems will gain a competitive edge in the years ahead.

Recent Developments

- In November 2024, Daimler Truck secured €226 million in government funding to advance the development of fuel cell trucks, accelerating its push toward zero-emission commercial transport.

- In September 2024, Volvo Trucks North America delivered 70 Volvo VNR Electric trucks under a $21.5 million initiative funded by the U.S. EPA and South Coast AQMD, promoting cleaner freight transportation.

- In April 2025, Van Hool Industrial Vehicles announced the acquisition of Tankcare Engineering, enhancing its service capabilities and expertise in industrial vehicle maintenance and repair.

- In April 2025, KAG completed the acquisition of MC Tank Transport, expanding its liquid bulk transportation network and strengthening its footprint in the North American logistics sector.

Conclusion

The Fuel and Lube Trucks Market is on a strong growth path, fueled by rising industrial activity, infrastructure expansion, and the need for efficient on-site servicing solutions. As industries demand mobile, eco-friendly, and tech-enabled trucks, manufacturers are responding with innovations in digital controls, emission compliance, and hybrid technologies. Though challenges like high costs and strict regulations persist, the future outlook remains positive. Companies that embrace smart technologies and sustainability will lead in a market increasingly focused on operational efficiency, safety, and environmental responsibility.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)