Table of Contents

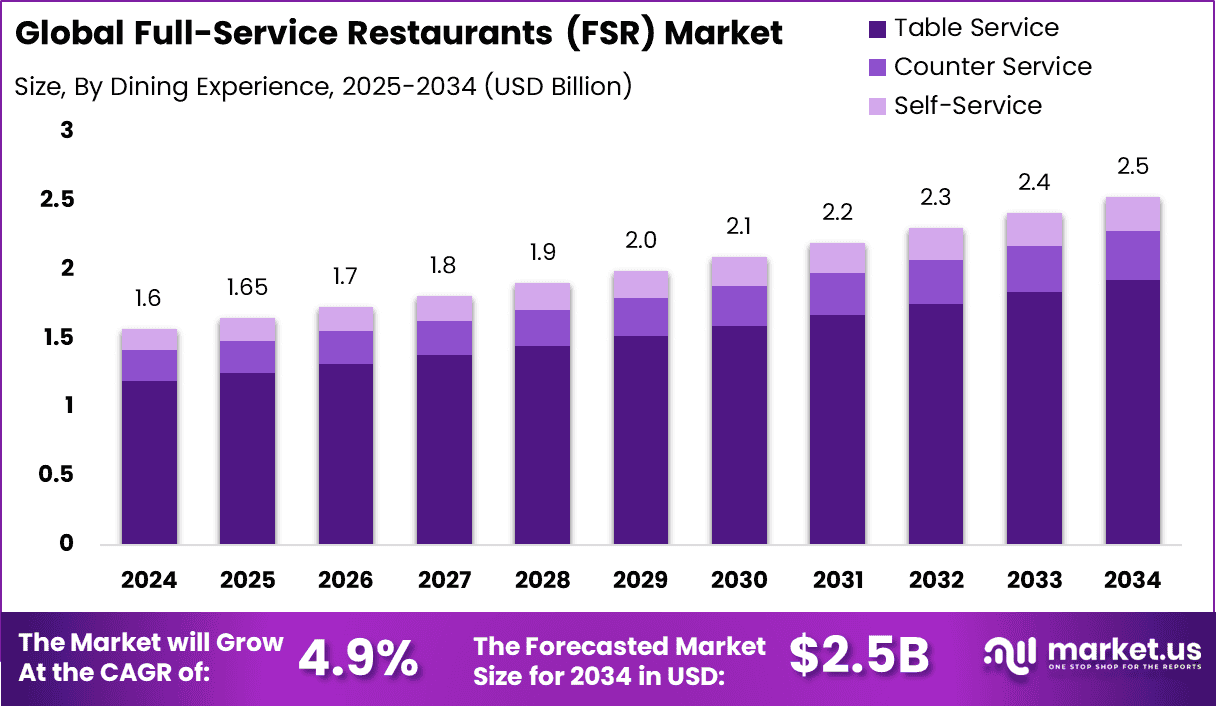

The global Full-Service Restaurants (FSR) market is projected to grow from USD 1.6 billion in 2024 to USD 2.5 billion by 2034, reflecting a steady CAGR of 4.9%. North America is the market leader, holding over 34% market share in 2024 and generating USD 0.5 billion in revenue.

The U.S. FSR market, valued at USD 0.52 billion in 2025, is expected to expand to USD 0.72 billion by 2034, growing at a CAGR of 3.7%. This growth is driven by urbanization, changing lifestyles, and increasing consumer demand for premium dining experiences, particularly in chain and table service restaurants.

How Tariffs Are Impacting the Economy

Tariffs have created significant disruptions in global supply chains, leading to higher production and operational costs. In the U.S., tariffs imposed on food imports have directly impacted the foodservice sector, including full-service restaurants. The increased cost of ingredients, equipment, and even labor due to higher import duties has squeezed restaurant profit margins.

Additionally, businesses are experiencing delays in product deliveries, resulting in supply shortages that impact menu offerings and customer satisfaction. While some restaurants have absorbed these higher costs, many have been forced to increase prices, contributing to inflation.

Consumer spending is also impacted as the cost of dining out rises, reducing discretionary spending in other sectors. Tariffs are exacerbating challenges in an already competitive market, forcing FSR businesses to adapt their sourcing strategies, rethink their pricing models, and invest in automation to offset higher costs. In the long term, tariffs may result in fewer investment opportunities and slower growth in the foodservice industry.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/full-service-restaurants-fsr-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Tariffs are driving up operational costs for full-service restaurants globally. Higher food prices, combined with increased shipping and logistics expenses due to tariff-related disruptions, are affecting profitability. Restaurants are struggling to maintain price consistency while managing these rising costs, which could impact consumer demand for dining out. Additionally, restaurants are exploring alternative sourcing strategies, shifting to local suppliers or diversifying their supply chain to mitigate tariff risks.

Sector-Specific Impacts

In the FSR sector, tariffs are particularly affecting large chain restaurants that rely on imported food products and equipment. The price increase in imported goods has forced many chains to adjust their pricing models, passing on the increased costs to consumers.

Additionally, smaller independent restaurants face challenges in absorbing these costs and may struggle to remain competitive. However, some chains with robust supply chain networks have managed to adapt by localizing production and sourcing materials from tariff-exempt regions.

Strategies for Businesses

To navigate the challenges posed by tariffs, FSR businesses are employing several strategies:

- Supply Chain Diversification: Sourcing ingredients and materials from non-tariff regions or local suppliers to reduce reliance on imports.

- Menu Innovation: Adapting menus to incorporate locally sourced, more cost-effective ingredients while maintaining high-quality offerings.

- Dynamic Pricing: Adjusting prices to reflect the increased costs of goods, while being mindful of consumer price sensitivity.

- Operational Efficiency: Investing in automation and improving supply chain efficiency to offset the increased cost burden.

➤ Explore more strategies, get full access now @ https://market.us/purchase-report/?report_id=147671

Key Takeaways

- Market Growth: The FSR market is expected to grow at a CAGR of 4.9%, reaching USD 2.5 billion by 2034.

- Regional Leadership: North America captured 34% of the market share in 2024, generating USD 0.5 billion.

- Chain Restaurants: Dominating the market with 58% share, driven by brand recognition and menu consistency.

- Consumer Preferences: Table service formats command 76% of the market, reflecting a preference for personalized dining experiences.

Analyst Viewpoint

The FSR market is on a steady growth trajectory, driven by the rising demand for premium dining experiences and the recovery of dine-in services post-pandemic. Despite the challenges posed by tariffs, businesses are adopting innovative strategies to mitigate the impact of rising costs.

With continued growth in North America and a rebound in global demand for full-service dining, the market outlook remains positive. Technological advancements in restaurant operations and menu customization will further fuel market expansion in the coming years.

Regional Analysis

North America remains the dominant region in the FSR market, capturing more than 34% of the global market share in 2024 with USD 0.5 billion in revenue. The U.S. is forecast to continue driving market growth, reaching USD 0.72 billion by 2034, driven by strong consumer spending and the continued adoption of premium dining experiences. Europe and Asia-Pacific are also expected to see steady growth, with rising urbanization and the expansion of international restaurant chains fueling demand for full-service dining experiences.

➤ Discover More Trending Research

- Multi Screen Advertising Market

- Earthquake Insurance Market

- Smart Asset Tracking Apps Market

- Blockchain for Supply Chain Traceability Market

Business Opportunities

The FSR market presents numerous opportunities, particularly in the chain restaurant segment, which holds over 58% of the market share. With consumer preferences shifting towards premium dining and personalized experiences, restaurants can capitalize on this trend by offering unique dining experiences and expanding their menu offerings.

Additionally, the increasing demand for sustainable and locally sourced ingredients presents an opportunity for restaurants to attract environmentally-conscious consumers. The expansion of dine-in services post-pandemic provides further opportunities for businesses to capitalize on the recovery of the restaurant industry.

Key Segmentation

The FSR market is segmented by type, service format, and region:

- Type: Chain restaurants dominate with over 58% market share, leveraging brand recognition and nationwide expansion strategies.

- Service Format: Table service formats hold a 76% share, driven by consumer demand for full-course dining experiences and personalized service.

- Region: North America leads with 34% market share, followed by Europe and Asia-Pacific, which are expected to see growing demand for full-service dining options.

Key Player Analysis

The FSR market is dominated by large restaurant chains, which benefit from economies of scale and strong brand recognition. These companies focus on expanding their market presence through consistent menu offerings and nationwide availability.

Additionally, they leverage technology to enhance the customer experience, streamline operations, and improve service delivery. Smaller, independent restaurants are also growing, but they face challenges due to increased costs and competition from larger chains. However, some are succeeding by offering unique, personalized dining experiences and focusing on niche markets.

Top Key Players in the Market

- 21c Museum Hotels

- American Cruise Lines

- Amici Partners Group, LLC

- BBQ Holdings, Inc.

- Best Western International, Inc.

- BJ’s Restaurants, Inc.

- Bloomin’ Brands, Inc.

- Brinker International, Inc.

- Carnival Corporation & PLC

- Darden Concepts, Inc.

- Dine Brands Global, Inc.

- Four Seasons Hotels Limited

- Golden Corral Corporation

- Groupe Barrière

- Hilton Worldwide Holdings Inc.

- Hyatt Hotels Corporation

- IHOP Restaurants LLC

- Marriott International, Inc.

- Others

Recent Developments

In 2024, the U.S. FSR market grew significantly, driven by consumer preference for premium dining experiences and increasing demand for dine-in services post-pandemic. New innovations in restaurant technology and dining experiences continue to shape the market’s future growth.

Conclusion

The Full-Service Restaurants market is on a steady growth path, supported by rising consumer demand for premium dining experiences. Despite the challenges posed by tariffs, businesses are finding ways to adapt and thrive. The market’s future looks promising, particularly in North America, with opportunities for innovation and expansion in emerging markets.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)