Table of Contents

Market Overview

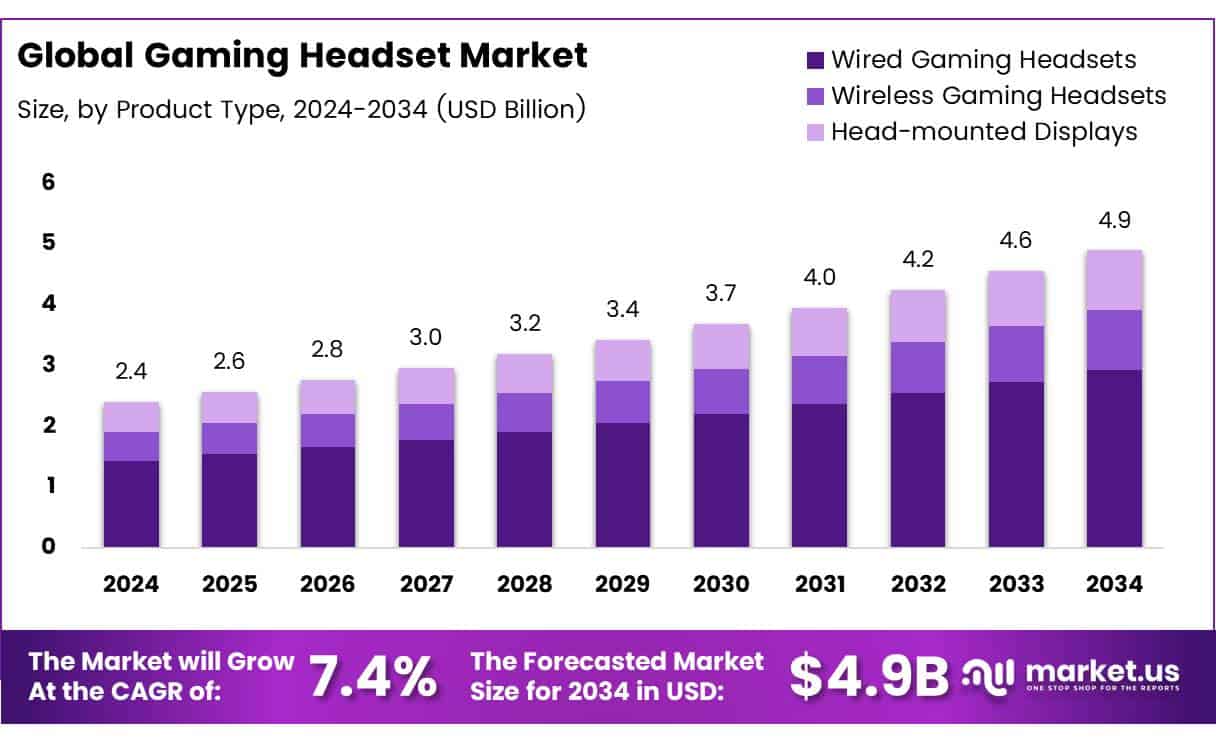

The Global Gaming Headset Market size is expected to be worth around USD 4.9 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 7.4% during the forecast period.

The Gaming Headset Market is growing fast due to rising global gaming demand. More people now want better sound and voice clarity while gaming. Adult gamers in Scotland spend 7.1 hours weekly on gaming. This shows strong engagement and ongoing interest in gaming gear.

Affordable headset options are increasing across markets. Entry-level and budget gaming headsets cost around $50, as per Rtings. This makes gaming gear more accessible to new and casual gamers. It also breaks the myth that quality headsets are always expensive. Esports and online gaming fuel the need for high-quality audio. Clear sound and noise-canceling mics are now must-haves. Wireless and Bluetooth options also add convenience.

Governments are supporting gaming and digital innovation. Many are investing in esports hubs and tech parks. These steps boost headset demand and create new business opportunities. Regulations around headset safety and wireless use remain favorable. Brands have room to innovate without strict limits. This helps bring better, safer, and smarter headsets to market.

With strong demand, low-cost options, and policy support, the Gaming Headset Market is ready for expansion. Businesses can tap into this by offering value-driven products that meet gamer needs.

Key Takeaways

- Global gaming headset market is projected to grow from USD 2.4 billion in 2024 to USD 4.9 billion by 2034, at a CAGR of 7.4%.

- Wired gaming headsets dominate the product type segment in 2024 due to superior connectivity and minimal latency.

- PC/Mac gaming headsets lead the platform compatibility segment in 2024, driven by high-quality audio demand from PC gamers.

- Wired headsets with 3.5mm and USB connections top the connectivity type in 2024, preferred for low latency and high fidelity.

- Asia Pacific holds the largest market share at 46.2% in 2024, fueled by gaming culture and tech adoption in South Korea, China, and Japan.

Market Drivers

- eSports : Competitive gaming is fueling demand for high-performance headsets with clear audio and communication features.

- Immersive Audio Demand: Gamers seek surround sound and noise-canceling headsets for a more engaging experience.

- Rise of Consoles : Expanding console and mobile usage, supported by better internet, is widening the headset user base.

- Tech Innovations: Advancements like wireless tech, spatial audio, and AI noise suppression drive headset upgrades.

Market Restraints

- High Cost of Premium Products

Gaming headsets with advanced features can be expensive, limiting accessibility for budget-conscious consumers. - Compatibility Issues Across Platforms

Some headsets may not be compatible with all gaming systems, which can hinder consumer satisfaction and limit potential sales. - Rapid Technological Obsolescence

The fast pace of innovation means that products can become outdated quickly, increasing pressure on manufacturers to continuously develop new models.

Segmentation Insights

Product Type Analysis

In 2024, wired gaming headsets led the market due to low latency and stable sound, preferred by serious gamers. Wireless headsets are growing with better battery and mobility features. Head-mounted displays are also rising in popularity, driven by VR and AR gaming trends.

Platform Compatibility Analysis

PC/Mac gaming headsets dominated in 2024, backed by strong demand from PC gamers for advanced audio. Console headsets followed closely, designed for smooth integration with Xbox and PlayStation. Mobile gaming headsets are gaining ground as mobile gaming expands.

Connectivity Type Analysis

Wired headsets remained the top choice in 2024 for their reliable, lag-free sound and no charging needs. While wireless headsets are advancing, wired models offer better stability and precision, especially in competitive gaming.

Regional Insights

APAC leads the gaming headset market in 2024 with 46.2% share and USD 0.92 billion revenue, driven by strong gaming culture and tech adoption in China, Japan, and South Korea.

North America follows, boosted by high spending, eSports, and VR gaming trends in the U.S. and Canada.

Europe shows steady demand, led by the UK, Germany, and France’s mature gaming markets.

MEA and Latin America are growing fast, fueled by rising internet use, young gamers, and better retail access in countries like UAE, Saudi Arabia, Brazil, and Mexico.

Competitive Landscape

The gaming headset market is highly competitive, with major players focusing on innovation, design, and strategic partnerships. Companies are investing in product development, brand collaborations, and influencer marketing to increase market share.

Key players compete on features such as sound quality, comfort, durability, and price. Brand loyalty and product performance play a crucial role in consumer decision-making. Manufacturers are also increasingly offering customizable headsets and limited-edition releases to attract niche segments.

Future Outlook

- Continued innovation in audio technology

- Increasing gamer base worldwide

- Growing popularity of virtual reality (VR) and augmented reality (AR) in gaming

- Expanding use of gaming headsets in non-gaming scenarios like remote work and online education

Recent Developments

- Jan 2025, Pimax, a leading innovator in high-end VR headsets, has recently successfully closed a $14 million C1+ round of financing.

- Jun 2025, Renowned headphone brand Beyerdynamic is being acquired by Chinese OEM manufacturer Cosonic International for €122 million.

- Jun 2025, Fractal Design announces its official expansion into a new product category, with gaming headset Scape becoming globally available.

- Oct 2024 , Electronics maker LYNE Originals has launched the Hydro 6 gaming wireless headset.

Conclusion

The gaming headset market is growing fast, set to reach USD 4.9 billion by 2034. Driven by esports, immersive audio demand, and tech innovation, it offers strong opportunities. With APAC leading and support from governments, brands that deliver value and performance will thrive.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)