Table of Contents

Introduction

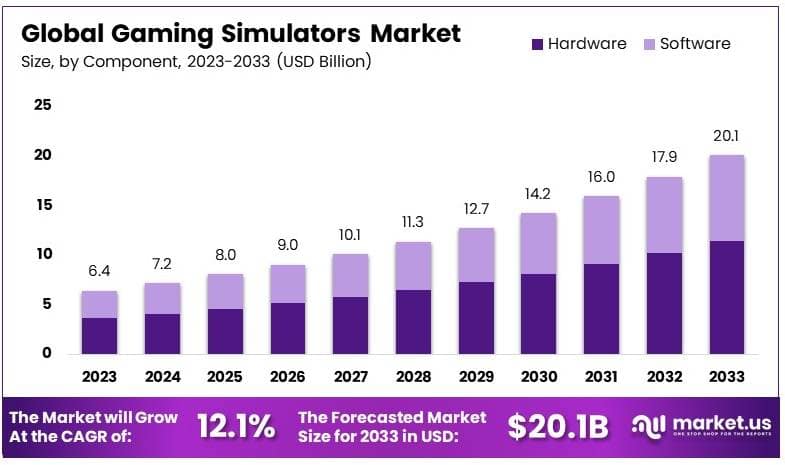

The Global Gaming Simulators Market is projected to reach a value of approximately USD 20.1 billion by 2033, up from USD 6.4 billion in 2023. This growth represents a compound annual growth rate (CAGR) of 12.1% over the forecast period from 2024 to 2033.

Gaming simulators are immersive, interactive systems designed to replicate real-world or fictional experiences through advanced hardware and software integration. These systems often include specialized equipment such as motion platforms, virtual reality headsets, and haptic feedback devices to enhance realism. Gaming simulators are primarily used for entertainment, training, and research purposes, providing users with lifelike environments for simulation-based gameplay. This category of gaming technology spans various genres, including racing, flight, sports, and military simulations, offering a high level of interactivity and engagement that traditional gaming cannot match.

The gaming simulators market encompasses the development, sale, and deployment of hardware and software solutions designed for high-fidelity, interactive simulation experiences. It includes both consumer-facing products, such as home-based gaming rigs and professional simulation systems, and enterprise-level solutions for training, research, and development in sectors like aviation, automotive, and military.

The market also covers the underlying technologies, including VR/AR (virtual reality/augmented reality), motion tracking, 3D visualization, and real-time rendering, all of which are essential components that drive the simulator’s performance and realism. Over the past decade, the market has evolved rapidly, with advancements in AI, machine learning, and 5G technology enhancing the potential for more sophisticated and personalized gaming simulations.

The growth of the gaming simulators market is driven by several key factors. First, the increasing demand for more immersive and lifelike gaming experiences, driven by advancements in virtual reality (VR) and augmented reality (AR), is significantly boosting market expansion. Technological improvements in graphics processing units (GPUs), motion sensors, and AI are also enhancing the realism and responsiveness of simulations, making them more appealing to both consumers and professional users.

The demand for gaming simulators is fueled by a combination of factors, including the increasing popularity of high-end gaming and virtual reality experiences. Consumers are seeking new ways to interact with digital worlds, driving growth in VR and AR-based simulators. The gaming community’s desire for realism and immersion is pushing the demand for more sophisticated, high-performance simulators, particularly in niche markets such as flight simulators and racing simulators.

The gaming simulators market presents numerous opportunities for innovation and growth, particularly through the integration of emerging technologies. Virtual reality (VR), augmented reality (AR), and AI are poised to revolutionize the simulation experience, opening up new possibilities for both consumers and professional sectors. The rise of cloud gaming and the increasing availability of 5G networks offer opportunities to create more accessible, scalable, and interactive simulation experiences.

Additionally, the growing focus on health and wellness presents opportunities for simulators to be used in physical therapy, rehabilitation, and mental health applications. With the increasing convergence of gaming with industries like automotive, aerospace, and education, there are significant opportunities for cross-industry collaborations, enabling the development of highly specialized simulators tailored to specific use cases. The expansion of esports also offers a unique growth avenue, with specialized simulators providing professional-level training and development for athletes and teams.

Key Takeaways

- The gaming simulators market was valued at USD 6.4 billion in 2023, expected to reach USD 20.1 billion by 2033, growing at a 12.1% CAGR.

- Hardware accounted for 57% of the market in 2023, driven by strong demand for equipment like racing seats and VR gear.

- Racing games led the market with a 48% share in 2023, reflecting a preference for immersive, high-adrenaline experiences.

- The residential sector held the largest share at 60%, highlighting the demand for home gaming setups.

- North America captured 36% of the market in 2023, generating USD 2.3 billion, supported by advanced infrastructure and high consumer spending.

Gaming Simulators Statistics

- In 2023, there were 216 million gamers aged 65 and above, representing 7% of the total gaming population.

- Gamers under 18 years contributed 20%, equating to 819 million globally.

- The majority of gamers in 2023 were aged 18 to 34, making up 38% or 1.17 billion worldwide.

- 18% of gamers spend 6 to 10 hours gaming weekly, while 11% spend less than 1 hour.

- About 7% of gamers reported gaming for 16 to 20 hours or more per week.

- In 2023, 71.4% of gamers used PCs as one of their gaming platforms.

- Female gamers are 7.5% more likely to prefer PlayStation, while male gamers are 5.7% more likely to prefer gaming on PCs.

- Teenagers aged 13 to 17 show a 7.3% preference for mobile gaming.

- Gamers aged 18 to 22 prefer PC gaming at 1.4%, with mobile gaming being least preferred at 3.0%.

- Among gamers aged 23 to 27, PlayStation is most popular at 4.7%, followed by tabletop gaming at 4.3%, while mobile gaming is the least favored at -5.3%.

- 83% of gamers aged 16 to 24 engage in online gaming.

- Chinese players are the highest eSports earners, collectively winning nearly $300 million.

- In 2023, 65% of Americans played video games, with the highest concentration of gamers aged 18 to 34.

- Sony estimated selling 25 million PS5 consoles in 2023.

- The 2024 Game Developers Conference revealed 66% of developers prefer PC as their platform of choice.

- PlayStation 5 and Xbox Series X were the second and third most developed platforms, at 35% and 34% respectively.

- As of 2023, 3.38 billion mobile gamers exist, with this number growing at over 6% annually.

- From 2018 to 2023, indie publishers accounted for 99% of game releases on platforms.

- Over half of indie games generate less than $4,000 in revenue.

- The gender split in gaming is narrow, with 55% identifying as male and 45% as female.

- Less than 10% of gamers globally face video game addiction, predominantly males.

- In the U.S., 90% of gamers find joy in gaming, and 87% report that it provides mental stimulation.

Emerging Trends

- Integration of Virtual Reality (VR) and Augmented Reality (AR): Gaming simulators are increasingly adopting VR and AR technologies to enhance realism and immersion. The use of VR headsets in gaming simulators has led to a more interactive and lifelike experience, with players able to engage in environments that feel more tangible. AR, on the other hand, overlays digital elements onto the real world, offering players a hybrid experience. The blending of these technologies is pushing the boundaries of what gaming simulators can offer.

- Cloud-Based Gaming and Streaming Services: Cloud gaming is transforming the landscape of gaming simulators, allowing players to stream high-quality games without needing expensive hardware. Services like cloud gaming platforms are making simulators more accessible to a wider audience, as users can access sophisticated simulations on devices that wouldn’t typically support them. This model is helping increase the scalability and accessibility of gaming simulators.

- Use of Artificial Intelligence (AI) for Enhanced Realism: Artificial Intelligence is being integrated into gaming simulators to provide more adaptive, intelligent, and unpredictable gaming experiences. AI-driven characters, environments, and scenarios are creating more dynamic and personalized simulations. This makes gameplay more realistic and challenging, as the AI can respond to player behavior in real-time.

- Mobile and Cross-Platform Simulations: As mobile gaming continues to grow, gaming simulators are adapting to mobile devices, allowing for cross-platform play. Players can experience the same simulation across various devices (e.g., consoles, PCs, mobile), ensuring a seamless experience and expanding the market reach of these simulators. This trend is driven by growing smartphone capabilities and the demand for gaming on-the-go.

- Simulators for Training and Professional Development: Gaming simulators are not only popular in entertainment but are also increasingly used for training in professional fields. Industries like aviation, medicine, military, and automotive are adopting simulators for realistic training without the risks associated with real-world environments. This trend has led to the development of specialized simulators that replicate complex and high-stakes situations, which can be used for skill development and testing.

Top Use Cases

- Driver Training Simulators: One of the most common use cases of gaming simulators is in driver training. Simulators are used to teach driving skills, whether for everyday vehicles or specialized ones like trucks or race cars. These simulators offer a risk-free environment where learners can practice before getting on the road. The use of real-time feedback and adaptive scenarios increases their effectiveness, helping drivers hone their skills.

- Flight Training and Pilot Simulators: Flight simulators are widely used in the aviation industry to train pilots. These simulators replicate the cockpit experience, enabling pilots to practice emergency procedures, navigation, and other critical flight maneuvers. Advanced flight simulators can mimic various weather conditions and in-flight emergencies, reducing training costs and enhancing safety without the need for actual flights.

- Military Simulations: Gaming simulators are employed by the military to replicate combat scenarios and improve decision-making under pressure. These simulations provide a cost-effective method to train personnel in various combat strategies and situational awareness. The use of gaming simulators allows for the creation of realistic battlefield scenarios that would be difficult, costly, and dangerous to recreate in real life.

- Medical Training Simulators: Medical professionals use gaming simulators to practice surgeries, diagnose conditions, and manage patient care in a controlled environment. These simulators allow medical students and practitioners to refine their skills and make critical decisions without the risks associated with treating real patients. They are particularly useful in teaching complex procedures or rare cases that require specialized knowledge.

- Entertainment and Immersive Gaming: The most well-known use case is in the entertainment industry, where gaming simulators provide immersive experiences in virtual worlds. This includes everything from high-end arcade machines and racing simulators to VR-based role-playing games. The growing interest in eSports also contributes to the adoption of gaming simulators, as they provide realistic training and competition settings for professional gamers.

Major Challenges

- High Development and Maintenance Costs: The creation and maintenance of high-quality gaming simulators require substantial investment in technology, software development, and regular updates. These costs can be a barrier for smaller companies trying to enter the market, as well as for institutions looking to implement them for training purposes. Advanced features like VR integration, AI algorithms, and detailed environments require specialized expertise and substantial funding.

- Hardware Limitations: High-performance gaming simulators demand cutting-edge hardware to run effectively. For example, VR and AR simulations require high-end graphics cards, sensors, and processing power to deliver smooth, immersive experiences. However, not all players or institutions can afford such hardware, which can limit the reach and adoption of these simulators.

- Player Motion Sickness: Despite advancements in VR, many players still experience motion sickness when using gaming simulators. This can occur when there’s a delay between the user’s physical movement and the visual feedback provided by the simulator. Addressing these issues requires significant optimization of the hardware and software to create a smoother and more comfortable experience for players.

- Complex User Interface and Learning Curves: Gaming simulators, particularly those used for professional training, often have complex interfaces and require significant time to master. This can be challenging for new users or those unfamiliar with the technology. As the technology becomes more sophisticated, creating intuitive user interfaces that can be easily navigated by both beginners and professionals is an ongoing challenge.

- Legal and Ethical Concerns: As gaming simulators are increasingly used for training in high-stakes environments (e.g., military or medical), ethical concerns regarding their use also arise. For example, concerns about the psychological impact of violent combat simulations or the accuracy of medical procedures simulated in training programs are ongoing issues. Additionally, there are legal considerations around the use of simulators in educational settings and the potential for misuse in sensitive industries.

Top Opportunities

- Growth in Virtual Reality (VR) and Augmented Reality (AR) Adoption: The expansion of VR and AR technology presents significant opportunities for the gaming simulator industry. As VR headsets and AR glasses become more affordable and widely available, the demand for immersive gaming and training simulations is expected to increase. The market for VR gaming hardware alone is expected to experience rapid growth, with a significant portion of that increase driven by simulator-based applications in entertainment, education, and training.

- Rising Demand for Simulation in Education and Training: The growing focus on experiential learning in education and professional training presents an opportunity for gaming simulators. Educational institutions and corporations are increasingly investing in simulators to enhance learning through real-world scenarios and hands-on practice. For example, simulators are being integrated into STEM (Science, Technology, Engineering, Mathematics) programs, offering students practical applications of theoretical concepts.

- Expansion of E-Sports and Competitive Gaming: E-sports is one of the fastest-growing sectors in the global gaming industry, with an increasing number of professional leagues, sponsorships, and audiences. Gaming simulators play a critical role in e-sports training, enabling gamers to refine their skills, practice strategies, and compete in virtual environments. This trend is expected to continue, driving demand for high-performance simulators for competitive gaming.

- Cross-Platform and Mobile Gaming Innovations: As mobile gaming continues to outpace traditional gaming in terms of users, there is a growing opportunity for gaming simulators to expand into mobile platforms. Advances in mobile technology and cloud-based gaming services are enabling more players to access high-quality gaming simulators on smartphones and tablets, increasing the potential market size.

- Corporate and Industrial Simulation Demand: Beyond traditional entertainment, industries such as aviation, automotive, healthcare, and military are adopting gaming simulators for training and operational improvement. This is creating new revenue streams for simulator developers as industries seek more cost-effective, scalable solutions for training personnel, improving safety, and enhancing operational efficiency.

Key Player Analysis

- D-BOX Technologies Inc.: D-BOX Technologies is a leader in creating motion systems for gaming simulators, leveraging haptic technology to enhance user experiences. The company specializes in immersive seating and motion platforms that are widely used in gaming, training, and entertainment. Its solutions are integrated with over 2,300 movies and gaming titles, appealing to both gamers and professionals. In FY2022, the company reported revenues of approximately CAD 26.4 million.

- CXC Simulations: CXC Simulations is renowned for its high-end racing simulators, targeting professional racers, enthusiasts, and eSports athletes. The company’s flagship Motion Pro II simulator is a market leader in racing and flight training. With prices ranging between $50,000 and $100,000 per unit, CXC serves a niche, high-income demographic and partners with professional racing teams to enhance simulation realism.

- CKAS Mechatronics Pty Ltd.: This Australian-based company is a pioneer in building advanced motion platforms for flight, driving, and entertainment simulators. CKAS Mechatronics focuses on 6-DOF (Degrees of Freedom) motion systems, which are used by aviation and automotive industries for training. Their flagship product, the U3 Series simulator, is employed globally for realistic training programs. The company’s systems are estimated to cost between $100,000 and $500,000, depending on customization.

- Vesaro: Vesaro specializes in modular simulation systems for both gaming and professional use. The company offers a wide range of customizable setups, including racing simulators starting at $5,000 and scaling up to $50,000 for professional-grade systems. Vesaro’s solutions are popular in eSports and with private buyers, thanks to their precision-engineered designs and VR integrations.

- Playseat B.V.: Playseat is a globally recognized brand in racing and flight simulators, offering affordable yet high-quality solutions. Its flagship Playseat Challenge model, priced at approximately $299, targets casual gamers, while premium models like the Playseat Sensation Pro (priced at $1,500+) cater to enthusiasts. The brand is particularly popular among eSports participants and has collaborated with professional racing organizations like F1 to develop licensed simulator seats.

Recent Developments

- In 2024, Logitech G, a brand of Logitech (SIX: LOGN) (NASDAQ: LOGI), unveiled the new Racing Series at Logi Play, showcasing advanced innovation in simulation racing. This series allows drivers to customize their gear and optimize equipment for personalized driving experiences, continuing Logitech G’s legacy in gaming technology.

- In 2023, Meta introduced Meta Quest 3, the next-generation virtual and mixed reality headset, featuring enhanced resolution, improved performance, and Meta Reality technology in a slimmer design. Launching globally in fall 2023, the 128GB version starts at $499.99 USD, with additional storage options available. More details were shared at Meta Connect on September 27.

- On February 22, 2023, Sony Interactive Entertainment (SIE) launched PlayStation®VR2 globally, delivering high-fidelity visuals, advanced sensory features, and improved tracking. Priced at $549.99 USD / €599.99 / £529.99 / ¥74,980, the headset, paired with the PlayStation VR2 Sense™ controller, elevates virtual reality gaming to a new level.

- In 2024, Razer™, the global leader in gaming lifestyle products, introduced groundbreaking innovations at RazerCon 2024, hosted by CEO Min-Liang Tan. Key announcements included the launch of Razer Synapse 4, Razer Sensa HD Haptics, and a new laptop cooling solution, underscoring Razer’s commitment to immersive gaming technology.

Conclusion

The gaming simulators market is poised for substantial growth, driven by the increasing demand for immersive and interactive experiences across entertainment, education, and professional training sectors. Advancements in VR, AR, AI, and cloud-based technologies are reshaping the capabilities of simulators, offering unparalleled realism and accessibility.

As industries such as aviation, healthcare, and military continue to adopt simulators for cost-effective and safe training solutions, the market’s potential extends far beyond traditional gaming. However, challenges such as high development costs, hardware limitations, and user comfort must be addressed to unlock further opportunities. With continuous technological innovations and expanding use cases, gaming simulators are set to become a cornerstone of modern entertainment and training ecosystems, fostering engagement and skill development across diverse applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)