Table of Contents

Introduction

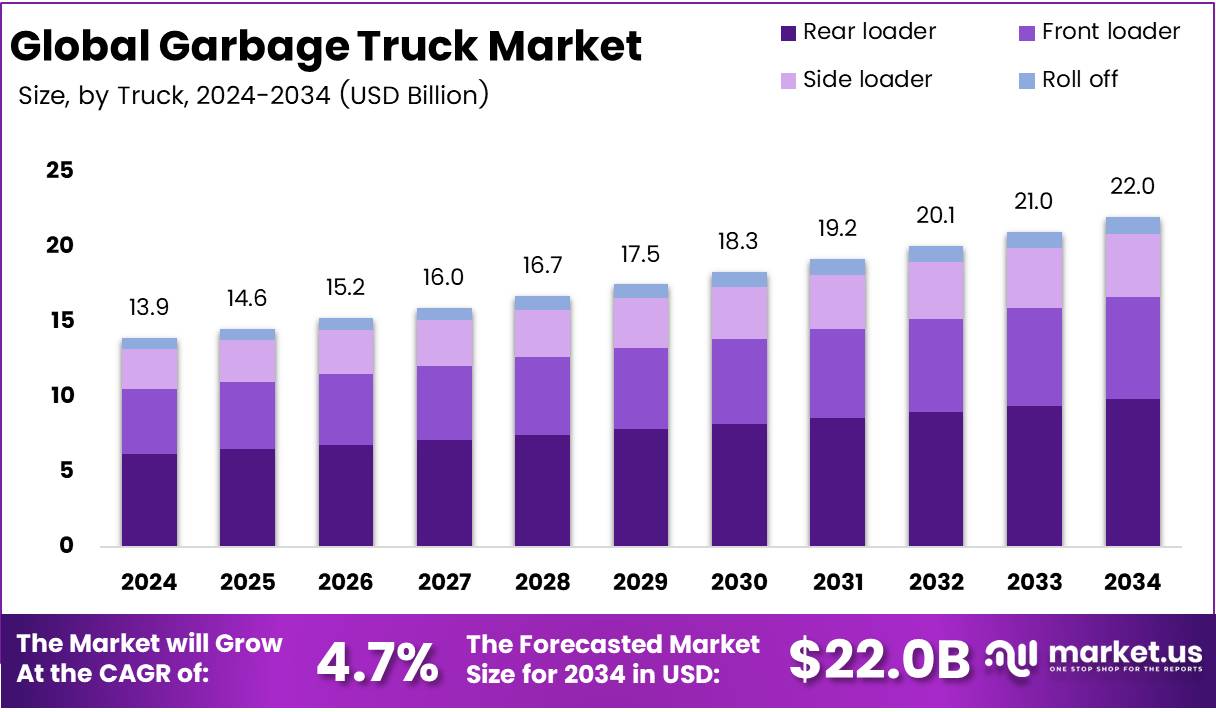

The global garbage truck market is poised for significant growth, with projections estimating it will reach USD 22.0 billion by 2034, up from USD 13.9 billion in 2024, expanding at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2034. Garbage trucks are essential vehicles in urban sanitation, waste management, and public health, playing a pivotal role in the collection, transportation, and disposal of waste. This market is evolving rapidly, driven by advances in automation, electrification, and telematics, as well as increasing urbanization and stricter environmental regulations.

Key Takeaways

- The global garbage truck market is expected to grow from USD 13.9 billion in 2024 to USD 22.0 billion by 2034, at a CAGR of 4.7%.

- Rear loader trucks dominate the truck analysis segment, holding 44.2% of the market share in 2024.

- Diesel-powered trucks lead the fuel analysis segment with a 62.5% share in 2024.

- Automatic technology was preferred in 2024, commanding 51.4% of the market share.

- The urban garbage treatment sector holds the largest end-use market share at 41.7% in 2024.

- Asia Pacific dominates the global market with a 41.1% share, valued at USD 5.7 billion in 2024.

Key Market Segments

By Truck Type:

- Rear Loader: Dominates with a 44.2% market share, favored for residential waste collection due to its efficient compacting capabilities.

- Front Loader: Gaining traction in commercial and industrial sectors due to its large bin-handling capacity.

- Side Loader: Appeals for its automated arm systems, reducing manual labor and improving safety.

- Roll-off Trucks: A niche segment used in large-scale cleanups and construction waste management.

By Fuel Type:

- Diesel: Holds the largest share at 62.5% due to its durability and wide availability.

- Electric: Gaining momentum with increasing adoption of zero-emission vehicles in urban centers.

- Gasoline: A smaller portion of the market, primarily in regions with lower fuel costs.

By Technology:

- Automatic: Leads with a 51.4% share due to enhanced convenience, safety, and reduced training needs.

- Manual: A staple in older or more budget-conscious fleets.

- Semi-Automatic: Serves as a transitional solution for operators balancing cost and efficiency.

By End Use:

- Urban Garbage Treatment: Leading the market with a 41.7% share due to urbanization and stricter waste management regulations.

- Municipal Waste Collection: Plays a crucial role in maintaining public sanitation and waste disposal systems.

- Industrial Waste Collection: Steady demand, particularly in manufacturing hubs and industrial zones.

- Construction and Demolition Waste: Driven by infrastructure projects and the need for heavy-duty waste management.

Drivers

- Adoption of Automation and Robotics: The rise of robotic arms, sensors, and cameras is transforming waste collection. These technologies reduce manual labor, enhance safety, and increase operational efficiency, enabling municipalities to cover more areas with the same fleet size.

- Sustainability Initiatives: Governments worldwide are tightening emissions standards and incentivizing the adoption of electric vehicles, encouraging the transition toward low-emission garbage trucks.

- Urbanization: As urban populations grow, the need for efficient and scalable waste management systems increases, fueling demand for garbage trucks.

- Technological Advancements: The development of smarter vehicles with better route management software, telematics, and energy-efficient powertrains are shaping the market’s future.

Use Cases

- Municipal Waste Collection: Ensuring the cleanliness and health of urban environments by providing efficient waste collection and disposal systems.

- Construction and Demolition: Removing debris and waste from construction sites to ensure proper site management and safety.

- Industrial Waste Management: Handling waste produced by manufacturing and processing plants, ensuring proper disposal of hazardous or non-hazardous materials.

- Urban Infrastructure Projects: Facilitating waste management in growing cities with advanced technologies like electric trucks and automation to optimize waste collection operations.

Major Challenges

- Inconsistent Regulations: Waste management regulations vary significantly across regions, leading to challenges in standardizing truck specifications, axle loads, and emissions, which increases operational costs.

- High Initial Investment for Electric Trucks: While electric garbage trucks offer long-term savings, their higher upfront costs, coupled with infrastructure limitations, create adoption hurdles.

- Training and Licensing Issues: The need for specialized training to operate advanced automated trucks, especially in regions with inconsistent safety standards, complicates workforce development.

Business Opportunities

- Electric Garbage Trucks: With a rising focus on sustainability and emissions reduction, electric garbage trucks present an opportunity for companies to lead in this emerging segment, particularly in urban environments.

- Telematics and Digital Fleet Management: With real-time monitoring, predictive maintenance, and optimized route planning, telematics-based solutions provide a growing business avenue for companies offering fleet management software.

- Automation and Robotics: Manufacturers developing advanced automated garbage trucks with robotic arms and autonomous capabilities stand to gain from rising labor costs and the demand for efficient waste management solutions.

Regional Analysis

- Asia Pacific: The region leads the global market with a 41.1% share, primarily driven by rapid urbanization, infrastructure growth, and government-backed smart city projects in countries like China and India.

- North America: With a mature market, North America is embracing electric and hybrid trucks due to stringent environmental regulations and growing urban demand for automated waste collection solutions.

- Europe: Europe is focused on sustainability, with strict waste disposal regulations, promoting the use of electric and hybrid vehicles in waste fleets. Countries are investing in eco-friendly refuse collection technologies to reduce carbon footprints.

- Middle East & Africa: The market is experiencing gradual growth, propelled by urban development projects and government initiatives aimed at improving sanitation and health standards.

Recent Developments

- GFL Environmental Services: In June 2025, GFL acquired OSI, marking a significant step in its market expansion and post-restructuring growth strategy.

- Casella Waste Systems: In March 2025, the company acquired Royal Carting and Welsh Sanitation to improve operational efficiency in the Northeastern U.S.

- City of Erie: In January 2024, the City of Erie secured a $3 million state grant to purchase electric garbage trucks, aligning with its sustainability goals.

Conclusion

The global garbage truck market is set to experience steady growth, driven by technological advancements, urbanization, and increasing demand for sustainable waste management solutions. With emerging trends such as automation, electric vehicles, and telematics, businesses in the sector have multiple avenues to capitalize on this growth. However, challenges related to regulation inconsistencies and high upfront costs for electric trucks remain. As regions like Asia Pacific, North America, and Europe continue to push for smarter, greener solutions, the garbage truck market is positioned for significant transformation in the coming years.