Table of Contents

Introduction

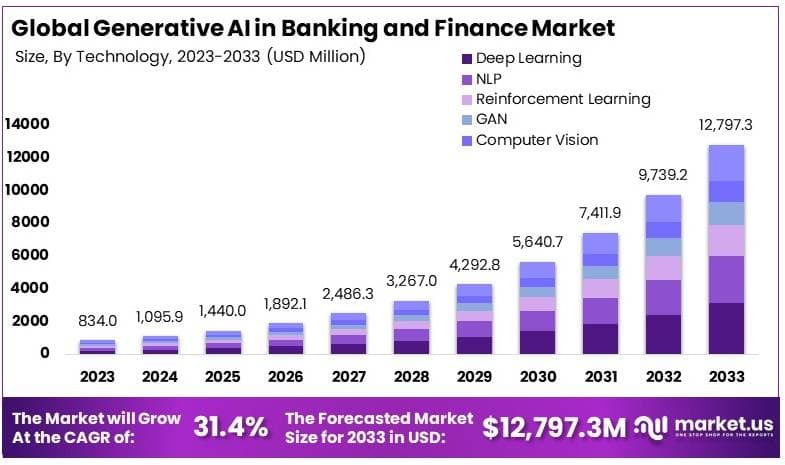

According to the Market.us reports, The Global Generative AI in Banking and Finance Market is projected to reach approximately USD 12,797.3 million by 2033, up from USD 834 million in 2023, reflecting a robust CAGR of 31.4% throughout the forecast period from 2024 to 2033.

Generative AI in banking and finance refers to the application of artificial intelligence technologies that can generate new data, insights, or predictive models based on existing financial datasets. This technology utilizes machine learning algorithms, particularly generative models like GANs (Generative Adversarial Networks) and variational autoencoders, to simulate financial scenarios, enhance decision-making, and personalize customer experiences. Its capabilities extend to generating realistic and synthetic financial data for training models without compromising sensitive information, automating complex financial documents, and creating personalized financial advice for customers.

The market for generative AI in banking and finance encompasses a range of applications and services aimed at automating and enhancing financial operations through AI-driven solutions. This includes everything from risk assessment, fraud detection, and compliance, to customer service and portfolio management. Financial institutions invest in this technology to gain a competitive edge by improving accuracy, reducing costs, and offering innovative services that meet the evolving expectations of tech-savvy consumers. The market is supported by a growing number of fintech startups, established technology vendors, and investment from major banks seeking to integrate advanced AI capabilities into their operations.

The demand for generative AI in banking and finance is driven by the industry’s need for more sophisticated tools to handle large volumes of complex data and to enhance decision-making processes. Banks and financial institutions are leveraging these technologies to develop more accurate predictive models for credit scoring, market analysis, and risk management. Additionally, the push towards personalized banking experiences and the need for improved regulatory compliance solutions further fuel the demand for generative AI solutions.

The growth of generative AI in the banking and finance sector is fueled by several dynamic factors. Technological advancements have greatly improved AI and machine learning algorithms, making it possible to process vast datasets more effectively and efficiently, thus enhancing the accuracy of predictions and simulations. The burgeoning volume of digital transaction data serves as a rich resource for training AI systems, continually improving their precision and learning capabilities.

Additionally, the strict regulatory landscape in finance demands robust compliance measures, which generative AI can streamline by automating record-keeping and compliance processes. Furthermore, the entry of fintech companies and tech giants into the financial services market intensifies competitive pressures, compelling traditional banks to embrace advanced technologies like AI to remain competitive and innovative.

The market opportunities for generative AI in banking and finance are vast and varied. One major area is in enhancing customer experience through personalized financial products and advice, tailored to individual needs and preferences. Another significant opportunity lies in fraud detection and security, where AI can identify patterns and anomalies that indicate fraudulent activity, thereby reducing losses and increasing trust. Additionally, AI-driven automation of back-office operations presents a chance for cost savings and efficiency improvements. Finally, the ability to generate synthetic financial data opens up new possibilities for training more robust financial models without compromising customer privacy.

Key Takeaways

- The Generative AI in Banking and Finance Market was valued at USD 834 million in 2023 and is projected to grow to USD 12,797.3 million by 2033, achieving a CAGR of 31.4%.

- In 2023, the Deep Learning segment led the technology category, capturing 24.6% of the market share, owing to its advanced capabilities in analyzing financial data.

- Risk Assessment was the leading application in 2023, accounting for 27.8% of the market, underscoring its vital role in managing risks within the banking sector.

- North America dominated the market in 2023, holding a 39.2% share, driven by the region’s robust technological infrastructure.

Generative AI in Banking and Finance Statistics

- The Global Generative AI Market is projected to reach approximately USD 255.8 Billion by 2033, up from USD 13.5 Billion in 2023.

- This market is expected to experience a compound annual growth rate (CAGR) of 34.2% during the forecast period from 2024 to 2033.

- The Global Generative AI in Banking Market is expected to be valued at USD 13,957 Million by 2033, starting from USD 818 Million in 2023. The projected CAGR for this market is 32.8% from 2024 to 2033.

- The Global AI in Finance Market is estimated to reach USD 73.9 Billion by 2033, growing from USD 12.4 Billion in 2023. This sector is expected to grow at a CAGR of 19.5% during the forecast period.

- In 2023, the financial services industry invested an estimated USD 35.2 Billion in AI technologies, with banking sectors leading the investment at approximately USD 21 Billion.

- Capital One, JPMorgan Chase, and the Royal Bank of Canada are recognized as leaders in AI adoption among the largest banks in the Americas and Europe.

- EY analysis suggests rethinking traditional financial institutions with Generative AI at their core could generate between USD 200 Billion to USD 400 Billion in value by 2030, with productivity gains potentially reaching up to 30% by 2028.

- According to NVIDIA, more than 90% of financial services companies are evaluating or actively using AI.

- 56% of financial services companies have adopted AI specifically for risk management tasks.

- 75% of banks with assets exceeding USD 100 Billion are actively implementing AI strategies.

- 91% of U.S. banks utilize AI to detect fraud, as noted by Temenos.

- Market.us forecasts that the Generative AI in Fintech Market size will reach approximately USD 16.4 Billion by 2032.

- 70% of financial services firms employ machine learning for functions like cash flow predictions, credit score adjustments, and fraud detection, according to Forbes Advisor.

- Banks are expected to save around USD 1.0 Trillion by 2030 through AI implementation.

- Annual growth in the adoption of AI within the finance sector is expected to rise by 23% until 2025.

- The cost reductions for using AI in personalized banking services are anticipated to decrease by 22% by 2030.

- Early adopters might see a productivity improvement of between 22% – 30% over the next three years.

- A potential rise in revenue growth is projected at 600 basis points.

- An increase in return on equity could reach 300 basis points.

- About 73% of the time spent by U.S. bank employees has high potential to be impacted by generative AI, divided into 39% by automation and 34% by augmentation.

Role of Generative AI in Transforming Financial Services

Generative AI is rapidly transforming the financial services sector by enabling enhanced efficiency, automation, and innovative customer service solutions. The technology is increasingly being adopted across various domains within financial institutions, leveraging AI’s potential to improve both front-office and back-office functions.

One of the critical ways generative AI is being utilized is through its integration into customer service operations. Banks are employing AI-driven tools to empower contact center agents, providing them with capabilities such as conversation summarization, insights generation across multiple dialogues, and real-time coaching. These tools not only enhance the efficiency of customer interactions but also improve the overall customer experience by enabling more personalized and responsive service.

Furthermore, the technology is playing a significant role in the backend operations of financial services. Generative AI aids in automating routine tasks, such as documentation and data analysis, thereby freeing up human resources for more complex and strategic activities. This shift is part of a broader digital transformation strategy that includes the deployment of AI “copilots” that work alongside human employees to augment decision-making and operational efficiencies.

Generative AI also facilitates a more agile and integrated approach within financial institutions. By adopting a centrally led AI strategy, banks can more effectively manage resources and streamline AI implementation across multiple departments, ensuring consistency and coherence in AI-driven initiatives. This centralized approach allows for better alignment with overall business strategies and can enhance the speed and scalability of AI applications within the organization.

However, the deployment of generative AI is not without challenges. Issues related to data security, privacy, and the accuracy of AI outputs are significant concerns. Moreover, the potential for job displacement due to automation remains a sensitive issue, requiring careful management and communication within organizations. To address these challenges, it’s crucial for financial institutions to adopt a responsible AI framework that emphasizes ethical considerations, human oversight, and continual training and upskilling of employees to work effectively with AI systems.

Key Applications

Generative AI is significantly reshaping the banking and finance sectors with a variety of transformative applications that enhance both operational efficiencies and customer experiences.

- Fraud Detection and Risk Management: Generative AI is adept at identifying patterns and anomalies within transactional data, which helps in proactively detecting and responding to fraudulent activities. This capability is crucial not only for fraud prevention but also for complying with strict financial regulations.

- Customer Experience Enhancement: By leveraging natural language processing (NLP), generative AI enhances customer interactions through virtual assistants and chatbots. These AI-powered tools offer real-time customer support, process inquiries, and can even handle complex financial queries, thus improving overall customer satisfaction.

- Personalized Financial Services: AI-driven tools analyze customer data to provide personalized financial advice and product recommendations. This tailored approach helps in significantly enhancing customer relations and satisfaction by ensuring customers are offered solutions that closely match their needs.

- Operational Efficiency: Generative AI streamlines various banking operations such as loan underwriting and document processing. It automates time-consuming tasks like data entry and report generation, which not only speeds up the processes but also reduces human errors.

- Compliance and Reporting: The technology supports compliance by automating the monitoring and reporting processes. It helps in maintaining rigorous standards by efficiently managing large volumes of data and ensuring accuracy in compliance-related documentation and reporting.

- Product Development and Testing: AI tools are used to simulate customer journeys and test new financial products. This helps in identifying potential issues before a full-scale launch, ensuring that new offerings are well-optimized to meet market demands and customer expectations.

- Innovative Financial Solutions: The ability of generative AI to generate synthetic data also enables the development of innovative financial products and services that can be dynamically adapted to changing market conditions or customer needs, creating opportunities for significant competitive advantages.

Emerging Trends

- Centralized AI Operations: Many financial institutions are moving towards a centralized model for generative AI to optimize resource allocation and operational risks. This model aids in quickly moving through initial experimentation to tackle more complex applications of AI in banking.

- AI-Driven Risk Management: The incorporation of generative AI into risk management processes is growing, allowing banks to respond more dynamically to financial crimes and market changes. AI is increasingly used to monitor transactions and detect anomalies that may indicate fraudulent activities.

- Regulatory Technology (RegTech): AI is being leveraged to streamline compliance and regulatory reporting, reducing the manual burden and increasing accuracy. This includes automating compliance processes and generating reports, making regulatory compliance more efficient.

- Personalized Banking Services: AI is facilitating a shift towards more personalized customer experiences. From customized financial advice to personalized marketing strategies, banks are using AI to tailor their services to individual customer preferences, enhancing satisfaction and engagement.

- Advanced Credit and Loan Services: Generative AI is refining the approach to credit scoring and loan servicing by incorporating a broader array of data points, which allows for more precise risk assessments and personalized loan offers.

Major Challenges

- Data Privacy and Security: Generative AI poses significant risks in terms of data privacy. Financial institutions must manage the risk of sensitive data being inadvertently included in training datasets, which could lead to privacy breaches and unauthorized data access.

- Bias and Fairness: Generative AI systems can perpetuate existing biases found in the data they are trained on. This can lead to unfair discrimination in financial services, such as in credit scoring and customer profiling, which are highly regulated areas that require fairness

- Regulatory Compliance: Adhering to stringent financial regulations is a challenge, as generative AI can produce outputs that may not always be easily explainable to regulators or consistent with regulatory standards.

- Technological Integration: Integrating generative AI into existing financial systems involves overcoming substantial technological hurdles, especially concerning compatibility with legacy systems.

- Risk of Advanced Fraud: The capability of generative AI to produce realistic synthetic data and text can enhance fraud techniques, making it more challenging to detect scams and prevent financial crimes.

Top Opportunities

- Enhanced Customer Experience: Generative AI can provide more personalized and efficient customer service through chatbots and virtual assistants, leading to improved customer satisfaction and retention.

- Operational Efficiency: AI can automate routine tasks like report generation, risk assessments, and compliance checks, freeing up valuable resources for more strategic activities.

- Advanced Risk Management: Generative AI can enhance risk management capabilities by providing more accurate predictions and analyses based on vast amounts of data, thereby improving decision-making processes

- Innovative Financial Products: There is potential to develop new financial products and services tailored to specific customer needs, leveraging the predictive capabilities of AI to create offerings that were not possible before.

- Fraud Detection and Prevention: With its advanced analytical capabilities, generative AI can significantly improve the detection of fraudulent activities and reduce the incidence of financial crime.

Recent Developments

- Accenture and AWS Collaboration (June 2023): Accenture extended its strategic collaboration with Amazon Web Services (AWS) to accelerate the adoption of generative AI across industries, including banking and finance. This collaboration focuses on developing AI-driven capabilities such as enhancing customer experiences and improving operational efficiencies in financial services.

- IBM’s Watsonx Platform Launch (May 2023): IBM introduced Watsonx, a new AI platform designed to help financial institutions leverage generative AI for tasks like fraud detection, regulatory compliance, and customer interactions. This platform allows banks to customize and deploy AI models tailored to their specific needs, significantly improving operational efficiency and customer satisfaction

- Google Cloud’s AI Partnerships (June 2023): Google Cloud expanded its partnerships with major financial institutions to integrate generative AI into their operations. This includes collaborations with global banks to use AI for improving customer service, automating compliance processes, and enhancing fraud detection systems.

- Accenture and Oracle Partnership (March 2023): Accenture partnered with Oracle to leverage Oracle Cloud Infrastructure (OCI) Generative AI, focusing initially on transforming financial operations. This partnership aims to enhance financial planning and analysis, procurement spend analysis, and dynamic scenario planning through the integration of generative AI technologies.

- Accenture’s $3 Billion AI Investment (June 2023): Accenture announced a $3 billion investment over three years to expand its Data & AI practice, which includes developing new generative AI tools and platforms tailored to various industries, including banking and finance. This investment aims to double Accenture’s AI talent and drive innovation in AI-driven solutions across sectors

- Microsoft Azure OpenAI Service Expansion (April 2023): Microsoft expanded its Azure OpenAI Service by integrating GPT-4 capabilities into its offerings for the banking and finance sector. This enhancement allows financial institutions to develop advanced AI-driven tools for customer service, risk management, and personalized financial advice.

Conclusion

Generative AI presents a transformative opportunity for the banking and finance sector, poised to revolutionize everything from customer interactions to back-end operations. However, the adoption of this technology comes with substantial challenges, including concerns around data privacy, regulatory compliance, and the potential for perpetuating biases.

Addressing these challenges effectively will require robust frameworks for governance and security, continuous monitoring and updating of AI models, and ongoing training and education of both AI systems and human operators. If these hurdles are navigated successfully, generative AI could lead to significant gains in efficiency, customer satisfaction, and financial innovation.

You May Also Like To Read

- “Generative AI Market: Fueling the Future of Automation and Customization”

- “Generative AI in Banking Market: Revolutionizing Financial Services with AI-driven Automation”

- “Blockchain Technology in BFSI Market: Securing the Future of Financial Transactions”

- “AI in Finance Market: Transforming Financial Services with Intelligent Automation”

- “Insurance IT Spending Market: Driving Digital Transformation in the Insurance Industry”

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)