Table of Contents

Introduction

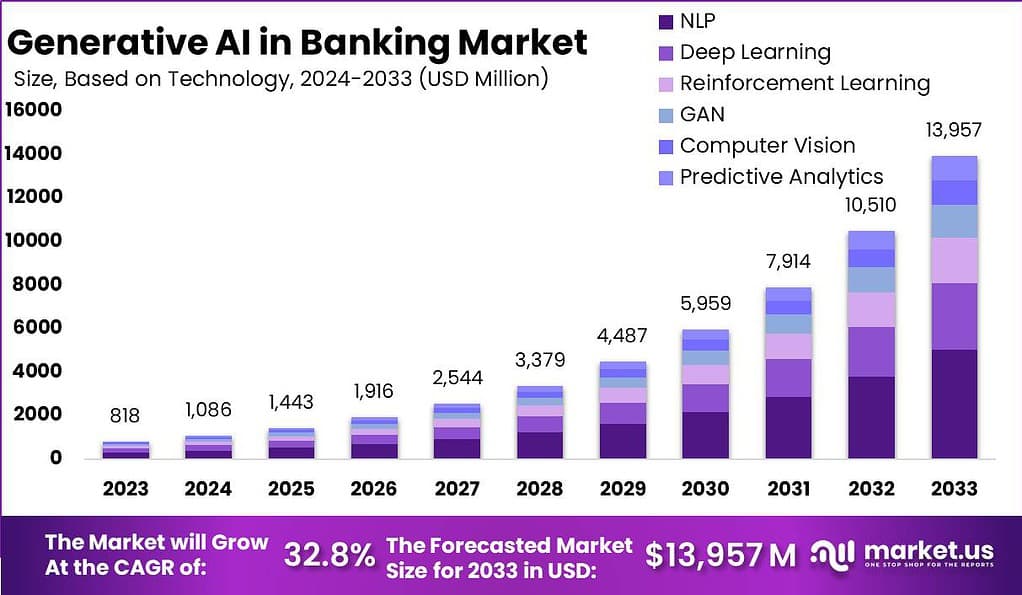

The Generative AI in Banking Market is poised for remarkable growth, with expectations of reaching USD 13,957 million by 2033, projected at a robust CAGR of 32%. Generative AI is revolutionizing banking operations by streamlining processes, enhancing customer experiences, and unlocking new revenue streams. Within the banking sector, Generative AI finds application in personalized customer service, risk assessment, fraud detection, and process automation. By analyzing vast data volumes, Generative AI models predict customer behavior, offer personalized financial advice, and automate routine tasks, thereby improving efficiency and cutting operational costs.

The market’s growth is propelled by the escalating demand for advanced analytical tools and the increasing need for automation and personalized services. Financial institutions are heavily investing in AI technologies to stay competitive, bolster security measures, and meet the evolving expectations of digitally savvy customers. The integration of AI with other technologies like blockchain and the Internet of Things (IoT) further amplifies its applications in banking, paving the way for substantial opportunities for technology providers and banking institutions alike.

To learn more about this report – request a sample report PDF

The growth of the generative AI market in banking can be attributed to several key factors. Firstly, the surge in digital transactions and the growing complexity of financial services demand more sophisticated technological solutions. Generative AI helps banks process large volumes of data quickly and accurately, leading to improved decision-making and customer satisfaction. Additionally, the need for personalized banking services encourages financial institutions to adopt these advanced AI tools.

However, this growth is not without challenges. Key issues include the high costs associated with implementing AI technologies and the need for significant investments in data infrastructure and skilled personnel. Privacy concerns and regulatory compliance also pose considerable hurdles, as banks must ensure that their use of AI aligns with legal standards and customer expectations.

For new entrants, the generative AI in banking market offers substantial opportunities. The ongoing technological advancements open doors for startups and new companies to introduce innovative solutions that address existing gaps in the market. New entrants can differentiate themselves by offering unique, cost-effective solutions tailored to specific banking needs, such as customer relationship management, compliance automation, or cybersecurity enhancements. Moreover, partnerships with established banks can provide a significant boost, offering credibility and a ready customer base to help overcome initial market entry barriers.

Key Takeaways

- The Generative AI in Banking Market is forecasted to reach a substantial value of USD 13,957 Million by 2033, growing at a robust CAGR of 32% during the forecast period.

- Natural Language Processing (NLP) emerged as a frontrunner, holding over 36% share in 2023. NLP’s pivotal role in enhancing customer interactions and backend processes makes it indispensable in the banking sector.

- Retail Banking Customers held a dominant position in 2023, capturing over 27% of the market. This is attributed to the widespread adoption of generative AI technologies enhancing consumer banking experiences.

- North America dominates the market with over 36% share in 2023, driven by advanced technological infrastructure, early adoption of AI solutions, and supportive regulatory frameworks.

Generative AI in Banking Statistics

- The Global Generative AI Market is projected to expand significantly, reaching an estimated USD 255.8 Billion by 2033, up from USD 13.5 Billion in 2023. This represents a robust compound annual growth rate (CAGR) of 34.2% over the forecast period from 2024 to 2033.

- In the fintech sector, the Generative AI market size is expected to grow markedly from USD 865 Million in 2023 to approximately USD 6,256 Million by 2032, reflecting a CAGR of 22.5% during the forecast period.

- The Open Banking Market is set for substantial growth, with its value predicted to surge from USD 30.9 Billion in 2024 to USD 203.8 Billion by 2033. The market could see a CAGR of 23.3% over this period.

- The Banking Process Automation Market is anticipated to grow from USD 3.0 Billion in 2022 to around USD 19.1 Billion by 2032, demonstrating a CAGR of 23.7%.

- Generative AI is poised to deliver substantial value across various industries, with banking, high tech, and life sciences potentially realizing an annual added value ranging between USD $200 billion and USD $340 billion.

- The financial services sector has significantly transformed digitally over the last two decades, improving convenience, efficiency, and security. Currently, 78% of financial institutions are either integrating or planning to integrate Generative AI, underscoring a major technological shift within the sector.

- Generative AI holds the potential to impact 73% of the time spent by US bank employees, divided between automation (39%) and augmentation (34%). Moreover, 60% of investment banks globally employ AI for predictive analysis.

- Operational cost savings for banks due to the deployment of chatbots are expected to reach USD 7.3 billion by 2023. Additionally, AI-enhanced processes are facilitating increased loan accessibility, approving 27% more applicants and offering 16% lower interest rates.

- Awareness among banks of the potential benefits of AI and machine learning is high, with 80% recognizing their significant impact.

Emerging Trends

- Strategic Integration and Leadership Alignment: Financial institutions are increasingly integrating generative AI into strategic operations, with senior leadership playing a pivotal role in steering these initiatives. This includes identifying key areas where AI can add value and aligning them with business objectives to maximize impact.

- Operational Transformation: Banks are adopting new operational models to support the deployment and scale-up of generative AI technologies. This involves centralizing AI functions to streamline governance and execution, enhancing agility and responsiveness within the organization.

- Talent Development and Upskilling: The rapid adoption of generative AI is driving a need for new skills and capabilities in the banking workforce. Institutions are focusing on upskilling employees and acquiring new talent to manage and advance AI technologies effectively.

- Enhanced Customer Interaction: Banks are leveraging generative AI to transform customer service operations, employing AI to enhance client interactions, provide personalized advice, and improve overall customer experience. This includes deploying AI tools that assist with customer queries and transaction handling.

- Risk Management and Compliance: As the use of generative AI expands, managing the associated risks, particularly in cybersecurity and regulatory compliance, has become a priority. Financial institutions are enhancing their risk management frameworks to address these challenges and ensure safe, compliant AI deployment.

Top Use Cases

- Customer Service Automation: Generative AI is being utilized to automate and enhance customer service, enabling banks to provide faster responses and more accurate information to customer inquiries through AI-driven chatbots and virtual assistants.

- Fraud Detection and Risk Assessment: AI technologies are increasingly used to improve fraud detection systems, using pattern recognition and predictive analytics to identify and mitigate potential risks before they affect the business.

- Personalized Banking Services: Generative AI enables banks to offer personalized financial advice and product recommendations by analyzing customer data and behavior, thus improving customer engagement and satisfaction.

- Document Processing and Compliance: AI is streamlining back-office operations, particularly in processing documents and ensuring compliance with regulatory requirements. This reduces manual effort and improves operational efficiency.

- Financial Analysis and Reporting: AI tools are being deployed to automate complex financial analyses and report generation, allowing banks to gain insights more quickly and make data-driven decisions with greater accuracy.

Major Challenges

- Talent Acquisition and Upskilling: The rapid emergence of generative AI requires banks to swiftly adapt by upskilling existing employees and recruiting new talent with specialized skills in AI, data engineering, and cloud services. This is crucial for banks to leverage generative AI effectively across their operations.

- Data Security and Privacy: As financial institutions integrate more sophisticated AI tools, they face significant challenges related to data security and privacy. Ensuring the integrity and confidentiality of customer data while using AI is paramount, given the sensitivity of financial information.

- Regulatory Compliance: The banking sector is highly regulated, and adding new technologies like generative AI introduces complexities in compliance. Banks must navigate these regulations carefully to deploy AI solutions without breaching legal standards.

- Integration with Existing Systems: Many banks operate on legacy systems that are not readily compatible with the latest AI technologies. Integrating generative AI into these existing infrastructures without disrupting ongoing operations is a complex challenge.

- Cost and ROI Uncertainty: The initial cost of implementing generative AI technologies can be high, and the return on investment (ROI) is not always immediately clear. Banks need to evaluate the long-term benefits and potential financial impacts carefully.

Market Opportunities

- Enhanced Customer Experience: Generative AI can significantly improve customer service through personalized banking advice and faster response times, thereby increasing customer satisfaction and retention.

- Operational Efficiency: By automating routine tasks and processes, generative AI can help banks reduce operational costs and improve efficiency. This includes tasks like report generation, risk assessment, and compliance checks.

- Risk Management: Advanced AI algorithms can enhance risk management capabilities by predicting and mitigating potential risks more accurately. This includes credit risk assessments and fraud detection.

- Innovative Product Development: Generative AI enables banks to develop new financial products and services by analyzing customer data and market trends to identify unmet needs and opportunities.

- Strategic Decision Making: AI-driven analytics can support better decision-making by providing more accurate forecasts and insights into market conditions, customer behaviors, and business operations.

Recent Developments

- In 2023, Microsoft enhanced its Azure OpenAI Service by integrating GPT-4, marking a significant advancement in AI models supporting banking operations.

- In March 2024, Goldman Sachs launched an AI-driven tool designed to optimize asset allocation for wealth management clients.

- On April 13, 2023, Deloitte launched a new Generative AI practice aimed at assisting clients in harnessing disruptive AI technologies.

- In early 2024, Finastra emphasized the transformative potential of generative AI in banking, focusing on innovation and efficiency within financial services.

Conclusion

In conclusion, the incorporation of Generative Artificial Intelligence (AI) in the banking industry is poised to revolutionize various aspects of the sector, driving innovation, efficiency, and customer-centricity. Generative AI, with its ability to autonomously generate new and unique content, is being leveraged by banks to streamline operations, improve risk management, and enhance customer experiences.

Generative AI algorithms are enabling banks to automate and optimize processes such as fraud detection, credit scoring, and compliance. By analyzing vast amounts of data, these algorithms can identify patterns and anomalies, helping banks detect fraudulent activities in real-time and minimize financial risks. Moreover, generative AI can assist in credit scoring by analyzing customer data and generating predictive models that enable banks to make more accurate lending decisions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)