Table of Contents

Introduction

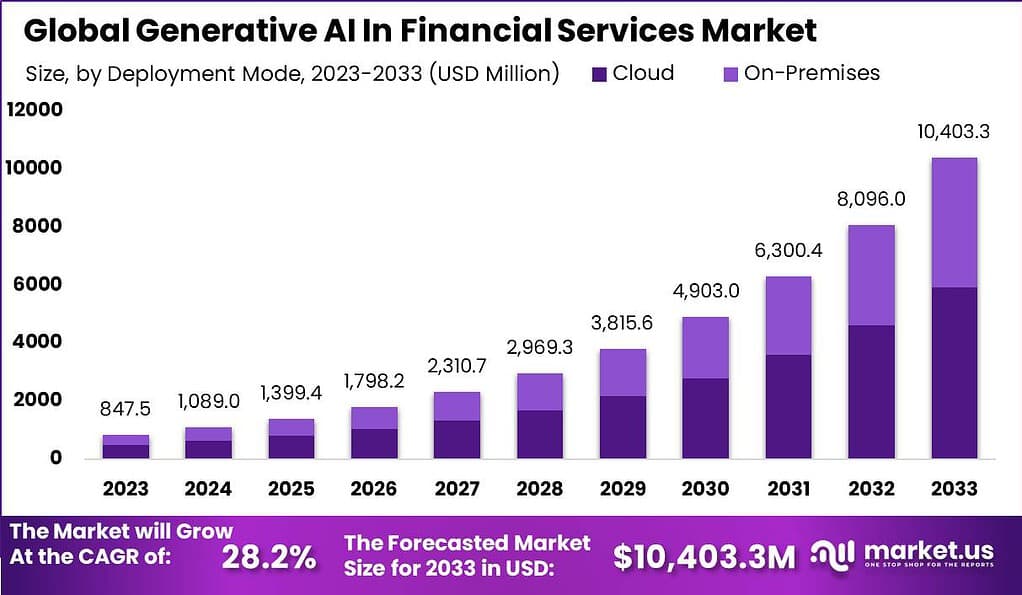

The Generative AI in Financial Services market is forecasted to reach a value of USD 10,403.3 million by 2033, with a robust CAGR of 28.2% from 2024 to 2033.

The integration of Generative AI in financial services is transforming the industry by enhancing efficiency, accuracy, and customer experience. This technology, through its ability to generate novel content and solutions, is being leveraged for a variety of applications including personalized financial advice, risk assessment, fraud detection, and automated customer service. The market for Generative AI in financial services is witnessing significant growth, propelled by the increasing demand for advanced analytical tools and the need for personalized financial solutions. Financial institutions are investing heavily in AI technologies to stay competitive and meet the evolving expectations of their customers.

The growth of the market can be attributed to the rising adoption of cloud-based solutions, advancements in machine learning algorithms, and the proliferation of data. Moreover, regulatory support for digital innovations in the financial sector is further boosting market expansion. Despite challenges such as data privacy and security concerns, the potential of Generative AI to revolutionize the financial services sector is immense, indicating a promising future for this market.

To learn more about this report – request a sample report PDF

Facts and Latest Statistics

- Generative AI in Financial Services Market size is expected to be worth around USD 10,403.3 Million by 2033, from USD 847.5 Million in 2023, growing at a CAGR of 28.2% during the forecast period from 2024 to 2033.

- In 2023, the Solutions segment held a dominant market position, capturing over 76.4% share. This reflects the increasing adoption of AI-driven solutions in financial institutions.

- The Forecasting & Reporting segment led the market in 2023, with over a 30% share. This signifies the growing demand for precise financial forecasts and reports powered by generative AI.

- On-Premises deployment was preferred in 2023, holding over 57% of the market share. This choice is driven by the need for data security and regulatory compliance in financial services.

- Around 70% of financial institutions are expected to embrace Generative AI by the end of 2024, indicating widespread recognition of its value across the sector.

- The market size for Generative AI is projected to surge to USD 255.8 billion by 2033, showcasing a robust CAGR of approximately 34.2% during the forecast period.

- Specifically within Fintech, the Generative AI market is expected to reach USD 6,256 million by 2033, reflecting a significant CAGR of 22.5% from 2024 to 2033.

- Financial institutions leveraging Generative AI for fraud detection and anti-money laundering have experienced a 25% increase in accuracy rates, highlighting its effectiveness in enhancing security measures.

- Nearly half of financial services executives identified Generative AI as a crucial element of their digital transformation initiatives in 2023, underlining its strategic importance.

- Adoption of Generative AI for compliance and regulatory reporting tasks resulted in a 20% reduction in operational costs for financial institutions, showcasing its role in streamlining operations and improving financial performance.

- Among various industry sectors, banking notably emerges with an exceptional annual potential ranging from ~$200.1 billion to ~$340 billion, representing approximately 9% to 15% of operating profits.

- In financial services, gen AI can enhance fraud management, credit underwriting, user onboarding, and more

Emerging trends

Emerging trends in generative AI within the financial services sector demonstrate the technology’s evolving role, from operational improvements to customer engagement enhancements. Insights from multiple sources highlight key areas of impact and development:

- Strategic Implementation and Talent Development: The rapid emergence of generative AI as a critical capability in banking necessitates a strategic approach, including senior leadership alignment, talent development for new roles such as prompt engineering, and a focus on upskilling and reskilling employees. This strategic planning must also address potential automation and job displacement concerns by being transparent with employees about the changes and opportunities generative AI brings.

- Applications in Audit, Tax, and Advisory Services: Generative AI’s potential spans across various service offerings within financial services, including audit, tax, and advisory services. Firms are exploring its use to enhance efficiency, accuracy, and insights in these areas, reflecting a broader trend of AI integration into traditional financial operations.

- Overcoming Barriers for Wider Adoption: While the promise of generative AI in financial services is significant, challenges remain, including the separation of hype from real value, overcoming legacy technology limitations, and addressing talent shortages. However, the industry is actively exploring solutions to these challenges to harness generative AI’s full potential.

- Innovative Use Cases by Financial Firms: Leading financial institutions are already leveraging generative AI for various applications, such as Morgan Stanley’s use of chatbots for financial advice and Citadel’s exploration of ChatGPT for software development and information analysis. These examples underscore the technology’s versatility and potential to transform traditional financial operations and customer interactions.

- Benefits and Risks: Generative AI offers several benefits, including instant content summarization, efficient search for company and market insights, and streamlined internal and external deal intelligence. However, it also presents challenges such as the requirement for large energy inputs, potential for poor outputs from poor inputs, cybersecurity threats, and regulatory compliance issues.

Use Cases for Generative AI in financial services

- Personalized Financial Planning: Generative AI can tailor financial advice and create personalized investment plans based on an individual’s financial history, goals, and risk tolerance, enhancing the value of financial advisory services.

- Automated Document Processing: This technology can automatically generate, review, and process complex financial documents, such as loan applications or regulatory filings, improving efficiency and reducing human error.

- Fraud Detection and Prevention: By analyzing transaction patterns and generating models of fraudulent behavior, Generative AI can identify and prevent fraud more effectively, safeguarding both institutions and customers.

- Enhanced Customer Service: Generative AI can power advanced chatbots and virtual assistants capable of handling customer inquiries, providing financial advice, and resolving issues with a level of interaction that closely mimics human customer service representatives.

- Risk Management: Through predictive modeling, Generative AI can forecast financial risks under various scenarios, assisting in the development of strategies to mitigate these risks before they impact the business.

- Credit Scoring and Underwriting: By generating comprehensive profiles of potential borrowers, including those with thin credit files, Generative AI can enable more accurate and inclusive credit scoring and underwriting processes.

Recent Developments

- In February 2023, Salesforce expanded its Einstein platform by integrating generative AI to deliver personalized customer experiences and enable automated financial reporting for institutions.

- AWS launched Amazon SageMaker Autopilot in March 2023, simplifying the process of creating and deploying machine learning and generative AI models for financial applications.

- A partnership was established between Microsoft and S&P Global Market Intelligence in June 2023, focusing on the development of a generative AI solution for the creation of insightful financial reports.

Summary

In summary, generative AI has the potential to revolutionize financial services by enhancing decision-making, automating processes, and improving customer experiences. While there are challenges to overcome, the benefits of generative AI in financial services are significant. As the technology continues to advance and mature, its widespread adoption will likely reshape the financial landscape, leading to more efficient and inclusive financial systems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)