Table of Contents

Introduction

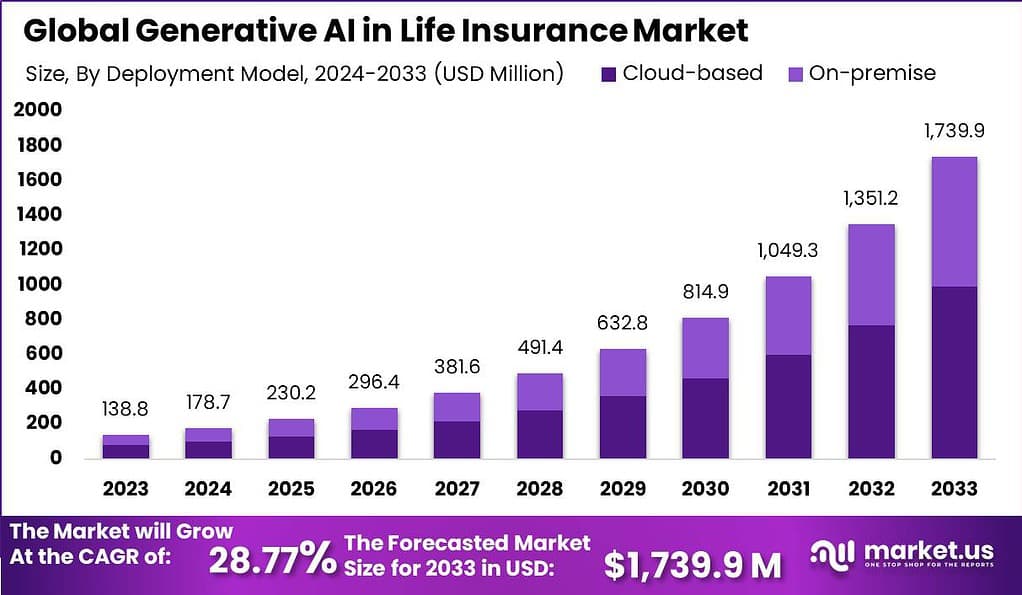

The Generative AI in Life Insurance Market is expected to experience significant growth, increasing from USD 138.8 million in 2023 to approximately USD 1,739.9 million by 2033, reflecting a CAGR of 28.77% over the forecast period from 2024 to 2033. This growth is fueled by several key factors, including rising demand for personalized insurance products, the use of generative AI for accurate risk assessment, and improved actuarial capabilities by life insurance companies. North America is expected to lead this market, thanks to its mature insurance industry, advanced technological infrastructure, and high insurance awareness among the population.

Generative AI uses data from various sources, including customer demographics, medical records, and financial information, to improve predictive modeling and risk assessment. This, in combination with stringent compliance requirements, helps insurers meet privacy laws and anti-discrimination regulations.

Generative AI has a significant impact on underwriting and risk assessment, enabling the creation of more accurate models for pricing and personalization of insurance offerings. This technology also enhances the customer experience through personalized product and service delivery based on deep analysis of customer behavior, preferences, and needs.

Recent developments in the Generative AI in Life Insurance sector have been marked by strategic mergers and acquisitions, underscoring the industry’s rapid evolution and the growing importance of technology integration. For example, Travelers Companies acquired Corvus Insurance for approximately $435 million to enhance its cyber capabilities through strategic partnerships and acquisitions.

Other significant transactions include Howden’s acquisition of Arctic Insurance AS to bolster its presence and offering in the Norwegian market and NFP’s acquisition of Advanced Insurance Consultants Limited to support its expansion strategy and client base in key markets such as London and the South East. These developments indicate a shift towards leveraging advanced technologies, such as generative AI, to enhance underwriting precision, risk management, and overall customer service in the life insurance sector.

Key Takeaways

- The Generative AI in Life Insurance Market is projected to reach a value of USD 1,726.7 million by 2033, with a growth rate of 4.5% during the forecast period.

- Cloud-based solutions accounted for over 70% of the market share in 2023, offering scalability, flexibility, and cost-effectiveness to insurers.

- Natural Language Processing (NLP) technology held a dominant market position in 2023, capturing more than 52% of the market share.

- The Personalized Policy Recommendations segment led the market with over 25% share in 2023, driven by the increasing demand for customized insurance products.

- Life Insurance Companies segment dominated the market, capturing a significant share of more than 30% in 2023.

- North America led the market with a share of over 32% in 2023, attributed to its mature and technologically advanced life insurance industry.

- IBM Corporation, Google LLC, Microsoft Corporation, Salesforce, and Amazon Web Services (AWS) are among the top market leaders in Generative AI in Life Insurance.

Generative AI in Life Insurance Statistics

- 59% of organizations in the insurance sector have already implemented Generative AI, aiming to enhance staff efficiency and productivity by 61%.

- Among the benefits reported, 48% of companies noted improvements in customer service, while 56% achieved cost savings.

- According to Statista, 47% of consumers in the UK and 55% in the US hold favorable opinions regarding Generative AI (GAI or Gen AI).

- Additionally, 44% of consumers are comfortable using insurance chatbots for claims, with 43% preferring them for coverage applications.

- The areas most likely to benefit from Generative AI in insurance include marketing and claims (54%), administration (47%), underwriting (46%), and customer onboarding (43%).

- Streamlining documentation processes could yield efficiency gains of 20-30%.

- The automation of claims appraisals is expected to result in significant cost savings for insurers, particularly in assessor-related expenses.

- Predictions indicate that Generative AI will lead to enhanced customer experiences by offering personalized insurance policies based on individual risk assessments, with virtual assistants providing 24/7 support and handling policy event analysis.

- Advanced risk assessment and pricing facilitated by Generative AI’s data analysis capabilities are expected to lead to more accurate evaluations and rates closely aligned with policyholders’ profiles.

- Claims processing automation enabled by Generative AI is anticipated to streamline adjudication processes, with image recognition and computing capabilities assessing damages from photos and even approving indemnity for straightforward cases without human intervention.

- The integration of Generative AI promises improved risk assessment and underwriting, leading to calibrated premiums and better risk allocation.

- Operational efficiency gains are expected through automation, resulting in a reduction in overall expenses and faster, more responsive insurance services.

- Quick and accurate claims processing facilitated by Generative AI is projected to strengthen customer trust and loyalty through faster application management and precise assessments.

Use Cases

- Underwriting: Generative AI aids underwriters by evaluating potential risks through the analysis of vast amounts of data. This includes historical claims, customer information, and external factors, enabling the generation of risk profiles and recommending appropriate coverage levels.

- Claims Processing and Fraud Detection: The technology streamlines claims processing by automating the assessment of claims documents, extracting relevant information, summarizing claims histories, and identifying potential inconsistencies or fraudulent claims based on patterns in the data.

- Quote and Policy Generation: By automating the creation of insurance quotes, policies, and associated documentation, generative AI reduces manual administrative tasks. It generates these documents based on predefined templates and customer information.

- Customer Support and Engagement: AI-powered chatbots reduce the workload on human agents by providing 24/7 customer support. They offer immediate answers to policy, coverage, and claims questions, and automate personalized communication with policyholders to enhance customer engagement and retention.

- Customer Upsell/Cross-Sell Opportunities: Generative AI can analyze customer data and preferences to recommend tailored insurance products, thereby increasing the likelihood of upselling or cross-selling additional policies.

- Improved Risk Assessment and Underwriting: With generative AI, insurers can more effectively analyze complex threats, resulting in well-calibrated premiums and better risk allocation.

- Operational Efficiency and Cost Savings: Automation introduced by generative AI optimizes processes, leading to significant cost savings and higher productivity.

- Automated Policy Administration: The technology handles routine administrative tasks with high accuracy and consistency, enhancing the client experience.

- Hyper-personalized Engagement: Generative AI personalizes engagement by analyzing individual user data to offer tailored coverage options, fostering a stronger bond with the client base.

Recent Developments

- Deloitte Launches Generative AI Practice: Deloitte announced the formation of a new practice designed to help clients leverage the power of Generative AI and Foundation Models. This initiative aims to enhance productivity and accelerate business innovation, combining Deloitte’s services, AI talent, and deep industry experience.

- Insurance Deal Activity in 2024: The insurance deals market has remained vibrant into the second half of 2023 and is expected to continue in 2024. Over a six-month period from mid-May to mid-November 2023, there were 318 announced insurance transactions valued at over $11.2 billion. This represents an increase from the 298 transactions and $7.7 billion in deal value recorded in the previous six months. Among these, Brookfield Reinsurance’s acquisition of American Equity Investment Life Holding Company stands out with a valuation of $4.3 billion. Additionally, National Western Life Group, Inc. entered a definitive merger agreement with S. USA Life Insurance Company, affiliated with Prosperity Life Group, valuing National Western Life at $1.9 billion.

- Modern Life Introduces Generative AI Product: In August 2023, Modern Life, a tech-forward life insurance brokerage, unveiled a generative AI product tailored for life insurance advisors. The product is designed to simplify complex insurance topics, improve underwriting precision, and facilitate sales concept generation, leveraging proprietary life insurance research and data.

Key Players Analysis

- IBM is heavily involved in the field of Generative AI within the life insurance sector. They are actively working towards enhancing digital transformation and core modernization of insurance processes by integrating generative AI. This approach aims to improve productivity, streamline operations, and offer better customer experiences by leveraging AI in various capacities, including DevOps productivity, AIOps, and cognitive process automation. IBM highlights the potential of generative AI to modernize the insurance industry’s infrastructure, making operations more efficient and customer-centric.

- Microsoft is deeply committed to applying generative AI to revolutionize the life insurance sector. They focus on enhancing customer experiences, driving efficiencies in corporate functions, and creating co-pilots for various insurance life cycle phases. Their work underscores the potential of generative AI to transform business operations, customer engagement, and product innovation within the insurance industry.

- Salesforce, in collaboration with Accenture, aims to expedite the adoption of generative AI in CRM, including the life insurance sector. This partnership focuses on creating an acceleration hub to scale Einstein GPT for enhancing productivity and customer experiences. This initiative underscores the transformative impact of generative AI, emphasizing personalized customer interactions and operational efficiencies.

- Amazon Web Services (AWS) is reimagining the insurance sector, including life insurance, by modernizing core systems to enhance operational efficiency and agility. AWS empowers insurers to reduce costs, quicken the launch of new products, and utilize data for automating and personalizing experiences.

- Cognizant is leveraging generative AI to transform the life insurance sector by enhancing decision-making processes, optimizing customer experiences, and streamlining operations. Their offerings include AI-powered conversational assistants, knowledge management tools, and AI-driven automation for process optimization. This integration aims to boost efficiency, customer satisfaction, and innovation in the life insurance industry.

- Accenture is embracing generative AI to transform the life insurance sector by innovating securely, responsibly, and sustainably. Their approach emphasizes a value-led strategy across the enterprise value chain, aiming for efficiency and strategic advantages. They advocate for a strong, secure digital core, investing in talent development, and establishing responsible AI principles to manage risks effectively. This comprehensive strategy positions Accenture to drive business optimization and innovation through generative AI.

- Intel is committed to supporting all AI models, including generative AI, with a focus on responsible use and development. They aim to create AI that not only enhances efficiency and creativity but also considers ethical implications, emphasizing the importance of human oversight in the development process.

- Palantir Technologies enhances its offerings in artificial intelligence and machine learning, with the aim of delivering high-performance models through continuous data streams. Their technology, known for its adaptability and efficiency, is designed to expedite outcome delivery, suggesting a potential to revolutionize operations in sectors like life insurance through improved data analysis and decision-making processes.

Conclusion

The Life Insurance Market powered by Generative AI is currently at a pivotal point, thanks to technological advancements and digital innovation. Despite facing challenges such as cost and integration complexities, there are unprecedented opportunities to enhance customer engagement, operational efficiency, and market reach. As the industry adapts to this changing landscape, the focus on leveraging cloud-based solutions, NLP, and personalized policy offerings will be crucial in sustaining growth and competitiveness in the future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)