Table of Contents

Introduction

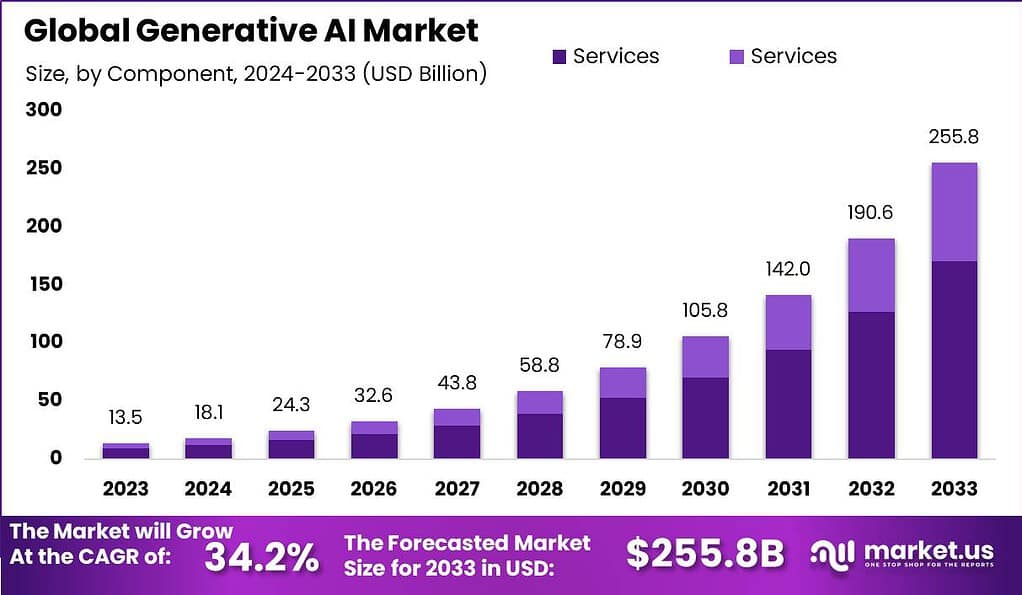

The global Generative AI Market is anticipated to experience remarkable growth, reaching an estimated value of USD 255.8 Billion by 2033, with a robust CAGR of 34.2% throughout the forecast period from 2024 to 2033. This significant expansion is fueled by the increasing adoption of generative AI technologies across various industries worldwide.

The increasing demand to modernize workflows is a primary catalyst propelling the demand for Generative AI applications. The evolution of AI and deep learning technologies, coupled with the rise of creative applications and content creation, are pivotal in driving market growth. Furthermore, innovations in cloud storage, facilitating easy data access, and the introduction of AI-powered gaming that offers enhanced visuals, interactivity, and realism are expected to contribute significantly to the market’s expansion in the forthcoming years.

Generative AI Statistics

- The Generative AI market is estimated to reach a value of USD 255.8 billion by 2033.

- This projection reflects a significant growth rate of 34.2% throughout the forecast period.

- In 2023, the market size stood at USD 13.5 billion, indicating substantial growth potential.

- Generative AI, also known as generative adversarial networks (GANs), focuses on creating new data samples resembling a given training dataset.

- Unlike traditional AI models, generative AI learns to generate new content by leveraging deep learning algorithms.

- The global generative AI market encompasses the development and utilization of AI systems capable of producing original outputs such as music, art, and literature.

- Applications span across sectors including entertainment, advertising, education, and gaming.

- Forbes projects a market value growth of US$180 billion for generative AI over the next eight years.

- A study by renowned professors suggests that generative AI can boost employee productivity by up to 40%.

- Generative AI adoption could increase US labor productivity by 0.5 to 0.9% points annually through 2030.

- The banking sector is expected to benefit significantly from generative AI tools, with estimated annual value addition ranging from US$200 billion to US$340 billion.

- Total funding in generative AI startups is projected to reach US$6 billion in 2023.

- The number of downloads of generative AI tools is expected to surpass 10.1 million by mid-2023.

- In 2023, the software segment dominated the generative AI market, capturing 66.7% of revenue.

- Transformer technology held the largest revenue share at 45.1% and is projected to grow at a CAGR of 32.2%.

- Large language models led the model segment and are expected to grow significantly.

- Computer vision anticipates the fastest CAGR due to expanded applications in transportation and surveillance.

- North America remained the leading segment with a market share of 42.1%.

- The Media & Entertainment sector dominated among end-users, with a market share of 24.3%.

- NLP led the market when classified by applications in 2023 and is projected to sustain growth.

- North America is leading the generative AI market, followed by the Asia Pacific region.

- IBM Corporation, Genie AI Ltd., and MOSTLY AI Inc. are among the top players in the generative AI market.

Key Analysis

The COVID-19 pandemic has had a notably positive impact on the Generative AI market. Many organizations, in response to the pandemic, accelerated their adoption of AI & Machine Learning (ML), with industry giants such as Microsoft, IBM, Google LLC, and Amazon Web Services, Inc. reporting increased sales of AI-based technology during this period. Notably, in June 2020, Amazon Web Services, Inc. expanded its AWS DeepComposer suite with the addition of the Autoregressive Convolutional Neural Network (AR-CNN), a new generative AI algorithm designed to enhance digital music creation.

In a significant development, Microsoft Corporation introduced Microsoft 365 Copilot in March 2023. This AI assistant feature for Microsoft 365 services and applications is set to revolutionize business operations by saving time, automating IT processes, and boosting productivity. The market is also witnessing advancements in technologies for improved image resolution, face aging, and video resolution, with companies like Tesla leading the way in developing autonomous algorithms for object detection and semantic segmentation.

The North American region, buoyed by the presence of tech behemoths and their investments in generative AI startups and technology, is anticipated to drive substantial market growth. Similarly, the Asia Pacific region is expected to register a considerable CAGR from 2024 to 2030, propelled by the expansion of end-user industries in countries like China and Japan.

The generative AI market’s projected growth to USD 255.8 billion by 2033 reflects the technology’s capacity to automate and enrich creative processes across sectors such as entertainment, advertising, education, and gaming. This growth is not only a testament to generative AI’s ability to drive innovation and efficiency but also highlights the immense investment opportunities within this burgeoning market. According to research from leading institutions, generative AI could enhance employee productivity by up to 40%, indicating its potential to revolutionize industries by fostering efficiency gains and innovative advancements. In the banking sector alone, generative AI tools are expected to add annual value ranging between $200 billion to $340 billion, marking a significant shift in operations, customer interactions, and risk assessments.

Recent Developments

- AI High Performers and Generative AI Use: Organizations recognized as AI high performers, where at least 20% of EBIT in 2022 was attributable to AI use, are leading in the adoption of Gen AI. These organizations are leveraging Gen AI in a broader range of business functions compared to others, especially in product and service development, risk, and supply chain management. A McKinsey survey highlights that these high performers are more likely to use AI to create new businesses or sources of revenue, rather than for cost reduction.

- Investment in AI Technologies: High-performing organizations invest significantly more in AI technologies, with respondents indicating they spend more than 20% of their digital budgets on AI. These companies are adopting AI in four or more business functions and embedding a higher number of AI capabilities, indicating a broader and more intensive use of AI technologies across their operations.

- Developer Productivity with Generative AI: A study involving 40 of McKinsey’s developers testing generative AI-based tools revealed notable efficiency improvements. Tasks like documenting code functionality, writing new code, and code refactoring saw task completion times reduced by up to 50%, nearly 50%, and two-thirds, respectively. These tools not only increased productivity but also significantly enhanced developers’ work satisfaction, with users reporting greater happiness, fulfillment, and a state of flow.

- Rapid Adoption and Talent Demand: A survey showed that a vast majority of workers across various industries have tried Gen AI tools, indicating rapid adoption within less than a year. Despite this widespread usage, there remains a substantial demand for more Gen AI-literate employees. Organizations are facing a challenge in filling the gap between the supply and demand for skilled workers in this domain.

- Job Market Growth: The technology trends outlook for 2023 noted a 400,000 increase in job postings related to tech trends between 2021 and 2022, with generative AI experiencing the fastest growth. This points to a burgeoning job market and the critical need for talent capable of working with advanced AI technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)