Table of Contents

Introduction

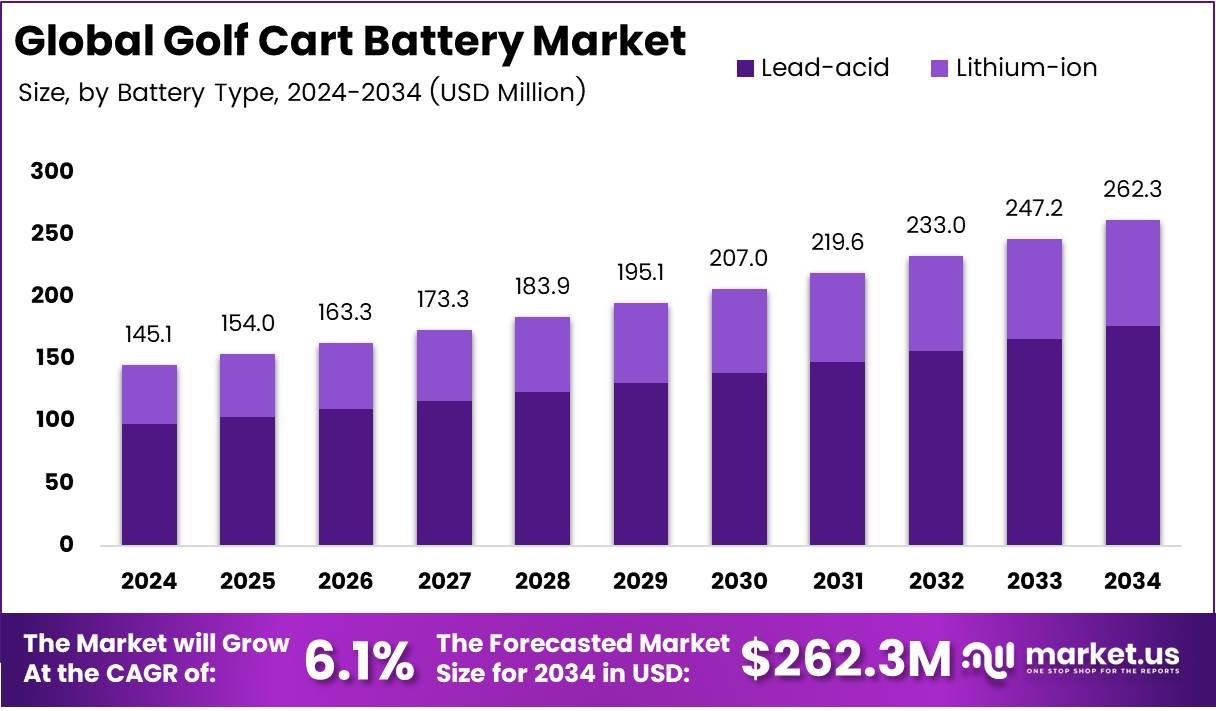

The Global Golf Cart Battery Market is projected to reach USD 262.3 Million by 2034 from USD 145.1 Million in 2024, expanding at a CAGR of 6.1% from 2025 to 2034. The market continues to evolve as electric mobility gains traction across golf courses, resorts, and gated communities worldwide.

Driven by the shift toward sustainable transport, advancements in lithium-ion and sealed lead-acid batteries have improved performance, charging speed, and longevity. Manufacturers are leveraging these innovations to meet demand for low-maintenance and eco-friendly power solutions, aligning with global sustainability goals.

Moreover, the surge in golf tourism and residential electrification is strengthening market adoption. Government incentives for electric mobility and battery recycling initiatives further accelerate the replacement and upgrade cycles for golf cart batteries.

Key Takeaways

- Global Golf Cart Battery Market projected to reach USD 262.3 Million by 2034 from USD 145.1 Million in 2024, at a CAGR of 6.1% (2025–2034).

- Lead-acid batteries dominate By Battery Type with 67.3% share in 2024, due to low cost, reliability, and compatibility.

- 12V batteries lead By Voltage with 38.7% share in 2024, offering versatility, availability, and affordability.

- Golf Courses dominate By End User with 67.9% share in 2024, driven by large fleet operational needs.

- OEM sales channel leads By Sales Channel with 67.2% share in 2024, ensuring compatibility and performance via direct manufacturer supply.

- Asia Pacific holds the largest regional share at 44.8% (USD 65.0 Million in 2024), fueled by urbanization, tourism, and sustainable transport initiatives.

Market Segmentation Overview

By Battery Type: Lead-acid batteries hold a 67.3% share, supported by low cost, widespread availability, and established recycling networks. Lithium-ion variants are rising steadily, especially in premium courses seeking longer lifespans and faster charging capabilities.

By Voltage: The 12V segment leads with 38.7% share, driven by its compatibility across diverse cart models. 6V and 8V batteries follow for extended performance or range-specific configurations, maintaining flexibility for operators.

By End User: Golf Courses dominate with 67.9% share, emphasizing large fleet management and consistent replacement cycles. Resorts and gated communities are emerging as secondary adopters due to growing eco-mobility trends.

By Sales Channel: The OEM segment leads with 67.2% share, offering direct manufacturer integration and enhanced warranty assurance. The aftermarket continues to grow, providing cost-effective replacement and upgrade options.

Drivers

Rising Adoption of Lithium-Ion Batteries for Enhanced Performance: Lithium-ion technology is transforming the golf cart battery market, offering superior charge retention, faster recharge rates, and extended lifecycles. As sustainability becomes a core purchasing factor, operators are investing in longer-lasting, maintenance-free battery systems.

Integration of Smart Battery Management Systems (BMS): Modern golf carts now feature advanced BMS technology that monitors battery health, optimizes charging cycles, and prevents overcharging or deep discharging. This innovation enhances fleet efficiency and minimizes downtime, ensuring operational continuity.

Use Cases

Golf Course Fleet Operations: Golf courses represent the largest user base, requiring dependable battery performance for player transportation and equipment movement. Consistent replacement cycles ensure uninterrupted service during high-traffic periods, particularly in global golf hubs.

Commercial and Community Mobility: Electric carts are widely deployed in resorts, airports, hospitals, and gated residential complexes. Their quiet operation, low emissions, and energy efficiency make them ideal for short-range transport and sustainability-focused environments.

Major Challenges

High Initial Cost of Advanced Batteries: The upfront expense of lithium-ion systems restricts adoption, particularly in developing regions and smaller clubs. Despite lower lifecycle costs, budget constraints drive many buyers toward conventional lead-acid models.

Limited Charging Infrastructure in Emerging Markets: Many golf destinations lack adequate fast-charging setups. This infrastructure gap delays the widespread adoption of high-capacity lithium systems, especially in off-grid and resort areas.

Business Opportunities

Development of Solar-Powered Charging Solutions: Solar integration offers a promising path to sustainability and cost savings. Courses and resorts investing in renewable charging infrastructure can reduce grid dependency and operating costs while promoting green credentials.

Expansion into Non-Golf Applications: Beyond golf, the use of electric carts in industrial logistics, campus mobility, and hospitality sectors presents fresh growth potential. Manufacturers offering customizable battery configurations can capture this expanding demand.

Regional Analysis

Asia Pacific: Dominating with 44.8% market share (USD 65.0 Million), the region benefits from rapid tourism growth, urbanization, and rising golf course development in China, Japan, and India. Government initiatives supporting electric transport amplify adoption across commercial and recreational facilities.

North America: With over 545 Million golf rounds annually in the U.S., fleet replacement and battery upgrades remain consistent. Established OEMs, strong consumer spending, and preference for sustainable transport keep North America a key contributor to global market growth.

Recent Developments

- Aug 2024: Neuron Energy raised ₹200 Million to expand EV battery production and R&D for next-generation sustainable technologies.

- Oct 2024: Khon Kaen University unveiled sodium-ion battery-powered golf carts at Srinagarind Hospital, marking a step toward low-cost eco-mobility.

- Jan 2025: Motive Energy acquired Deep Cycle Battery San Diego to strengthen its service and distribution network in Southern California.

- Mar 2025: Yamaha introduced new electric golf carts using LFP battery technology, enhancing safety, energy density, and lifecycle performance.

- Jul 2025: Bolt Energy USA launched a 48V 60Ah lithium battery for commercial EV and golf cart applications, offering improved efficiency and runtime.

Conclusion

The Global Golf Cart Battery Market continues to evolve with rapid technological advancement, eco-friendly innovation, and government-backed sustainability initiatives. While lead-acid batteries retain dominance due to affordability, the ongoing shift toward lithium-ion and solar-powered systems signals a more efficient future.

Manufacturers emphasizing recyclability, smart energy management, and cross-sector applications are poised for long-term success. As golf tourism, luxury resorts, and community electrification expand globally, the market’s consistent growth trajectory through 2034 underscores its strong potential in the broader electric mobility ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)