Table of Contents

Introduction

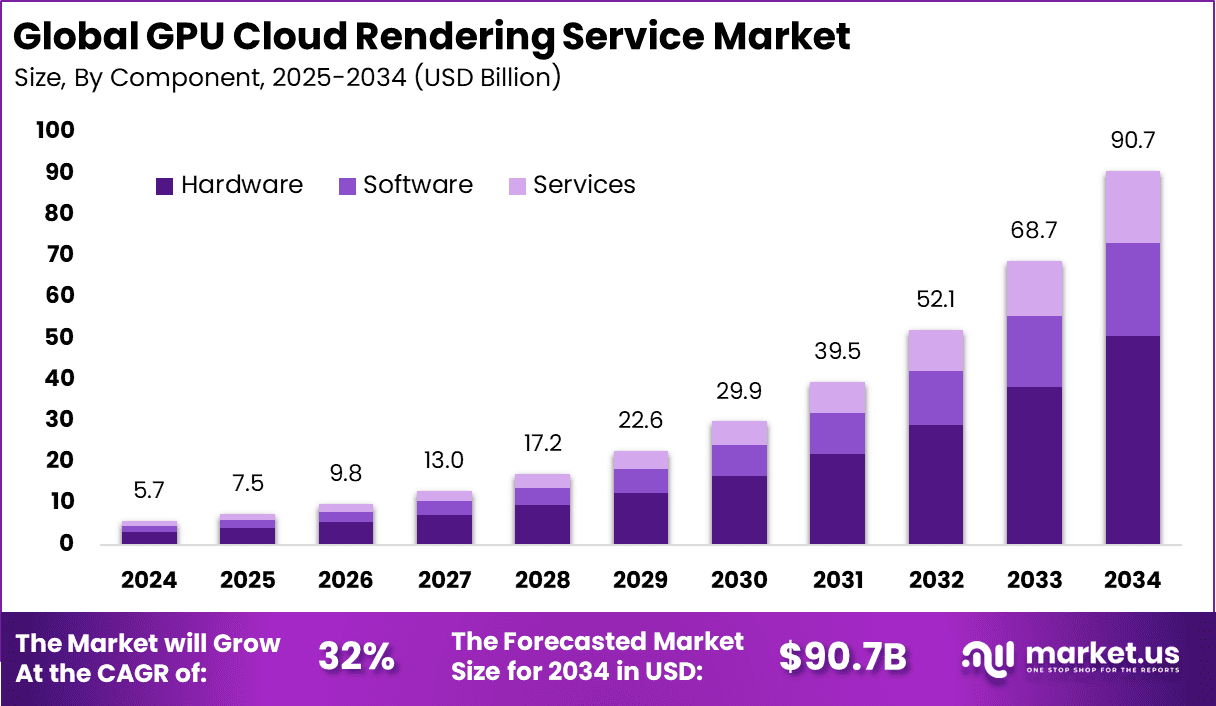

The Global GPU Cloud Rendering Service Market was valued at USD 5.7 billion in 2024 and is expected to grow from USD 7.5 billion in 2025 to approximately USD 90.7 billion by 2034, reflecting an impressive CAGR of 32% over the forecast period. In 2024, North America dominated the global landscape, accounting for over 34.4% of market share with USD 1.9 billion in revenue. This growth is primarily driven by the surge in demand for real-time rendering, VFX production, AI training, metaverse development, and high-performance computing across diverse industries such as media & entertainment, architecture, gaming, and healthcare.

How Growth is Impacting the Economy

The GPU cloud rendering service market is fueling significant economic momentum by accelerating innovation in digital content creation and data-intensive computing. By enabling cost-effective access to powerful GPU infrastructure, it reduces capital expenditure for animation studios, gaming developers, and scientific institutions.

This democratization of rendering capacity is catalyzing creativity and enhancing productivity, particularly in small and mid-sized enterprises. The growing ecosystem also stimulates job creation across cloud management, 3D modeling, simulation design, and AI R&D roles. Moreover, the market contributes to the growth of data center construction, edge computing deployment, and green cloud initiatives, directly impacting IT spending and digital transformation across economies.

➤ Unlock growth! Get your sample now! – https://market.us/report/gpu-cloud-rendering-service-market/free-sample/

Impact on Global Businesses

For businesses, GPU cloud rendering services offer flexibility, scalability, and reduced time-to-market. Studios can now render complex visual effects, architectural visualizations, or product designs in hours instead of days. Businesses in sectors like e-commerce and automotive are integrating GPU rendering into AR/VR-based marketing strategies. However, increased GPU demand has led to hardware shortages and higher service costs in some regions. Additionally, data security, latency, and regulatory concerns influence deployment strategies. As a result, companies are exploring hybrid cloud architectures, rendering zones closer to data sources, and encryption for sensitive workloads to ensure compliance and performance.

Strategies for Businesses

Businesses are adopting several strategies to optimize GPU rendering operations. These include leveraging pay-as-you-go cloud pricing models to scale based on project demands, integrating GPU rendering APIs into design workflows, and utilizing AI to predict and optimize rendering time. Partnerships with hyperscalers and CDN providers are enhancing content delivery speeds globally. For competitive advantage, companies are investing in containerized workloads and automation pipelines (CI/CD) for 3D rendering. Data residency requirements are being addressed through multi-region deployments and sovereign cloud options. Additionally, firms are prioritizing carbon-efficient rendering by selecting providers with green data center certifications.

Key Takeaways

- Market to grow from USD 7.5B (2025) to USD 90.7B (2034) at 32% CAGR

- North America led in 2024 with USD 1.9B revenue and 34.4% market share

- Media & entertainment, gaming, and AR/VR sectors driving growth

- Pay-as-you-go and containerized GPU workflows gaining traction

- Green rendering and latency-optimized cloud regions emerging as differentiators

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=160168

Analyst Viewpoint

The GPU cloud rendering market is transitioning from a niche service to a critical infrastructure layer for real-time 3D content and compute-intensive tasks. Presently, the demand is strongest in entertainment, digital twins, and simulation-heavy sectors. As AI and immersive technologies proliferate, the need for flexible, cost-efficient GPU rendering will grow exponentially. The future of this market lies in decentralized GPU networks, edge-enabled rendering, and integration with next-gen creative platforms. Providers that offer speed, cost efficiency, and compliance will dominate as rendering becomes central to innovation across industries.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| VFX and Animation Studios | High-resolution rendering, deadline-driven projects, real-time collaboration |

| Architecture & Engineering | Photorealistic 3D visualization, BIM modeling, interactive design reviews |

| Gaming & Metaverse Development | Real-time ray tracing, asset scalability, global game streaming |

| Medical Imaging & Simulation | High-fidelity rendering, AI-assisted diagnostics, remote training tools |

| E-commerce AR/VR | Interactive product modeling, dynamic content rendering, immersive UX |

Regional Analysis

North America led the GPU cloud rendering market in 2024 with a 34.4% share and USD 1.9 billion in revenue. This leadership is supported by the presence of major cloud providers, strong media and entertainment demand, and advanced R&D in AI. Europe follows, driven by increased adoption of GPU workloads in automotive design, visual effects, and product engineering—especially in Germany, France, and the UK. Asia Pacific is the fastest-growing region, with China, Japan, and South Korea investing heavily in 3D content creation, gaming, and virtual experiences. The Middle East and Latin America are emerging with growth opportunities tied to urban visualization, edtech, and online retail.

Business Opportunities

The GPU cloud rendering ecosystem offers diverse opportunities for software vendors, infrastructure providers, rendering platform startups, and system integrators. SaaS-based rendering tools tailored for SMEs, plug-ins for popular 3D software, and GPU optimization services are in demand. Regional data centers optimized for rendering latency, especially in gaming hubs, can attract localized clientele. Offering GPU-as-a-Service (GPUaaS) with vertical-specific SLAs is a growing opportunity. There’s also a gap in the market for carbon-neutral rendering platforms, which can appeal to sustainability-conscious brands. Emerging markets represent new growth territories for lightweight GPU workloads and mobile-first creative tools.

Key Segmentation

The market is segmented by rendering type, deployment model, end-user, application, and region. Rendering types include real-time rendering and non-real-time (offline) rendering, with the former growing rapidly due to AR/VR and gaming use. Deployment models cover public cloud, private cloud, and hybrid infrastructure. Applications span VFX, animation, architecture, gaming, simulations, and virtual reality. End-users include media & entertainment studios, game developers, architects, product designers, and scientific institutions. Public cloud dominates the segment due to flexibility, while hybrid deployments are gaining popularity for balancing cost, performance, and compliance.

Key Player Analysis

Leading providers are innovating through high-speed rendering engines, support for popular 3D tools, and integration with collaborative platforms like Autodesk, Blender, and Unreal Engine. Many are partnering with GPU chipmakers to ensure compatibility with the latest hardware. Companies are investing in AI-based render time prediction, rendering orchestration tools, and GPU workload optimization. Providers are also expanding geographically with rendering-specific zones to reduce latency and enable multi-region failover. Differentiation lies in pricing flexibility, ease of API integration, and sustainability commitments, as well as customer support for complex rendering pipelines.

Top Key Players in the Market

- NVIDIA Corporation

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform

- Autodesk Inc.

- Siemens AG

- Renderro

- Radeon ProRender (AMD)

- Alibaba Cloud

- IBM Cloud

- CoreWeave

- iRender

- Vast.ai

- Zync Render (Google)

- RebusFarm

- GarageFarm.NET

- TurboRender

- SheepIt Render Farm

- Fox Renderfarm

- GridMarkets

- Other Major Players

Recent Developments

- In April 2025, a cloud provider launched an on-demand real-time ray tracing service for VFX creators

- In June 2025, a startup unveiled a decentralized GPU rendering platform for indie game developers

- In March 2025, a GPUaaS vendor partnered with a major chipmaker to release AI-enhanced rendering nodes

- In February 2025, a global architecture firm adopted cloud rendering for virtual building walkthroughs

- In January 2025, a carbon-neutral rendering zone was launched in Northern Europe by a hyperscaler

Conclusion

GPU cloud rendering services are revolutionizing how digital content is created, rendered, and delivered. With strong demand across entertainment, design, healthcare, and simulation, the market is set for rapid expansion. As rendering shifts toward real-time, decentralized, and intelligent platforms, service providers that prioritize speed, security, sustainability, and developer experience will lead the next phase of growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)