Table of Contents

Handheld POS Market Size

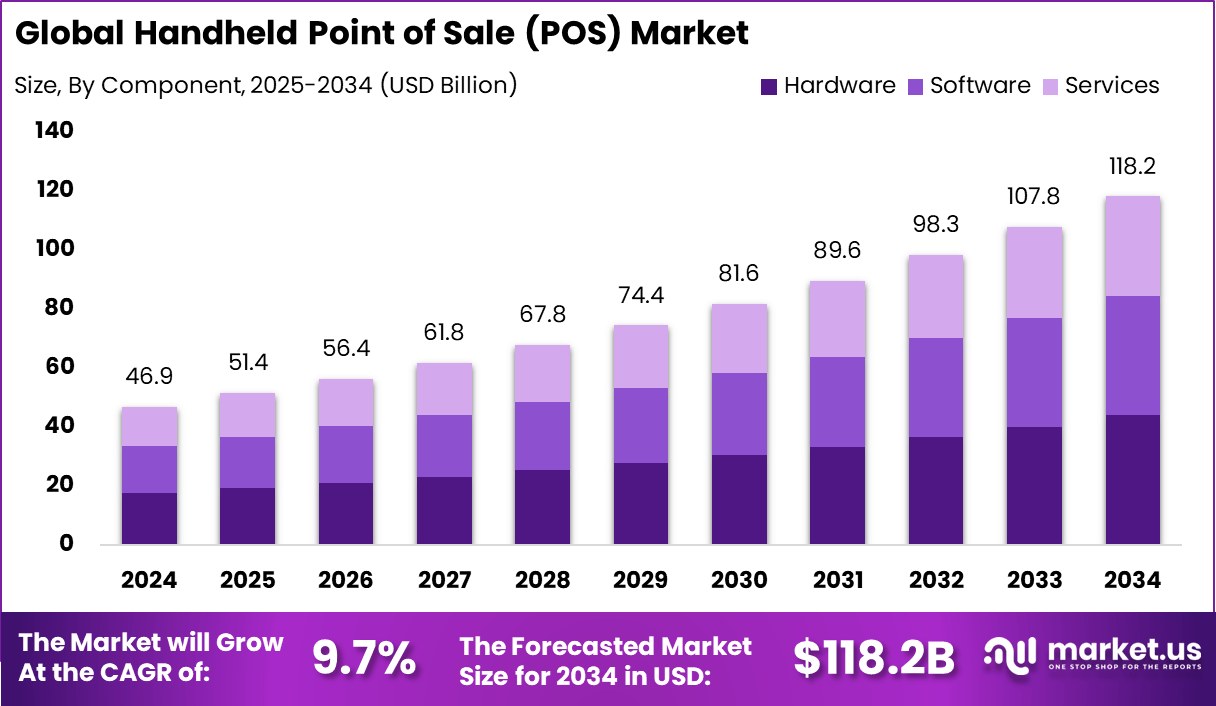

According to Market.us, The Global Handheld Point of Sale (POS) Market is projected to reach USD 118.2 billion by 2034, up from USD 46.85 billion in 2024, reflecting a CAGR of 9.7% between 2025 and 2034. In 2024, North America led the market with over 41% share, generating approximately USD 19.2 billion in revenue.

Key insight summary

- Hardware components hold 37.2%, driven by demand for handheld terminals, scanners, and mobile POS devices.

- Hospitality industry leads with 46%, as hotels, restaurants, and travel services embrace mobile payment solutions.

- North America accounts for 41%, supported by strong payment infrastructure and a shift toward cashless transactions.

- The US market reached USD 17.6 billion and is growing at a CAGR of 7.3%, fueled by digital payment adoption and rapid expansion in retail and hospitality.

Market Overview

The Handheld Point of Sale (POS) market is centered on mobile devices that facilitate sales transactions anywhere in retail, hospitality, or field services. These portable systems integrate payment card readers, barcode scanners, printers, and wireless connectivity options such as Wi-Fi, Bluetooth, and cellular networks. The shift towards cashless and digital payments has driven businesses to adopt handheld POS for faster, more convenient customer interactions. The appeal lies in enabling staff to process sales on-site, whether at a restaurant table or a retail aisle, which improves service speed and customer satisfaction.

Top driving factors shaping this market include the rising consumer preference for contactless payments and mobile wallets. The pandemic accelerated this trend, creating demand for touchless transaction options to enhance hygiene and speed. Retail and hospitality sectors prioritize mobile payment solutions to reduce wait times and improve service flow. The rapid urbanization and smartphone penetration in regions like Asia Pacific contribute significantly, where handheld POS commands a substantial revenue share.

Analysts’ Viewpoint

Demand analysis shows sustained growth fueled by the need for efficient transaction processing, real-time inventory tracking, and personalized customer engagement. Handheld POS devices support instant stock updates, sales analytics, and customer profiling, empowering businesses with actionable insights. Mobile POS enhances staff productivity by reducing the need to return to a fixed checkout, enabling quicker service and increasing throughput, particularly in high-traffic environments like quick-service restaurants or pop-up retail events.

Approximately 73% of retailers using AI-powered POS report faster decision-making and improved automation, showing demand for integrated smart functionalities is rising. Technologies increasing adoption of handheld POS include AI and cloud-based platforms. AI-driven features like personalized marketing, fraud detection, and upselling at the point of sale are becoming common. Cloud POS enables businesses to access their systems remotely, offering scalability and low upfront cost.

Android-based handheld devices are favored for their compatibility with diverse applications and ease of integration with CRM and loyalty programs. The prevalence of 4G, 5G, and Wi-Fi connectivity improves device performance and reliability. These technologies make handheld POS more attractive and accessible, especially for small and medium-sized enterprises (SMEs). Key reasons for adopting handheld POS systems include improving customer experience, increasing staff efficiency, and accessing real-time business intelligence.

Mobility lets staff serve customers anywhere, significantly reducing checkout lines and wait times. Businesses gain deeper insights into sales patterns and inventory needs through data analytics, enabling smarter stock management and targeted marketing. Enhanced payment security features, including biometric authentication and PCI-compliant encryption, build consumer trust and reduce fraud risk. Smaller enterprises benefit from flexible pricing models and cloud deployment, allowing easier entry and scaling without heavy capital expenditure.

Investment and business benefits

Investment opportunities in handheld POS are robust due to growing digital payment adoption and SME growth, particularly in rapidly digitizing regions like Asia Pacific. Investors focus on developing AI-powered and wireless devices that integrate seamlessly with backend platforms, as well as cloud-based and subscription models reducing entry barriers. Expanding payment options to include cryptocurrency and multi-currency support also opens new market niches. The integration of generative AI in POS systems presents a novel investment avenue, helping retailers automate marketing, personalize experiences, and enhance fraud prevention. Companies offering customizable solutions for diverse industries stand to benefit most.

The business benefits of handheld POS extend beyond transaction speed to include improved operational flexibility, enhanced customer satisfaction, and optimized inventory management. By allowing sales from anywhere on-site, businesses can cater better to customer needs and boost loyalty through real-time CRM integration. Analytical insights from POS data help refine product offerings and marketing strategies. Cost savings arise from reduced checkout staffing needs and streamlined delivery logistics, with evidence of around a 23% reduction in delivery costs when paired with mobile POS. Security features in new devices help maintain compliance and protect brand reputation.

The regulatory environment for handheld POS focuses primarily on data security, consumer protection, and financial compliance. Strict standards like PCI-DSS mandate encryption and secure handling of payment data, adding complexity and cost for device manufacturers and users. Different regions impose varying rules on data privacy, such as GDPR in Europe and other local mandates, requiring businesses to stay vigilant about compliance. Emerging frameworks by regulators like the RBI introduce licensing and oversight to ensure safe operation and consumer trust. Legal guidelines also emphasize Know Your Customer (KYC) practices and secure fund settlement processes to prevent fraud and misuse.

Emerging trends

Emerging trends in handheld POS include a strong shift toward wireless devices which held a 50% market share in 2025, giving merchants the flexibility to accept payments anywhere on site. Android-based systems dominate with about 60% market share due to their compatibility and openness.

Sectors like restaurants have adopted handheld POS heavily, representing 18% of applications, using features like mobile ordering and contactless payments to improve speed and customer experience. AI-driven enhancements such as dynamic upselling, real-time inventory alerts, and advanced sales analytics are gaining traction as well.

Growth factors

Growth factors for handheld POS adoption are diverse, but the increasing demand for mobility, contactless payments, and cloud integration are key contributors. Hardware innovations like longer battery life, multi-layered security, and NFC support help businesses operate more efficiently. In fast-growing regions like Asia-Pacific, smartphone penetration and electronic payment usage are expanding at a rate of roughly 12% annually, pushing the demand even higher. Retailers benefit from faster checkout times and better floor engagement, improving customer satisfaction.

POS Market Segments

By Component

- Hardware

- Smartphones & Tablets

- Dedicated Handheld Terminals

- Card Reader Accessories

- Software

- On-Premise

- Cloud-Based

- Services

- Payment Processing Services

- Subscription & Support Services

End-User Industry

- Retail

- Specialty Stores (Apparel, Electronics)

- Supermarkets/Hypermarkets

- Convenience Stores

- Hospitality

- Restaurants & Cafés

- Food Trucks & Quick-Service Restaurants (QSR)

- Hotels & Resorts

- Entertainment & Events

- Stadiums & Arenas

- Museums & Theaters

- Festivals & Pop-up Events

- Healthcare

- Transportation & Logistics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Top Key Players

- Ingenico SA (Worldline)

- VeriFone Systems Inc.

- PAX Technology Ltd.

- NCR Corporation

- Diebold Nixdorf Inc.

- Toshiba Global Commerce Solutions

- HP Inc.

- Panasonic Corporation

- Fujitsu Ltd.

- Samsung Electronics Co. Ltd.

- Newland Payment Technology

- BBPOS Ltd.

- Square Inc. (Block)

- Fiserv Inc. (Clover)

- Lightspeed Commerce Inc.

- Shopify Inc. (Shopify POS)

- Toast Inc.

- Revel Systems Inc.

- Oracle Corporation (MICROS)

- Agilysys Inc.

- Aptos Inc.

- GK Software SE

- NEC Corporation

- Other Key Players

In summary, the handheld POS market is driven by strong demand for mobility, efficiency, and secure digital payments. Continuous advancements in AI, cloud computing, and wireless communication enrich the capabilities of these devices, making them indispensable for modern retail and hospitality operations. Strategic investments into innovative technologies and compliance adherence are key to capturing growth opportunities.

Businesses adopting handheld POS enjoy operational agility, enhanced customer experiences, and valuable insights for decision-making, solidifying their competitiveness in an evolving payment landscape. The combination of rising digital transactions and evolving consumer expectations ensures ongoing expansion and innovation within this market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)