Table of Contents

Overview

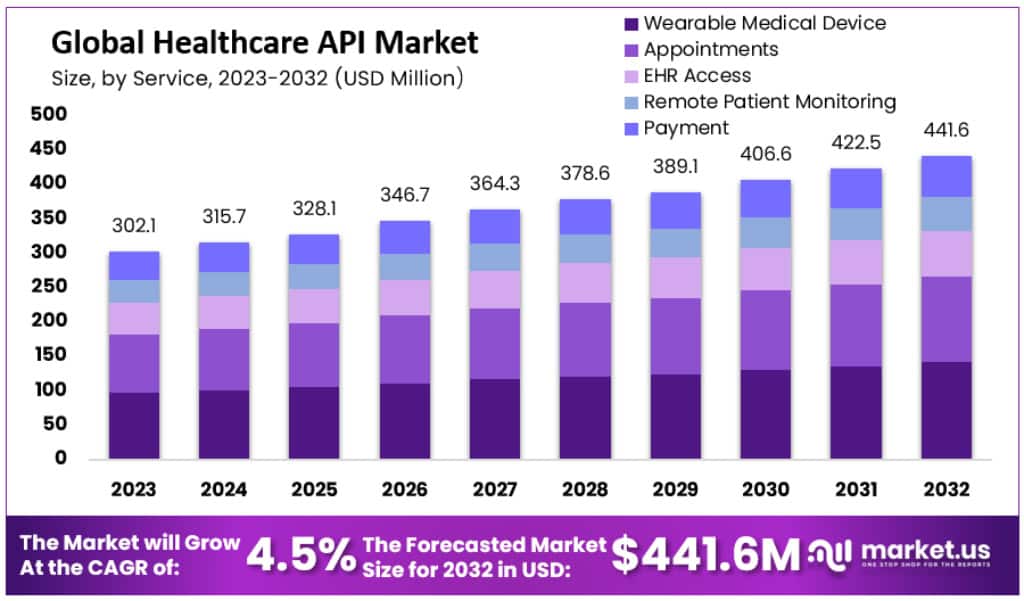

The Global Healthcare API Market is expected to grow significantly, reaching USD 441.6 million by 2032, up from USD 302.1 million in 2023. This growth, driven by a CAGR of 4.5%, is largely attributed to the increasing adoption of digital health solutions, enhanced interoperability, and improved patient care. Key drivers behind this market expansion include regulatory support, advancements in digital infrastructure, and integration with emerging technologies like AI and IoT.

Regulatory initiatives have played a key role in the expansion of healthcare APIs. For example, in the United States, the Centers for Medicare & Medicaid Services (CMS) has implemented the Interoperability and Patient Access Final Rule. This regulation mandates that Medicare Advantage plans provide access to health information via APIs, promoting seamless data exchange between healthcare providers, payers, and patients. The Office of the National Coordinator for Health Information Technology (ONC) also supports the adoption of Fast Healthcare Interoperability Resources (FHIR), a standardized format for secure data exchange across health systems.

The rapid development of digital health infrastructure is another major driver. In India, the Ayushman Bharat Digital Mission (ABDM) aims to create a unified digital health ecosystem by linking various healthcare stakeholders through interoperable systems. This initiative, among others globally, is accelerating the adoption of healthcare APIs to enable more efficient data management and exchange. As digital health solutions become more widespread, healthcare APIs are essential in improving both operational efficiency and patient care.

Moreover, the integration of emerging technologies like artificial intelligence (AI) and the Internet of Things (IoT) is transforming healthcare. Platforms such as Eka Care, which utilize AI to digitize and manage health data, are benefiting from API-enabled interoperability. By facilitating secure, real-time data exchange, these technologies enhance accessibility, improve decision-making, and streamline healthcare workflows. This integration boosts both the efficiency and quality of care, benefiting healthcare providers and patients alike.

The focus on data security and privacy remains paramount in the healthcare API sector. With the increasing digitization of health records, robust security measures are critical to maintaining patient trust and regulatory compliance. Guidelines set by the U.S. Department of Health and Human Services (HHS) outline strict security protocols for API data exchanges. This focus on secure data transmission is essential to ensure that sensitive patient information remains protected while supporting the transition to more efficient, patient-centered healthcare systems.

The healthcare API market is poised for continued growth, driven by regulatory support, digital infrastructure advancements, emerging technologies, and a focus on data security. These factors are transforming healthcare delivery by improving efficiency, accessibility, and patient outcomes.

Key Takeaways

- The Global Healthcare API Market is expected to reach approximately USD 441.6 Million by 2032, growing from USD 302.1 Million in 2023.

- The market is projected to experience a Compound Annual Growth Rate (CAGR) of 4.5% from 2023 to 2033.

- In 2023, Electronic Health Records (EHR) access represented more than 32% of the total healthcare API market share.

- Cloud-based deployment models were the dominant choice in 2023, accounting for over 71% of the market share.

- North America holds the largest share of the Healthcare API Market, contributing 36.4% with USD 109.9 Million in 2023.

- Healthcare providers led the healthcare API segment in 2023, commanding over 47% of the market share.

Regional Analysis

North America’s Market Dominance

North America is the leading region in the Healthcare API market, capturing 36.4% of the global share with USD 109.9 million in 2023. This dominance can be attributed to high digital literacy and a well-established healthcare infrastructure. Integrated patient Electronic Health Records (EHRs) have enhanced the use of APIs, making healthcare more efficient. Additionally, the region benefits from advanced technological adoption and a favorable regulatory environment, supporting widespread healthcare API deployment.

Europe’s Growth Prospects

Europe is expected to experience the highest Compound Annual Growth Rate (CAGR) in the Healthcare API market during the forecast period. The region’s robust healthcare infrastructure and strict data protection regulations, such as the General Data Protection Regulation (GDPR), contribute to this growth. The increased adoption of healthcare APIs is supported by favorable government policies and the presence of major healthcare organizations (HCOs). These factors make Europe a strong contender in the global healthcare API market.

Germany’s Market Outlook

Germany is forecasted to hold approximately 7.0% of the global healthcare API market share in 2023. The market’s growth is driven by the increasing use of Electronic Health Records (EHRs), which are increasingly integrated with APIs to enhance data access. In addition, continued advancements by EHR vendors and healthcare IT companies are accelerating adoption. These factors make Germany a significant player in the healthcare API market, with strong growth prospects in the coming years.

China’s Market Growth

China’s healthcare API market is expected to grow at a CAGR of 3.2% over the forecast period. Key drivers include improved patient satisfaction and better treatment quality. Services such as wearable medical devices and remote patient monitoring are gaining popularity, boosting market demand. Additionally, healthcare APIs are increasingly used to access detailed information on healthcare professionals’ qualifications and availability, contributing to a more streamlined healthcare experience in China.

Segmentation Analysis

In 2023, the healthcare API market experienced notable segmentation. The Electronic Health Records (EHR) access segment dominated, capturing over 32% of the market share. This growth is driven by the increasing demand for seamless data accessibility and interoperability in healthcare. APIs in wearable medical devices also showed significant growth, allowing for real-time health tracking and improved patient engagement. Additionally, appointment scheduling services enhanced efficiency, reducing administrative burdens and improving patient access to healthcare services.

The remote patient monitoring (RPM) segment played a vital role, particularly in chronic disease management and elderly care. RPM APIs enabled healthcare providers to monitor patients remotely, a trend accelerated by telehealth advancements. The payment segment also gained traction, as healthcare providers increasingly relied on APIs to streamline billing and payment processing. This shift aligns with the broader trend of digital transformation in healthcare financial management, improving operational efficiency for healthcare providers.

In terms of deployment models, the cloud-based segment dominated the healthcare API market, holding over 71% of the market share in 2023. The flexibility, scalability, and cost-effectiveness of cloud technologies were key drivers for this growth. On-premise deployments remained relevant, especially for organizations focused on data security and regulatory compliance. This dual approach reflects the evolving needs of healthcare, with cloud solutions driving widespread adoption and on-premise options providing essential control over sensitive data and IT infrastructure.

Key Players Analysis

Apple Inc.

Apple Inc. has made significant strides in the healthcare API sector, particularly with its HealthKit and Health Records APIs, which allow for seamless integration of health data across devices and applications. In 2024, Apple further expanded its reach by introducing APIs aimed at improving mental health and well-being. These new features help developers create apps that track depression and anxiety symptoms, enhancing the overall effectiveness of digital health solutions.

Apple’s focus on improving data interoperability has driven further growth in the healthcare API market. The company’s tools facilitate the exchange of electronic health records (EHRs), integrating data from wearable devices, fitness trackers, and health apps. This increased connectivity benefits healthcare providers and patients alike, promoting more efficient and accurate health monitoring.

With Apple’s continued innovation in the healthcare sector, its APIs are expected to play a key role in shaping the future of digital health services, particularly as the demand for accessible and actionable health data continues to rise. The company’s advancements in API technology reflect its commitment to enhancing healthcare solutions and improving patient outcomes.

Greenway Health LLC

Greenway Health LLC is a U.S.-based health information technology company specializing in electronic health records (EHR), practice management, and revenue cycle management solutions. In 2024, Greenway Health introduced updates to its Application Access APIs for the Intergy and Prime Suite platforms, aligning with the Centers for Medicare & Medicaid Services (CMS) 2024 standards, including QRDA 1 and 3 formats for regulatory reporting.

In 2025, Greenway Health continued to enhance its API offerings, enabling third-party applications to access patient data from Intergy and Prime Suite EHR systems. This integration allows patients to view their medical records through compatible applications, promoting greater flexibility and patient engagement.

Furthermore, Greenway Health has leveraged Amazon Web Services (AWS) HealthLake to improve the performance and scalability of its EHR solutions, ensuring compliance with regulatory requirements and enhancing data interoperability.

These developments reflect Greenway Health’s commitment to advancing healthcare technology through API-driven solutions, facilitating seamless data exchange and improved patient care.

Microsoft Corporation

Microsoft Corporation has significantly advanced its position in the healthcare API sector through the development of Azure Health Data Services. These services offer managed API solutions based on open standards such as FHIR®, DICOM®, and MedTech, facilitating secure and scalable healthcare data workflows. Notably, the Azure API for FHIR service, which allows for the ingestion, management, and exchange of Protected Health Information (PHI), is scheduled for retirement in 2026, with new customer deployments ceasing on April 1, 2025.

In 2025, Microsoft introduced several enhancements to its healthcare APIs. The FHIR service now supports bulk deletion with reference removal, improved patient export performance through parallel processing, and enhanced query optimization for data range searches. Additionally, the MedTech service has been optimized to handle data from Internet of Medical Things (IoMT) devices, transforming this data into FHIR®-based Observation resources. These advancements aim to streamline healthcare data integration and improve interoperability across systems.

Microsoft’s commitment to healthcare innovation is further demonstrated by the launch of Dragon Copilot, an AI assistant designed to alleviate administrative burdens in healthcare settings. Leveraging voice-dictating and ambient listening technologies, Dragon Copilot automates tasks such as note-taking, clinical evidence summaries, and referral letters, thereby enabling clinicians to focus more on patient care.

These developments underscore Microsoft’s strategic focus on enhancing healthcare delivery through advanced API solutions and AI-driven tools, positioning the company as a key player in the healthcare technology sector.

Cerner Corporation

Cerner Corporation, now operating as Oracle Health, has been a significant player in the healthcare API sector, particularly through its Cerner Ignite API platform. This platform facilitates interoperability by enabling seamless data exchange across diverse healthcare applications and services. In 2025, Cerner’s Real World Testing Plan underscored its commitment to enhancing API functionalities, focusing on areas such as patient access, FHIR-based data retrieval, and electronic health information export. The plan highlighted the implementation of standardized APIs, including HL7 FHIR, to support the exchange of electronic health records, thereby aligning with industry standards and regulatory requirements.

Additionally, Cerner’s Patient Portal and Millennium Clinical modules have been integral in supporting API-driven functionalities. These modules have been involved in real-world testing activities aimed at improving the efficiency and reliability of data exchange processes. For instance, the Patient Portal module has been utilized to track and enhance the view, download, and transmit capabilities of patient data to third-party applications, ensuring compliance with data access standards.

Furthermore, Cerner’s strategic initiatives, including the development of a new AI-native EHR platform and the pursuit of Qualified Health Information Network (QHIN) status under the Trusted Exchange Framework and Common Agreement (TEFCA), reflect its ongoing efforts to advance healthcare interoperability. These endeavors aim to bolster data exchange capabilities and integrate advanced technologies into healthcare workflows, positioning Cerner as a forward-thinking entity in the healthcare API landscape.

General Electric Company

General Electric HealthCare (GE HealthCare) has been actively advancing in the healthcare API sector between 2024 and 2025. The company is leveraging artificial intelligence (AI) and cloud computing to enhance healthcare delivery. In 2025, GE HealthCare continued to expand its AI-enabled medical devices and maintained its position as a leader in FDA AI authorizations for the fourth consecutive year, with 100 approvals.

GE HealthCare’s strategic investments and innovations in AI and cloud technologies are expected to contribute to this market expansion. The company’s initiatives aim to reduce cognitive overload for physicians and improve operational efficiencies in hospitals, ultimately enhancing patient outcomes.

In summary, GE HealthCare’s commitment to integrating AI and cloud computing into healthcare APIs positions it as a significant player in the evolving healthcare technology landscape.

Conclusion

The healthcare API market is set for substantial growth, driven by advancements in digital health infrastructure, regulatory support, and the integration of emerging technologies like AI and IoT. These factors are enhancing data interoperability, improving patient care, and streamlining healthcare processes. The adoption of healthcare APIs across regions, such as North America and Europe, reflects increasing demand for efficient data exchange systems. The emphasis on data security and regulatory compliance remains essential in fostering trust and ensuring patient privacy. Overall, healthcare APIs are playing a critical role in transforming healthcare delivery by improving efficiency, accessibility, and the quality of care.

View More:

Smart Healthcare Market | Healthcare BPO Market | Healthcare CRM Market | Healthcare Business Intelligence Market | Healthcare Claims Management Market | Generative AI in Healthcare Market | Quantum Computing in Healthcare Market | Healthcare IT Market | Healthcare Information Systems Market | Digital Twins in Healthcare Market | Metaverse in Healthcare Market | Healthcare Automation Market