Table of Contents

Introduction

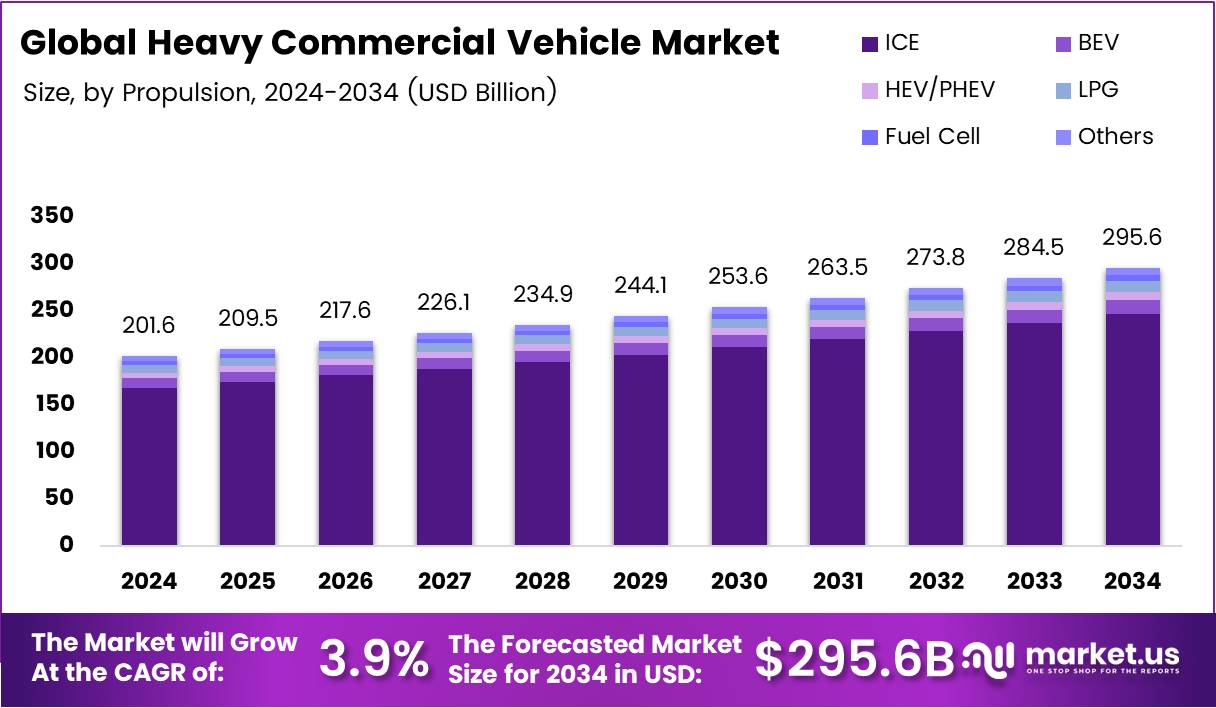

The Global Heavy Commercial Vehicle (HCV) Market is poised for steady expansion, projected to reach USD 295.6 Billion by 2034, growing from USD 201.6 Billion in 2024 at a CAGR of 3.9%. This growth underscores the vital role HCVs play in global logistics, construction, and freight operations.

Driven by rapid urbanization and infrastructure development, the demand for efficient freight and logistics solutions continues to surge. Heavy-duty trucks, trailers, and tractor units form the backbone of industrial supply chains, catering to industries from e-commerce and manufacturing to construction and mining.

Furthermore, the transition toward sustainability and emission-free operations is reshaping the industry. As governments tighten emission norms, manufacturers are increasingly adopting electric, hybrid, and fuel-efficient propulsion systems, ensuring compliance while unlocking new growth avenues in global markets.

Key Takeaways

- Global Heavy Commercial Vehicle Market size to reach USD 295.6 Billion by 2034, growing at a CAGR of 3.9% from 2025–2034.

- Internal Combustion Engine (ICE) holds a dominant position with 83.3% share.

- Class 8 trucks dominate by class with 58.5% share in 2024.

- Tractor Units lead by type with 65.9% share in 2024.

- Asia Pacific (APAC) region dominates with 46.2% share, valued at USD 93.1 Billion.

Market Segmentation Overview

By Propulsion, the Internal Combustion Engine (ICE) segment maintains leadership with 83.3%, owing to robust infrastructure and long-range capabilities. However, Battery Electric Vehicles (BEVs) are gaining rapid momentum, supported by emission regulations and government incentives encouraging zero-emission truck adoption across urban delivery and logistics operations.

By Class, Class 8 trucks command a 58.5% share, reflecting their versatility in long-haul freight and heavy-duty applications. Their ability to transport bulk cargo efficiently across extensive distances positions them as indispensable assets in industrial transportation, particularly in sectors like logistics, construction, and international trade.

By Type, Tractor Units dominate with 65.9%, owing to their modular design and operational flexibility. They allow fleet operators to swap trailers for varied cargo, optimizing utilization. Rigid trucks continue serving niche applications such as construction, municipal services, and localized deliveries demanding enhanced maneuverability.

Drivers

1. Increasing Demand for Efficient Transportation Solutions

The rise in cross-border trade and e-commerce has spurred demand for fuel-efficient, high-capacity trucks capable of reducing delivery times and operational costs. Fleet operators seek vehicles that combine reliability with enhanced payload capacity, driving continuous innovation in drivetrain performance and vehicle durability.

2. Infrastructure Development and Urbanization

Massive investments in road, bridge, and port development across emerging economies are propelling vehicle demand. As urban centers expand, construction and logistics activities intensify, necessitating specialized HCVs for transporting raw materials, heavy machinery, and large-scale equipment essential for infrastructure growth.

Use Cases

1. Long-Haul Freight Operations

Class 8 tractor-trailers are central to interstate freight transport, carrying essential goods across long distances efficiently. Their advanced powertrains and optimized aerodynamics support extended operations while minimizing downtime, making them indispensable for logistics providers managing large distribution networks.

2. Construction and Mining Applications

In sectors like construction and mining, rigid trucks and tippers play a pivotal role in material handling. From transporting aggregates to hauling heavy equipment, their durability and load capacity ensure seamless operations in demanding terrains and under heavy-duty conditions.

Major Challenges

1. Stringent Emission Regulations

Global emission norms such as Euro VI and EPA standards impose strict compliance requirements. Manufacturers face rising R&D costs as they develop cleaner engines and electrified powertrains, increasing vehicle prices and creating barriers for smaller fleet operators.

2. Fluctuating Fuel Prices and Skilled Labor Shortages

Volatile fuel costs significantly affect profit margins for logistics companies. Simultaneously, a shortage of skilled drivers hampers operational efficiency, escalating labor costs and constraining capacity expansion, particularly in developed economies facing workforce aging challenges.

Business Opportunities

1. Expansion of Electric and Hybrid HCVs

Growing environmental awareness and supportive government incentives present vast opportunities for BEV and HEV adoption. Leading OEMs are developing high-capacity batteries, fast-charging infrastructure, and modular hybrid systems, creating a sustainable transition pathway toward zero-emission heavy-duty fleets.

2. Telematics and Fleet Management Integration

The incorporation of AI-powered telematics offers real-time monitoring, predictive maintenance, and route optimization. These tools enable operators to minimize downtime, boost fuel economy, and enhance asset utilization—delivering competitive advantages in logistics and supply chain management.

Regional Analysis

1. Asia Pacific Dominates the Market

Accounting for 46.2% share and valued at USD 93.1 Billion, Asia Pacific leads the HCV market, underpinned by booming infrastructure projects, urban expansion, and industrial output. Countries like China, India, and Japan serve as manufacturing and export hubs, supporting robust regional demand.

2. Europe and North America Emerging as Sustainable Hubs

Europe’s strong environmental policies accelerate adoption of electric and hybrid trucks, while North America’s technological innovation and logistics modernization drive market maturity. Together, these regions are pioneering sustainability standards and fostering cross-border freight modernization initiatives.

Recent Developments

- May 2025: Mahindra & Mahindra acquired a 58.96% controlling stake in SML Isuzu, enhancing its position in the commercial vehicle segment.

- July 2025: Tata Motors explored a USD 4.5 Billion acquisition of Iveco, signaling ambitions to expand in the European HCV market.

- April 2025: Mahindra and SML Isuzu completed a ₹555 crore partnership, leveraging expertise in light commercial vehicle manufacturing.

Conclusion

The Global Heavy Commercial Vehicle Market stands at a transformative juncture. As demand for freight efficiency, sustainability, and smart logistics accelerates, industry players must innovate across propulsion, telematics, and safety technologies. Emerging economies, infrastructure projects, and regulatory shifts will continue shaping a USD 295.6 Billion opportunity by 2034, empowering manufacturers and fleet operators to redefine the next era of heavy-duty transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)