Table of Contents

Introduction

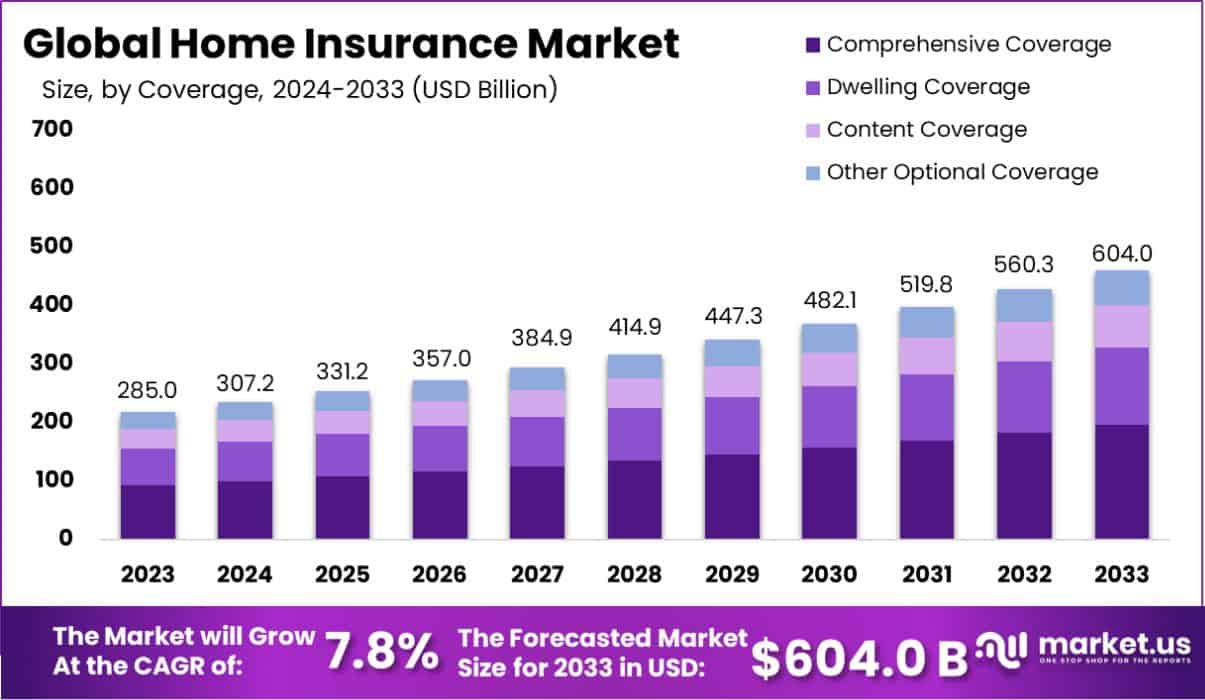

Based on data from Market.us, The Global Home Insurance Market is projected to experience significant growth over the next decade. By 2033, the market is expected to reach a valuation of around USD 604.0 billion, up from USD 285.0 billion in 2023, representing a steady compound annual growth rate (CAGR) of 7.8% from 2024 to 2033. This expansion is driven by increasing demand for home protection due to rising property values and unpredictable natural disasters.

In 2023, North America held a dominant position in the global market, accounting for a substantial 38.5% share. This translates to a revenue of approximately USD 109.72 billion generated within the region. Factors contributing to this dominance include a high homeownership rate and strong regulatory frameworks supporting insurance coverage. Going forward, North America is expected to maintain its leadership, with other regions seeing notable growth as awareness and the need for home insurance continue to rise globally.

Home insurance, also known as homeowners’ insurance, is a form of property insurance that provides coverage for a private residence. This policy combines various personal insurance protections, which can include losses occurring to one’s home, its contents, loss of use (additional living expenses), or loss of other personal possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of the homeowner within the policy territory.

The home insurance market is characterized by the provision of these policies to homeowners seeking protection against potential financial losses due to accidents, natural disasters, theft, and other unforeseen events that can affect their properties. This market operates through various distribution channels such as direct sales, brokers, and online platforms, tailoring coverage to meet the diverse needs of property owners.

Driving factors for the home insurance market include the increasing awareness among homeowners about the benefits of insurance and the rising incidence of property damage due to natural disasters and other hazards. The expansion of the real estate sector worldwide also significantly contributes to the growth of this market as new homeowners seek to protect their investments. Additionally, technological advancements such as the integration of AI and big data analytics in the assessment and management of insurance claims have enhanced the efficiency and attractiveness of home insurance products.

Future growth opportunities in the home insurance market are linked with the continuous development of innovative insurance products that cater to evolving homeowner needs, such as coverage for eco-friendly home constructions and protection against cyber threats. The increasing popularity of smart home technologies presents an opportunity for insurance companies to offer products that integrate more seamlessly with tech-driven home management systems, providing real-time data to both the insurer and the insured for better risk management.

Moreover, emerging markets represent a significant growth area for the home insurance industry, as economic development and improving income levels increase homeownership rates. The penetration of mobile technologies and internet access allows for more direct and efficient interaction between insurers and potential customers, lowering barriers to entry and expanding market reach. The adaptation of policies to include more comprehensive coverages, such as protection against climate change impacts and flexible pricing models to attract younger homeowners, will be crucial in sustaining the growth of the home insurance market in the coming years.

Key Takeaways

- The Global Home Insurance Market is projected to reach USD 604.0 billion by 2033, up from USD 285.0 billion in 2023, growing at a steady CAGR of 7.8% over the forecast period from 2024 to 2033. This growth is driven by increasing awareness about property protection and the rising value of homes worldwide.

- In 2023, Comprehensive Coverage led the market in the By Coverage segment, capturing more than 32.5% of the market. This reflects the growing demand for all-encompassing protection against various risks such as fire, theft, and natural disasters.

- Moreover, in the By End User segment, Landlords dominated, accounting for over 75.5% of the market share. This high figure is primarily due to the increasing number of rental properties, where landlords seek robust insurance solutions to protect their investments.

- North America continued to lead the global home insurance market in 2023, holding a dominant 38.5% share, with revenues reaching USD 109.72 billion.

Home Insurance Statistics

- 85% of U.S. homeowners hold insurance policies, with 79.09% of these being HO-3 policies, as per the National Association of Insurance Commissioners (NAIC).

- 47% of homeowners, according to a ValuePenguin survey, are unsure of what their insurance actually covers. This sentiment is echoed by J.D. Power, which found that 52% do not fully comprehend their coverage details.

- A significant challenge is the underinsurance of property values. Marshall & Swift/Boeckh discovered that 60% of homes are undervalued for insurance purposes, with an average undervaluation of 17%.

- The Insurance Services Office (ISO) reports that 98.1% of homeowners insurance claims result from property damage. Notably, wind and hail account for 34.4% of home insurance claims.

- The breakdown of claims is as follows:

- Wind and hail: 34.4%

- Fire and lightning: 32.7%

- Water damage and freezing: 23.8%

- Other property damage (including vandalism and mischief): 6.2%

- Liability for bodily injury and property damage to others: 1.8%

- Theft: 1.0%

- Medical payments: 0.1%

- Credit card and other: less than 0.1%

- Recent trends indicate a sharp increase in premiums, with a 10.3% rise in the last quarter alone, marking the most substantial quarterly hike in a decade.

- Regional differences in premium increases are pronounced:

- London: 49.9%

- North West: 37.6%

- South East: 45.8%

- South West: 40.6%

- Homeowners with claims have seen even larger spikes in premium costs. Theft claims, for instance, led to a 13.8% increase in premiums over three months.

- Specific claim types have seen dramatic increases in associated costs:

- Buildings claims: 50.3%

- Water-related damage claims: 49.8%

- The average cost for a combined home insurance policy as of Q4 2023 was £213, up 36% from the previous year.

- Costs for contents-only policies have risen by 30%, while buildings-only policies have increased by 29%.

- The availability of insurance quotes has significantly declined, with an average of only 1.07 quotes per person as of June 2024, representing a 27% decrease since June 2023.

Emerging Trends

- Artificial Intelligence in Policy Customization: Home insurance is getting smarter with AI advancements that allow for more personalized policies. Insurers are utilizing AI to analyze large sets of data, which enables them to offer tailored policies that meet the specific needs of individual homeowners, potentially leading to more competitive pricing and comprehensive coverage.

- Integration of Smart Home Technology: More homeowners are adopting smart home devices that help prevent risks such as fires and burglaries. Insurers are encouraging this trend by offering discounts to those who integrate these technologies into their homes, as these devices can significantly mitigate risks.

- Increased Focus on Climate Resilience: With the rising occurrence of natural disasters due to climate change, insurers are expanding coverage options to better protect against these risks. This includes policies that are more focused on resilience, helping homeowners to adapt and recover from environmental challenges.

- Growth of Usage-Based Insurance (UBI): Borrowing from the auto insurance model, home insurance is increasingly using real-time data from smart home devices to tailor premiums. This can lead to lower costs for homeowners who adopt technology that reduces their risk profile.

- Expansion of Cybersecurity Insurance: As homes become more connected, the risk of cyber threats increases. Insurers are responding by offering cybersecurity insurance products that protect homeowners from the financial repercussions of cyberattacks, ensuring peace of mind in an increasingly digital world.

Top Use Cases

- Disaster-Ready Home Modifications: Insurance companies are offering incentives for homeowners to make their homes disaster-ready through structural upgrades like storm shutters and fire-resistant materials. These modifications can help reduce premiums and enhance safety.

- Tailored Coverage for Unique Needs: Homeowners now have the option to customize their insurance policies more granularly, choosing only the coverage they need based on their specific circumstances, such as excluding flood insurance if they are not in a flood zone.

- AI-Enhanced Claims Processing: AI is streamlining the claims process, making it faster and more efficient. This technology can assess damage through photos and automate claim approvals, significantly speeding up the process for homeowners.

- Proactive Risk Assessment with IoT: The Internet of Things (IoT) is being used to monitor home environments in real time, allowing insurers to proactively assess and address risks before they lead to claims. This use of technology is transforming how insurers evaluate and price risk.

- Support for Eco-Friendly Home Practices: Insurers are supporting the shift towards sustainability by offering discounts and incentives for eco-friendly home practices and features, promoting energy efficiency and the use of sustainable materials.

Major Challenges

- Rising Reinsurance Costs: The escalating frequency and severity of natural disasters have significantly impacted the reinsurance market, causing a steep rise in reinsurance costs. This increase makes it challenging for primary insurers to secure adequate coverage, which in turn affects the availability and affordability of home insurance for consumers.

- Natural Disasters and Climate Change: A string of natural disasters, such as wildfires, hurricanes, and hailstorms across various states, has led to huge losses in the home insurance sector. These events strain insurers as they struggle to manage the mounting claims, pushing some to exit high-risk markets like California and Florida.

- Increased Cost of Construction Materials: The surging costs of building materials have significantly driven up home repair and replacement expenses post-disaster. This increase has, in turn, led to higher home insurance premiums, making policies less affordable for many homeowners.

- Regulatory and Legal Challenges: Home insurers face significant challenges from the legal system, including a rise in litigation over claims. For example, in Florida, insurers contend with numerous lawsuits, often involving roof damage, which can be costly and time-consuming to address.

- Market Volatility and Restrictive Treaties: The home insurance market is also affected by restricted treaties with reinsurers and ongoing market volatility, which complicates the landscape for insurers trying to balance risk with profitability.

Attractive Opportunities

- Technological Advancements: Leveraging technology such as AI and big data analytics can help insurers better predict risks, set more accurate pricing, streamline claims processing, and improve customer service, opening up new avenues for growth and efficiency.

- Product Diversification: Insurers have the opportunity to diversify their product offerings to include more comprehensive packages that cover a wider range of perils, or to specialize in niche markets that are underserved, such as flood insurance or insurance for green buildings.

- Global Market Expansion: The global nature of the reinsurance market means insurers can explore opportunities in less saturated markets abroad, potentially spreading their risk and tapping into new customer bases.

- Improved Risk Management: Advances in modeling and forecasting can enable insurers to better understand and manage risks associated with climate change and other emerging threats, leading to more sustainable practices and products.

- Enhanced Customer Engagement: By adopting a more customer-centric approach, insurers can improve trust and loyalty, potentially attracting a broader client base. This includes offering tailored policies, transparent pricing, and proactive communication.

Conclusion

In conclusion, the home insurance market is poised for continued expansion, fueled by growing homeowner awareness and technological innovations that enhance policy management and claims processing. As the market adapts to include coverages for modern risks and integrates more closely with technological advancements in home management, it will likely attract a broader base of consumers, especially in emerging markets. The industry’s ability to innovate and adapt to changing environmental and technological landscapes will be key to its sustained growth and relevance. These developments ensure that home insurance remains a crucial component of financial security for homeowners globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)