Table of Contents

Overview

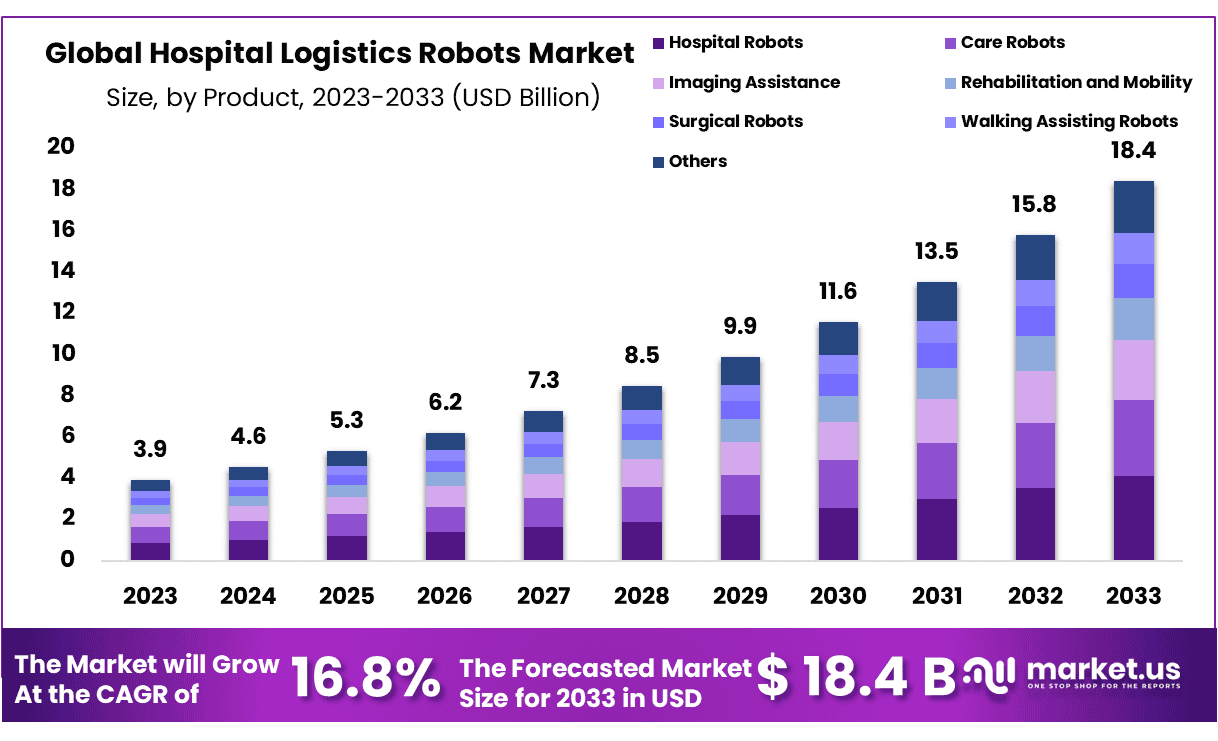

New York, NY – Sep 18, 2025 – The Global Hospital Logistics Robots Market size is expected to be worth around USD 18.4 Billion by 2033 from USD 4.6 Billion in 2024, growing at a CAGR of 16.8% during the forecast period from 2025 to 2033.

The deployment of advanced hospital logistics robots is revolutionizing healthcare facilities by enhancing efficiency, reducing operational burdens, and improving patient care delivery. Designed to automate routine yet essential tasks, these robots are redefining how hospitals manage internal logistics.

Hospital logistics robots are equipped to transport medical supplies, medications, laboratory samples, and linens across various departments. By minimizing human involvement in repetitive duties, staff resources can be redirected toward critical patient-focused activities. This shift not only reduces workload pressures but also improves accuracy and timeliness in supply chain management.

The adoption of such robots is driven by rising patient volumes, increasing demand for operational efficiency, and the necessity of maintaining infection control standards. Robots provide consistent, contactless delivery solutions, significantly lowering the risk of contamination in sensitive hospital environments. Their ability to navigate autonomously within complex hospital layouts makes them vital to seamless operations.

Furthermore, integration with hospital information systems allows real-time tracking and coordination of logistics tasks. This ensures timely availability of essential items, supports faster clinical decision-making, and enhances overall hospital responsiveness.

Hospitals implementing logistics robots have reported measurable gains in efficiency, reduced turnaround times, and improved staff satisfaction. The advancement reflects a broader trend toward smart healthcare facilities, where automation plays a central role in delivering safe, reliable, and high-quality patient care.

Key Takeaways

- Market Size & Growth: Global Hospital Logistics Robots Market size is expected to be worth around USD 18.4 Billion by 2033 from USD 4.6 Billion in 2024, growing at a CAGR of 16.8% during the forecast period from 2025 to 2033.

- Type Analysis: Within the hospital robotics segment, logistics robots accounted for 22.02% of the overall revenue share, reflecting their growing importance in automating critical support functions.

- End-Use Analysis: Hospitals represented the leading end-use segment, contributing 36.2% of total revenue in 2023. This segment is also expected to register the fastest growth rate in the coming years, supported by increasing adoption of automation solutions to improve efficiency and patient care.

- Regional Analysis: North America emerged as the dominant regional market, holding a 41.3% revenue share and generating USD 1.4 billion in 2023. The strong presence of advanced healthcare infrastructure and early adoption of robotics technologies underpin this leadership.

- Key Market Trends: The increasing deployment of autonomous mobile robots (AMRs) and humanoid robots is a defining trend. These advanced systems enable hospitals to handle more complex logistics tasks while navigating challenging environments with greater precision.

- Future Outlook: The market is expected to witness sustained growth, supported by technological innovations, rising demand for operational efficiency, and the ongoing transformation toward smart healthcare facilities.

Hospital Logistics Robots Technical Analysis

Hospital logistics robots are engineered with advanced navigation, sensing, and automation technologies that enable efficient and safe operations within complex healthcare environments. Most systems are built on autonomous mobile robot (AMR) platforms, integrating LiDAR sensors, 3D cameras, and artificial intelligence algorithms to ensure real-time obstacle detection and route optimization. These capabilities allow robots to transport medical supplies, medications, and laboratory samples seamlessly across departments with minimal human intervention.

Connectivity and system integration play a crucial role in their performance. Many hospital logistics robots are linked with hospital information systems (HIS) and inventory management platforms, allowing automated task scheduling, supply tracking, and delivery verification. Battery efficiency and charging automation also ensure continuous availability.

Recent advancements include humanoid features for enhanced interaction, multi-load capacity systems, and improved safety protocols such as collision avoidance and access control. Collectively, these technical enhancements are driving higher adoption and ensuring reliability in mission-critical hospital logistics.

Regional Analysis

North America accounted for 41.3% of the hospital logistics robots market in 2023, generating revenue of approximately USD 1.4 billion. The region’s leadership position is strongly supported by its advanced healthcare infrastructure, high technology adoption rates, and significant investments in medical innovation. Healthcare facilities across the United States and Canada are increasingly deploying logistics robots to streamline internal operations, reduce costs, and improve patient care efficiency.

The widespread adoption of automation technologies is creating attractive opportunities for stakeholders and industry players seeking expansion in this market. Hospitals and medical institutions in North America are particularly receptive to solutions that enhance operational accuracy and optimize resource allocation. In addition, the presence of leading robotics manufacturers and supportive government initiatives for healthcare modernization further accelerate market penetration. As a result, North America is expected to remain a central hub for growth, shaping the global trajectory of hospital logistics robots.

Emerging Trends

- From pilots to hospital-wide systems (AGV → AMR).

U.S. Veterans Affairs (VA) now publishes a formal AGV/AMR System Design Manual for hospitals. It specifies capacity planning (hour-by-hour traffic matrices), dedicated robot elevators when usage exceeds 40% of an elevator’s hourly capacity, and target ≥95% mission success during peak periods signals that logistics robots are moving into standard infrastructure, not experiments. - Safety-by-design and life-safety integration.

Government guidance requires robots to obey marked lanes, keep ≥0.5 m clearances, interlock with fire doors/alarms, and default to safe modes during smoke/fire events. Batteries must support “opportunity charging,” and vehicles must include non-contact object detection and emergency stops. - Benchmarking and performance metrics becoming standardized.

NIH’s PubMed Central hosts a 2024 study proposing a structured benchmarking protocol for hospital AMRs with quantitative metrics (e.g., success rate, path regularity, completion time) across static and moving-obstacle scenarios indicating a shift toward comparable, reproducible performance testing. - Operational scale in leading health systems.

Changi General Hospital (CGH, SingHealth) reports “about 80 robots” on campus, including units that move medications, specimens, meals, and beds evidence of scaled, mixed-fleet logistics in day-to-day care. - Cybersecurity hardening of connected fleets.

U.S. HHS 405(d) technical practices emphasize asset inventories, network segmentation, vulnerability management, and incident response for connected clinical tech principles that are directly applicable to mobile logistics robots integrated with hospital networks and elevators. - Clean/soiled flow segregation and infection-prevention workflows.

Design rules now explicitly require separation of clean vs. soiled carts and controlled lobbies/vestibules for staging pickups and drop-offs embedding infection-control logic into robot-enabled material flows. - Workforce relief aligned with national nursing pressures.

Government workforce analyses highlight non-nursing tasks consuming time; logistics robots are being positioned to take on these transport tasks so nurses can focus on direct care.

Use Cases

- Pharmacy & ward supply delivery (meds, IVs, PPE, consumables).

- What happens: Robots move secured carts between pharmacy, supply rooms, and wards; elevator integration and access-controlled drop-off lobbies protect chain-of-custody.

- Why it matters (numbers): Simulation and hospital studies indicate time savings of ~23% in staff time for logistics when AGVs are applied, and single transports often complete in <1–2 minutes median (0.70 min; 90% under 4.05 min) in nursing transport analyses.

- Governance details: Dedicated AGV/AMR elevators may be required once robot traffic exceeds 40% of an elevator’s hourly capacity; peak-hour planning must demonstrate ≥95% delivery success.

- Specimen logistics (lab pickups/returns).

- What happens: AMRs run frequent, short hops from wards/clinics to core labs, reducing nurse/porter trips.

- Why it matters (numbers): Reviews of robotic use in clinical environments report that 71.5% of staff felt robots saved time and 77.2% felt they improved clinical processes; targeted deployments show per-trip nurse time savings ≈ 30 minutes in OR contexts with mobile service robots (tele-delivery & coordination).

- Design hooks: Marked lanes, collision avoidance, and emergency-stop hardware are mandatory; traffic matrices must show hour-by-hour specimen flow capacity.

- Meal, linen, and waste runs (heavy and repetitive moves).

- What happens: Robots handle bulk meal carts, clean linen delivery, and soiled/regulated waste retrieval along segregated paths.

- Why it matters (numbers): At system scale, CGH reports ~80 robots across logistics and care support tasks (medication, meals, case notes, heavy items). This breadth indicates dozens–hundreds of automated missions daily, offloading routine walking and pushing tasks from staff.

- Infection control: Policies require separate flows for clean vs. soiled carts and controlled vestibules for staging.

- Operating-room (OR) support & couriering.

- What happens: Robots shuttle sets/instruments, meds, and urgent items to from OR cores; some deployments show integrated telepresence or nurse-assist functions.

- Why it matters (numbers): Reports note two robots can cover 20–25 ORs, with ~30 minutes of nurse walking time saved per run (reducing back-and-forth trips).

- Safety: Non-contact detection on all sides and manual override are required; robots must not deviate from assigned pathways and must not auto-restart after contact.

- Point-of-use (POU) restocking with automated cabinets.

- What happens: Integration of automated POU supply stations with robot replenishment streamlines reorder/stocking cycles.

- Why it matters (numbers): VA’s directive defines POU systems for timely delivery and automatic replenishment at set par levels, enabling predictable robot restock loops and reducing stock-outs that drive ad-hoc staff errands.

- After-hours couriering and surge operations.

- What happens: Robots provide 24/7 runs for labs, pharmacy, and nutrition, smoothing workload peaks and covering nights/weekends.

- Why it matters (numbers): Benchmarking frameworks now quantify completion time (CT) and success rate (SR) in dynamic, obstacle-rich environments to ensure around-the-clock reliability in real wards.

Conclusion

Hospital logistics robots are reshaping healthcare delivery by automating repetitive transport tasks, improving accuracy, and ensuring timely supply chain operations. Their deployment reduces staff workload, enhances infection control through contactless delivery, and supports faster clinical decisions with real-time tracking.

Hospitals adopting these systems report efficiency gains, reduced turnaround times, and improved staff satisfaction. Technical advances in navigation, sensing, and integration ensure reliability in complex environments. Backed by strong growth prospects and government-led standards, logistics robots are becoming integral to modern healthcare, driving the transition toward smart, efficient, and patient-centered hospital operations.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)