Table of Contents

- Introduction

- Editor’s Choice

- Global HR Analytics Market Overview

- Basic Views Regarding Analytics

- Activities Overseen by HR Departments

- HR Software or Platforms Used in Organizations

- Expected HR Resourcing Increase by Organizations Worldwide

- HR and People Analytics Capability Gap

- Assessment of HR Capabilities in Key Analytical Areas

- State of HR Analytics Capabilities

- Recent Developments

- Conclusion

- FAQs

Introduction

HR Analytics Statistics: HR analytics, the application of data analysis to human resources data, enables organizations to make informed decisions about their workforce, aligning strategies with business objectives.

It begins with collecting data such as employee demographics, performance evaluations, and recruitment metrics.

After cleaning and preparing the data, descriptive analytics summarizes historical trends, while predictive analytics forecasts future outcomes like turnover rates and staffing needs.

Prescriptive analytics then offers actionable recommendations for process optimization and risk mitigation.

Key metrics such as turnover rates and employee satisfaction scores are tracked, ensuring continuous improvement and adherence to data privacy regulations.

Through HR analytics, organizations can optimize their HR processes, enhance employee engagement, and drive better business results.

Editor’s Choice

- The global HR analytics market revenue is expected to culminate at USD 9.9 billion by 2032.

- Throughout 2022-2032, workforce planning will see an increase from USD 0.73 billion to USD 2.48 billion, demonstrating its growing importance in strategic HR processes.

- In the distribution of market share among services related to HR analytics, Implementation & Integration services dominate, accounting for 50% of the market.

- From 2016 to 2025, the core human resources (HR) applications market has seen varied growth across different segments. Core HR and personnel management, being the largest segment, grew from USD 3,489 million in 2016 to USD 5,838 million in 2020, with a forecast to reach USD 6,250 million by 2025.

- The most widely used is the HR information system, which includes functionalities to store, update, and track employee information, with a usage rate of 84.5%.

- Among large organizations, the highest expected increase was observed in HR data analytics, with 34% anticipating an expansion, followed by online recruiting and talent/career management at 24% and 21%, respectively.

- Only 8% of respondents describe their HR analytics capabilities as strong, indicating a robust and effective use of analytics within their HR functions.

(Source: Market.us)

Global HR Analytics Market Overview

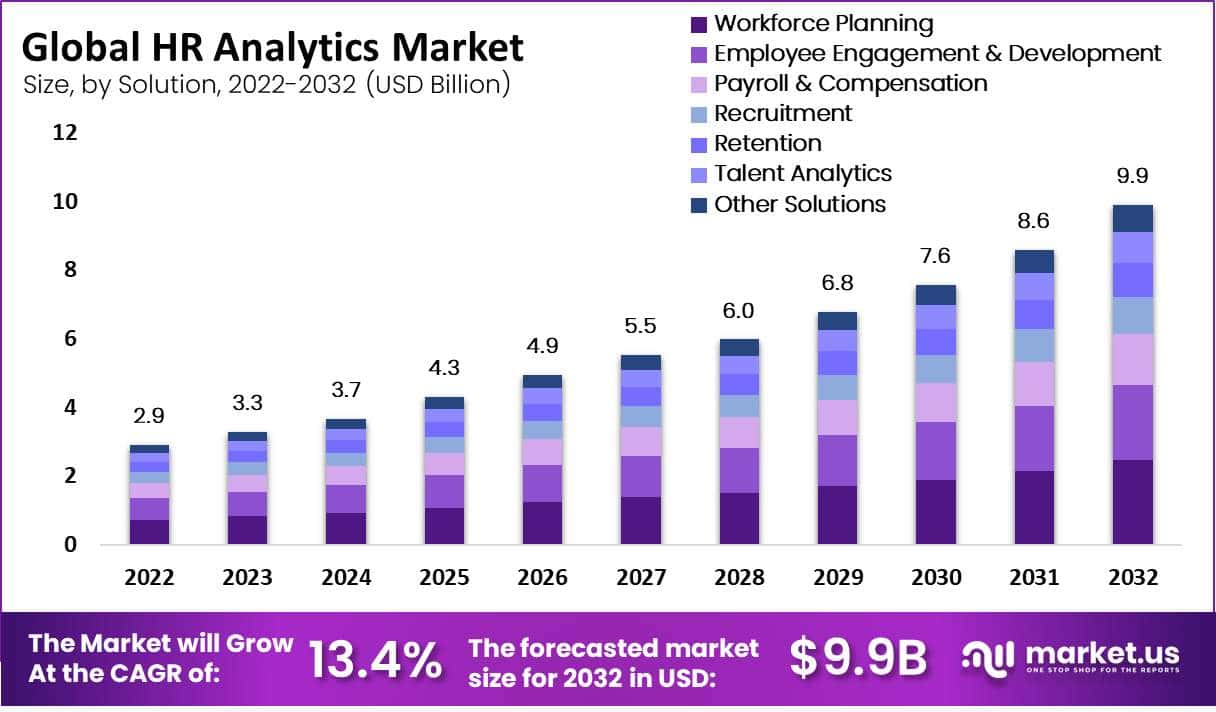

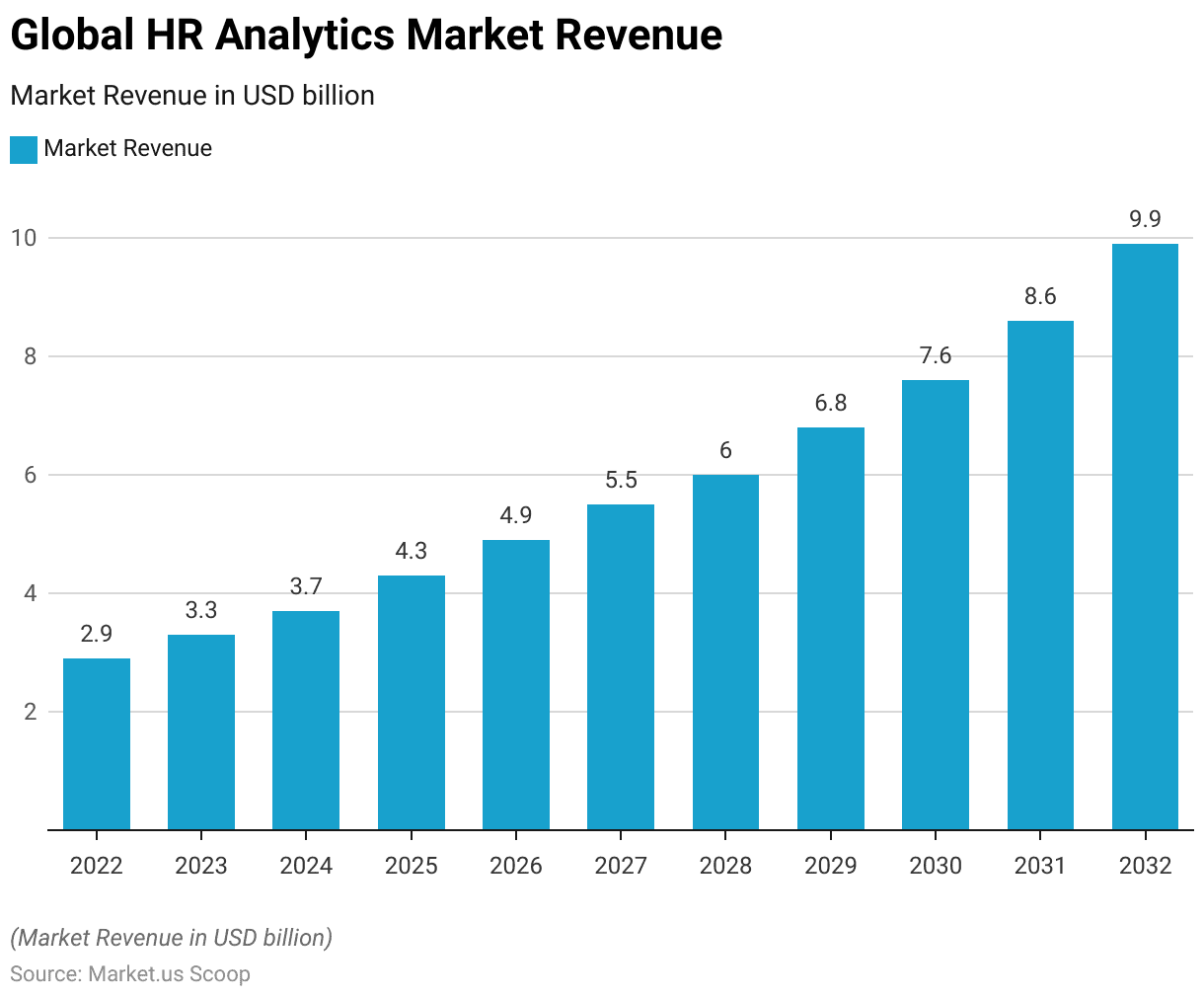

Global HR Analytics Market Size

- The global HR analytics market has demonstrated a strong growth trajectory at a CAGR of 13.4%, with revenue figures consistently rising from USD 2.9 billion in 2022.

- The market is projected to increase steadily, reaching USD 3.3 billion in 2023 and further expanding to USD 3.7 billion by 2024.

- Over the subsequent years, the market is expected to continue its upward trend, achieving USD 4.3 billion in 2025 and USD 4.9 billion by 2026.

- The growth momentum is anticipated to carry forward, with market revenues rising to USD 5.5 billion in 2027, USD 6.0 billion in 2028, and USD 6.8 billion by 2029.

- By the end of the decade, the market is projected to reach USD 7.6 billion in 2030 and culminate at USD 9.9 billion by 2032.

- This consistent growth underscores the increasing reliance on and investment in HR analytics solutions across various industries.

(Source: Market.us)

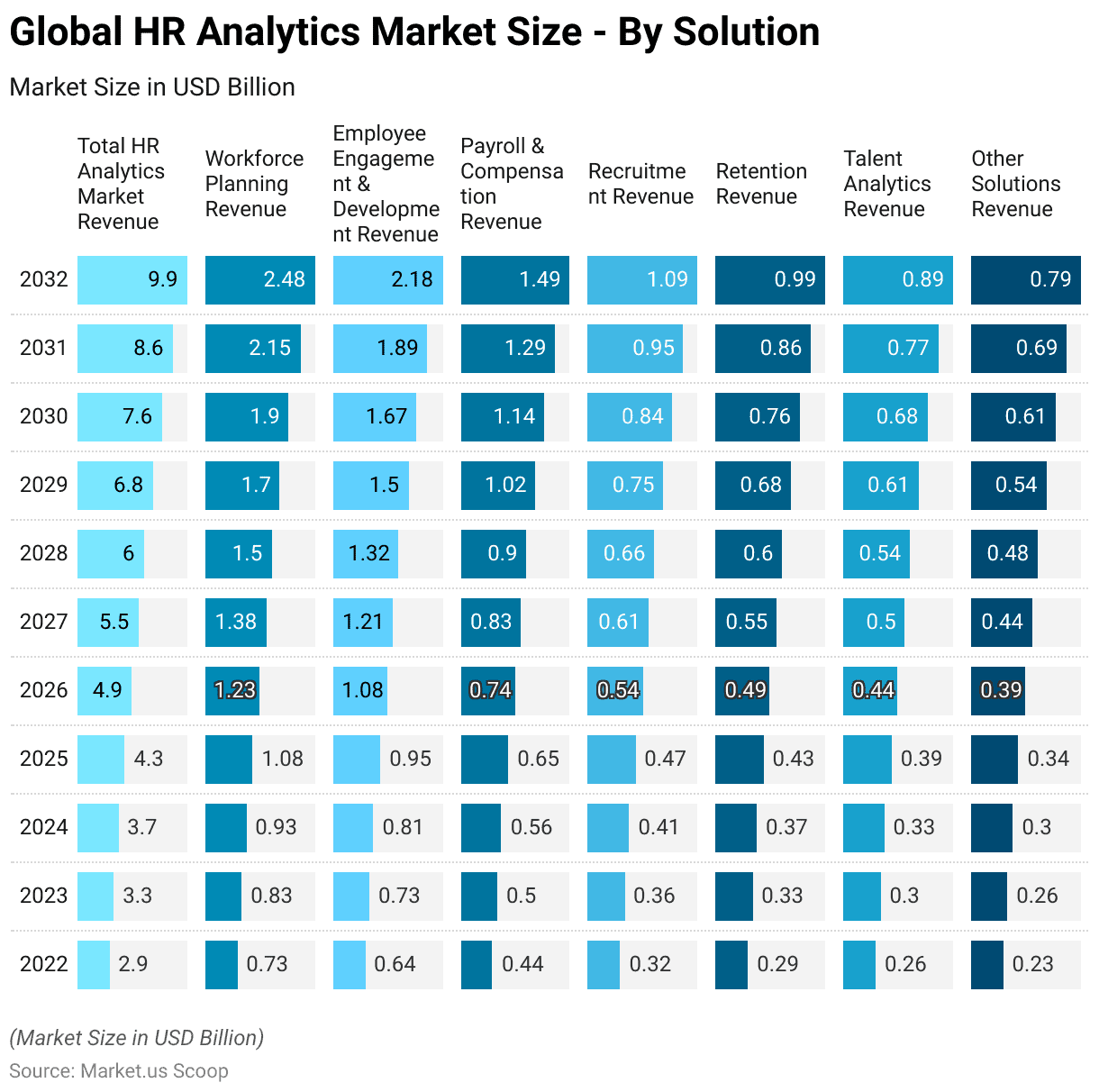

Global HR Analytics Market Size – By Solution

- The global HR analytics market is forecasted to exhibit substantial growth across various segments, expanding from a total revenue of USD 2.9 billion in 2022 to USD 9.9 billion by 2032.

- Over this period, workforce planning will see an increase from USD 0.73 billion to USD 2.48 billion, demonstrating its growing importance in strategic HR processes.

- Similarly, revenue from employee engagement and development solutions is expected to grow from USD 0.64 billion to USD 2.18 billion, reflecting heightened focus on improving workplace environments and employee growth.

- Payroll and compensation solutions will also see a notable rise, from USD 0.44 billion in 2022 to USD 1.49 billion in 2032, indicating an ongoing emphasis on optimizing compensation strategies.

- Recruitment analytics are set to grow from USD 0.32 billion to USD 1.09 billion, and retention solutions will increase from USD 0.29 billion to USD 0.99 billion, both critical for maintaining competitive advantage through talent acquisition and retention.

- Talent analytics is projected to rise from USD 0.26 billion to USD 0.89 billion, underscoring the growing reliance on data-driven decision-making in talent management.

- Lastly, revenue from other HR solutions will expand from USD 0.23 billion to USD 0.79 billion, highlighting the broadening scope of HR analytics applications.

- This growth trajectory underscores the vital role of HR analytics in enhancing organizational efficiency and effectiveness across various human resource functions.

(Source: Market.us)

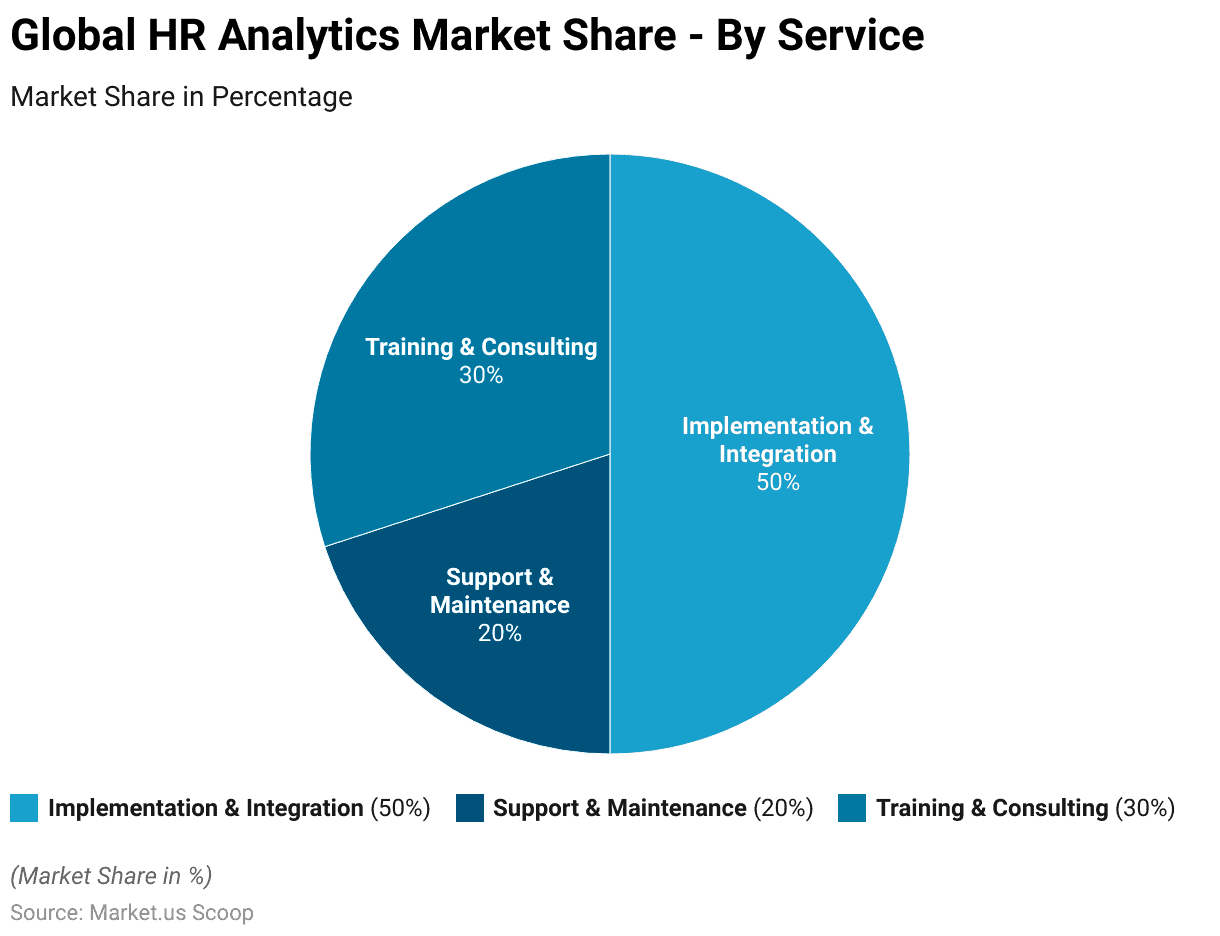

Global HR Analytics Market Share – By Service

- In the distribution of market share among services related to HR analytics, Implementation & Integration services dominate, accounting for 50% of the market. This highlights the critical need for robust setup and seamless integration of analytics systems within HR operations.

- Support & Maintenance services also play a significant role, comprising 20% of the market share, underscoring the importance of ongoing assistance and system upkeep to ensure continuous operational efficiency.

- Lastly, Training & Consulting services claim 30% of the market share, reflecting the demand for expert guidance and education in utilizing HR analytics tools effectively to drive strategic decisions and enhance workforce management.

- This allocation demonstrates a balanced emphasis on both the foundational setup and the ongoing enhancement of HR analytics capabilities within organizations.

(Source: Market.us)

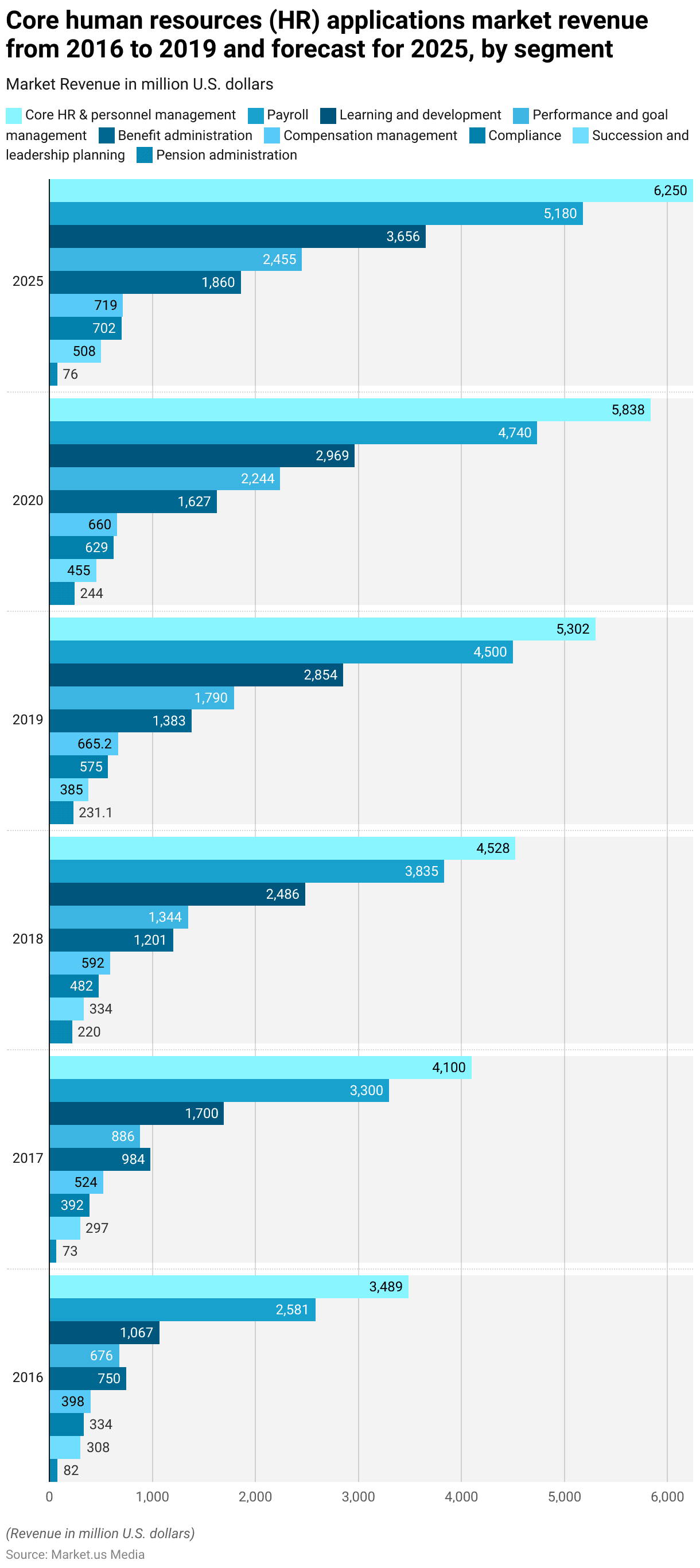

Core Human Resources (HR) Applications Market Revenue – By Segment

- From 2016 to 2025, the core human resources (HR) applications market has seen varied growth across different segments. Core HR and personnel management, being the largest segment, grew from USD 3,489 million in 2016 to USD 5,838 million in 2020, with a forecast to reach USD 6,250 million by 2025.

- The payroll segment also saw significant growth, starting at USD 2,581 million in 2016 and increasing to USD 4,740 million in 2020, which is projected to rise further to USD 5,180 million by 2025.

- Learning and development experienced substantial expansion from USD 1,067 million in 2016 to USD 2,969 million in 2020, with expectations to grow to USD 3,656 million by 2025.

- Performance and goal management more than tripled its revenue from USD 676 million in 2016 to USD 2,244 million in 2020 and is anticipated to reach USD 2,455 million by 2025.

- Benefits administration and compensation management segments also saw growth, with benefits administration increasing from USD 750 million in 2016 to USD 1,627 million in 2020, expected to reach USD 1,860 million by 2025. Compensation management grew from USD 398 million to USD 660 million in the same period, with a slight increase projected to USD 719 million by 2025.

More Insights

- Compliance rose from USD 334 million in 2016 to USD 629 million in 2020, with a forecast of USD 702 million by 2025.

- Succession and leadership planning fluctuated slightly, ultimately growing from USD 308 million in 2016 to USD 455 million in 2020, with a prediction of reaching USD 508 million by 2025.

- Interestingly, pension administration saw a peak in 2019 at USD 231.1 million but is expected to drop significantly to USD 76 million by 2025, reflecting shifting priorities or regulatory changes affecting pension management within HR functions.

- This data underscores the dynamic nature of the HR applications market, reflecting evolving business needs and technological advancements in managing workforce requirements.

(Source: Market.us)

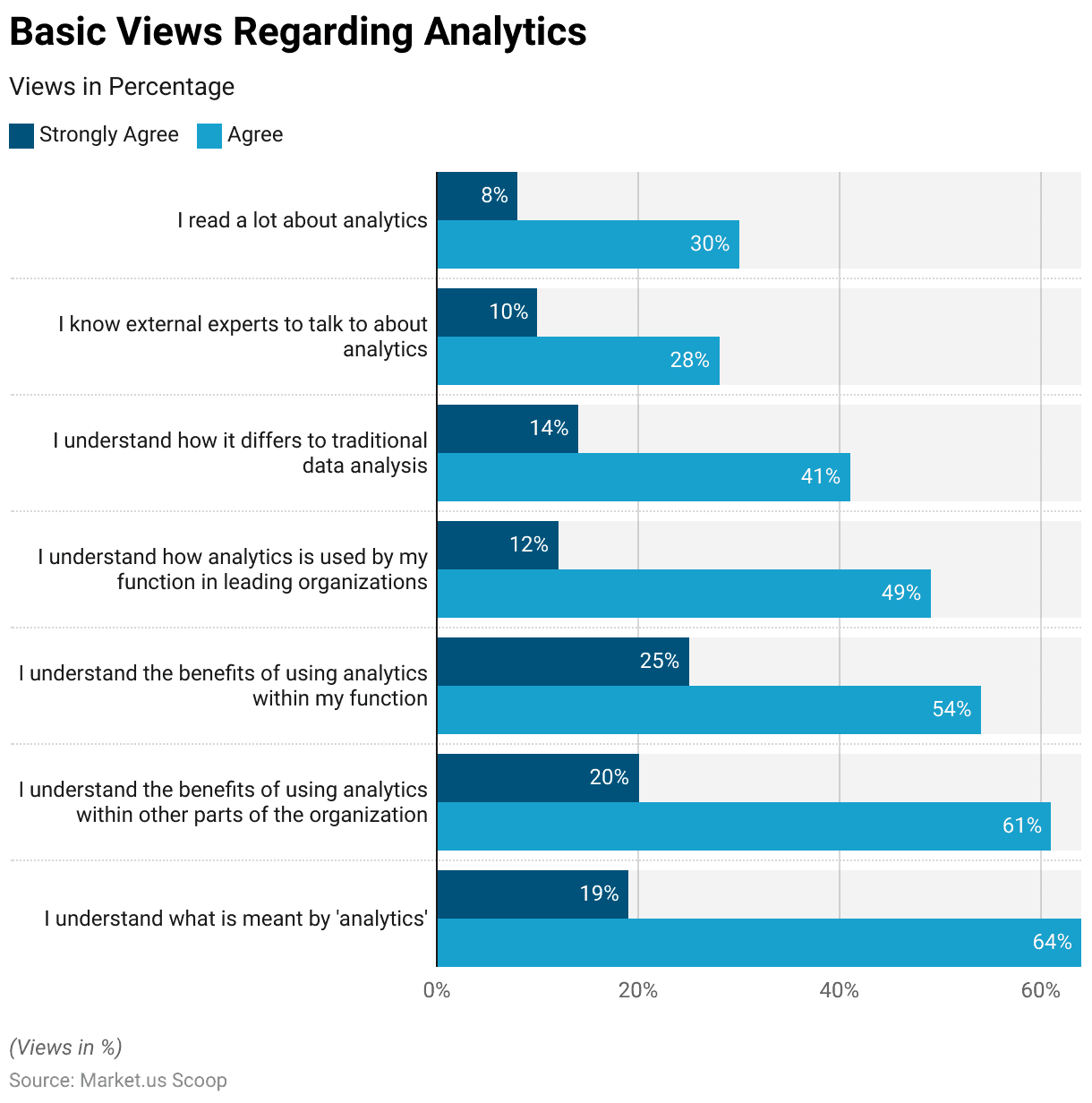

Basic Views Regarding Analytics

- The survey on basic views regarding analytics shows varying levels of agreement among respondents.

- A majority, 83% (19% strongly agree and 64% agree), understand what is meant by ‘analytics.’

- Regarding the recognition of the benefits of using analytics in other parts of the organization, 81% (20% strongly agree and 61% agree) acknowledge these advantages.

- When it comes to the benefits of using analytics within their function, a slightly lower total of 79% (25% strongly and 54% agree) express understanding.

- However, understanding seems to diminish slightly with more specific applications; only 61% (12% strongly agree and 49% agree) understand how their function in leading organizations uses analytics.

- About 55% (14% strongly agree and 41% agree) recognize how analytics differs from traditional data analysis.

- Knowledge of external experts to consult about analytics is less common, with only 38% (10% strongly agree and 28% agree) affirming they know whom to contact.

- Lastly, a minority, 38% (8% strongly agree and 30% agree), report that they read a lot about analytics, indicating a lesser engagement with ongoing developments in the field.

- This data highlights a general familiarity with the concept of analytics but a varying depth of understanding and engagement across different aspects of its application.

(Source: EMPXTrack)

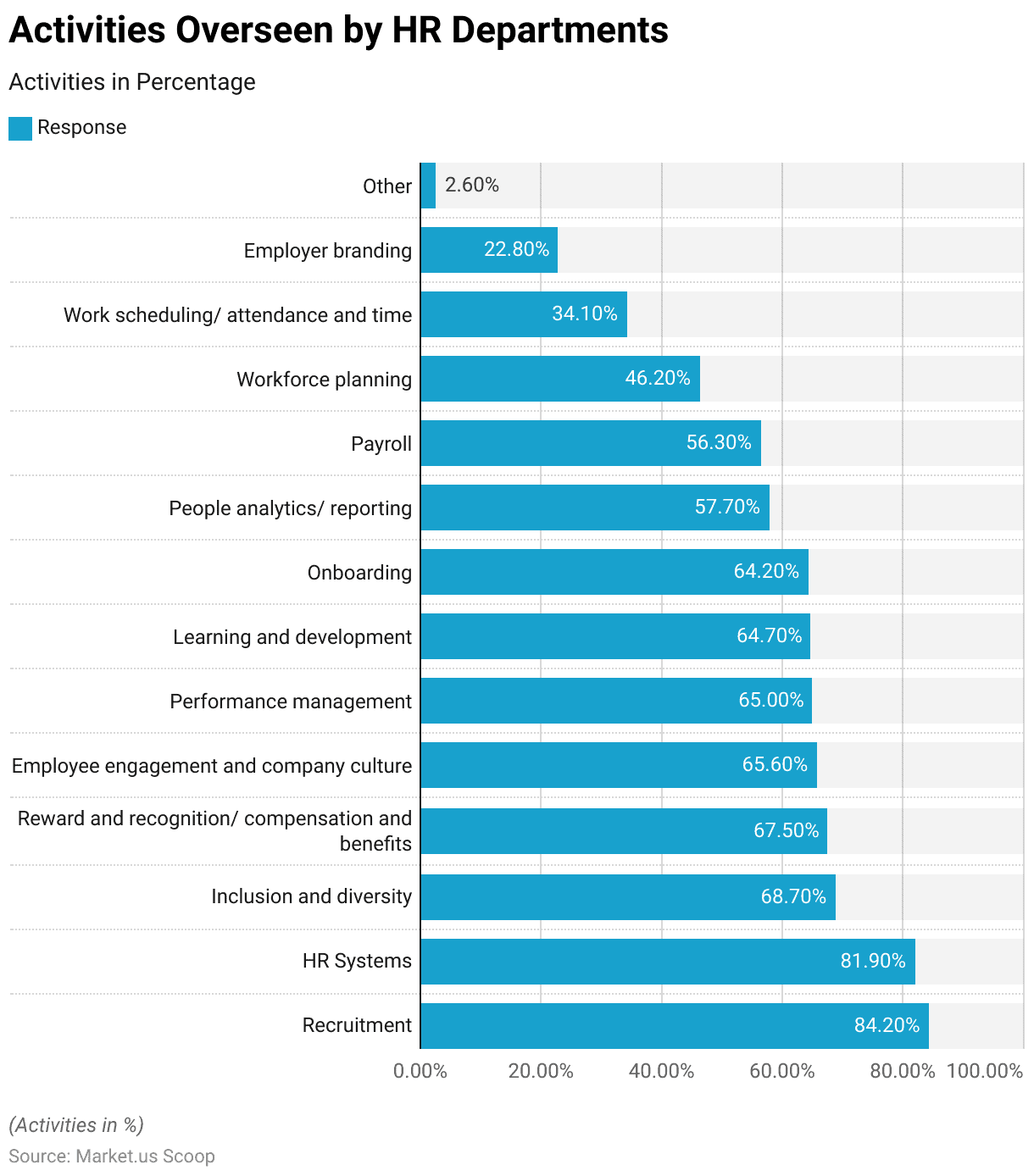

Activities Overseen by HR Departments

- In the survey concerning the activities overseen by HR departments in various organizations, recruitment emerges as the most prevalent function, with 84.2% of respondents indicating their HR departments handle this activity.

- Close behind, HR systems are managed by 81.9% of HR departments. Inclusion and diversity initiatives are also a significant focus, overseen by 68.7% of HR departments. Activities related to reward and recognition, alongside compensation and benefits, are managed by 67.5% of departments.

- Employee engagement and company culture are prioritized by 65.6% of HR departments, closely followed by performance management at 65% and learning and development at 64.7%.

- Onboarding activities are handled by 64.2% of HR departments. The use of people analytics and reporting is indicated by 57.7% of respondents, showing a substantial but not universal adoption.

- Payroll functions are managed by 56.3% of HR departments, while workforce planning is overseen by 46.2%.

- Work scheduling, attendance, and time management are managed by 34.1% of HR departments, indicating a lesser focus compared to other HR functions. Employer branding is at the lower end of the spectrum, managed by only 22.8% of HR departments.

- A small percentage (2.6%) of respondents indicated other functions not listed in the survey, underscoring the diverse responsibilities that HR departments may carry within different organizations.

- This array of activities highlights the extensive and varied role of HR in shaping organizational structure and culture.

(Source: CIPD)

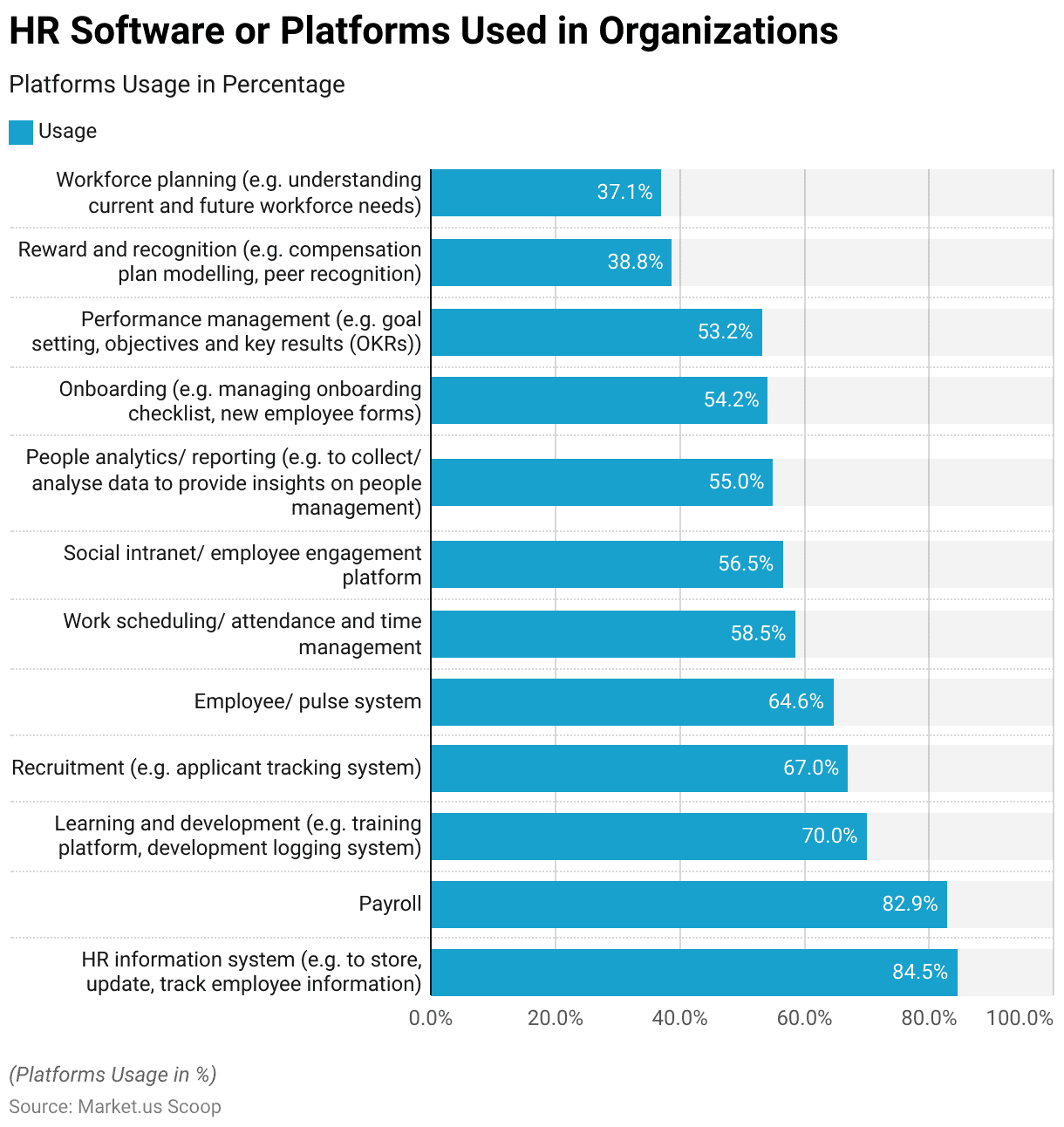

HR Software or Platforms Used in Organizations

- In the context of HR software and platform usage within organizations, various tools are employed to enhance different aspects of human resource management.

- The most widely used is the HR information system, which includes functionalities to store, update, and track employee information, with a usage rate of 84.5%. Payroll systems are also highly prevalent, utilized by 82.9% of organizations.

- Learning and development platforms, which support training and professional growth, are used by 70.0% of organizations. Recruitment tools, such as applicant tracking systems, are employed by 67.0% of respondents.

- Additionally, employee or pulse systems, which may gather regular feedback and monitor employee sentiment, are used by 64.6% of organizations.

- Work scheduling, attendance, and time management tools are employed by 58.5%, while social intranet or employee engagement platforms are utilized by 56.5%. People analytics and reporting tools, which help in analyzing data to provide insights on people management, are used by 55.0% of organizations.

- Onboarding software, which facilitates the management of new employee integration processes, is employed by 54.2% of organizations. Performance management systems, including those for goal setting and tracking objectives and key results (OKRs), are used by 53.2%.

- The use of software for reward and recognition, which may include compensation plan modeling and peer recognition features, is somewhat less common at 38.8%.

- Finally, workforce planning tools, critical for understanding current and future workforce needs, are used by 37.1% of organizations. This data illustrates a broad spectrum of digital tools deployed to streamline and enhance the efficiency of HR functions across various sectors.

(Source: CIPD)

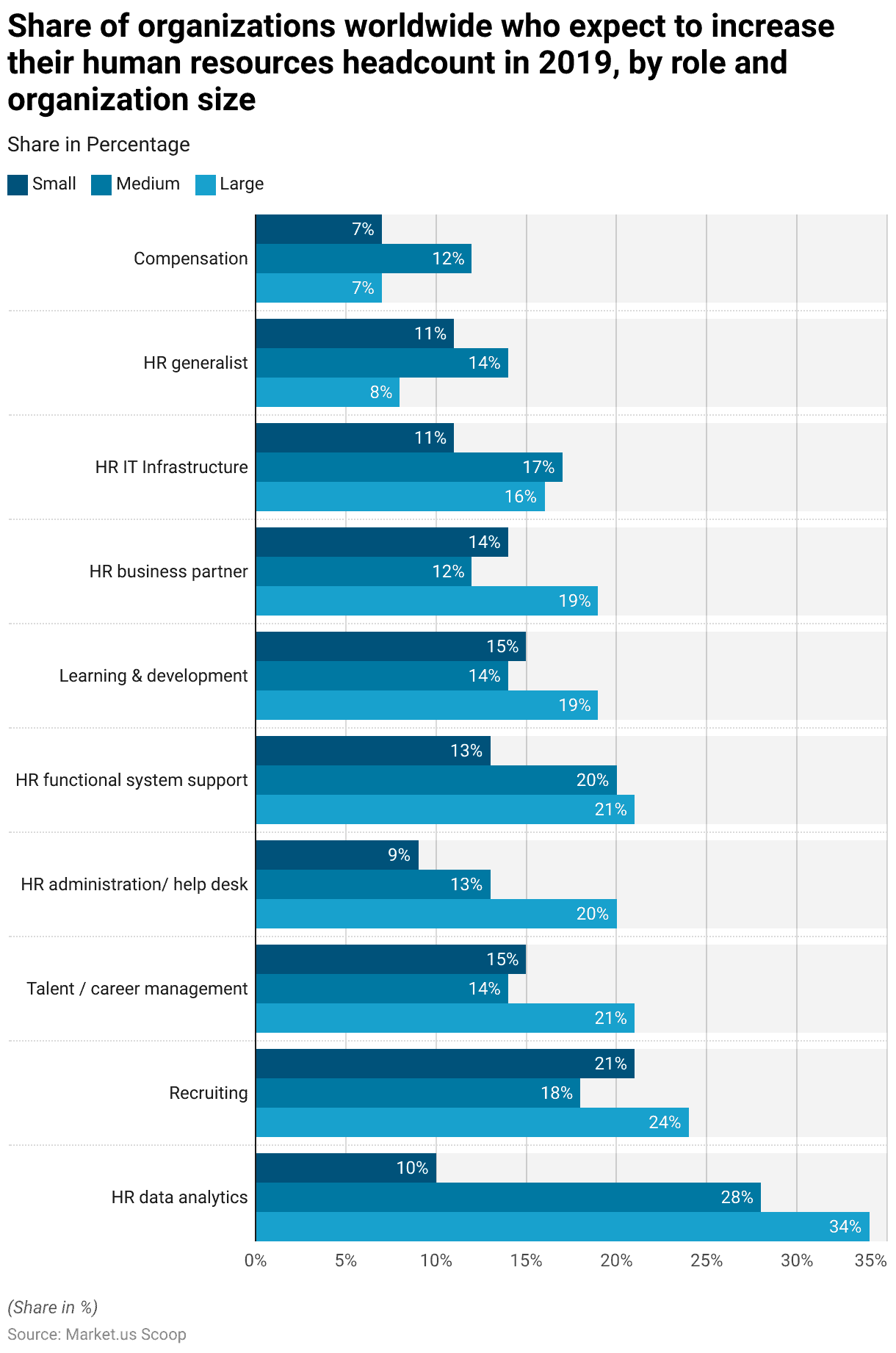

Expected HR Resourcing Increase by Organizations Worldwide

- In 2019, organizations worldwide exhibited varying intentions to increase their human resources headcount across different roles and depending on their size.

- Among large organizations, the highest expected increase was observed in HR data analytics, with 34% anticipating an expansion, followed by recruiting and talent/career management at 24% and 21%, respectively.

- Large organizations also projected significant growth in roles such as HR administration/help desk (20%), HR functional system support (21%), and learning & development (19%).

- Medium-sized organizations showed a stronger inclination to enhance their HR data analytics capabilities, with 28% planning to increase headcount in this area.

- Other roles like HR functional system support and HR IT infrastructure saw 20% and 17% of these organizations, respectively, expecting to expand their teams.

- Small organizations, while generally less likely to increase HR headcounts, still showed notable interest in recruiting, with 21% aiming to hire more personnel in this role.

- HR data analytics and learning & development were also focus areas, with 10% and 15% of small organizations, respectively, planning to boost their teams in these areas.

- Overall, the trend across different organization sizes highlighted a significant focus on expanding roles related to data analytics, recruiting, and strategic HR functions, reflecting the evolving needs and strategic priorities within human resources.

(Source: Market.us)

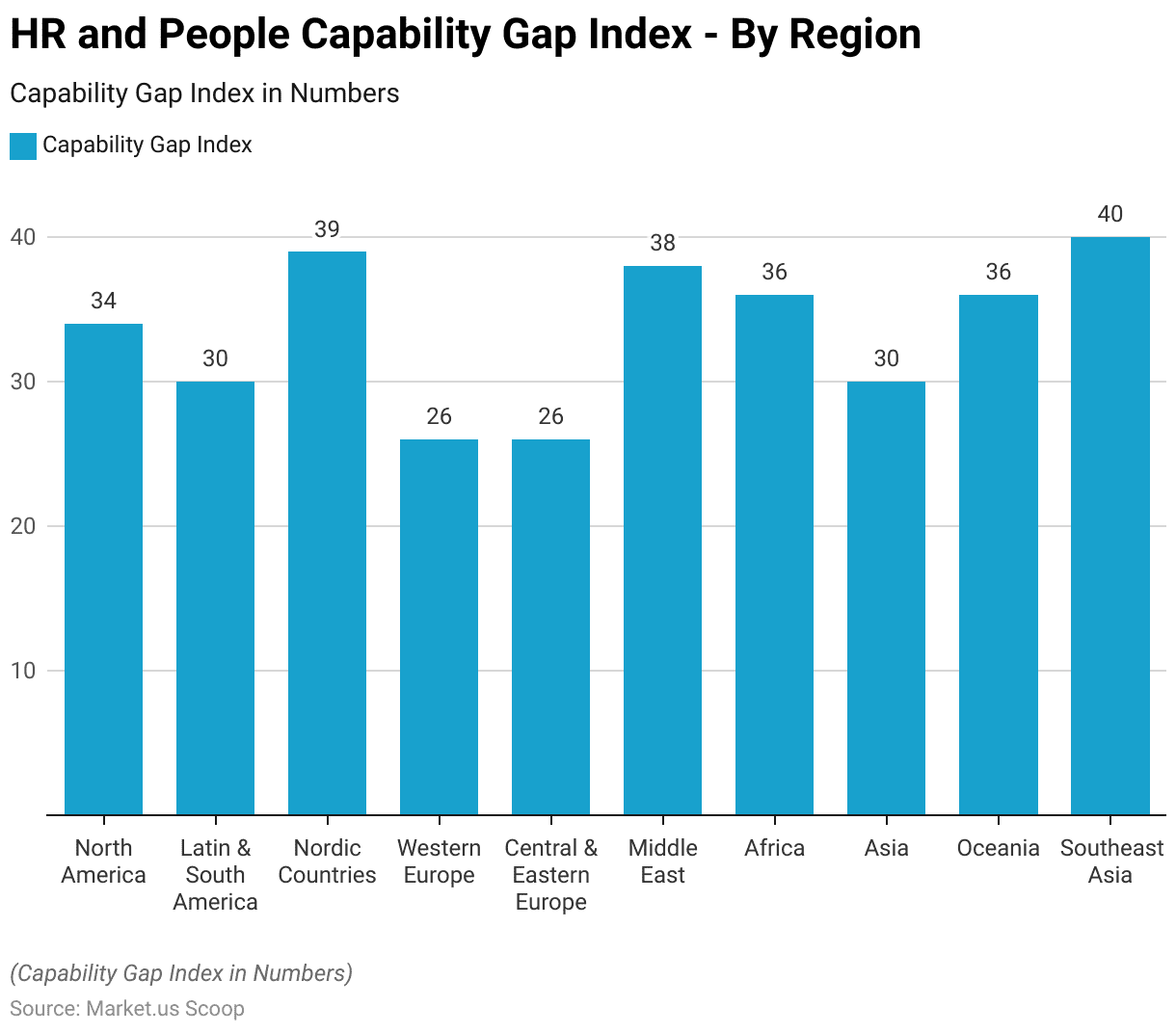

HR and People Analytics Capability Gap

HR and People Analytics Capability Gap – By Region

- The HR and People Analytics Capability Gap, as measured by a specific index, reveals considerable regional variations in the perceived inadequacies of HR analytics capabilities.

- Southeast Asia exhibits the highest capability gap with an index of 40, closely followed by the Nordic countries at 39 and the Middle East at 38.

- Oceania and Africa also display significant gaps, each scoring 36 on the index.

- North America’s capability gap is noted at 34, indicating a lesser but still notable need for improvement in HR analytics capabilities compared to some other regions.

- Latin America, Asia, Western Europe, and Central & Eastern Europe share lower yet comparable gaps, each scoring 30 and 26, respectively.

- These numbers reflect diverse regional challenges and priorities in enhancing HR analytics capabilities to support organizational decision-making and strategic human resource management better.

(Source: Deloitte Insights)

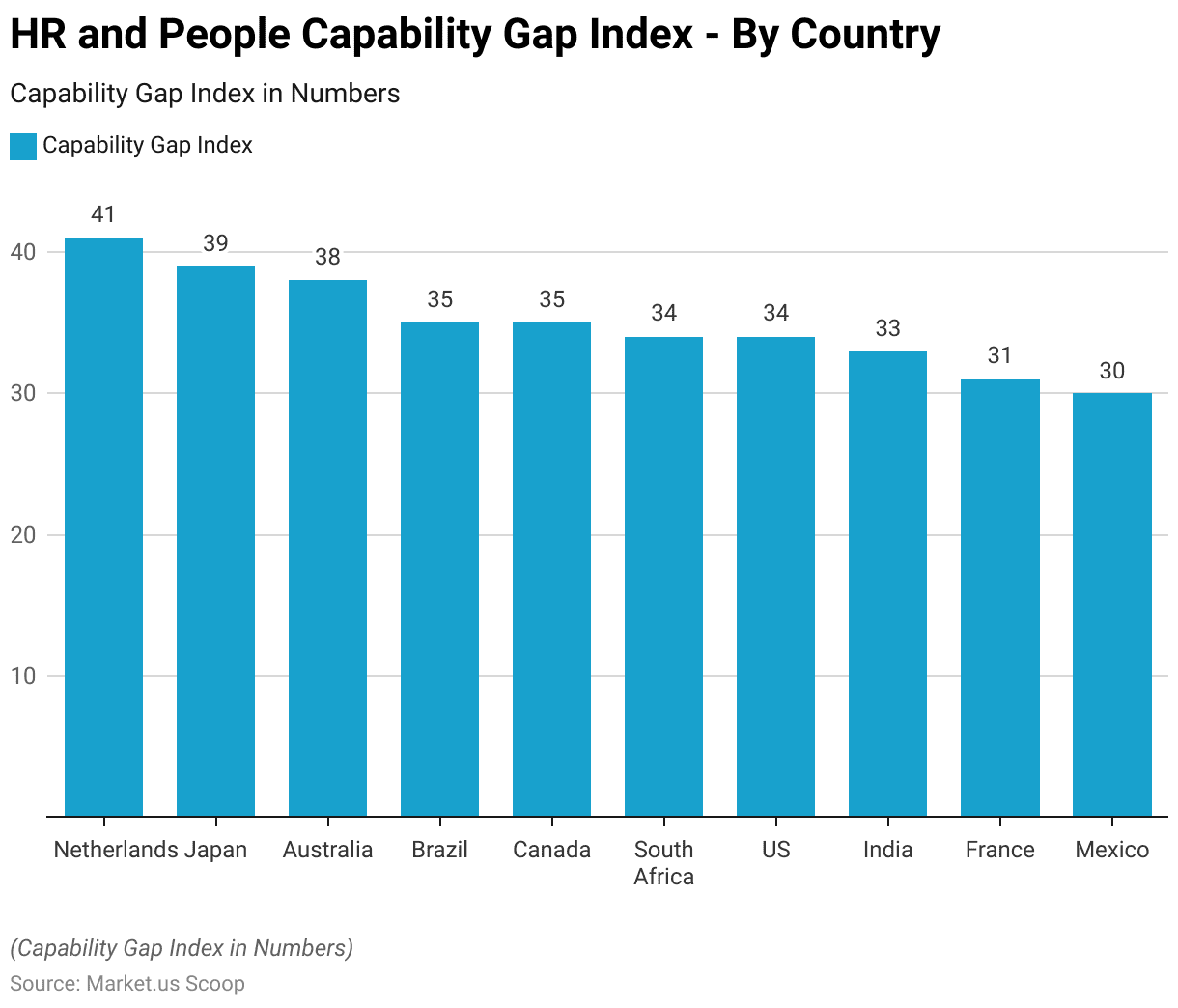

HR and People Analytics Capability Gap – By Country

- The HR and People Analytics Capability Gap Index showcases variations across different countries, indicating varying levels of need for advancement in HR analytics capabilities.

- The Netherlands leads with the highest capability gap at an index of 41, suggesting a significant need for enhancement in their HR analytics practices.

- Japan follows closely with a gap index of 39 and Australia with 38, both indicating substantial room for improvement in leveraging HR analytics more effectively.

- Brazil and Canada each have a capability gap index of 35, showing strong demand for better analytics capabilities within their HR sectors.

- South Africa and the United States each score 34 on the index, further highlighting the global need for advancements in HR analytics.

- Slightly lower but still noteworthy, India registers a gap index of 33, while France and Mexico round out the list with indices of 31 and 30, respectively.

- These figures underscore the global challenge and opportunity to bridge the gap in HR analytics to optimize human resource management and strategic decision-making across varied organizational contexts.

(Source: Deloitte Insights)

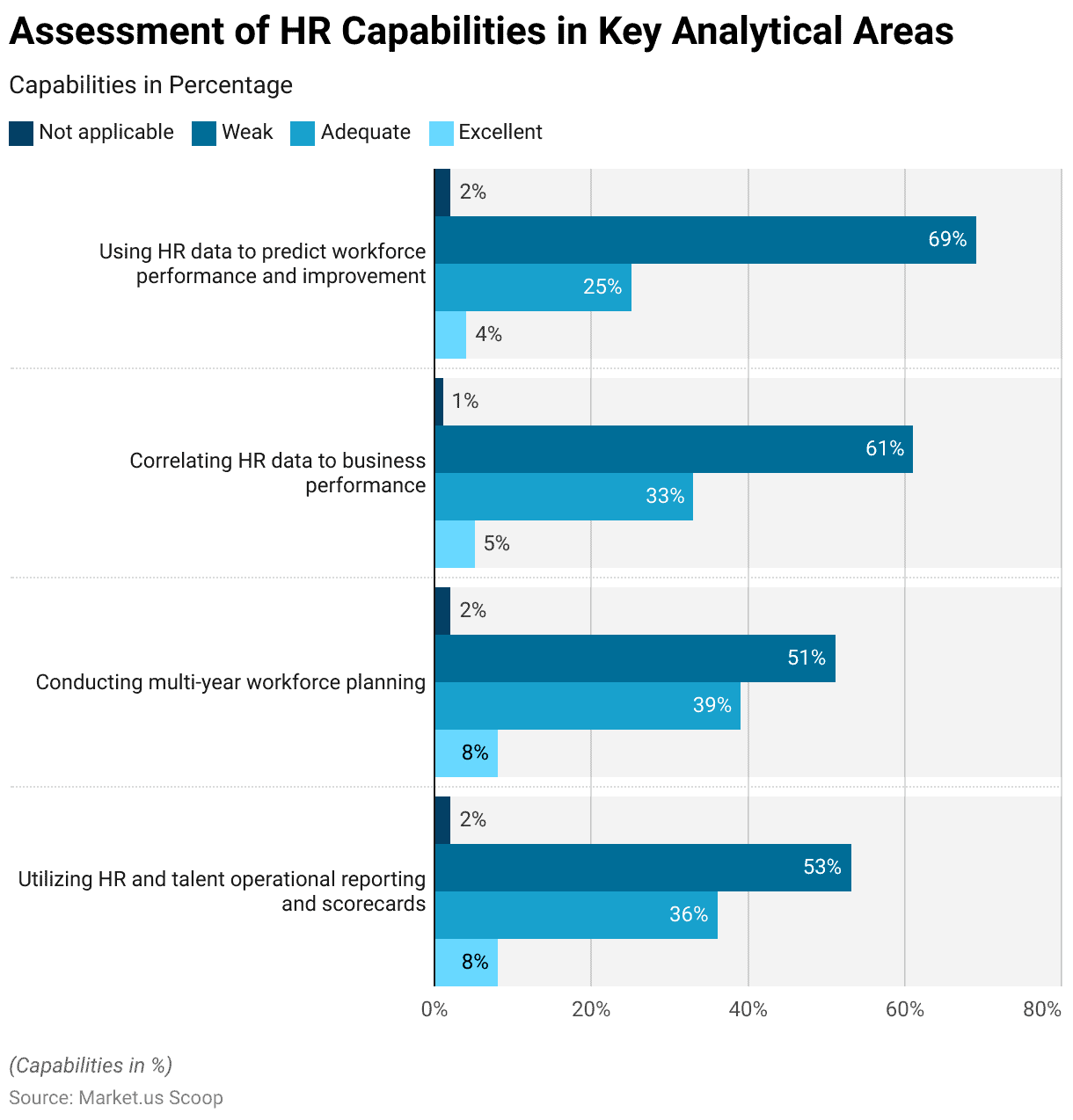

Assessment of HR Capabilities in Key Analytical Areas

- The evaluation of HR and people analytics capabilities across various organizations reveals significant insights into how these capabilities are perceived.

- In the realm of utilizing HR and talent operational reporting and scorecards, only 8% of respondents rate their capabilities as excellent. In comparison, a majority of 53% consider them weak, 36% find them adequate, and a minimal 2% deem them not applicable.

- Similarly, in conducting multi-year workforce planning, 8% also view their capabilities as excellent, but 51% find them weak, and 39% rate them as adequate, with 2% indicating it’s not applicable.

- The capability to correlate HR data to business performance shows an even more concerning trend, where only 5% believe it to be excellent and a significant 61% view it as weak; 33% consider it adequate, and a negligible 1% find it not applicable.

- Lastly, the use of HR data to predict workforce performance and improvement presents the most challenging area, with a mere 4% rating it as excellent and a predominant 69% rating it as weak; 25% find it adequate, and 2% see it as not applicable.

- These evaluations highlight critical areas for development in HR analytics capabilities to support strategic business objectives better.

(Source: Deloitte Insights)

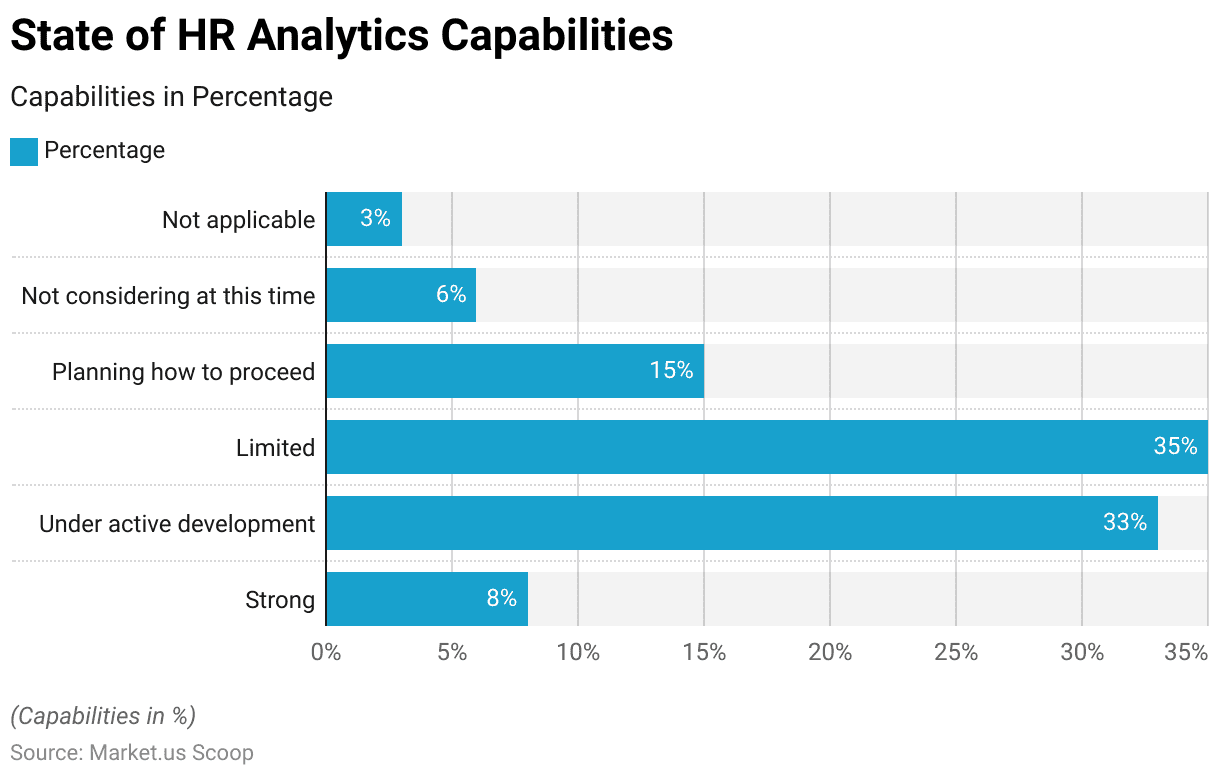

State of HR Analytics Capabilities

- The current state of HR analytics capabilities within organizations shows a diverse range of development and implementation stages.

- Only 8% of respondents describe their HR analytics capabilities as strong, indicating a robust and effective use of analytics within their HR functions.

- A significant 33% report that their HR analytics capabilities are under active development, reflecting ongoing efforts to enhance these systems.

- The largest segment, 35%, admits that their capabilities are limited, highlighting a prevalent challenge in fully leveraging HR analytics tools.

- Additionally, 15% of respondents are still planning how to proceed with HR analytics, suggesting that while they recognize the importance, they have yet to initiate substantial development.

- A smaller segment of 6% are not considering HR analytics at this time, indicating a lack of priority or resources for these initiatives.

- Lastly, 3% find HR analytics not applicable to their operations, possibly due to the nature of their business or current strategic focus.

- This distribution underscores the varying degrees of engagement and maturity in HR analytics across different organizations.

(Source: Deloitte Insights)

Recent Developments

Acquisitions and Expansions:

- In February 2022, Crunchr, a company specializing in HR analytics, received funding to expand its people analytics product offerings and to fuel its international expansion. This funding also supports enhancements in data-driven storytelling and skill-based workforce planning.

- ADP’s Acquisition of Workforce Analytics Firm: ADP, a leading provider of human resources management solutions, announced its acquisition of a workforce analytics firm specializing in data-driven HR solutions.

- The acquisition, valued at $100 million, strengthens ADP’s capabilities in HR analytics and workforce planning, enabling clients to make informed decisions based on data-driven insights.

Product Innovations and Technology Integration:

- SAP’s SuccessFactors Workforce Analytics continues to enable HR professionals, analysts, and business partners to make data-driven business decisions.

- In October 2020, Tata Consultancy Services launched TCS Workforce Analytics, an AI-based system providing insights and enhancing workforce experiences to aid businesses in talent management during the digital era

Funding Round for HR Analytics Startup:

- AHR Analytics, a startup specializing in predictive analytics for human resources, secured $10 million in Series A funding led by venture capital firm XYZ Ventures.

- The funding will support AHR Analytics’ expansion efforts and further development of its predictive modeling algorithms for talent acquisition and employee retention.

- This investment underscores the growing interest in HR analytics solutions among investors and organizations seeking to optimize their HR processes.

Shift Towards Cloud-Based HR Analytics Platforms:

- Companies are shifting towards cloud-based HR analytics platforms to access scalable, flexible, and cost-effective solutions for managing and analyzing HR data.

- Cloud-based platforms offer real-time access to data insights, seamless integration with existing HR systems, and enhanced data security features.

- As organizations seek to modernize their HR operations and adapt to remote work environments, cloud-based HR analytics solutions are becoming increasingly essential for driving business agility and decision-making effectiveness.

Conclusion

HR Analytics Statistics – HR analytics has become a cornerstone in modern HR management, reflecting substantial investments in data-driven tools and technologies to optimize functions such as recruitment and performance management.

Despite noticeable advancements, significant capability gaps exist across various regions, highlighting opportunities for further development.

Many organizations are actively expanding their HR analytics functions, though integration remains uneven, suggesting a need for continued investment in training and upskilling HR professionals.

Overall, while HR analytics is instrumental in enhancing organizational effectiveness, further efforts are required to fully leverage its potential and ensure its transformative impact on HR practices aligns with evolving business demands.

FAQs

HR analytics involves the application of analytic processes to the human resource department of an organization to improve employee performance and, therefore, get a better return on investment. It uses data analysis techniques to understand and improve processes related to human resources.

HR analytics is crucial as it allows HR professionals to make data-driven decisions that can lead to more effective and efficient HR policies and practices. This can include everything from recruitment, retention strategies, and employee performance to optimizing training programs and improving employee satisfaction.

Common metrics include turnover rates, training return on investment (ROI), employee performance data, cost-per-hire, time-to-hire, and employee engagement levels. Advanced metrics might include predictive analytics for employee turnover, workforce productivity models, and the impact of HR interventions on overall business performance.

HR analytics can identify key factors that contribute to employee turnover and provide insights into the necessary changes in workplace policies or practices to enhance employee retention. This could involve adjustments in compensation, work-life balance initiatives, career development opportunities, and more.

Common tools include HR information systems (HRIS), advanced statistical tools, and specialized software like SAP SuccessFactors, Workday, or Tableau for data visualization. These tools help gather, store, and analyze HR data effectively.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)