Table of Contents

- Introduction

- Editor’s Choice

- Global HR Analytics Market Overview

- Basic Views Regarding Analytics

- Activities Overseen by HR Departments

- HR Software or Platforms Used in Organizations

- Expected HR Resourcing Increase by Organizations Worldwide

- HR and People Analytics Capability Gap

- Assessment of HR Capabilities in Key Analytical Areas

- State of HR Analytics Capabilities

Introduction

According to HR Analytics Statistics, HR analytics, the application of data analysis to human resources data, enables organizations to make informed decisions about their workforce, aligning strategies with business objectives.

It begins with collecting data such as employee demographics, performance evaluations, and recruitment metrics.

After cleaning and preparing the data, descriptive analytics summarizes historical trends, while predictive analytics forecasts future outcomes like turnover rates and staffing needs.

Predictive analytics then offers actionable recommendations for process optimization and risk mitigation.

Key metrics such as turnover rates and employee satisfaction scores are tracked, ensuring continuous improvement and adherence to data privacy regulations.

Through HR analytics, organizations can optimize their HR processes, enhance employee engagement, and drive better business results.

Editor’s Choice

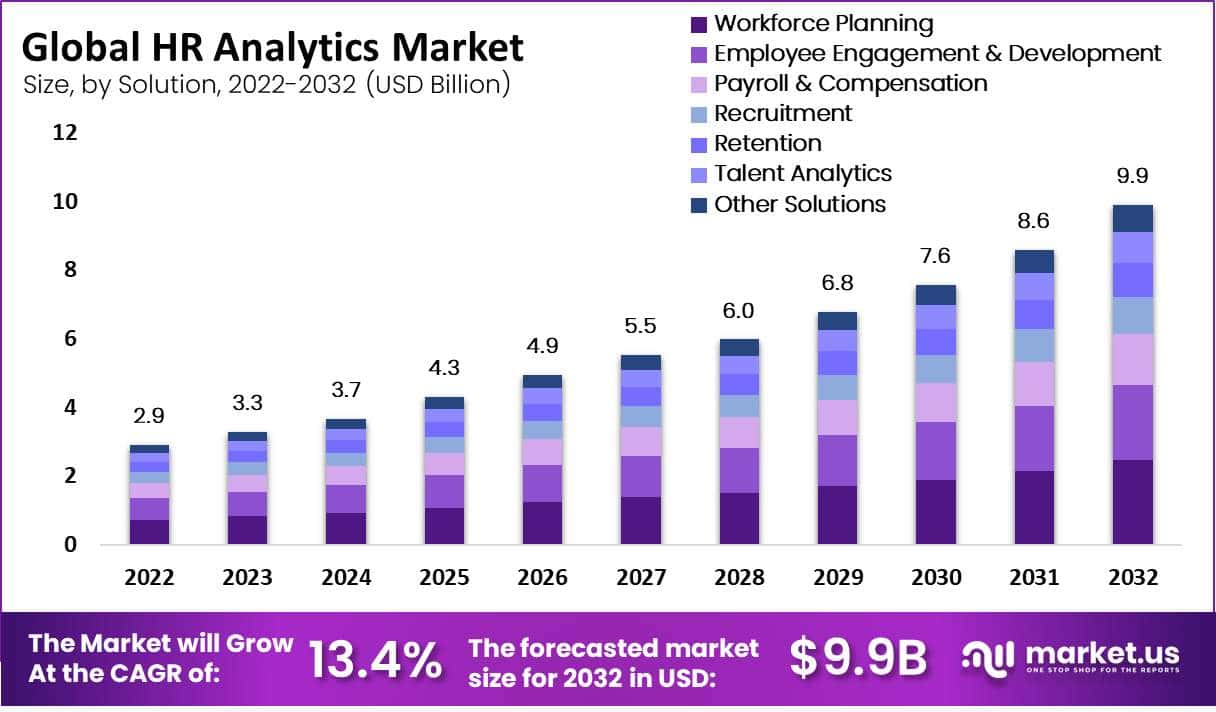

- The global HR analytics market revenue is expected to culminate at USD 9.9 billion by 2032.

- Throughout 2022-2032, workforce planning will see an increase from USD 0.73 billion to USD 2.48 billion, demonstrating its growing importance in strategic HR processes.

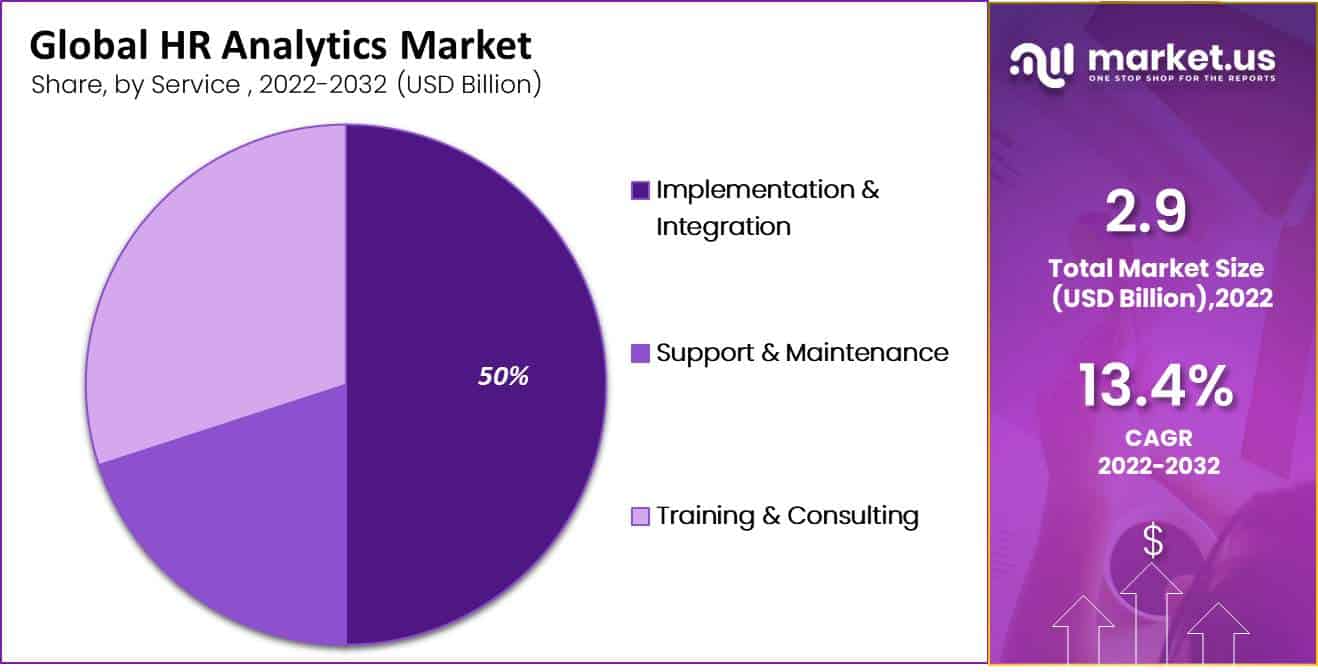

- In the distribution of market share among services related to HR analytics, Implementation & Integration services dominate, accounting for 50% of the market.

- From 2016 to 2025, the core human resources (HR) applications market has seen varied growth across different segments. Core HR and personnel management, being the largest segment, grew from USD 3,489 million in 2016 to USD 5,838 million in 2020, with a forecast to reach USD 6,250 million by 2025.

- The most widely used is the HR information system, which includes functionalities to store, update, and track employee information, with a usage rate of 84.5%.

- Among large organizations, the highest expected increase was observed in HR data analytics, with 34% anticipating an expansion, followed by online recruiting and talent/career management at 24% and 21%, respectively.

- Only 8% of respondents describe their HR analytics capabilities as strong, indicating a robust and effective use of analytics within their HR functions.

Global HR Analytics Market Overview

HR Analytics Market Size

- The global HR analytics market has demonstrated a strong growth trajectory at a CAGR of 13.4%, with revenue figures consistently rising from USD 2.9 billion in 2022.

- The market is projected to increase steadily, reaching USD 3.3 billion in 2023 and further expanding to USD 3.7 billion by 2024.

- Over the subsequent years, the market is expected to continue its upward trend, achieving USD 4.3 billion in 2025 and USD 4.9 billion by 2026.

- By the end of the decade, the market is projected to reach USD 7.6 billion in 2030 and culminate at USD 9.9 billion by 2032.

HR Analytics Market Size – By Solution

- The global HR analytics market is forecasted to exhibit substantial growth across various segments, expanding from a total revenue of USD 2.9 billion in 2022 to USD 9.9 billion by 2032.

- Over this period, workforce planning will see an increase from USD 0.73 billion to USD 2.48 billion, demonstrating its growing importance in strategic HR processes.

- Similarly, revenue from employee engagement and development solutions is expected to grow from USD 0.64 billion to USD 2.18 billion, reflecting heightened focus on improving workplace environments and employee growth.

- Payroll and compensation solutions will also see a notable rise, from USD 0.44 billion in 2022 to USD 1.49 billion in 2032, indicating an ongoing emphasis on optimizing compensation strategies.

- Recruitment analytics are set to grow from USD 0.32 billion to USD 1.09 billion, and retention solutions will increase from USD 0.29 billion to USD 0.99 billion, both critical for maintaining competitive advantage through talent acquisition and retention.

- Talent analytics is projected to rise from USD 0.26 billion to USD 0.89 billion, underscoring the growing reliance on data-driven decision-making in talent management.

Global HR Analytics Market Share – By Service

- In the distribution of market share among services related to HR analytics, Implementation & Integration services dominate, accounting for 50% of the market.

- Support & Maintenance services also play a significant role, comprising 20% of the market share, underscoring the importance of ongoing assistance and system upkeep to ensure continuous operational efficiency.

- Lastly, Training & Consulting services claim 30% of the market share, reflecting the demand for expert guidance and education in utilizing HR analytics tools effectively to drive strategic decisions and enhance workforce management.

Core Human Resources (HR) Applications Market Revenue – By Segment

- From 2016 to 2025, the core human resources (HR) applications market has seen varied growth across different segments. Core HR and personnel management, being the largest segment, grew from USD 3,489 million in 2016 to USD 5,838 million in 2020, with a forecast to reach USD 6,250 million by 2025.

- The payroll segment also saw significant growth, starting at USD 2,581 million in 2016 and increasing to USD 4,740 million in 2020, which is projected to rise further to USD 5,180 million by 2025.

- Learning and development experienced substantial expansion from USD 1,067 million in 2016 to USD 2,969 million in 2020, with expectations to grow to USD 3,656 million by 2025.

- Performance and goal management more than tripled its revenue from USD 676 million in 2016 to USD 2,244 million in 2020 and is anticipated to reach USD 2,455 million by 2025.

- Benefits administration and compensation management segments also saw growth, with benefits administration increasing from USD 750 million in 2016 to USD 1,627 million in 2020, expected to reach USD 1,860 million by 2025. Compensation management grew from USD 398 million to USD 660 million in the same period, with a slight increase projected to USD 719 million by 2025.

Basic Views Regarding Analytics

- A majority, 83% (19% strongly agree and 64% agree), understand what is meant by ‘analytics.’

- Regarding the recognition of the benefits of using analytics in other parts of the organization, 81% (20% strongly agree and 61% agree) acknowledge these advantages.

- When it comes to the benefits of using analytics within their function, a slightly lower total of 79% (25% strongly and 54% agree) express understanding.

- However, understanding seems to diminish slightly with more specific applications; only 61% (12% strongly agree and 49% agree) understand how their function in leading organizations uses analytics.

- About 55% (14% strongly agree and 41% agree) recognize how analytics differs from traditional data analysis.

- Knowledge of external experts to consult about analytics is less common, with only 38% (10% strongly agree and 28% agree) affirming they know whom to contact.

Activities Overseen by HR Departments

- In the survey concerning the activities overseen by HR departments in various organizations, recruitment emerges as the most prevalent function, with 84.2% of respondents indicating their HR departments handle this activity.

- Close behind, HR systems are managed by 81.9% of HR departments. Inclusion and diversity initiatives are also a significant focus, overseen by 68.7% of HR departments. Activities related to reward and recognition, alongside compensation and benefits, are managed by 67.5% of departments.

- Employee engagement and company culture are prioritized by 65.6% of HR departments, closely followed by performance management at 65% and learning and development at 64.7%.

- Onboarding activities are handled by 64.2% of HR departments. The use of people analytics and reporting is indicated by 57.7% of respondents, showing a substantial but not universal adoption.

- Payroll functions are managed by 56.3% of HR departments, while workforce planning is overseen by 46.2%.

- Work scheduling, attendance, and time management are managed by 34.1% of HR departments, indicating a lesser focus compared to other HR functions. Employer branding is at the lower end of the spectrum, managed by only 22.8% of HR departments.

HR Software or Platforms Used in Organizations

- The most widely used is the HR information system, which includes functionalities to store, update, and track employee information, with a usage rate of 84.5%. Payroll systems are also highly prevalent, utilized by 82.9% of organizations.

- Learning and development platforms, which support training and professional growth, are used by 70.0% of organizations. Recruitment tools, such as applicant tracking systems, are employed by 67.0% of respondents.

- Additionally, employee or pulse systems, which may gather regular feedback and monitor employee sentiment, are used by 64.6% of organizations.

- Work scheduling, attendance, and time management tools are employed by 58.5%, while social intranet or employee engagement platforms are utilized by 56.5%. People analytics and reporting tools, which help in analyzing data to provide insights on people management, are used by 55.0% of organizations.

- Onboarding software, which facilitates the management of new employee integration processes, is employed by 54.2% of organizations. Performance management systems, including those for goal setting and tracking objectives and key results (OKRs), are used by 53.2%.

- The use of software for reward and recognition, which may include compensation plan modeling and peer recognition features, is somewhat less common at 38.8%.

Expected HR Resourcing Increase by Organizations Worldwide

- Among large organizations, the highest expected increase was observed in HR data analytics, with 34% anticipating an expansion, followed by recruiting and talent/career management at 24% and 21%, respectively.

- Large organizations also projected significant growth in roles such as HR administration/help desk (20%), HR functional system support (21%), and learning & development (19%).

- Medium-sized organizations showed a stronger inclination to enhance their HR data analytics capabilities, with 28% planning to increase headcount in this area.

- Other roles like HR functional system support and HR IT infrastructure saw 20% and 17% of these organizations, respectively, expecting to expand their teams.

- Small organizations, while generally less likely to increase HR headcounts, still showed notable interest in recruiting, with 21% aiming to hire more personnel in this role.

- HR data analytics and learning & development were also focus areas, with 10% and 15% of small organizations, respectively, planning to boost their teams in these areas.

HR and People Analytics Capability Gap

By Region

- Southeast Asia exhibits the highest capability gap with an index of 40, closely followed by the Nordic countries at 39 and the Middle East at 38.

- Oceania and Africa also display significant gaps, each scoring 36 on the index.

- North America’s capability gap is noted at 34, indicating a lesser but still notable need for improvement in HR analytics capabilities compared to some other regions.

- Latin America, Asia, Western Europe, and Central & Eastern Europe share lower yet comparable gaps, each scoring 30 and 26, respectively.

By Country

- The Netherlands leads with the highest capability gap at an index of 41, suggesting a significant need for enhancement in their HR analytics practices.

- Japan follows closely with a gap index of 39 and Australia with 38, both indicating substantial room for improvement in leveraging HR analytics more effectively.

- Brazil and Canada each have a capability gap index of 35, showing strong demand for better analytics capabilities within their HR sectors.

- South Africa and the United States each score 34 on the index, further highlighting the global need for advancements in HR analytics.

- Slightly lower but still noteworthy, India registers a gap index of 33, while France and Mexico round out the list with indices of 31 and 30, respectively.

Assessment of HR Capabilities in Key Analytical Areas

- In the realm of utilizing HR and talent operational reporting and scorecards, only 8% of respondents rate their capabilities as excellent. In comparison, a majority of 53% consider them weak, 36% find them adequate, and a minimal 2% deem them not applicable.

- Similarly, in conducting multi-year workforce planning, 8% also view their capabilities as excellent, but 51% find them weak, and 39% rate them as adequate, with 2% indicating it’s not applicable.

- The capability to correlate HR data to business performance shows an even more concerning trend, where only 5% believe it to be excellent and a significant 61% view it as weak; 33% consider it adequate, and a negligible 1% find it not applicable.

- Lastly, the use of HR data to predict workforce performance and improvement presents the most challenging area, with a mere 4% rating it as excellent and a predominant 69% rating it as weak; 25% find it adequate, and 2% see it as not applicable.

State of HR Analytics Capabilities

- Only 8% of respondents describe their HR analytics capabilities as strong, indicating a robust and effective use of analytics within their HR functions.

- A significant 33% report that their HR analytics capabilities are under active development, reflecting ongoing efforts to enhance these systems.

- The largest segment, 35%, admits that their capabilities are limited, highlighting a prevalent challenge in fully leveraging HR analytics tools.

- Additionally, 15% of respondents are still planning how to proceed with HR analytics, suggesting that while they recognize the importance, they have yet to initiate substantial development.

- A smaller segment of 6% are not considering HR analytics at this time, indicating a lack of priority or resources for these initiatives.

- Lastly, 3% find HR analytics not applicable to their operations, possibly due to the nature of their business or current strategic focus.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)