Table of Contents

Introduction

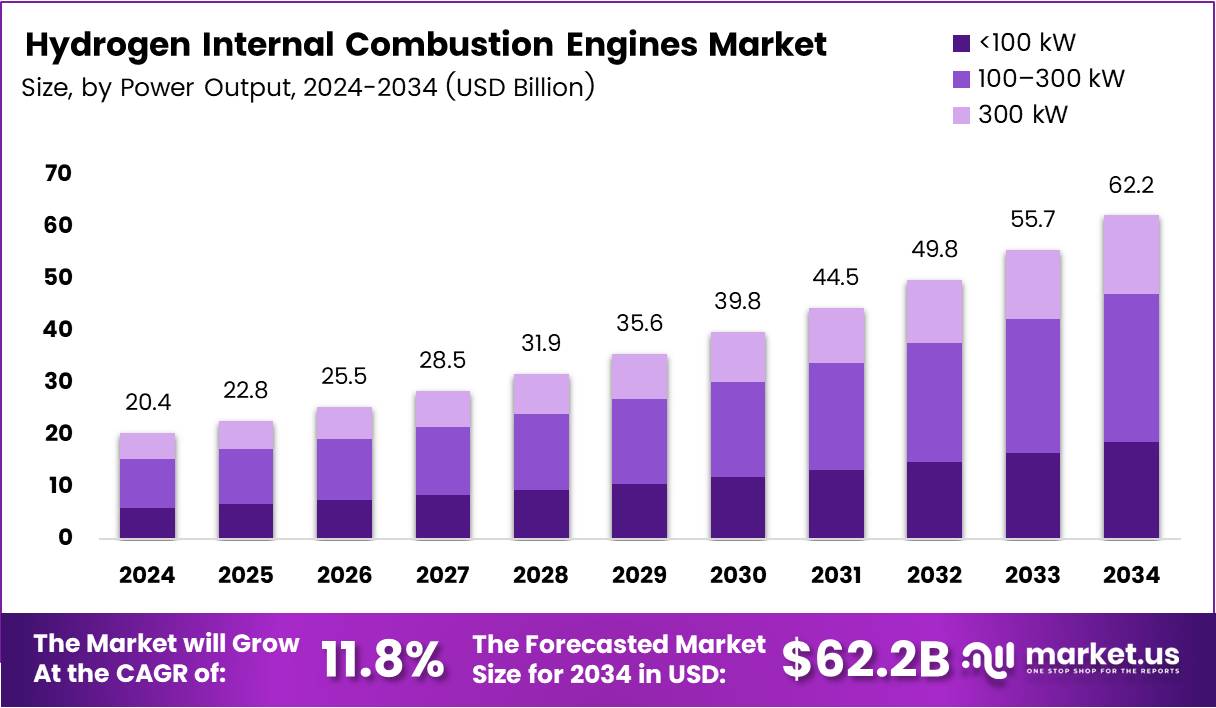

The Global Hydrogen Internal Combustion Engines (HICE) Market is witnessing accelerated momentum, projected to reach USD 62.2 Billion by 2034, up from USD 20.4 Billion in 2024. With a robust CAGR of 11.8%, the market marks a pivotal shift toward sustainable propulsion systems, bridging the transition between conventional and electric mobility.

As governments worldwide intensify decarbonization efforts, hydrogen ICEs are emerging as a viable solution offering zero-carbon combustion. These engines emit water vapor instead of CO₂, aligning perfectly with global emission reduction targets and providing a cost-effective alternative for sectors requiring high-performance powertrains.

Moreover, ongoing technological advancements, favorable regulatory frameworks, and expanding hydrogen infrastructure are collectively fueling adoption across commercial, industrial, and transportation sectors. The market’s trajectory highlights hydrogen’s potential as a cornerstone for the next generation of clean, efficient, and scalable energy solutions.

Key Takeaways

- The Global Hydrogen Internal Combustion Engines Market is projected to reach USD 62.2 Billion by 2034, growing from USD 20.4 Billion in 2024 at a strong CAGR of 11.8%.

- In 2024, Commercial Vehicles led the market By Vehicle Type with a 34.6% share, driven by rising adoption in logistics and public transport.

- Green Hydrogen dominated the By Fuel Type segment in 2024, capturing a 47.3% share due to renewable energy expansion and low-carbon mandates.

- Spark Ignition (SI) accounted for a 39.2% share in 2024 under the By Ignition Type category, supported by easy integration with gasoline engines.

- The Transportation & Logistics sector held the top position By End Use in 2024, with a 39.7% share, fueled by emission norms and fleet electrification.

- North America emerged as the leading region in 2024, commanding a 46.8% market share, valued at USD 9.5 Billion, due to strong policy support and hydrogen infrastructure growth.

Market Segmentation Overview

By Vehicle Type, Commercial Vehicles dominate the market with a 34.6% share, reflecting early adoption in heavy-duty and public transportation fleets. Passenger vehicles are gradually gaining traction, while off-highway, marine, and stationary applications expand hydrogen ICE penetration across industries.

By Fuel Type, Green Hydrogen leads with a 47.3% share, underscoring the global shift toward renewable energy sources. Blue Hydrogen acts as a transitional option supported by carbon capture, while Grey Hydrogen’s usage declines under stricter emission regulations.

By Ignition Type, Spark Ignition (SI) engines command a 39.2% share due to compatibility with existing gasoline platforms. Meanwhile, hydrogen-diesel dual-fuel and direct injection technologies are gaining traction in heavy-duty applications for enhanced performance and efficiency.

By End Use, Transportation & Logistics hold a 39.7% market share, propelled by emission compliance and clean fleet initiatives. Agriculture, construction, and power generation sectors are increasingly turning to hydrogen ICEs for sustainable and reliable energy solutions.

Drivers

Rising Government Incentives and Subsidies: Governments across major economies are launching financial support programs such as tax rebates, R&D grants, and green fuel credits to accelerate hydrogen mobility adoption. These policies lower the entry barriers for automakers and fleet operators, driving large-scale commercialization of hydrogen internal combustion engines.

Expansion of Hydrogen Refueling Infrastructure: A surge in public-private partnerships is boosting the development of hydrogen refueling networks. Europe, North America, and Asia are investing heavily in fueling stations, ensuring accessibility and convenience that enable hydrogen ICEs to compete with battery-electric vehicles in long-range and high-duty operations.

Use Cases

Commercial and Heavy-Duty Transportation: Hydrogen ICEs are increasingly utilized in trucks, buses, and delivery vans where long-range and quick refueling are critical. These engines support zero-carbon logistics while maintaining the reliability and torque demanded by freight operations and municipal fleets.

Power Generation and Off-Grid Applications: Hydrogen-fueled ICEs are being integrated into backup power systems and remote industrial facilities. Their ability to provide stable, low-emission energy makes them ideal for data centers, mining operations, and remote communities targeting sustainability goals.

Major Challenges

Limited Hydrogen Supply Chain Development: The lack of mature hydrogen production and distribution networks remains a key challenge. High-purity hydrogen essential for combustion is not yet widely available, constraining adoption in regions with underdeveloped energy infrastructure.

High Maintenance and NOx Management Costs: Hydrogen combustion can lead to nitrogen oxide emissions, requiring advanced aftertreatment systems. These increase operational and maintenance costs, making hydrogen ICEs less economically attractive compared to battery-electric or fuel-cell alternatives.

Business Opportunities

Hybrid Hydrogen ICE Configurations: Combining hydrogen internal combustion engines with electric drivetrains presents significant potential for extended-range and flexible operations. Such hybrid systems deliver high efficiency and enable smoother transitions toward full zero-emission mobility, attracting investments from OEMs and fleet operators alike.

Engine Retrofitting for Decarbonization: Retrofitting existing diesel engines to run on hydrogen offers a cost-efficient pathway for industries to cut emissions. This approach is particularly beneficial in heavy equipment, marine, and industrial fleets where total replacement costs are prohibitive.

Regional Analysis

North America: Holding a 46.8% market share valued at USD 9.5 Billion in 2024, North America dominates the hydrogen ICE landscape. Strong policy support, tax incentives, and the expansion of clean fuel corridors in the U.S. and Canada are key drivers of regional growth and technological advancement.

Asia Pacific: Emerging as the fastest-growing region, Asia Pacific’s momentum is fueled by strategic hydrogen roadmaps in Japan, China, and South Korea. Massive investments in hydrogen refueling networks, coupled with automotive innovation, are positioning the region as a global manufacturing hub for hydrogen ICE technologies.

Recent Developments

- In March 2025, Cummins and partners celebrated the completion of a landmark hydrogen engine project demonstrating commercial viability for zero-carbon heavy-duty transport.

- In March 2025, the University of Michigan and University of California, Riverside formed an alliance to advance hydrogen fuel adoption in internal combustion vehicles.

- In January 2024, Volvo announced a hydrogen-focused scholarship program supporting research in combustion efficiency and emission reduction technologies.

- In April 2024, Ferrari filed a patent for a hydrogen internal combustion engine, signaling its commitment to integrating performance engineering with sustainable propulsion strategies.

Conclusion

The Global Hydrogen Internal Combustion Engines Market is on a transformative path, backed by innovation, supportive policies, and growing demand for clean mobility. As industries seek practical decarbonization solutions, hydrogen ICEs bridge the gap between conventional and zero-emission technologies. With expanding infrastructure, technological breakthroughs, and strategic partnerships, the sector is poised to redefine sustainable transportation and power generation globally by 2034.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)