Table of Contents

Market Overview

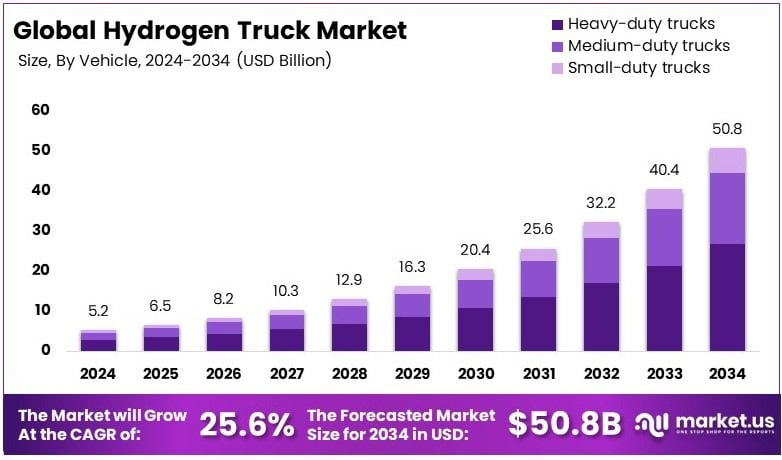

The Global Hydrogen Truck Market size is expected to be worth around USD 50.8 Billion by 2034, from USD 5.2 Billion in 2024, growing at a CAGR of 25.6% during the forecast period.

The Hydrogen Truck Market is growing fast with green transport demand. Hydrogen trucks cut emissions in heavy-duty freight. They support long-haul and regional delivery needs. Trucks carry 59kg hydrogen and run up to 700km fully loaded. Smart hydrogen trucks haul 40 tonnes cargo across 200km range. These trucks are ideal for logistics and supply chain firms.

Governments invest in hydrogen infrastructure and fuel stations. Policies support zero-emission trucks globally. Europe, China, and the U.S. lead with strong regulations. Fleet owners shift to hydrogen to meet carbon targets. Subsidies lower costs for early adoption. Clean fuel rules drive hydrogen truck sales. The tech supports efficient and quiet transport. Range and payload are better than electric trucks. Hydrogen trucks face less charging downtime. Class 4–7 truck sales dropped 8.8% recently.

This signals a short-term slowdown in adoption. Long-term demand will grow with better supply chains. OEMs are innovating fast in fuel cell technology. Hydrogen production is also scaling globally. Market players must act on this momentum. Early investment gives a competitive edge. Hydrogen trucks will shape the future of freight. Cleaner fleets create value and meet climate goals. The market holds big opportunity in coming years.

Key Takeaways

- The Hydrogen Truck Market was valued at USD 5.2 billion in 2024 and is projected to reach USD 50.8 billion by 2034, growing at a CAGR of 25.6%.

- Heavy-duty trucks held a 52.6% market share in 2024, driven by long-haul transportation demand.

- PEMFC (Proton Exchange Membrane Fuel Cells) led with a 61.4% share in 2024 due to superior efficiency.

- Trucks with a 300–500 miles range accounted for 42.1% of the market in 2024, favored by logistics fleets.

- Above 400 kW motor power dominated with 46.7% share in 2024, offering high output for large vehicles.

- Logistics and Transport applications captured 55.6% market share in 2024, aided by hydrogen incentives.

- North America led with a 37.2% share in 2024, valued at USD 1.93 billion, due to hydrogen infrastructure.

Market Drivers

- Stringent Emission Laws: Hydrogen trucks help meet tough global emission norms without sacrificing range or load.

- Clean Energy Demand: Net-zero targets push shift to hydrogen over diesel vehicles.

- Edge over Electric Trucks: Faster refueling and longer range make hydrogen ideal for long-haul use.

- Government Support: Incentives, subsidies, and hydrogen infrastructure boost adoption.

- Heavy-Duty Viability: Suits logistics needs with low emissions and high performance.

Challenges

- High Production and Operating Costs: Fuel cell technology and hydrogen production are still expensive compared to conventional fuels and battery-electric alternatives.

- Limited Refueling Infrastructure: The lack of widespread hydrogen refueling stations is a significant barrier to commercial deployment, especially for cross-border or long-haul routes.

- Hydrogen Supply Chain Limitations: Producing, storing, and transporting hydrogen at scale is still a logistical challenge. Green hydrogen production remains limited due to high energy requirements.

Segmentation Insights

Vehicle Analysis

Heavy-duty trucks lead with 52.6% share due to their load capacity and efficiency for long-distance transport. Medium-duty trucks are ideal for city deliveries, while small-duty trucks handle last-mile logistics in urban areas.

Fuel Cell Technology Analysis

PEMFC dominates with 61.4% share thanks to its high efficiency and fast refueling. SOFC is growing for long-distance use due to its fuel flexibility and high-temperature efficiency.

Range Analysis

Trucks with 300–500 miles range lead at 42.1%, balancing cost and distance for regional transport. Below 300 miles suits urban trips; above 500 miles is ideal for long hauls.

Motor Power Analysis

Above 400 Kw motors hold 46.7% share, perfect for heavy loads and long routes. 200–400 Kw motors suit mixed uses, while up to 200 Kw is best for light, city-based tasks.

Application Analysis

Logistics and Transport lead with 55.6% share, driven by the push for greener fleets. Municipal and construction sectors are also adopting hydrogen trucks to cut emissions.

Regional Insights

North America leads the Hydrogen Truck Market with 37.2% share (USD 1.93 billion) due to strong green policies, heavy investment in hydrogen tech, and support from key industry players.

Europe is growing fast, backed by government support and hydrogen corridors that make long-distance travel easier for hydrogen trucks.

Asia Pacific led by China and South Korea, is investing heavily in hydrogen to fight pollution and boost energy security.

Middle East & Africa are slowly entering the market, focusing on energy diversification and long-term hydrogen strategies.

Latin America is in early stages, with rising interest in hydrogen to reduce fossil fuel use and improve urban air quality.

Recent Developments

- In Nov 2024, Daimler Truck secured €226 million in funding to advance the development, small-series production, and deployment of 100 hydrogen fuel cell trucks.

This investment supports Daimler’s mission to scale zero-emission transport and accelerate hydrogen truck adoption across Europe. - In Jul 2025, Toyota committed $139 million through a joint venture with Shudao Investment Group to establish a hydrogen fuel cell manufacturing facility.

The move enhances Toyota’s production capabilities and expands its footprint in China’s growing clean mobility market. - In Jul 2024, LIDL, Jacky Perrenot, and Lhyfe launched the first green hydrogen vehicle for the French mass retail sector.

This initiative marks a milestone in sustainable logistics and showcases the operational readiness of hydrogen-powered freight in retail.

Future Outlook

The hydrogen truck market is expected to expand rapidly over the next decade as technology matures and infrastructure develops. With global decarbonization goals pushing industries to adopt clean alternatives, hydrogen trucks are well-positioned to meet the unique demands of long-haul and heavy-duty transportation. Ongoing innovation, declining hydrogen production costs, and government support will be key to overcoming current challenges and achieving widespread adoption.

Manufacturers and fleet operators that embrace hydrogen mobility early will likely gain a competitive edge in the transition to zero-emission logistics and industrial transport.

Conclusion

The Hydrogen Truck Market is set to grow from USD 5.2 billion in 2024 to USD 50.8 billion by 2034, driven by strong demand for clean, long-range transport. Hydrogen trucks offer fast refueling, high payload, and low emissions—ideal for heavy-duty and long-haul use. Government support, emission laws, and major investments are boosting adoption, especially in North America, Europe, and Asia Pacific. While challenges like high costs and limited infrastructure remain, innovation and scaling production are addressing these gaps. Early adopters will gain a competitive edge as hydrogen trucks become key to zero-emission logistics.