Table of Contents

- Introduction

- Editor’s Choice

- Historical Overview of Image Sensors

- Image Sensor Market Revenue Statistics

- Image Sensor Market, By Type Statistics

- Image Sensor Market, By Designation Statistics

- Image Sensor Regional Analysis Statistics

- Image Sensor Statistics by Companies Share

- Types of Image Sensor Statistics

- Smartphone Image Sensor Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Image Sensor Statistics: An image sensor is a core element in digital imaging devices. Like cameras and smartphones, responsible for converting incoming light into electrical signals for image creation.

It consists of an array of light-sensitive pixels, with each pixel detecting light intensity and converting it into an electrical charge.

Two main sensor types are used: CCD (Charge-Coupled Device) and CMOS (Complementary Metal-Oxide-Semiconductor).

CCD sensors employ a complex capacitor structure for charge transfer and are known for high-quality, low-noise image production. Making them suitable for professional photography and astronomy.

In contrast, CMOS sensors, prevalent in modern devices, feature simpler pixel designs, each with its amplifier and converter.

While initially considered inferior in image quality to CCDs, CMOS technology advancements have improved their quality, cost-effectiveness, and power efficiency.

Image sensors are pivotal in capturing and transforming our visual world into digital images. Impacting various applications, from casual smartphone photography to professional imaging systems.

Editor’s Choice

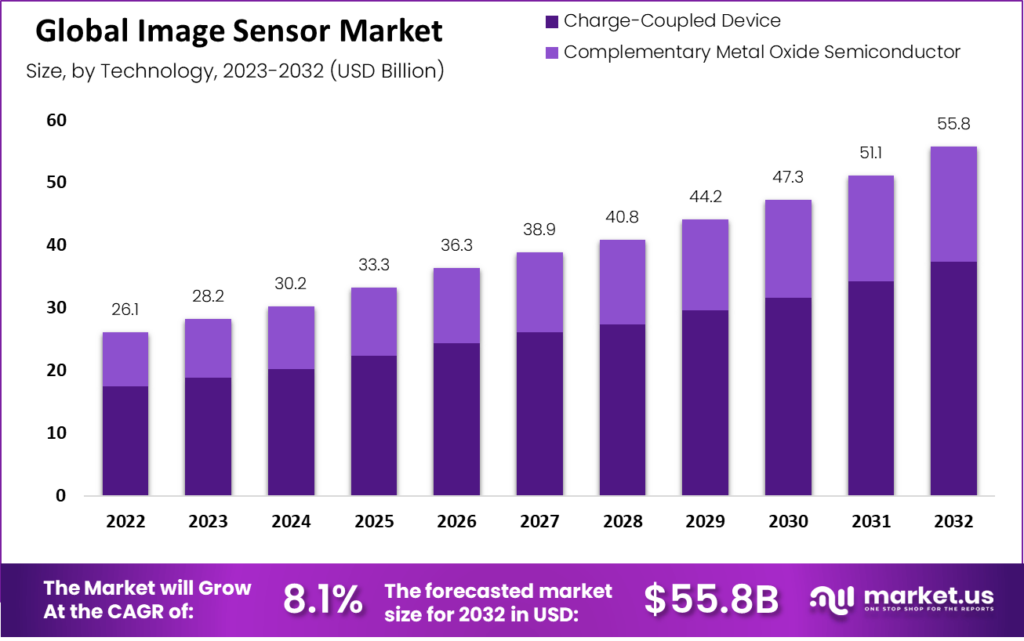

- In 2022, the image sensor market was valued at 26.1 billion.

- By 2032, the market had experienced significant growth, reaching 55.8 billion.

- 2D image sensors dominate the market with a commanding 65% share

- Manager-level designations constitute the largest share of the market, accounting for a substantial 45%.

- In North America, these sensors account for a significant 22.5%. Reflecting their integral role in various industries, including technology and automotive, in this region.

- The Asia-Pacific (APAC) region emerges as a dominant force, commanding the largest share at 41%.

- The subsequent years witnessed more substantial growth, with a 5.9% market share in 2011 and 7.1% in 2012. As CMOS image sensors became increasingly integral to the consumer electronics and imaging sectors.

- The first image sensor was a MOS (metal-oxide-semiconductor) device developed by Bell Labs in 1969.

Historical Overview of Image Sensors

- Image sensors have come a long way since their inception in the mid-1960s.

- The first image sensor was a MOS (metal-oxide-semiconductor) device developed by Bell Labs in 1969.

- It was a simple, low-resolution device that had limited practical applications.

- In the early 1990s, solid-state image sensors sold for $20-25 and were a negligible portion of the available semiconductor.

- However, with the rise of digital cameras, smartphones, and other imaging devices, image sensors have become an essential component of the semiconductor industry.

- The first commercially successful digital camera, the Apple QuickTake 100, was introduced in 1994.

- It had a resolution of 640×480 and used a CCD (charge-coupled device) image sensor.

- CCD sensors were the dominant image sensor technology until the early 2000s when CMOS (complementary metal-oxide-semiconductor) sensors began to gain popularity.

- CMOS sensors offer several advantages over CCD sensors, including lower power consumption and higher readout speeds.

- As a result, CMOS sensors have become the dominant image sensor technology in recent years.

- Today, image sensors are used in various applications, from consumer electronics to scientific research.

- They are found in digital cameras, smartphones, security cameras, medical imaging equipment, and more.

- As the demand for high-quality imaging grows, image sensor technology will likely continue to evolve and improve.

- Overall, the history of image sensors is a story of innovation and progress.

- From the humble beginnings of the MOS sensor to the advanced CMOS sensors of today. Image sensors have come a long way and have become an essential part of modern life.

Image Sensor Market Revenue Statistics

- The revenue of the image sensor market is expected to experience steady growth over the next decade.

- In 2022, the market generated approximately USD 26.1 billion in revenue, projected to increase to USD 28.2 billion in 2023.

- The growth trend continues, with anticipated revenues of USD 30.2 billion in 2024, USD 33.3 billion in 2025, and USD 36.3 billion in 2026.

- As technological advancements and increasing demand for image sensors persist. The market is set to achieve revenues of USD 38.9 billion in 2027, USD 40.8 billion in 2028, and USD 44.2 billion in 2029.

- Looking further ahead, the market is forecasted to reach USD 47.3 billion in 2030 and USD 51.1 billion in 2031.

- By 2032, the image sensor market is expected to grow substantially. With revenues projected to surge to USD 55.8 billion, reflecting the industry’s continuous expansion and innovation.

(Source – Market.US)

Image Sensor Market, By Type Statistics

- 2D image sensors dominate the market with a commanding 65% share.

- 3D image sensors, although a smaller segment, hold a significant 35% market share.

- 2D sensors excel in capturing two-dimensional images with precision and are widely used in various applications.

- 3D sensors, prized for their ability to capture depth information, find applications in facial recognition, augmented reality, and 3D scanning, contributing to their market presence.

(Source – Market.us)

Image Sensor Market, By Designation Statistics

- Manager-level designations constitute the largest share of the market, accounting for a substantial 45%.

- C Level designations, including CEOs, CFOs, and CTOs, hold a 32% market share, representing top-tier corporate leadership.

- Director-level designations, overseeing specific departments or functions, contribute significantly with a 23% market share.

- These designations reflect the varying levels of responsibility and authority within the corporate hierarchy. Like Managers, C Level executives, and Directors each play distinct roles in organizational leadership and management.

(Source – Market.us)

Image Sensor Regional Analysis Statistics

- A comprehensive analysis of image sensor market distribution across different regions reveals a dynamic landscape.

- In North America, these sensors account for a significant 22.5%. Reflecting their integral role in various industries, including technology and automotive, in this region.

- Europe closely follows, with a 24% market share, showcasing the strong presence of image sensors in diverse applications across the continent.

- The Asia-Pacific (APAC) region emerges as a dominant force, commanding the largest share at 41%.

- APAC’s robust market share can be attributed to its pivotal role in the global electronics and smartphone manufacturing industry, where image sensors are critical in enhancing device functionality and camera capabilities.

- In contrast, Latin America and the Middle East & Africa (MEA) regions contribute 6.5% and 6%, respectively, to the global image sensor market.

- While these regions may have a smaller market share, they represent emerging markets with growth potential, as technological adoption expands.

(Source – Market.us)

- A diverse array of companies marks the competitive landscape of the image sensor industry, each vying for its market share.

- Among these key players, Galaxy Core, Inc. and Infineon Technologies AG lead the pack, each commanding a substantial 15% market share.

- These companies are renowned for their innovation and cutting-edge technology, contributing significantly to the advancements in image sensor technology.

- AMS AG. and Hamamatsu Photonics K.K. closely follow, with market shares of 12% and 11%, respectively.

- Their presence in the industry is notable, with their image sensors being integrated into various applications, from smartphones to medical devices.

- Canon, Inc. and ON Semiconductor Corporation also play crucial roles, each holding a 10% and 9% market share, respectively.

- These companies are recognized for their quality and reliability, making them the preferred choices for many manufacturers.

- Additionally, PMD Technologies AG and Panasonic Corporation contribute 8% and 7% market shares, respectively, while OmniVision Technologies Inc.

- Other Key Players collectively account for 13% of the market.

(Source – Market.us)

Types of Image Sensor Statistics

CMOS Sensors

Global CMOS Sensors Market Size

- The sales revenue of CMOS (Complementary Metal-Oxide-Semiconductor) image sensors has shown a remarkable upward trajectory over the years, reflecting their pivotal role in various industries.

- In 2007, these sensors accounted for a modest 4% of the market share.

- However, this percentage steadily increased, reaching 4.5% in 2008 and 2009.

- The subsequent years witnessed more substantial growth, with a 5.9% market share in 2011 and 7.1% in 2012, as CMOS image sensors became increasingly integral to the consumer electronics and imaging sectors.

- From 2013 onwards, the growth accelerated, with sales revenue consistently climbing.

- By 2021, CMOS image sensors captured a significant 22.8% market share, demonstrating their importance in applications such as smartphones, digital cameras, and automotive systems.

- Looking ahead, the forecast for 2025 projects a remarkable 33.6% market share, reflecting the continued proliferation of CMOS image sensors and their expanding role in shaping the future of imaging technology.

- This data underscores the ongoing evolution and significance of CMOS image sensors in electronics and visual imaging.

(CMOS) image sensor market growth

- The growth trajectory of the CMOS (Complementary Metal-Oxide-Semiconductor) image sensor market has witnessed a series of fluctuations and trends over the past decade.

- In 2016, the market experienced a substantial surge, with a growth rate of 13%, reflecting the increasing demand for CMOS image sensors in applications like smartphones, digital cameras, and automotive systems.

- This momentum continued into 2017, when the market saw an even more impressive growth rate of 20%, indicating a rapid expansion of CMOS image sensor technology in various industries.

- However, the growth rate moderated in 2018, dropping to 11%, but remained positive.

- The subsequent years showed remarkable growth again, with 25% in 2019, showcasing the growing importance of image sensors in emerging technologies like artificial intelligence and augmented reality.

- In 2020, despite some challenges, the market continued to grow at 7%, reflecting resilience in the face of adverse conditions.

- In 2021, a growth rate of 12% underscored the enduring relevance of CMOS image sensors in consumer electronics and imaging.

- The following years, 2022 and 2023, saw growth rates of 8% and 5%, respectively, indicating a steady but slightly moderated pace of expansion.

- As we look further into the future, the growth rate is expected to stabilize, with 3% in 2024 and 2% in 2025.

- This suggests a more mature market with a continued but slower growth trajectory, as CMOS image sensors are an integral part of the evolving technological landscape.

CCD Sensors

Global CCD Sensors Market Size

- The revenue trend in the CCD sensor market shows some fluctuations over the two years provided.

- In 2020, the market generated a total revenue of USD 2.38 million, indicating a strong performance.

- However, in 2021, there was a slight decline in revenue, with the market yielding USD 2.16 million.

- It’s worth noting that various factors, including technological advancements, changes in consumer preferences, and economic conditions can influence market revenues.

- As such, while 2021 saw a dip in revenue compared to the previous year, it’s essential to consider the broader industry context and potential future developments that may impact the CCD sensor market’s performance in the coming years.

Global Infrared Sensors Market Size

- The revenue trajectory of the infrared sensor market exhibits notable growth over the specified time frame.

- In 2023, the market’s revenue stood at USD 0.77 billion, indicating a starting point for its expansion.

- Over the subsequent five years, the market is projected to experience substantial growth, with revenue anticipated to reach USD 1.42 billion by 2028.

- This growth likely reflects increasing demand for infrared sensors across various industries, including security, automotive, and consumer electronics.

- Technological advancements, greater awareness of the advantages of infrared sensing, and the integration of these sensors into an ever-widening range of applications may drive the market’s expansion.

- As the market continues to evolve, it is expected to offer significant opportunities for businesses and innovators in the field of infrared sensor technology.

Smartphone Image Sensor Statistics

- In the realm of smartphone technology, the choice of image sensor plays a pivotal role in determining the quality of the photos and videos captured by these ubiquitous devices.

- Sony, a renowned industry leader, boasts a significant presence in this field with a substantial 46% market share.

- Their image sensors are lauded for their exceptional performance and image quality, making them a preferred choice for many smartphone manufacturers.

- Samsung LSI, another prominent player in the industry, holds a respectable 29% of the market share.

- Samsung’s image sensors are widely recognized for their innovation and efficiency, contributing to the impressive camera capabilities of their smartphones.

- Omnivision, with a smaller share at 10%, still plays a vital role in the smartphone image sensor landscape.

- Their technology is appreciated for its versatility and suitability in various smartphone models. Finally, the remaining 15% comprises various other manufacturers, each bringing unique offerings.

- While they may not dominate the market like Sony and Samsung, they contribute to the diversity of image sensor options available to smartphone manufacturers, fostering healthy competition and technological advancement.

(Source: Straightanyalitics, Handset Component Technologies)

Recent Developments

Acquisitions and Mergers:

- Sony acquires Altair Semiconductor: In early 2023, Sony acquired Altair Semiconductor, a key player in IoT chipsets, for $200 million. This acquisition strengthens Sony’s position in the image sensor market, particularly for IoT and AI-driven applications, enhancing its sensor capabilities for connected devices.

- ON Semiconductor acquires Fairchild Imaging: In mid-2023, ON Semiconductor completed its acquisition of Fairchild Imaging, a developer of high-performance CMOS image sensors, for $400 million. This acquisition expands ON Semiconductor’s portfolio in medical imaging and industrial applications, catering to sectors with high demand for advanced sensors.

New Product Launches:

- Sony’s IMX800 Image Sensor: In 2024, Sony introduced the IMX800, the world’s first 1-inch mobile camera sensor, designed for high-end smartphones. This sensor enhances image quality, low-light performance, and dynamic range, catering to the growing demand for better smartphone cameras.

- Samsung’s 200MP Image Sensor: Samsung launched its ISOCELL HP2 in late 2023, a 200-megapixel image sensor targeting premium smartphones. This sensor offers ultra-high resolution, advanced HDR capabilities, and better color accuracy, aimed at providing top-tier performance for photography and videography.

Funding:

- OmniVision secures $150 million in funding: OmniVision, a major player in image sensor technology, raised $150 million in 2023 to fund research and development, particularly in areas like AI-powered sensors, automotive applications, and healthcare imaging solutions.

- Gpixel raises $100 million: Gpixel, a rising star in the CMOS image sensor market, secured $100 million in early 2024 to accelerate the development of ultra-high-performance sensors for industrial and scientific imaging, including sensors for space and medical applications.

Technological Advancements:

- AI-Powered Image Sensors: The integration of AI capabilities within image sensors is becoming more prevalent. These sensors can now process image data in real time, enabling features like object detection and facial recognition. By 2024, over 30% of image sensors will include AI-driven features, improving performance in devices like smartphones, security cameras, and autonomous vehicles.

- Quantum Dot Image Sensors: Quantum dot technology is enhancing the sensitivity and resolution of image sensors. These sensors can capture clearer images in low-light conditions, which is critical for applications in smartphones, medical imaging, and autonomous vehicles.

Market Dynamics:

- Growth in Image Sensor Market: The growth is primarily driven by increasing demand in automotive, consumer electronics, and industrial applications, where high-performance imaging is crucial.

- Rising Demand in the Automotive Sector: With the growth of autonomous driving and advanced driver-assistance systems (ADAS), the automotive sector is a major contributor to the rising demand for image sensors. By 2025, it is expected that automotive applications will account for over 20% of the image sensor market, with high demand for sensors in cameras, LiDAR systems, and other safety features.

Conclusion

Image Sensor Statistics – In conclusion, image sensors are the fundamental components that underpin the world of digital imaging, facilitating the transformation of light into electrical signals for the creation of digital images.

They come in two primary types, CCD and CMOS, each with strengths and weaknesses, catering to various applications, from professional photography to everyday smartphone snapshots.

The continual advancement of image sensor technology has led to improved image quality, cost-efficiency, and power consumption.

Making digital imaging accessible and versatile across various industries and daily life, ultimately shaping the way we capture and interact with the visual world around us.

FAQs

An image sensor is a device that converts light into electrical signals, enabling the capture and conversion of visual information into digital images in digital cameras, smartphones, and other imaging devices.

The two main types of image sensors are Charge-Coupled Device (CCD) sensors and Complementary Metal-Oxide-Semiconductor (CMOS) sensors. CCD sensors use capacitors to transfer charge, while CMOS sensors have individual amplifiers for each pixel.

CCD sensors traditionally provide higher image quality with lower noise but consume more power. CMOS sensors are more power-efficient and cost-effective, with continually improving image quality.

Image sensors consist of light-sensitive pixels that generate electrical signals when exposed to light. These signals are then processed to create a digital image.

Pixel size refers to the dimensions of an individual photosensitive element on the sensor. Smaller pixels can capture less light, potentially reducing image quality, especially in low-light conditions.

Resolution refers to the level of detail an image sensor can capture. It is typically measured in megapixels and represents the number of individual pixels in the sensor.