Table of Contents

Introduction

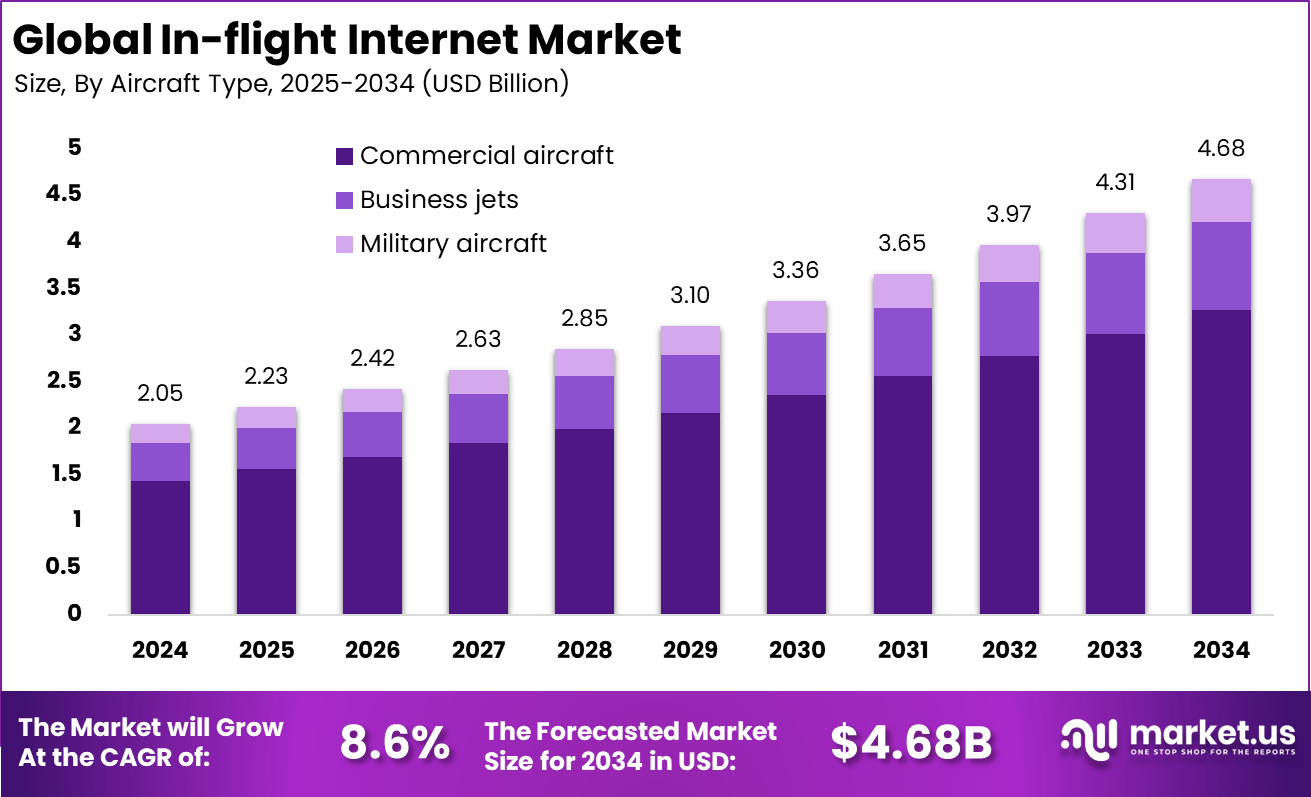

The global in-flight internet market is projected to grow from USD 2.05 billion in 2024 to approximately USD 4.68 billion by 2034, reflecting a compound annual growth rate (CAGR) of 8.6% over the forecast period. In 2024, North America held a dominant position, generating around USD 0.82 billion in revenue and capturing more than 40 % of the global market share. This expansion is fuelled by rising passenger expectations for connectivity in the skies, increasing fleet upgrades by airlines, and advances in satellite and air-to-ground networking technologies.

How Growth is Impacting the Economy

The expansion of the in-flight internet market is projected to deliver meaningful economic benefits across multiple sectors. Increased investment in satellite communications, aircraft retrofit programmes and connectivity infrastructure is expected to support manufacturing, aerospace services and IT-systems employment. As airlines adopt onboard Wi-Fi and digital services, ancillary revenue streams emerge—ranging from premium subscriptions to targeted in-flight advertising and real-time data services.

By enabling connectivity at altitude, productivity gains for business travellers and enhanced passenger experience for leisure flyers contribute to higher airline yields and greater willingness to pay. Supply-chain demand for specialised avionics, antennas and network hardware stimulates innovation and exports. Governments benefit from improved aviation infrastructure and can potentially derive tax revenue from increased digital service uptake. Overall, the market’s scaling helps drive industrial growth, service employment and export-led opportunities tied to aviation connectivity.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/in-flight-internet-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

For airlines and connectivity service providers, the push to deliver robust in-flight internet requires significant CapEx and OpEx: satellite capacity leases, aircraft retrofit installation, certification and ongoing maintenance. Supply chains are shifting toward high-bandwidth antennas, modem hardware, cabin Wi-Fi access points and cloud-based content platforms rather than legacy in-flight entertainment systems. Vendors further down the chain must adapt to recurrent service models and shorter upgrade cycles.

Sector-Specific Impacts

In commercial aviation, airlines are leveraging in-flight internet as a differentiator to attract premium and business-class travellers and to open new revenue streams through connectivity-based services. In business aviation, demand is growing for boutique high-speed Wi-Fi even on smaller jets, increasing aftermarket retrofit activity. Satellite network providers and equipment manufacturers benefit from global deployments, while content and streaming services redefine their partnerships with airlines to deliver in-flight offerings. Hospitality and travel-ecosystem businesses (e.g., loyalty programmes, inflight retail) gain new channels for passenger engagement. Airlines operating international, long-haul flights face heightened connectivity expectations, prompting global supply-chain coordination across aircraft OEMs, satellite operators and cabin integrators.

Strategies for Businesses

Businesses looking to capitalise on the in-flight internet trend should prioritise early collaboration with aircraft operators and satellite providers to secure placement in retrofit programmes. Firms should adopt modular, upgrade-friendly hardware platforms to accommodate future bandwidth demands and leverage service-based revenue models (e.g., tiered connectivity, sponsorship). Connectivity service providers must integrate analytics, content-delivery and value-added services to enhance monetisation beyond mere internet access.

Airlines should bundle in-flight internet offerings into loyalty programmes and pricing strategies to boost uptake and yield. Equipment manufacturers need to align with certification standards and focus on weight, power-efficiency and installation ease to appeal to aircraft operators. Finally, global players must navigate regulatory harmonisation (airspace, spectrum allocation) and tailor offerings regionally to address divergent infrastructure and cost structures.

Key Takeaways

- The in-flight internet market is set to nearly double in size by 2034, underscoring robust demand.

- North America holds a significant early-lead, generating over 40 % of market revenue in 2024.

- Rising connectivity expectations are driving airlines to view Wi-Fi as a strategic offering rather than a nicety.

- Businesses face higher upfront and operational costs but stand to unlock new service-based revenue streams.

- Strategic alignment across airlines, equipment providers, satellite networks and content ecosystems will determine market leadership.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=161593

Analyst Viewpoint

Currently the in-flight internet market is positioned at a pivotal juncture where connectivity at altitude transitions from supplementary amenity to core passenger expectation. The convergence of upgraded aircraft fleets, satellite network investment and bandwidth-intensive user behaviour is fuelling growth.

Looking ahead, the positive outlook remains strong as the projected growth to USD 4.68 billion by 2034 suggests broad-based adoption across airlines, regions and cabin classes. Vendors with integrated hardware-software-service ecosystems, airlines embedding connectivity into value propositions and satellite networks expanding capacity are expected to capture significant opportunity. Overall, the market trajectory is favourable and signals a new era of connected flight experience.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Long-haul commercial flights offering high-speed Wi-Fi to business and premium travellers | Business and private aviation jets are upgrading to boutique connectivity services |

| Retrofit campaigns for aircraft fleets in regional and domestic markets to enable cabin Wi-Fi | Growing availability of lighter, lower-power hardware and falling costs of connectivity units supporting retrofit viability |

| Business and private aviation jets upgrading to boutique connectivity services | Increased demand for personalised in-flight internet and remote-working enabled travel driving aftermarket installations |

Regional Analysis

North America maintains a dominant position in the in-flight internet market, capturing revenue of approximately USD 0.82 billion in 2024, which equates to over 40 % share of the global market. The region benefits from a mature commercial aviation fleet, advanced connectivity infrastructure and high passenger willingness to pay for in-flight Wi-Fi.

Europe and Asia-Pacific are expected to register strong growth due to rising air travel volumes, emerging low-cost carriers, and increasing retrofit activities in fleets. Latin America, the Middle East, and Africa present developing opportunities given improving aviation connectivity investments, although slower infrastructure roll-out and regulatory variability may moderate near-term uptake.

➤ More data, more decisions! see what’s next –

Business Opportunities

The in-flight internet market offers substantial opportunity for hardware suppliers, connectivity network providers, cabin-integration specialists and content delivery platforms. Firms offering modular retrofit kits, cabin Wi-Fi subscription platforms or hybrid satellite/air-to-ground solutions stand to gain. Partnerships between airlines and service providers can unlock ancillary revenue through tiered connectivity services, in-flight streaming, targeted advertising and passenger engagement. Connectivity providers may expand into adjacent services such as aircraft operations data links and real-time flight analytics. Regional roll-outs, especially in Asia-Pacific and emerging aviation markets, provide untapped growth corridors for bespoke solutions and emerging airline partnerships.

Key Segmentation

Key market segments in the in-flight internet space include deployment model (retrofit versus line-fit on new aircraft), connectivity technology (satellite-based, air-to-ground, hybrid), service model (paid Wi-Fi, free/basic, tiered premium), end-user class (commercial airlines, business/private aviation) and region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa).

The satellite-based segment is anticipated to command the largest share owing to global coverage requirements and long-haul flight connectivity demands. The retrofit segment is expected to grow rapidly as airlines upgrade existing fleets rather than waiting for new aircraft. The paid/tiered service model is projected to dominate monetisation strategies as airlines seek to capture ancillary revenue.

Key Player Analysis

Key vendors in the in-flight internet market are focusing on offering end-to-end connectivity solutions encompassing hardware, network access, content delivery and subscription services. These companies are entering partnerships with airlines and satellite constellation providers to secure fleet deployments and global coverage.

They are emphasising certification, system reliability, installation ease and scalability as differentiators in a competitive environment. Strategic focus is on achieving high-bandwidth connectivity, minimised latency and seamless user experience across cabins. As the market matures, consolidation and vertical integration (hardware plus service plus content) are expected, and only players addressing full value-chain delivery are likely to sustain leadership.

- Gogo Inc.

- Panasonic Avionics Corporation

- Viasat Inc.

- Inmarsat Plc

- Thales Group

- Honeywell Aerospace

- Global Eagle Entertainment

- Collins Aerospace

- Deutsche Telekom AG

- Airbus SE

- SITAONAIR

- EchoStar Corporation (Hughes Network Systems)

- Rockwell Collins Inc.

- Kymeta Corporation

- Iridium Communications Inc.

- SmartSky Networks LLC

- Other Key Players

Recent Developments

- A major airline announced it will offer free high-speed in-flight Wi-Fi for members of its loyalty programme beginning January 2026, signalling connectivity as a loyalty and differentiation tool.

- A satellite internet provider signed its first airline partnership to deliver low-Earth orbit connectivity for in-flight Wi-Fi starting in 2027, indicating next-gen capacity entering aviation.

- An industry report showed emerging measurements of in-flight connectivity performance for satellite-based systems, pointing to median downlink speeds of 64 Mbps and uplink 24 Mbps in flight environments.

- A carrier in Asia-Pacific deployed high-speed Wi-Fi across new narrow-body aircraft on a domestic-international route, providing streaming and messaging services for all cabin classes.

- A network analysis article confirmed that next-gen satellite constellations are enabling in-flight internet to approach home broadband speeds, changing airline service expectations.

Conclusion

The in-flight internet market is undergoing rapid transformation and is poised for meaningful growth over the next decade. Airlines, connectivity providers and service vendors that align strategy around high-speed, reliable connectivity and integrated services stand to benefit. As passenger expectations continue to rise, connected flight will become a standard, not a premium.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)