Table of Contents

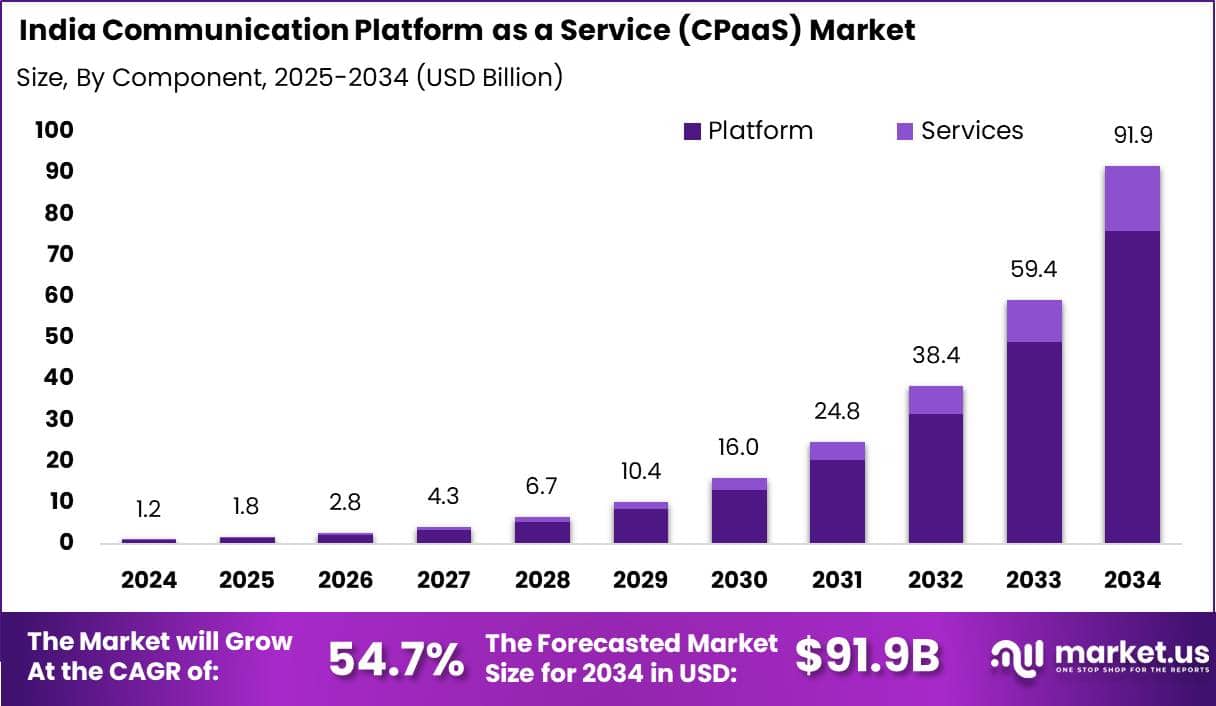

The India Communication Platform as a Service (CPaaS) Market is set for exponential growth, with a projected value of USD 91.9 billion by 2034, up from USD 1.2 billion in 2024. This growth is driven by a remarkable CAGR of 54.7% from 2025 to 2034. In 2024, the platform segment holds a dominant 82.7% share, underscoring its pivotal role in CPaaS adoption.

Large enterprises make up 75.6% of the market share, contributing significantly to the market’s expansion. The Banking, Financial Services, and Insurance (BFSI) sector also plays a critical role, holding 32.8% of the market share in 2024, as businesses in this sector increasingly turn to CPaaS for customer engagement.

How Tariffs are Impacting the Economy

Tariffs have a profound impact on the economy by increasing the cost of imports and reducing the affordability of goods and services. As tariffs raise the price of foreign products, businesses face higher costs for materials and components, leading to increased production expenses. This increase in costs is typically passed down to consumers, causing inflationary pressures.

Businesses are also forced to adapt to changes in trade patterns, often seeking alternative suppliers or shifting production to countries with more favorable tariff rates. The result is often disruption in supply chains, with longer lead times and less predictable costs.

Additionally, tariffs can lead to a reduction in consumer demand as higher prices discourage spending. On a broader scale, the implementation of tariffs can slow economic growth by reducing international trade and investment flows, diminishing the efficiency of global markets, and creating a more fragmented trade environment.

➤ Discover how our research uncovers business opportunities @ https://market.us/purchase-report/?report_id=141046

Impact on Global Businesses

Global businesses face significant challenges due to rising costs driven by tariffs. The increase in the price of raw materials, intermediate goods, and finished products results in higher production costs, which are either absorbed by companies or passed on to consumers. This, in turn, can reduce demand and profitability.

Moreover, businesses are increasingly revising their supply chains to mitigate the impact of tariffs. Companies may shift production to countries with lower tariffs or adjust their sourcing strategies to manage costs. Sectors such as manufacturing, technology, and retail are particularly vulnerable as they depend on complex global supply chains.

In the India CPaaS market, this disruption may affect software and technology providers, leading to delays or cost increases in the development of CPaaS platforms. Furthermore, sectors like BFSI, heavily reliant on CPaaS solutions for customer communication, could experience operational challenges as they face costlier or disrupted service deliveries.

Strategies for Businesses

To navigate the impact of tariffs, businesses should adopt strategies like diversifying their supply chains and leveraging local production. Shifting operations to countries with lower tariff rates can reduce exposure to tariff-related costs. Companies should also invest in technology to automate processes, improve operational efficiency, and reduce dependency on costly materials.

For businesses in sectors like CPaaS, focusing on cloud-based platforms that offer scalability and flexibility can reduce overhead and optimize service delivery. Additionally, forming partnerships or alliances with local providers can help mitigate the impact of international tariffs. Developing agile pricing strategies and enhancing customer engagement can also allow businesses to adapt more effectively to changing economic conditions.

➤ Explore more strategies get full access now @ https://market.us/purchase-report/?report_id=141046

Key Takeaways

- The India CPaaS market is expected to grow at a CAGR of 54.7%, reaching USD 91.9 billion by 2034.

- The platform segment holds a dominant share of 82.7% in 2024.

- Large enterprises are the major contributors, accounting for over 75% of the market share.

- BFSI remains a critical sector in CPaaS adoption, holding 32.8% of the market share.

- Tariffs are increasing production costs and causing supply chain shifts, requiring businesses to adapt.

Analyst Viewpoint

The India CPaaS market is experiencing significant growth, driven by increasing adoption across large enterprises and the BFSI sector. As digital transformation accelerates, the demand for seamless communication and customer engagement tools is set to increase, offering vast opportunities for CPaaS providers.

Despite challenges posed by rising tariffs, businesses that leverage cloud-based platforms and embrace digital innovation will thrive. The future of the market looks promising, with continued technological advancements and expansion expected across various industries, including finance, retail, and healthcare.

Regional Analysis

India is experiencing rapid growth in the CPaaS market, with significant adoption among large enterprises and the BFSI sector. The platform segment remains the most dominant, capturing 82.7% of the market share in 2024. The rapid digital transformation and the increased need for efficient customer engagement drive the adoption of CPaaS in India.

The market is also seeing expansion in other sectors such as e-commerce, retail, and healthcare, where communication solutions are integral to business operations. As the demand for digital communication services rises, India is expected to become a leading hub for CPaaS adoption in the coming years.

Business Opportunities

The growth of the India CPaaS market presents numerous business opportunities, especially in sectors like BFSI, retail, and healthcare. Companies can capitalize on the increasing demand for cloud-based communication solutions by offering scalable, secure, and innovative platforms.

There is significant potential for businesses to provide CPaaS solutions tailored to the unique needs of large enterprises, focusing on improving customer engagement, enhancing communication channels, and driving digital transformation. Additionally, as more businesses in India embrace cloud technologies, there is growing potential for partnerships, collaborations, and joint ventures within the CPaaS ecosystem.

Key Segmentation

The India CPaaS market is segmented into platform, services, and end-users. The platform segment, dominating with more than 82.7% market share in 2024, focuses on providing robust communication services. The large enterprises segment holds over 75.6% of the market share, reflecting their primary contribution to market growth.

Key end-users include BFSI, retail, e-commerce, and healthcare, with BFSI alone accounting for over 32.8% of the market. Cloud-based solutions play a crucial role in driving market expansion, accounting for over 64% of the market share. The increasing demand for digital communication platforms in these sectors is expected to drive continued growth.

➤ Discover More Trending Research

- Smartphone Processors Market

- Semiconductor Photomask Market

- Asia Pacific Communication Platform as a Service Market

- Environmental, Social and Governance (ESG) Consulting Market

Key Player Analysis

Key players in the India CPaaS market focus on providing scalable, cloud-based platforms that cater to large enterprises and industries like BFSI, retail, and healthcare. These players are investing heavily in the development of innovative communication solutions that enable seamless customer engagement and enhance business operations.

By leveraging advanced technologies such as AI, machine learning, and big data analytics, CPaaS providers are enhancing the capabilities of their platforms to offer better personalization and real-time communication. Additionally, players are forming strategic alliances and partnerships to expand their reach and enhance the services offered to enterprises across diverse sectors.

Top Key Players in the Market

- TWILIO INC.

- Avaya Inc.

- Vonage America, LLC

- MessageBird

- Infobip Ltd.

- Plivo Inc.

- Telnyx LLC

- TEXTUS

- Voximplant

- Bandwidth Inc.

- Others

Recent Developments

Recent developments in the India Communication Platform as a Service (CPaaS) Market include the launch of new cloud-based platforms designed to enhance communication in large enterprises. Additionally, companies are integrating AI-driven features into their CPaaS solutions, offering improved customer engagement and operational efficiency.

Conclusion

The India Communication Platform as a Service (CPaaS) Market is on an impressive growth trajectory, driven by the increasing adoption of cloud-based solutions and a strong demand for digital communication tools across industries. With vast opportunities for businesses, especially in sectors like BFSI, retail, and healthcare, the market is expected to continue expanding, offering significant potential for both new and established players.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)