Table of Contents

Introduction

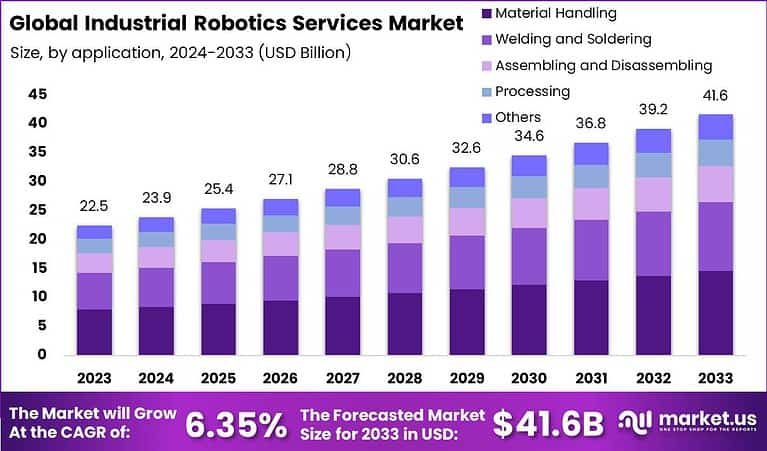

The Global Industrial Robotics Services Market is projected to experience steady growth, expected to increase from USD 22.5 billion in 2023 to USD 41.6 billion by 2033, at a CAGR of 6.35%. The Asia-Pacific (APAC) region leads the market, holding a 35.4% share and generating USD 7.9 billion in revenue in 2023. The growth is primarily driven by advancements in automation, robotics-as-a-service (RaaS) models, and increasing adoption of robotic systems across industries such as manufacturing, automotive, and electronics. As industries continue to adopt automated solutions to enhance efficiency, safety, and productivity, the demand for industrial robotics services is expected to expand.

How Growth is Impacting the Economy

The growth of the industrial robotics services market is playing a key role in driving economic transformation across various sectors. Robotic systems improve productivity and reduce operational costs, leading to higher profits and more efficient manufacturing processes. This growth is also fostering innovation and technological development, stimulating economic activities in robotics development, software, and hardware manufacturing.

Additionally, the adoption of robotics services is generating new job opportunities in robotics engineering, AI, and automation technology. The increasing demand for automation is helping industries transition to digital-first models, improving global competitiveness and economic sustainability.

➤ Unlock growth! Get your sample now! – https://market.us/report/industrial-robotics-services-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: Businesses are increasingly investing in robotics solutions to counter rising labor costs and supply chain disruptions. Robotics-as-a-service (RaaS) models help businesses reduce upfront capital expenditure by offering flexible subscription-based models. This shift is enabling small and medium-sized enterprises (SMEs) to access robotics technology more affordably.

Sector-Specific Impacts: In manufacturing, industrial robots are used to automate assembly lines, reduce production time, and improve product quality. In automotive manufacturing, robots enable precision welding, painting, and parts assembly. The electronics industry uses robotics for testing and assembling intricate components. Logistics and warehousing sectors are also seeing growing adoption of robotics solutions for material handling and automation of distribution processes.

Strategies for Businesses

- Invest in Robotics-as-a-Service (RaaS) to reduce capital expenditure and enhance scalability.

- Integrate AI and machine learning algorithms into robotic systems for predictive maintenance and enhanced decision-making.

- Explore collaborative robots (cobots) for human-robot collaboration in manufacturing and assembly tasks.

- Foster partnerships with robotics service providers to implement customized automation solutions across production lines.

- Focus on the continuous training and upskilling of workforce members to work alongside robotic systems.

Key Takeaways

- The market is expected to reach USD 41.6 billion by 2033.

- CAGR of 6.35% from 2024 to 2033.

- APAC leads with 35.4% share and USD 7.9 billion revenue in 2023.

- Growth driven by automation, Robotics-as-a-Service (RaaS), and adoption of AI and collaborative robots.

- Key sectors impacted: manufacturing, automotive, electronics, and logistics.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=130673

Analyst Viewpoint

The industrial robotics services market is poised for steady growth as industries continue to embrace automation technologies. Robotics-as-a-Service (RaaS) models are making robotics more accessible, allowing businesses to scale their automation efforts without large capital investments. The future of industrial robotics will see further integration with AI, machine learning, and IoT, enabling smarter, more autonomous systems that can adapt to changing market demands. As robotics technology continues to evolve, the market is expected to expand across new sectors, creating significant opportunities for innovation and growth in automation services.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Manufacturing Automation | Need for cost reduction, improved product quality, and faster production cycles |

| Automotive Assembly | Precision and efficiency in tasks like welding, painting, and parts assembly |

| Electronics Assembly | Automation of intricate testing, assembly, and component handling tasks |

| Logistics & Warehousing | Automation in material handling, sorting, and inventory management |

| Packaging & Palletizing | Increased adoption in industries for faster and more efficient packaging processes |

Regional Analysis

APAC dominates the market with a 35.4% share and USD 7.9 billion revenue in 2023, driven by major manufacturing hubs in countries like China, Japan, and South Korea. Europe follows with steady growth, fueled by increased automation in automotive and electronics industries. North America is growing steadily, with robotics gaining traction across manufacturing and logistics sectors. Latin America and the Middle East & Africa are emerging markets, showing potential for robotics services adoption as industries modernize and invest in automation solutions to enhance operational efficiency.

Business Opportunities

The industrial robotics services market offers numerous opportunities for both established companies and start-ups. Robotics-as-a-Service (RaaS) is an emerging business model that allows companies to access robotics solutions on a subscription basis, reducing upfront costs. The demand for collaborative robots (cobots) in small and medium-sized enterprises (SMEs) is growing, providing an opportunity for companies to develop affordable automation solutions. Additionally, advancements in AI and machine learning can help businesses enhance predictive maintenance and increase the adaptability of robots in dynamic environments, presenting significant growth potential.

Key Segmentation

The market is segmented by Service Type (Maintenance, Integration, Consulting, Support), Application (Manufacturing, Automotive, Electronics, Logistics, Warehousing, Others), Robot Type (Articulated, SCARA, Cartesian, Cylindrical, Collaborative), and Region (North America, Europe, APAC, Latin America, Middle East & Africa). In terms of robot type, articulated robots dominate, with high adoption in automotive and manufacturing sectors due to their versatility and precision. The collaborative robot segment is expected to grow rapidly as industries increasingly use robots in environments where humans and machines work together.

Key Player Analysis

Leading companies in the industrial robotics services market are focusing on expanding their service offerings to include robotics-as-a-service (RaaS), AI-driven solutions, and collaborative robots (cobots). These companies are investing in R&D to enhance the performance and versatility of robotic systems while lowering the cost of integration for smaller businesses. Strategic partnerships with industries such as automotive, electronics, and logistics are key to expanding their market presence and providing customized robotics solutions that align with sector-specific needs.

- ABB Ltd.

- Carl Cloos Schweisstechnik GmbH

- Daihen Corp.

- DENSO Corp.

- FANUC Corp.

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- NACHI FUJIKOSHI Corp.

- OMRON Corp.

- Panasonic Holdings Corp.

- Seiko Epson Corp.

- Staubli International AG

- Teradyne Inc.

- Universal Robots AS

- Yaskawa Electric Corp

- Other Key Players

Recent Developments

- Launch of advanced Robotics-as-a-Service (RaaS) models to democratize access to automation technology.

- Growth in collaborative robotics (cobots) adoption for human-robot collaboration in manufacturing.

- Expansion of robotics services in the logistics and warehousing sectors, focusing on material handling automation.

- Increased investment in AI and machine learning integration into robotics systems for predictive maintenance and smarter decision-making.

- Partnerships between robotics service providers and manufacturers to develop industry-specific automation solutions.

Conclusion

The Global Industrial Robotics Services Market is on a strong growth trajectory, driven by the increasing adoption of automation across industries such as manufacturing, automotive, and logistics. Robotics-as-a-Service (RaaS) is making robotics more accessible, while AI and collaborative robots are enhancing productivity and efficiency. As the market expands, companies that provide scalable, cost-effective, and innovative robotics services will be well-positioned for success in the coming years.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)