Table of Contents

Inflight Retail and Advertising market refers to the services offered on airplanes, where airlines sell products and advertise goods or services to passengers during their flights. This includes the sale of snacks, beverages, duty-free products, and luxury items, as well as advertisements shown through seatback screens, inflight magazines, or digital platforms. It has become a significant revenue stream for airlines, especially as they seek to diversify their income sources beyond just ticket sales. Inflight retailing also includes digital and interactive advertising platforms, where brands can engage directly with passengers during their flight experience.

In recent years, there has been a growing trend of airlines integrating advanced technologies to enhance the inflight retail experience, such as wireless payment options, mobile apps for onboard shopping, and personalized advertising based on passenger data. With travelers looking for convenience and personalized experiences, the inflight retail and advertising sector has evolved to meet these demands, offering an increasingly sophisticated platform for brands and airlines alike.

The global Inflight Retail and Advertising Market is growing steadily, driven by the increasing number of air travelers and the airlines’ need for alternative revenue streams. As the aviation industry rebounds post-pandemic, airlines are looking to diversify their income and offset rising operational costs, and inflight retail and advertising provide a lucrative opportunity. The rise of low-cost carriers has also expanded the market by encouraging airlines to adopt innovative retail and advertising strategies, even on short-haul flights.

Moreover, passengers are increasingly open to inflight shopping and entertainment. As in-flight technology advances, travelers now have access to more personalized content, which creates a more engaging retail environment. Offering items that appeal directly to passengers, such as exclusive products and localized items, is an additional growth driver for the sector.

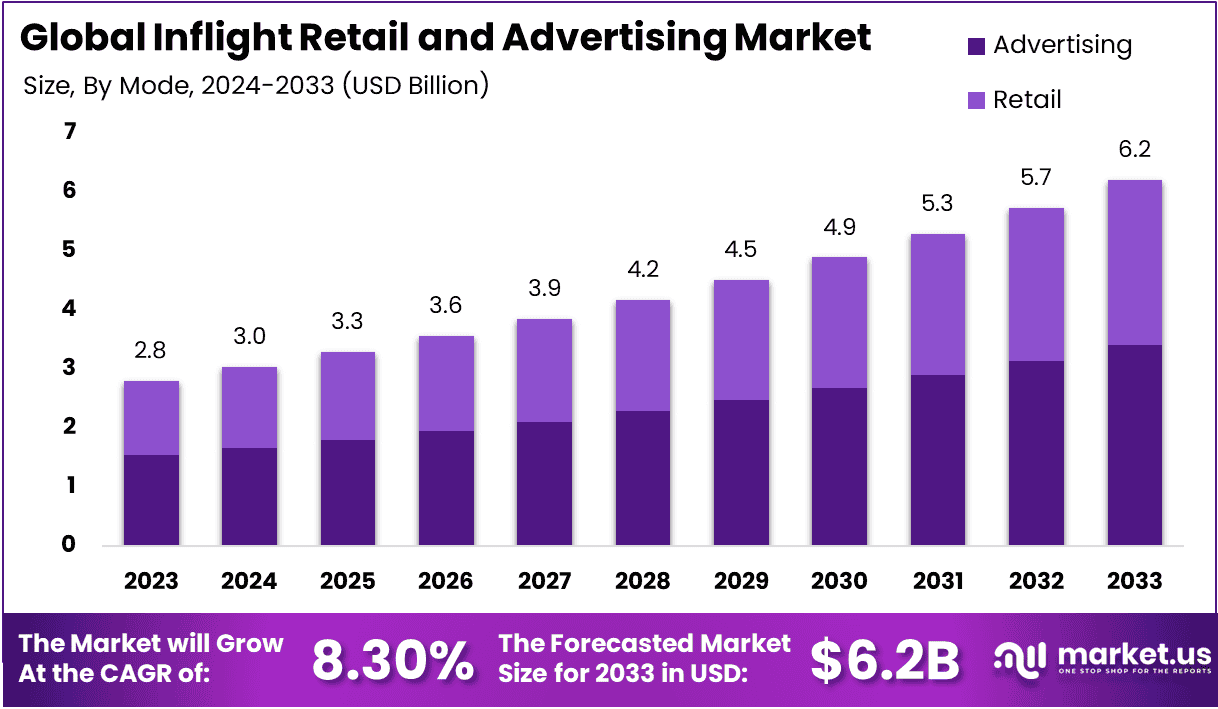

The demand for Inflight Retail and Advertising is experiencing significant growth due to the increasing number of air passengers worldwide, with a large share of travelers looking for entertainment or shopping options during their flights. With a projected market value of USD 2.8 billion in 2023, this sector is expected to grow to USD 6.2 billion by 2033, expanding at a CAGR of 8.30% from 2024 to 2033. This growth can be attributed to the increasing adoption of technology by airlines and passengers alike, such as the shift towards digital payment methods, inflight entertainment, and wireless connectivity.

Passengers are not only purchasing products during flights but are also more receptive to digital and video advertising content during their travels. With an increase in the number of long-haul flights and premium services, passengers now expect more than just in-flight meals — they seek a full experience, and inflight shopping and advertising cater to this demand.

Technology is reshaping the Inflight Retail and Advertising landscape. Advancements in Wi-Fi connectivity, mobile apps, and personalized content are transforming how airlines engage with passengers. Airlines are increasingly leveraging real-time data to provide personalized recommendations, advertisements, and retail options based on a passenger’s preferences or past behavior. For example, an airline may offer a personalized duty-free product based on a passenger’s location or past purchases.

Furthermore, advancements in digital signage and augmented reality (AR) are enhancing inflight advertising, enabling interactive and immersive experiences. In-flight entertainment systems now offer more dynamic advertising platforms, where brands can offer tailored advertisements, integrating them into the seatback screens or the mobile apps passengers use during their flights.

The Inflight Retail and Advertising Market presents numerous growth opportunities. Airlines can capitalize on data-driven advertising and personalized shopping experiences. As travelers increasingly demand more convenience, digitalization offers airlines a way to streamline the buying process, allowing passengers to make purchases through mobile apps or their seatback screens, enhancing the convenience of in-flight shopping.

Moreover, partnerships with premium brands and sponsorships for inflight entertainment are potential revenue streams for airlines. As brands seek new, targeted ways to engage with consumers, inflight advertising offers a unique channel, especially for global brands that want to reach a captive audience in a closed, distraction-free environment. Airlines can also explore partnerships with e-commerce platforms, allowing passengers to place orders for delivery to their homes after the flight. This opportunity can expand the customer base beyond just the people on board the flight.

With an expected market worth of USD 6.2 billion by 2033, airlines have ample space to innovate and introduce new ways to integrate retail and advertising into the passenger experience, capitalizing on this growing opportunity.

Display advertising is also significant, projected to grow from USD 1.2 billion in 2024 to USD 1.8 billion by 2032. The North American region currently dominates the inflight advertising market, with a valuation of USD 1.78 billion in 2024, expected to increase to USD 2.73 billion by 2032. Europe follows closely, with a projected market size of USD 1.25 billion in 2024, growing to USD 1.9 billion by 2032.

Overall, the inflight advertising market reflects a strong trajectory, driven by innovative advertising formats and the strategic integration of technology, positioning it as a critical revenue stream for airlines looking to enhance passenger engagement and experience during flights.

Key Statistics

- The Inflight Retail and Advertising market was valued at USD 2.8 billion in 2023.

- The market is expected to grow to USD 6.2 billion by 2033, reflecting significant expansion.

- The market is growing at a robust CAGR of 8.30% during the forecast period from 2024 to 2033.

- Asia Pacific held a 37.4% share of the global market in 2023, generating USD 1.04 billion in revenue.

- The Advertising segment dominated the market with a 54.7% share in 2023, driven by growing digital advertising platforms onboard.

- Stored operations accounted for 72.4% of the market share, emphasizing the demand for preloaded content and retail offerings.

- Economy Class led the market, capturing 48.3% of the share, due to its high passenger volume.

- Commercial Aviation accounted for 57.4% of the market, highlighting the prominence of inflight retail and advertising in large airline operations.

Emerging Trends

- The Inflight Retail and Advertising market is witnessing several exciting trends that are shaping its future. One of the most notable developments is the growing shift toward digital and interactive advertising on airlines. With the integration of more in-flight entertainment systems, airlines are utilizing seatback screens, Wi-Fi networks, and personal devices to deliver targeted advertisements. This shift allows brands to engage with passengers in real time and offer more personalized content, enhancing the overall passenger experience and increasing advertising revenue.

- Another key trend is the increasing use of mobile and app-based platforms for inflight retail. Airlines are increasingly adopting digital shopping experiences, where passengers can browse products, place orders, and make payments directly through their smartphones or tablets. These platforms provide a more seamless and efficient shopping experience, which is particularly attractive to tech-savvy passengers. This trend is being fueled by the growing adoption of Wi-Fi-enabled aircraft and the rise of mobile payment solutions, making it easier for passengers to make purchases onboard.

- Additionally, the focus on eco-friendly products is gaining traction in the inflight retail segment. As airlines and passengers become more environmentally conscious, there is a growing demand for sustainable and eco-friendly products. Airlines are responding to this by offering more sustainable, ethically sourced goods in their retail offerings, including reusable water bottles, organic snacks, and eco-friendly travel accessories. This trend is not only aligned with global sustainability goals but also resonates with the increasing number of environmentally aware travelers.

- Lastly, data analytics is playing an increasingly important role in optimizing both inflight retail and advertising strategies. By leveraging big data and AI-powered algorithms, airlines can track passenger behavior, preferences, and purchase history to deliver highly personalized advertisements and product recommendations. This helps airlines to enhance their marketing strategies, improve passenger engagement, and boost sales. The ability to use real-time data to personalize the inflight experience is expected to be a significant driver of growth in the coming years.

Top Use Cases

- Personalized Advertising and Promotions

One of the key use cases in Inflight Retail and Advertising is the use of personalized advertising. Airlines are leveraging passenger data (such as travel history, seat class, and even loyalty program status) to deliver tailored ads during the flight. This targeted approach has been shown to increase passenger engagement and drive higher conversion rates for advertised products. For example, a passenger traveling on a business class seat may see luxury product ads or exclusive promotions, while economy passengers might receive offers for more affordable goods.

- Duty-Free Sales and Special Offers

Duty-free retailing is another prominent use case. Airlines are increasingly offering a wide range of duty-free products onboard, ranging from perfumes and cosmetics to electronics and alcohol. In 2023, duty-free sales accounted for a significant portion of inflight retail revenue, contributing approximately 40% to total inflight retail sales. Airlines are leveraging inflight advertising channels, such as inflight magazines, interactive screens, and mobile apps, to promote these exclusive products. This not only drives sales but also enhances the overall passenger experience, providing them with a unique shopping opportunity mid-flight.

- Inflight Food and Beverage Promotions

Airlines are also using inflight advertising to promote food and beverage items. With passengers increasingly looking for a customized experience, airlines have started offering premium meal options that can be pre-ordered through mobile apps or onboard kiosks. For instance, American Airlines has introduced a program where passengers can browse and order food and beverages directly from their mobile devices during the flight. This trend has seen growing adoption, particularly with the rise in demand for healthier meal options and exclusive food offerings.

- Interactive Inflight Shopping Platforms

Another growing use case is the adoption of interactive in-flight shopping platforms. Through advanced Wi-Fi and onboard mobile apps, passengers can browse a catalog of products ranging from gadgets to travel accessories. In 2023, nearly 30% of airlines worldwide had integrated such digital shopping options. These platforms not only enhance the retail experience but also allow passengers to make purchases seamlessly through contactless payment methods, reducing the reliance on traditional onboard sales. The Asian-Pacific region has been particularly quick to adopt such systems, seeing an increase of 35% in inflight retail transactions through digital platforms in 2023.

- Targeted Digital Advertising

Digital advertising during flights has moved from basic banner ads to more immersive and interactive content. Airlines like Lufthansa and Qantas are using Wi-Fi-enabled inflight screens to deliver location-based advertising. For example, during long-haul flights, advertisements tailored to specific regions are displayed to passengers based on the flight’s destination. This type of real-time, geo-targeted advertising is expected to grow rapidly and is projected to account for over 54% of inflight advertising revenue by 2033.

Major Challenges

- Inconsistent Passenger Engagement

One of the major challenges facing the Inflight Retail and Advertising market is the inconsistent engagement levels of passengers with inflight advertisements. Although the potential for personalized, interactive advertising is high, passenger engagement often varies significantly based on factors such as flight duration, time of day, or even seat class. In 2023, it was reported that only 25% of passengers actively engage with inflight advertisements, which limits the overall effectiveness of these campaigns. Despite the growing adoption of digital platforms, converting passive viewers into active participants remains a significant hurdle for advertisers and airlines alike.

- Technological Limitations and Integration

Another challenge is the technical limitations surrounding the integration of new technologies. While airlines are increasingly adopting digital inflight retail platforms, many airlines still rely on outdated legacy systems that aren’t fully compatible with modern advertising and retail technologies. As of 2023, only 30% of airlines had fully integrated mobile-based retail systems onboard. The lack of uniformity in the technology across airlines means that brands are unable to execute consistent, high-quality campaigns across all carriers, which undermines the potential for large-scale advertising.

- Regulatory Constraints

Regulatory constraints are also a challenge, especially when it comes to digital content. Countries have varying regulations on what types of products can be advertised onboard, particularly for items such as alcohol, tobacco, or certain pharmaceuticals. For example, in regions like the European Union, restrictions on alcohol promotions limit airlines’ ability to run full-spectrum advertising campaigns. Airlines must navigate these regulatory environments carefully, which sometimes slows down the rollout of new advertising programs. This complexity adds a layer of operational challenges and increases costs for both airlines and advertisers.

- Monetizing Inflight Advertising in Low-Cost Segments

While premium cabins have a high potential for inflight retail and advertising revenues, the low-cost carrier (LCC) segment presents a challenge for advertisers. Passengers in economy or budget classes tend to have lower engagement with both in-flight retail and advertising content. LCCs make up over 40% of global air traffic, but the lower disposable income of their passengers reduces the effectiveness of upselling and cross-selling tactics, creating a significant challenge for marketers to generate high returns from inflight advertising in this segment.

- Cybersecurity and Data Privacy Concerns

As inflight retail and advertising become more digitized, cybersecurity and data privacy issues are emerging as key concerns. Passengers are becoming more wary of sharing personal data during inflight purchases or interactions with digital advertising. In 2023, an increasing number of cybersecurity breaches targeted inflight systems, leading to heightened security measures by airlines. However, concerns about data privacy could undermine consumer trust in inflight retail systems, and airlines must find a balance between delivering personalized services and protecting customer data.

Growth Opportunities

- Expansion of Digital and Mobile Platforms

A significant growth opportunity in the Inflight Retail and Advertising market lies in the expansion of digital and mobile platforms. With the increasing adoption of in-flight Wi-Fi and mobile connectivity, airlines have the potential to offer passengers a more interactive and seamless shopping experience. Passengers can browse products, access exclusive deals, and make purchases directly from their smartphones or tablets. This shift towards mobile commerce is expected to drive a significant increase in onboard retail sales, with the global inflight mobile commerce market anticipated to grow at a CAGR of 10-12% over the next decade. By 2030, it’s expected that over 60% of inflight retail transactions will be made through mobile platforms, representing a substantial opportunity for airlines and advertisers.

- Personalized Advertising

Personalized advertising presents another major growth opportunity. As airlines collect more passenger data through loyalty programs, ticket sales, and flight preferences, they can deliver highly targeted and relevant ads to passengers. Studies show that 70% of passengers are more likely to engage with personalized ads than with generic ones, which increases the likelihood of purchases and brand engagement. With personalized ads, airlines can boost revenue not just from retail sales but also from advertisers seeking to reach a highly specific audience during flights. This trend is particularly promising in markets like North America and Europe, where digital ad spending is on the rise.

- Emerging Markets and Increasing Air Travel

The rapid growth of air travel in emerging markets, especially in Asia Pacific, presents a significant opportunity for the inflight retail and advertising sector. Asia Pacific, which accounted for 37.4% of the market share in 2023, is expected to continue driving growth, with passenger traffic projected to grow at a CAGR of 6-8% in the coming years. As more travelers take to the skies, airlines can tap into these new markets by offering localized products and tailored advertising strategies. This region also has a growing middle class, which will likely increase demand for premium retail products onboard.

- Eco-Friendly and Sustainable Products

With increasing consumer interest in sustainability, airlines are exploring eco-friendly and sustainable retail offerings onboard. A recent survey showed that 55% of passengers are willing to pay a premium for sustainable products. Airlines can take advantage of this trend by introducing sustainable inflight retail items such as eco-friendly toiletries, reusable water bottles, or organic snacks, creating a new revenue stream and appealing to environmentally conscious travelers.

Recent Developments

- Panasonic Avionics Launches New Digital Retail Platform (2023)

In 2023, Panasonic Avionics Corporation launched a new digital retail platform aimed at enhancing the inflight shopping experience. This platform integrates with the airline’s entertainment systems, enabling passengers to shop from a wide range of products, including luxury goods, electronics, and travel accessories. By leveraging in-seat displays and mobile apps, the platform allows passengers to make purchases directly from their devices, improving convenience and boosting onboard retail sales. This innovation aligns with the growing trend of digitalization and personalized experiences in air travel.

- Inmarsat Partners with Immfly for Inflight Retail Expansion (2023)

In 2023, Inmarsat, a leading satellite communications provider, partnered with Immfly, a specialist in inflight entertainment, to launch a new Wi-Fi-based inflight retail platform. This partnership aims to enhance the shopping experience by allowing airlines to offer a wide array of retail services onboard, including duty-free shopping and on-demand advertisements. By integrating Immfly’s system with Inmarsat’s high-speed satellite network, airlines can deliver seamless and engaging shopping experiences to passengers, driving increased revenue from onboard retail activities.

- New Funding Round for Airline Retail Tech Startups (2024)

In 2024, several inflight retail tech startups secured funding to expand their product offerings and improve in-flight advertising solutions. Notably, companies like AirFi and SkyLights received significant investments to enhance their wireless inflight shopping platforms and personalized advertising technologies. These investments aim to make inflight shopping more convenient, accessible, and profitable for both airlines and passengers. This trend of increasing venture funding suggests a growing interest in digital transformation and innovative customer experiences within the airline industry.

Conclusion

The Inflight Retail and Advertising market is on a clear growth trajectory, driven by the increasing demand for digital and personalized passenger experiences. As airlines continue to invest in Wi-Fi-enabled platforms and mobile-based solutions, there is a growing shift towards interactive and targeted advertising, allowing for real-time engagement with passengers. The Asia Pacific region, in particular, is showing strong potential, with 37.4% of the market share in 2023 and significant revenue contributions.

Key developments, such as new partnerships, innovative retail platforms, and enhanced customer engagement strategies, are setting the stage for more profitable and streamlined operations within the inflight retail space. However, challenges such as passenger engagement inconsistencies and technological limitations still need to be addressed to fully capitalize on the available opportunities. The growing focus on sustainability, along with enhanced data analytics for personalized advertising, will likely fuel further advancements in this market.

Overall, Inflight Retail and Advertising is becoming a crucial component of the broader airline revenue model, offering vast opportunities for growth. As technologies evolve and consumer expectations increase, airlines are in a strong position to leverage these innovations to enhance passenger satisfaction while driving significant revenue streams.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)