Table of Contents

Introduction

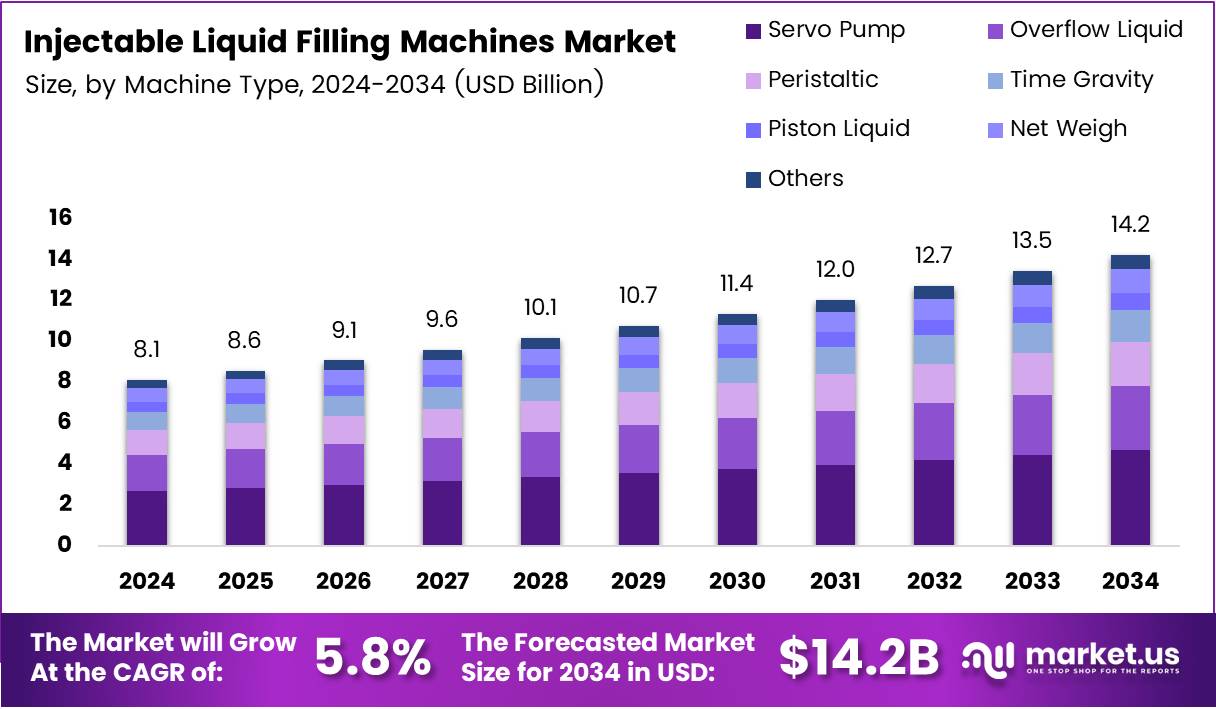

The Global Injectable Liquid Filling Machines Market is on a strong growth trajectory, expected to reach USD 14.2 Billion by 2034 from USD 8.1 Billion in 2024, growing at a CAGR of 5.8% from 2025 to 2034. This rise is fueled by the increasing demand for sterile injectable formulations and the global shift toward automated pharmaceutical production.

Moreover, the market expansion aligns with growing biologics and vaccine manufacturing worldwide. Automated injectable liquid filling machines enhance production accuracy, minimize contamination, and support compliance with international regulatory standards. As healthcare systems modernize, manufacturers are prioritizing advanced aseptic filling technologies to improve quality and efficiency.

Additionally, Industry 4.0 integration and government investment in pharmaceutical infrastructure are accelerating adoption. Automation-driven facilities, particularly in Asia-Pacific and North America, are reinforcing market growth through smart filling systems, robotics, and digital monitoring tools that ensure consistency and sterility in drug manufacturing processes.

Key Takeaways

- The Global Injectable Liquid Filling Machines Market will reach USD 14.2 Billion by 2034, growing at a CAGR of 5.8% (2025–2034).

- Servo Pump led the Machine Type category with a 23.2% share in 2024 due to precision and automation compatibility.

- 4 Heads dominated the Type segment with a 46.8% share for its efficiency and cost-effectiveness.

- Medium size machines captured 48.5% of the Size segment owing to their versatility across applications.

- Pharmaceutical applications led with a 57.3% share driven by vaccine and biologics demand.

- Asia Pacific dominated the market with a 41.2% share, valued at USD 3.3 Billion.

Market Segmentation Overview

By Machine Type, the Servo Pump segment dominates with 23.2% share, driven by its precision in liquid dosing and minimal wastage. These systems are preferred in pharmaceutical and biotech facilities for their high automation compatibility and reliability during aseptic production processes.

By Type, 4 Heads filling machines lead with 46.8% share, providing an optimal mix of accuracy and speed for mid-scale operations. Their ability to handle multiple vials efficiently makes them the preferred choice for large pharmaceutical companies aiming for productivity and consistency.

By Size, Medium machines hold 48.5% share due to their scalability and cost-effectiveness. They suit both small and large manufacturers, offering an ideal capacity balance for laboratories, contract manufacturing organizations, and full-scale pharmaceutical lines.

By Application, the Pharmaceutical segment dominates with 57.3% share, reflecting strong demand for injectable vaccines, biologics, and sterile drug formulations. This trend is supported by regulatory emphasis on precision dosing and aseptic processing standards.

Drivers

Rising Demand for Pre-Filled Syringes and Injectable Drug Delivery Systems: The surge in pre-filled syringe usage is transforming pharmaceutical packaging and delivery. These systems reduce contamination and improve patient safety, leading manufacturers to adopt precision liquid filling machines capable of maintaining sterility and accurate dosage control.

Growing Automation in Biopharmaceutical Production: As biologics and vaccines become central to healthcare, automation in liquid filling enables greater efficiency and compliance. Automated systems ensure high throughput, reduce human error, and enhance consistency—making them vital to modern sterile drug production lines.

Use Cases

Pharmaceutical Manufacturing: Injectable liquid filling machines play a critical role in producing vaccines, insulin, and biosimilars. Their aseptic filling capability supports large-scale production while ensuring compliance with GMP and FDA standards, essential for drug quality and safety.

Contract Manufacturing Organizations (CMOs): CMOs rely heavily on high-speed liquid filling machines to meet global outsourcing demands. These machines provide flexibility in batch sizes, quick changeovers, and scalability, allowing CMOs to deliver sterile formulations efficiently for multiple clients.

Major Challenges

Stringent Regulatory and Validation Requirements: Compliance with global regulatory standards such as FDA and EMA guidelines remains a significant barrier. Validation and certification processes are time-intensive and expensive, often delaying new equipment installation and operational rollout.

Lack of Skilled Technical Workforce: Operating advanced aseptic filling systems requires specialized skills in automation and maintenance. The shortage of trained professionals, particularly in developing economies, limits adoption and increases downtime and maintenance costs.

Business Opportunities

Expansion of Local Pharmaceutical Production in Emerging Markets: Governments in Asia, Africa, and Latin America are investing in pharmaceutical manufacturing infrastructure. This development creates strong demand for reliable, high-speed injectable filling machines to support domestic drug production and reduce import reliance.

Innovation in Dual-Chamber and Modular Filling Systems: The evolution of multi-dose and modular filling systems presents lucrative opportunities. These technologies enhance drug formulation flexibility, improve production efficiency, and cater to next-generation biologic and biosimilar manufacturing needs.

Regional Analysis

Asia Pacific Dominance: The Asia Pacific region leads the market with a 41.2% share, valued at USD 3.3 Billion. Rapid expansion in pharmaceutical manufacturing, especially in China, India, and Japan, coupled with strong government support and automation initiatives, drives growth. The rise of biosimilar and vaccine production further strengthens regional demand.

North America and Europe Growth: North America continues to show robust adoption of smart filling systems supported by advanced R&D capabilities, particularly in the U.S. In Europe, countries like Germany and France emphasize precision engineering and compliance. Both regions benefit from technological innovation, strong healthcare infrastructure, and regulatory enforcement promoting high-quality manufacturing standards.

Recent Developments

- In October 2025, Groninger Group acquired Reinraumtechnik Ulm GmbH (RTU) to strengthen its aseptic processing portfolio by integrating cleanroom and isolator technologies.

- In May 2025, Syntegon introduced the SynTiso filling line, enhancing flexibility and sterility with integrated isolator and small-batch manufacturing capabilities.

- In July 2025, TurboFil became Ravona’s exclusive U.S. distributor, combining aseptic containment solutions with advanced filling technology for complete sterile processing systems.

Conclusion

The Global Injectable Liquid Filling Machines Market is advancing rapidly, supported by automation, regulatory compliance, and the growing production of biologics and vaccines. With strong momentum across Asia Pacific and developed markets, the industry is shifting toward digitalized, smart filling systems that enhance precision, sterility, and efficiency.

As pharmaceutical companies and CMOs invest in scalable, compliant solutions, innovations like IoT-enabled monitoring and modular designs will redefine aseptic manufacturing standards. The market’s evolution will continue to align with healthcare’s increasing demand for injectable drugs, ensuring sustainable growth through 2034.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)