Table of Contents

Introduction

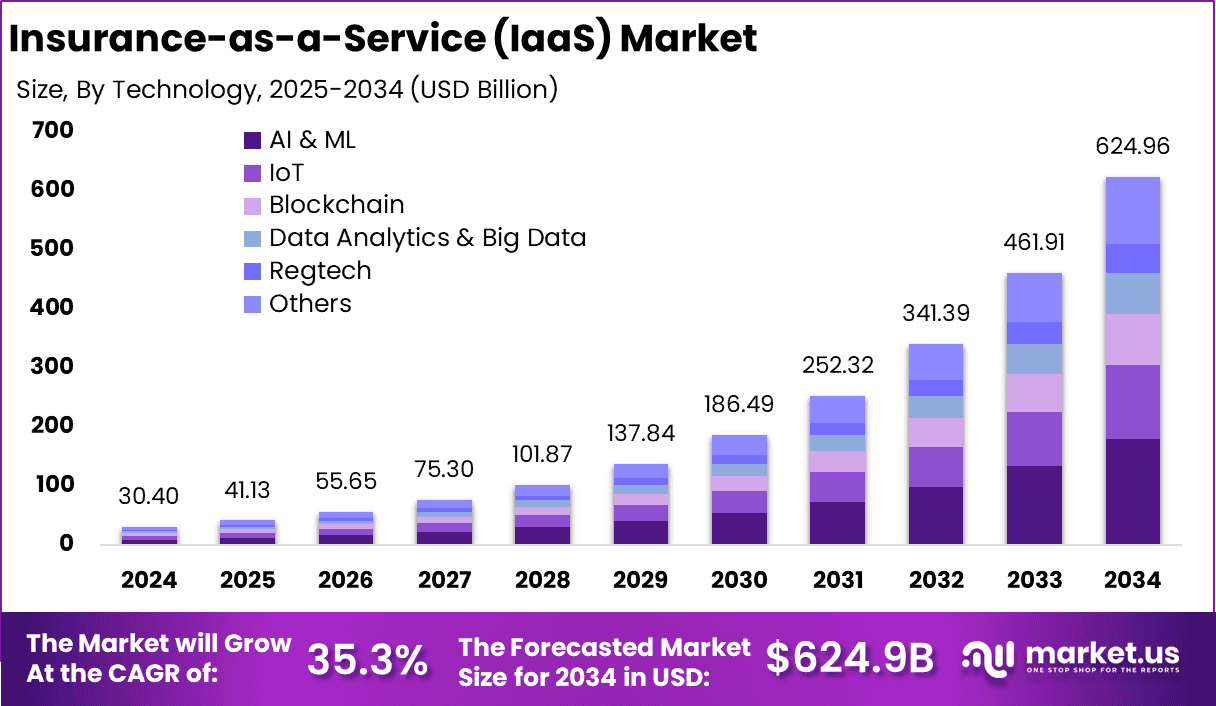

The global Insurance-as-a-Service (IaaS) market was valued at US$30.4 billion in 2024 and is projected to reach US$624.9 billion by 2034, growing at a robust CAGR of 35.3%. North America holds a dominant market share of 39.4%, generating US$11.9 billion in revenue.

This growth is driven by the increasing demand for on-demand, flexible, and scalable insurance solutions across various sectors. As insurers embrace cloud technologies, AI-driven tools, and embedded insurance models, the IaaS market is rapidly transforming the traditional insurance industry into a more accessible and customer-centric service.

How Growth is Impacting the Economy

The exponential growth of the IaaS market is positively influencing the global economy by enabling greater financial inclusion and improving access to insurance products. As the industry shifts towards digital platforms, more consumers—particularly underserved populations—are gaining access to tailored insurance solutions. The growth of IaaS supports job creation in IT, customer service, and regulatory compliance sectors.

Additionally, financial institutions are benefiting from the rise of innovative insurance products that increase customer loyalty and reduce operational costs. The ability to scale insurance services dynamically means businesses can more efficiently manage risk exposure and operational overheads.

As IaaS drives innovation, it accelerates digital transformation in financial services, opening new revenue streams, enhancing operational efficiencies, and fostering competition. With its disruptive potential, IaaS is reshaping the insurance landscape and contributing to the broader digital economy.

➤ Unlock growth! Get your sample now! @ https://market.us/report/insurance-as-a-service-iaas-market/free-sample/

Impact on Global Businesses

The rapid rise of IaaS is reshaping global business models across various sectors. As businesses adopt IaaS platforms, operational costs associated with traditional insurance models are declining, while efficiencies in underwriting, claims processing, and risk management are improving. The increased reliance on cloud-based infrastructure, data analytics, and AI in insurance services drives up initial implementation costs, but businesses realize long-term savings.

Supply chains are adapting to the demand for faster, more scalable solutions, with insurers offering personalized services that can be integrated seamlessly with other digital ecosystems. Sector-specific impacts are visible in industries like fintech, where IaaS is enabling real-time insurance products, and in healthcare, where embedded insurance is supporting telemedicine growth. The move toward pay-per-use models and micro-insurance solutions is reshaping customer expectations and driving insurers to innovate rapidly.

Strategies for Businesses

To capitalize on the IaaS market, businesses should prioritize digital transformation by adopting flexible, cloud-native insurance platforms. Insurers must integrate AI, machine learning, and data analytics to create personalized insurance products that align with customer needs. Investing in customer-centric models and expanding partnerships with fintech and insurtech startups can open new revenue streams.

Businesses should also focus on improving their data security and privacy compliance in response to increased digital transactions. Building scalable platforms that allow seamless integration with third-party services will be key to long-term success. Lastly, leveraging the growing trend of embedded insurance will provide businesses with opportunities to expand into new markets.

Key Takeaways

- IaaS market projected to grow from US$30.4B in 2024 to US$624.9B by 2034, with a CAGR of 35.3%

- North America holds a 39.4% share in 2024, generating US$11.9B in revenue

- Increased adoption of cloud technologies and AI is driving growth

- Benefits include reduced operational costs, scalable services, and enhanced customer engagement

- Sector-specific transformations in fintech, healthcare, and telecom

➤ Stay ahead—secure your copy now @ https://market.us/purchase-report/?report_id=153697

Analyst Viewpoint

The current IaaS market is marked by rapid adoption, with insurers seeking flexibility, scalability, and cost-efficiency in their offerings. Analysts anticipate that as more insurers embrace digital-first platforms, the market will continue its rapid expansion. Over the next decade, AI-driven insurance services and embedded insurance models will become mainstream.

The growth of insurtechs and their partnerships with traditional insurers will further drive innovation and service customization. The future of the IaaS market looks promising, with increasing consumer demand for personalized and on-demand insurance solutions expected to sustain growth. As technology continues to evolve, businesses that leverage IaaS platforms will lead in efficiency and customer satisfaction.

Regional Analysis

North America dominates the IaaS market due to the presence of major insurers, high levels of investment in fintech, and widespread adoption of cloud technologies. The U.S. is a key player, with a strong regulatory framework that supports the development of digital insurance services. Europe is also experiencing significant growth, driven by the EU’s digital finance initiatives and regulatory reforms aimed at improving consumer protection and financial inclusion.

Asia Pacific is poised for rapid growth, particularly in emerging markets like India and China, where digital adoption and mobile-first solutions are transforming the insurance landscape. The Middle East and Latin America are gradually adopting IaaS solutions, with increasing investments in digital financial services.

Business Opportunities

The IaaS market offers significant business opportunities for both established insurers and emerging startups. Insurtech companies can leverage IaaS platforms to develop innovative, scalable products that meet evolving consumer needs. There is also growing demand for integrated insurance solutions across industries like healthcare, automotive, and e-commerce, providing opportunities for embedded insurance models.

Businesses offering AI-powered underwriting, claims automation, and fraud detection tools will be well-positioned to capture market share. Additionally, there is a rising demand for micro-insurance and pay-per-use insurance models, particularly in emerging markets, creating new opportunities for flexible and affordable solutions. Partnerships between traditional insurers and technology providers will enable companies to scale their offerings.

Key Segmentation

The IaaS market is segmented by Service Type, End-User, Deployment Model, and Region.

- Service Type: Policy Management, Claims Processing, Underwriting, Risk Management, and Others—claims processing and underwriting are key revenue-generating segments due to automation and efficiency gains.

- End-User: Individuals, SMEs, Large Enterprises, and Governments—large enterprises and governments lead adoption for comprehensive coverage solutions.

- Deployment Model: Cloud-Based and On-Premise—Cloud-based solutions dominate due to flexibility, scalability, and lower upfront costs.

- Region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa—North America leads, but Asia Pacific shows the highest growth potential due to mobile-first and tech-savvy populations.

Key Player Analysis

Leading companies in the IaaS market focus on offering end-to-end solutions that integrate policy management, claims processing, and risk assessment tools into digital platforms. These companies are investing in AI, machine learning, and blockchain to enhance automation and transparency in insurance processes.

Their solutions often feature customer-centric interfaces that allow for personalized coverage and real-time policy management. Strategic partnerships with fintech companies and cloud service providers help strengthen their market position. These players are also committed to building scalable and secure platforms to support global operations while maintaining compliance with regional insurance regulations.

- Cognizant

- Adobe Inc.

- Salesforce, Inc.

- International Business Machines Corporation (IBM)

- Oracle Corporation Company Profile

- SAP SE Company Profile

- Pegasystems Inc.

- Accenture plc Company Profile

- DXC Technology Company

- Guidewire Software, Inc.

- Duck Creek Technologies

- Applied Systems, Inc.

- Prima Solutions

- Majesco

- Sapiens International

- Others

Recent Developments

- Launch of cloud-based platforms enabling seamless integration of insurance services

- Expansion of AI-driven underwriting and claims automation tools

- Partnerships with fintech companies to offer embedded insurance models

- Development of micro-insurance products for low-income and underserved populations

- Implementation of blockchain for improved transparency and fraud prevention in insurance transactions

Conclusion

The IaaS market is set for remarkable growth, driven by advancements in cloud technology, AI, and data analytics. Businesses that adopt these solutions will gain competitive advantages through enhanced customer engagement, operational efficiency, and scalability. The future of insurance is digital, and companies investing in IaaS are positioning themselves for long-term success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)