Table of Contents

Introduction

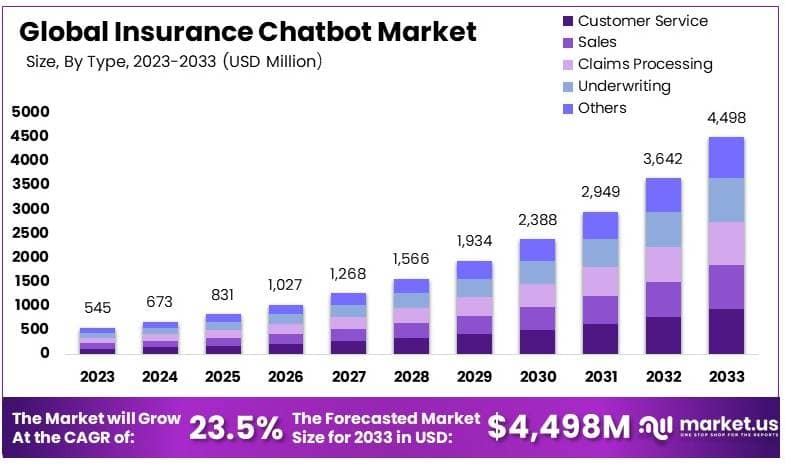

According to the Market.us, The Global Insurance Chatbot Market is projected to reach approximately USD 4,498 million by 2033, up from USD 545 million in 2023, with an expected CAGR of 23.5% during the forecast period from 2024 to 2033.

Insurance chatbots are automated solutions designed to enhance customer experience in the insurance sector. These chatbots can handle a variety of tasks traditionally managed by human agents, such as answering policy-related questions, guiding customers through the claim process, and providing quotations for different types of insurance covers. The adoption of chatbots allows insurance companies to offer 24/7 customer service, reduce operational costs, and streamline claim processes. Chatbots are also increasingly capable of handling more complex queries through advances in AI, making them an integral part of digital transformation strategies within the industry.

The insurance chatbot market is witnessing significant growth, driven by the digitalization of insurance services and the increasing demand for more efficient customer service solutions. Insurance companies are investing in chatbot technology to enhance customer engagement and operational efficiency. The market expansion is also supported by the rise in AI capabilities, which enable chatbots to provide more personalized and accurate responses. As technology evolves, the market sees a broader adoption of chatbots across various insurance sectors, including health, automotive, and life insurance. The integration of chatbots with existing IT infrastructure and the ongoing improvement in natural language processing algorithms are expected to further drive market growth in the coming years.

Several growth factors are propelling the Insurance Chatbot Market forward. Technological advancements in artificial intelligence and machine learning have greatly improved the capabilities of chatbots, making them more intuitive and capable of handling complex interactions. The integration of chatbots with existing customer relationship management (CRM) systems is another critical factor, as it allows for seamless service experiences. Additionally, the increasing adoption of digital platforms by insurance companies to reduce costs and improve customer satisfaction rates fuels the market growth.

Opportunities in the Insurance Chatbot Market are vast. As AI technology evolves, there is potential for chatbots to become even more sophisticated, with better natural language processing abilities and deeper integration into mobile applications and social media platforms. This integration enables insurers to reach a broader audience, particularly among younger, tech-savvy consumers who prefer digital-first interactions. Moreover, as data privacy regulations continue to develop, there is an opportunity for chatbots to use advanced security features to ensure that all user interactions are compliant with global standards, thereby enhancing consumer trust and adoption.

Key Takeaways

- The Insurance Chatbot Market was valued at USD 545 million in 2023 and is projected to grow to USD 4,498 million by 2033, reflecting a CAGR of 23.5%.

- In 2023, Customer Service Chatbots led the type segment with a 21.2% share, primarily due to their effectiveness in enhancing customer interactions.

- Text-based Interfaces dominated the user interface segment in 2023, capturing 68.4% of the market, thanks to their simplicity and user familiarity.

- North America emerged as the leading region in 2023, holding a 37.5% market share, driven by the advanced adoption of AI technologies in the insurance sector.

Insurance Chatbot Statistics

- The global chatbot market has been witnessing remarkable growth, with the market size reaching USD 6 Billion in 2023 and a robust CAGR of 23.9% year-on-year. This upward trend is expected to continue, projecting the market to soar to USD 42 Billion by 2032.

- Similarly, the subset focusing on Generative AI in chatbots is also experiencing rapid growth, poised to expand from USD 151.0 Million in 2023 to USD 1,714.3 Million by 2033, demonstrating a CAGR of 27.5%.

- The broader AI chatbot sector mirrors this growth trajectory, expecting to increase from USD 6.4 Billion in 2023 to USD 66.6 Billion by 2033, at a CAGR of 26.4%.

- In the insurance sector, the deployment of conversational AI chatbots is set to generate significant cost savings, approximating ~$1.4 billion in 2023 across various segments such as life, motor, property, and health insurance. This technological adoption is becoming a strategic advantage for insurers aiming to outpace their competitors.

- Customer preferences are also shifting, with 80% favoring companies that offer personalized experiences. Moreover, 87% of insurance brands are making substantial investments in AI technologies, each pouring at least ~$5 million annually into these initiatives. The main applications of these technologies include customer service (67%), claims processing (45%), risk management (31%), and underwriting (25%).

- Internationally, 44% of insurers are in the process of integrating AI chatbots or generative AI into their claims resolution operations, with 42% having already successfully done so. Regionally, the UK shows comparable activity, with 40% of insurers fully integrated and 43% progressing towards implementation.

- Furthermore, a significant portion of interactions, over 80%, handled by insurance chatbots involve routine inquiries or FAQs, underscoring the efficiency of chatbots in managing these common customer service tasks. The transition towards automation in customer interaction is strongly supported by insurance executives, 71% of whom believe that customers will prefer chatbots over human agents by 2021, signaling a transformative shift in customer service paradigms within the insurance industry.

Emerging Trends

- Integration with IoT and Telematics: Insurance companies are integrating chatbots with IoT and telematics to collect real-time data, which enhances personalized services and risk assessment. This allows for more tailored insurance policies and proactive customer service.

- Advanced AI and NLP Capabilities: The use of advanced artificial intelligence and natural language processing is improving chatbots’ ability to understand and respond to complex customer inquiries. This leads to more accurate and context-aware interactions, improving overall customer satisfaction.

- Omnichannel Support: Insurance companies are emphasizing the provision of consistent service across multiple platforms, including web, mobile, and social media, using chatbots. This ensures a seamless customer experience regardless of how or where a customer chooses to interact with the company.

- Automated Claims Processing: Chatbots are increasingly being used to automate the claims process, from initial notification to final settlement. This reduces the processing time and improves efficiency, leading to higher customer satisfaction.

- Personalization and Customer Engagement: Chatbots are being designed to offer personalized advice and product recommendations based on individual customer data. This not only enhances the customer experience but also aids in effective cross-selling and upselling strategies.

Top Use Cases

- Customer Service and Support: Chatbots provide 24/7 customer support, handling inquiries about policies, coverage details, and billing questions, thereby enhancing customer service and reducing operational costs.

- Claims Registration and Management: Chatbots streamline the claims process by guiding customers through the claims registration, document submission, and status updates, making the process faster and more user-friendly.

- Policy Management and Renewal: Customers can manage their policies, update personal details, and renew policies through chatbots without needing to speak directly with an agent, which simplifies policy management.

- Lead Generation and Sales: Chatbots qualify leads by gathering preliminary information from potential customers and can direct them to appropriate sales channels or provide initial quotes, enhancing the sales process.

- Fraud Detection and Risk Assessment: Utilizing AI, chatbots can analyze customer data to detect unusual patterns that may indicate fraudulent activities. They also assist in risk assessment by analyzing data from various sources to provide insights to insurers.

Major Challenges

- Data Privacy and Security: As chatbots handle sensitive customer data, ensuring robust security measures and data privacy is paramount. This includes complying with stringent regulatory requirements to protect personal information from breaches and unauthorized access.

- Integration Complexity: Integrating chatbots with existing insurance systems and databases can be technically challenging. It involves syncing with legacy systems, which often requires extensive customization and can lead to potential integration issues.

- Consumer Expectations: Meeting the high expectations of consumers for personalized and instant responses can be challenging for chatbots, especially when handling complex queries that require nuanced understanding or human empathy.

- Talent Acquisition: There is a significant demand for professionals with expertise in AI, machine learning, and data security to develop and maintain sophisticated chatbot systems. Attracting and retaining such talent is increasingly competitive.

- Ethical and Legal Concerns: Navigating the ethical implications of AI in insurance, such as ensuring fairness in automated decisions and maintaining transparency, poses ongoing challenges. Additionally, legal hurdles concerning the autonomous functioning of AI systems continue to evolve.

Top Opportunities

- Enhanced Customer Service: Chatbots provide 24/7 customer service, handling inquiries and claims efficiently, which significantly enhances customer satisfaction and retention. This continuous availability can be a major market differentiator.

- Operational Efficiency: By automating routine tasks such as data entry, claim processing, and customer inquiries, chatbots can significantly reduce operational costs and free up human resources for more complex tasks, thus improving overall efficiency.

- Personalized Insurance Products: Utilizing AI to analyze customer data, chatbots can offer personalized insurance recommendations and products, tailored to individual customer profiles. This not only improves customer engagement but also increases the likelihood of policy conversions.

- Claims Processing: Chatbots streamline the claims process by providing quicker reporting, real-time updates, and efficient management of claims. This leads to faster claims resolution and enhances customer trust and loyalty.

- Market Penetration and Expansion: As chatbots can be integrated across various digital platforms, they offer insurers the ability to expand their market reach and penetrate new demographic segments, particularly the tech-savvy younger generation.

Recent Developments

- LivePerson (May 2024) launched new AI capabilities and integrations aimed at improving customer conversations. These include a “Conversation Orchestration” tool that integrates large language models (LLMs) such as OpenAI’s GPT-4 and third-party bots like Amazon Lex and IBM Watson. They also announced a new partnership with Avaya, combining voice and digital customer experience solutions.

- Nuance Communications (March 2023), a subsidiary of Microsoft, introduced Dragon Ambient eXperience (DAX) Express, an AI-driven solution that integrates OpenAI’s GPT-4 model. This product automates clinical documentation, reducing the administrative burden on healthcare professionals and helping companies streamline their insurance claims processing.

- IBM (August 2023) announced the launch of its Azure OpenAI Service, in partnership with Microsoft, to enhance chatbot capabilities in industries like insurance. This collaboration also led to the creation of the IBM-Microsoft Experience Zone in India, focusing on generative AI solutions and helping insurance companies modernize their digital workflows.

- Zurich Insurance Acquires AlphaChat (April 2023), Zurich Insurance strengthened its AI capabilities by acquiring AlphaChat, an Estonian company specializing in conversational AI. This move aims to enhance Zurich’s customer service automation with advanced AI tools, focusing on personalized communication through virtual assistants. This acquisition reflects the growing trend of insurance firms investing in AI to improve customer interactions

Conclusion

In conclusion, insurance chatbots represent a transformative shift within the insurance industry, propelled by advancements in artificial intelligence and the growing imperative for digital-first customer experiences. These automated systems are not just augmenting customer service; they are reshaping the operational dynamics of insurance companies, driving efficiency, and enhancing customer engagement across multiple touchpoints.

As the technology continues to evolve and integrate more deeply with the core systems of insurance providers, the potential for chatbots to improve service delivery and operational efficiency appears boundless. This ongoing evolution positions the insurance chatbot market for sustained growth, promising significant advancements in how insurance products and services are offered and managed in the digital age.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)