Table of Contents

Report Overview

According to Market.us, The global insurance fraud detection market is on a remarkable growth trajectory, projected to surge from USD 19.6 billion in 2023 to an impressive USD 144.3 billion by 2033. This represents a robust compound annual growth rate (CAGR) of 21.1% over the forecast period of 2024 to 2033. In 2023, North America dominated the market, contributing a significant 49.1% share and generating revenues of approximately USD 9.4 billion. The region’s stronghold is attributed to advanced technological adoption, stringent regulatory frameworks, and the increasing focus on minimizing fraudulent claims.

Insurance fraud detection refers to the set of practices, tools, and technologies used by insurers to identify and prevent fraudulent activities within the insurance industry. Fraudulent activities such as false claims, identity theft, and billing manipulations are significant threats that lead to financial losses for insurance providers. Modern fraud detection systems leverage advanced technologies like artificial intelligence (AI), machine learning (ML), and big data analytics to spot suspicious patterns, automate investigations, and streamline fraud prevention.

Several factors are propelling the growth of this market. The surge in digital transactions has created more opportunities for fraud, prompting insurers to invest in robust detection systems. Additionally, stringent regulatory compliance requirements mandate the implementation of effective fraud detection measures. Collaborations between insurers and technology firms have also led to innovative solutions, enhancing fraud detection capabilities.

According to the U.S. Department of Justice and the Federal Bureau of Investigation, fraud is a major challenge for the insurance industry, costing an estimated over $40 billion annually. This staggering figure highlights the scale of the issue and its impact on both businesses and consumers. For context, this cost isn’t just absorbed by insurance companies-it trickles down to everyday policyholders, who pay higher premiums as a result.

The demand for insurance fraud detection solutions is escalating as insurers seek to protect their financial resources and maintain customer trust. The increasing sophistication of fraudulent schemes necessitates advanced detection systems capable of real-time monitoring and analysis. This growing demand is further fueled by the need to comply with regulatory standards and minimize financial losses.

Technological advancements present significant opportunities in the insurance fraud detection market. The integration of artificial intelligence (AI), machine learning (ML), and big data analytics enables insurers to detect fraudulent activities more efficiently and accurately. These technologies facilitate real-time data processing, predictive analytics, and the development of sophisticated fraud detection models, enhancing the ability to identify and prevent fraud.

The adoption of AI and ML has revolutionized fraud detection by enabling the analysis of vast datasets to identify patterns indicative of fraud. Blockchain technology offers enhanced security and transparency, making it suitable for verifying the authenticity of insurance transactions. Additionally, cloud-based solutions provide scalability and cost-effectiveness, allowing insurers to access advanced fraud detection capabilities without extensive infrastructure investments.

Key Takeaways

- The Global Insurance Fraud Detection Market is experiencing remarkable growth, with projections estimating it will reach USD 144.3 billion by 2033, up from USD 19.6 billion in 2023. This represents an impressive CAGR of 21.1% from 2024 to 2033.

- In 2023, North America led the market, holding a commanding share of 49.1%, which translates to USD 9.4 billion in revenue. This region remains a powerhouse in adopting fraud detection technologies.

- The Solutions segment stood out as the frontrunner in 2023, capturing a significant 64.5% of the market share. These solutions are increasingly crucial for addressing the growing complexity of fraud schemes.

- When looking at deployment methods, the on-premise segment dominated in 2023. Many organizations continue to prefer on-premise systems for better control and security over sensitive data.

- Large organizations drove the majority of the demand last year, commanding a notable 62.3% share of the market. Their need for sophisticated fraud detection tools to handle vast volumes of data plays a significant role in shaping the market.

Insurance Fraud Detection Statistics

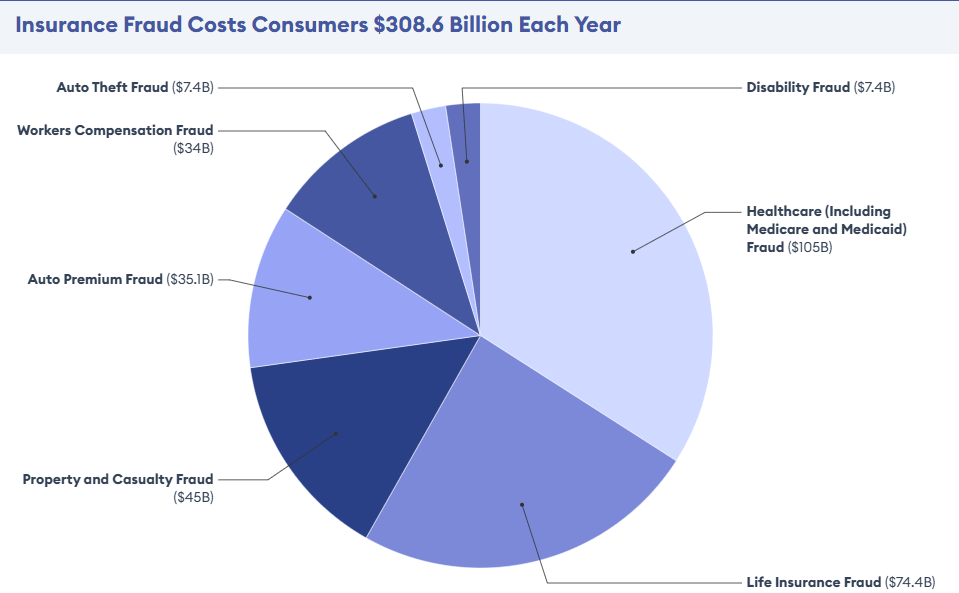

- $308.6 billion is lost annually in the U.S. due to insurance fraud.

- On average, insurance fraud costs $900 per consumer, primarily through higher premiums.

- The largest category of insurance fraud is healthcare insurance fraud, which includes Medicaid and Medicare fraud, accounting for an estimated $105 billion in losses each year.

- Life insurance fraud follows closely with an estimated loss of $74.7 billion, while property and casualty insurance fraud results in a loss of $45 billion.

- Approximately 20% of all insurance claims are fraudulent.

- Medicare alone loses about $60 billion annually due to fraud, with 10% of its budget misappropriated.

- Fraudulent activities in the UK lead to an estimated loss of £3.3 billion every day, with the average dishonest claim valued at £11,500.

- The total damage caused by insurance fraud in the U.S. amounts to $80 billion each year.

- U.S. consumers face a financial burden of $400 to $700 annually due to increased premiums caused by fraud.

- According to the Coalition Against Insurance Fraud, 78% of consumers are concerned about insurance fraud.

- Insurance fraud is recognized as a crime in all 50 states and the District of Columbia, with 30 states specifically criminalizing insurer fraud.

- Around 60% of surveyed respondents believe fraud has increased significantly, while an additional 10% report a slight increase.

- The U.S. insurance industry consists of more than 7,000 organizations, making it a highly complex sector.

- Auto insurance fraud alone causes $29 billion in losses annually.

- Approximately 85% of insurance companies have dedicated fraud investigation teams to combat this issue.

- Taiwan has the highest rate of insurance penetration in the world, with a rate of 14.8%.

Source – forbes.com [Coalition Against Insurance Fraud via Forbes Advisor ]

North America Insurance Fraud Detection Market Size

In 2023, North America held a dominant position in the insurance fraud detection market, capturing over 49.1% of the market share and generating approximately USD 9.4 billion in revenue. This leadership is attributed to several key factors. The region’s advanced technological infrastructure has enabled the widespread adoption of sophisticated fraud detection solutions. Insurance companies in North America have been proactive in integrating artificial intelligence (AI), machine learning (ML), and big data analytics into their operations, enhancing their ability to detect and prevent fraudulent activities effectively.

Insurance fraud is a significant challenge worldwide, costing the U.S. over $308 billion annually, according to the Coalition Against Insurance Fraud. Families bear the brunt of this issue, with the FBI estimating $400 to $700 added to yearly premiums. As technology evolves and tools like generative AI become more prominent, experts predict a growing threat of fraud, requiring urgent advancements in detection and prevention methods.

Moreover, North America faces a high incidence of insurance fraud cases, which has compelled insurers to invest heavily in robust fraud detection systems. The significant financial impact of fraudulent claims has driven the industry to prioritize the development and implementation of advanced detection technologies. Additionally, stringent regulatory requirements in the region mandate comprehensive fraud prevention measures. Compliance with these regulations has necessitated the adoption of cutting-edge fraud detection solutions, further solidifying North America’s leading market position.

Emerging Trends

- Predictive Analytics: Utilizing vast datasets, predictive analytics identifies suspicious patterns before they escalate, enabling proactive risk mitigation.

- Artificial Intelligence and Machine Learning: AI and ML algorithms analyze complex datasets to detect anomalies and patterns indicative of fraud, improving detection accuracy and reducing false positives.

- Blockchain Technology: Providing a secure and transparent ledger, blockchain enhances trust in claims processing and deters fraudsters by making information manipulation easily traceable.

- Data Enrichment and Advanced Analytics: Integrating external data sources enriches the information available for analysis, allowing for more comprehensive fraud detection strategies.

- Real-Time Detection Capabilities: Advancements in technology enable the immediate identification of suspicious activities, allowing insurers to prevent fraud before it occurs.

Top Use Cases

- Claims Fraud Detection: AI-powered algorithms analyze claims data to identify inconsistencies and anomalies, flagging potentially fraudulent claims for further investigation.

- Underwriting Fraud Prevention: Machine learning models assess the authenticity of information provided during the underwriting process, ensuring accurate risk assessment and premium calculation.

- Identity Verification: Advanced analytics and AI verify the identities of policyholders and claimants, preventing identity theft and impersonation in insurance transactions.

- Behavioral Analysis: Monitoring policyholder behavior over time helps detect deviations that may indicate fraudulent intentions, allowing for timely intervention.

- Network Analysis for Collusion Detection: Analyzing relationships between entities involved in claims helps identify collusive fraud schemes, such as staged accidents involving multiple parties.

Major Challenges

- Evolving Fraud Techniques: Fraudsters continually develop sophisticated methods, such as staged accidents and falsified claims, making detection increasingly complex. For instance, “crash for cash” scams have seen a significant rise, with reports indicating a 60-fold increase in such cases since last year, involving £27 million in disputed fraudulent claims.

- Data Management Complexities: The insurance industry generates vast amounts of data from various sources. Effectively integrating and analyzing this information is challenging, often leading to inefficiencies in fraud detection processes.

- Regulatory Compliance: Navigating diverse regulations across regions complicates the implementation of standardized fraud detection systems, potentially hindering effective prevention strategies.

- Resource Constraints: Limited resources, including specialized personnel and advanced technological tools, can impede the timely identification and investigation of fraudulent activities.

- Technological Limitations: While artificial intelligence and machine learning offer promising solutions, their effectiveness is often limited by the quality of data and the need for continuous updates to address emerging fraud patterns.

Attractive Opportunities

- Advanced Analytics Implementation: Leveraging predictive analytics enables insurers to identify suspicious patterns proactively, enhancing the accuracy of fraud detection.

- Artificial Intelligence Utilization: AI and machine learning algorithms can process extensive datasets to detect anomalies indicative of fraud, thereby improving detection rates and reducing false positives.

- Blockchain Technology Adoption: Implementing blockchain provides a secure and transparent ledger system, reducing opportunities for fraudulent claims and enhancing trust in the insurance process.

- Collaboration and Data Sharing: Establishing industry-wide data-sharing platforms allows insurers to identify fraudsters more effectively by recognizing patterns across different entities.

- Real-Time Fraud Detection Systems: Developing systems capable of analyzing transactions as they occur enables immediate identification and prevention of fraudulent activities, thereby minimizing potential losses.

Recent Developments

- In May 2024, Solutis, a leading Brazilian technology company, announced a strategic partnership with FICO. This collaboration aims to support medium-sized banks and insurance businesses by reducing fraud, avoiding significant financial losses, and improving decision-making processes. The partnership also emphasizes promoting financial inclusion by making financial systems more secure and accessible.

- In June 2024 witnessed a major step in fraud prevention with the alliance of ForMotiv and FRISS, two notable players in behavioral data science and trust automation. Their combined expertise will provide advanced insights into applicant behaviors and intent, helping organizations enhance their fraud detection and risk assessment capabilities. This collaboration is expected to set a new standard in fraud prevention across the insurance sector.

- In October 2023, the Insurance Fraud Bureau (IFB) and Shift Technology launched IFB Exploration, an AI-powered solution designed for UK insurers. This innovative system uses real-time AI analytics to identify suspicious activities and organized fraud networks. It reflects the industry’s push toward using technology to address evolving fraud patterns effectively.

- Earlier in June 2023, Verisk, a global data analytics leader, introduced ClaimSearch in Israel. This cloud-based platform, developed in partnership with the Israel Insurance Association and backed by government support, represents a significant milestone in combating insurance fraud. By providing advanced analytics, ClaimSearch is setting a precedent for how data and technology can protect industries from fraudulent activities globally.

Conclusion

In conclusion, the insurance fraud detection market is evolving rapidly, driven by a combination of rising fraud incidents, technological advancements, and regulatory pressures. Insurers are increasingly adopting innovative solutions powered by artificial intelligence, machine learning, and big data analytics to enhance their fraud prevention capabilities. These technologies not only improve the accuracy and efficiency of fraud detection but also help safeguard financial resources and maintain customer trust.

As the market continues to expand, the integration of advanced systems like blockchain and cloud-based solutions will open new opportunities for insurers to stay ahead of increasingly sophisticated fraud schemes. This dynamic landscape underscores the critical need for proactive investment in fraud detection measures to ensure the resilience and integrity of the insurance industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)