Table of Contents

Introduction

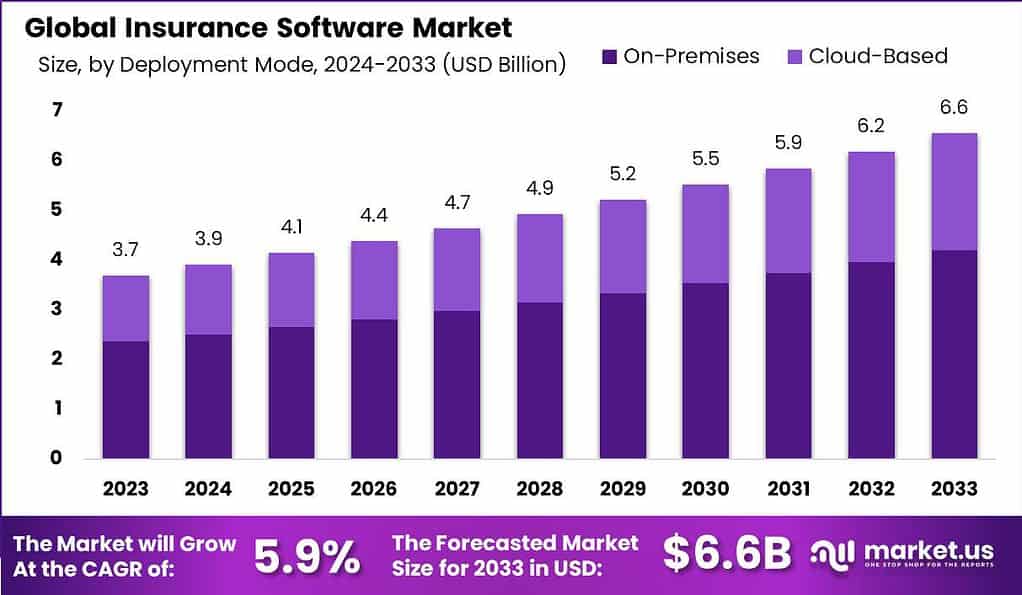

The Insurance Software Market is expected to witness significant growth, with a projected valuation of USD 6.6 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 6.6%. This growth trajectory is driven by the escalating demand for digital solutions within the insurance industry. The market encompasses various deployment models, including On-Premises and Cloud-Based solutions, with the former holding a dominant position in 2023, primarily due to its control over data and systems, crucial for insurance companies concerned with data security and compliance.

Insurance software is a type of computer program designed specifically for insurance companies. This software helps these companies manage their daily operations and provides tools to handle tasks such as policy management, claims processing, and customer service. Insurance software aims to make these processes more efficient and accurate, saving time and reducing errors.

The insurance software market is growing as more insurance companies adopt technology to improve their services. This market includes a wide range of products, from simple database management systems to sophisticated platforms that use artificial intelligence to analyze risks and automate claims. Key factors driving the growth of this market include the need for streamlined operations, the demand for personalized insurance services, and regulatory compliance requirements. As technology advances, the market is expected to expand further, offering new tools that help insurance companies serve their customers better and more efficiently.

To learn more about this report – request a sample report PDF

Key Takeaways in Insurance Software Market

- Projected Market Valuation: The Insurance Software Market is anticipated to capture a valuation of USD 6.6 Billion by 2033, exhibiting a steady growth trajectory with a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period.

- Dominance of On-Premises Deployment: In 2023, the on-premises deployment model dominated the market with over 64% share. This dominance is attributed to the control it offers over data and systems, appealing particularly to insurance companies concerned with data security and compliance.

- Life Insurance Segment: In 2023, the life insurance segment held a dominant market position, capturing over 36% share. This dominance is driven by the complexity of life insurance products, necessitating robust software solutions for effective management of policy administration, underwriting, and claims processes.

- Key End-User Insights: Insurance companies held the largest market share in 2023, accounting for over 57%. This significant market share is attributed to the increasing adoption of advanced software solutions to streamline operations, manage vast amounts of data, and enhance customer service.

- Regional Analysis: North America led the market in 2023, capturing over 31% share, driven by its advanced technological infrastructure and emphasis on digital transformation within the insurance sector

Insurance Software Statistics

- 29% of insurance customers report satisfaction with their current providers.

- 46% indicate that customer experience is a crucial factor in choosing an insurance provider.

- 41% of consumers are likely or more likely to switch providers due to inadequate digital capabilities.

- 15% of consumers consider the lack of digital capabilities the most significant challenge when interacting with insurers.

- Nearly 75% of customers encountered issues when trying to purchase insurance online.

- 88% of consumers seek more personalized insurance products, yet 21% believe their experiences are not tailored at all by their providers.

- By 2025, it is predicted that 95% of customer interactions will involve chatbots.

- The number of connected, smart devices is expected to exceed 50 billion by 2025.

- 69% of consumers are willing to install a sensor in their car for lower insurance premiums.

- 67% of insurance Chief Information Officers (CIOs) believe that Software as a Service (SaaS) will transform the industry within five years.

- The insurance workforce aged 55 and older has grown by 74% over the past decade. The US Bureau of Labor Statistics forecasts that over 50% of the current insurance workforce will retire in the next fifty years.

- 34% of customers prefer using a mobile app for managing their insurance policies, including claims, payments, and disbursements.

- However, preference for digital wallets in the insurance sector remains low, under 9%.

- 43% of customers prefer receiving their insurance policy statements via email.

Emerging Trends

- AI and Machine Learning: Insurance companies are increasingly using AI and machine learning to improve risk assessment, automate claims processing, and enhance customer service.

- Cloud Computing: The adoption of cloud-based solutions allows insurance companies to scale their operations, improve data accessibility, and reduce IT costs.

- Blockchain Technology: Blockchain is being used to increase transparency, reduce fraud, and streamline the claims process in the insurance industry.

- InsurTech Collaboration: Traditional insurance companies are partnering with InsurTech startups to innovate and offer new, customer-centric products.

- Cybersecurity: With the rise in digital transactions and data storage, there is a growing emphasis on improving cybersecurity measures to protect sensitive customer information.

Top Use Cases for Insurance Software

- Claims Management: Software solutions are used to automate and streamline the claims process, reducing processing times and improving accuracy.

- Policy Administration: Insurance software helps manage policy issuance, renewals, and cancellations efficiently, ensuring compliance with regulations.

- Customer Relationship Management (CRM): CRM systems help insurance companies manage customer interactions, track sales leads, and improve customer service.

- Underwriting: Advanced software tools assist underwriters in evaluating risks more accurately and setting appropriate premiums.

- Fraud Detection: AI-powered software helps identify and prevent fraudulent activities by analyzing patterns and anomalies in data.

Major Challenges

- Cybersecurity Threats: As insurance companies adopt more digital solutions, they face increased risks of cyber-attacks, which can lead to data breaches and loss of customer trust.

- Regulatory Compliance: Keeping up with changing regulations across different regions can be challenging, especially for software that manages sensitive customer information.

- Integration with Legacy Systems: Many insurers still use outdated systems. Integrating new software with these can be difficult and costly.

- Data Management and Analysis: Efficiently managing and analyzing large volumes of data to deliver personalized services and make informed decisions is a significant challenge.

- Changing Customer Expectations: As customers become more tech-savvy, they expect more digital and mobile services, which requires continuous updates and improvements to insurance software.

Market Opportunities

- Digital Transformation Initiatives: Insurers are investing in digital transformation, providing significant opportunities for software solutions that enhance digital customer experiences.

- Cloud-Based Solutions: There is growing demand for cloud-based insurance platforms that offer scalability, flexibility, and cost-efficiency.

- Artificial Intelligence and Machine Learning: Software that incorporates AI and ML can help insurers automate tasks, improve decision-making, and enhance customer service.

- Telematics and IoT: These technologies offer new ways to assess risks and customize insurance policies, opening up new market segments.

- Regulatory Technology (RegTech): Software that helps companies comply with regulations efficiently can gain a significant foothold in the market, given the complex regulatory landscape in insurance.

Recent Developments

- Oracle: In 2023, Oracle enhanced their cloud-based insurance platform with new features like AI-powered claims processing, automated underwriting, and omnichannel customer experience solutions. This move reflects Oracle’s commitment to leveraging advanced technologies to improve efficiency and customer satisfaction within the insurance industry.

- SAP: Also in 2023, SAP launched their new cloud-based insurance platform, SAP Cloud for Insurance, offering core insurance functionalities and pre-built solutions for various insurance lines. This launch signifies SAP’s dedication to providing comprehensive and tailored solutions to meet the evolving needs of insurance companies worldwide.

- IBM Corporation: June 2023: Expanded IBM Insurance Platform with AI and machine learning capabilities.

- Microsoft Corporation: May 2023: Introduced new features in Dynamics 365 for Insurance, integrating advanced analytics and AI.

Conclusion

In conclusion, the insurance software market has witnessed significant growth and transformation in recent years. The increasing digitalization and automation of the insurance industry have propelled the demand for software solutions that streamline operations, enhance efficiency, and improve customer experience. Insurance companies are embracing these software applications to automate tasks, gain insights from data analytics, and facilitate seamless communication and collaboration. With a highly competitive landscape, the insurance software market offers a wide range of solutions tailored to specific insurance sectors. As technology continues to advance, the insurance software market is expected to evolve further, providing innovative solutions to meet the evolving needs of the insurance industry and contribute to its continued growth and success.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)