Table of Contents

Introduction

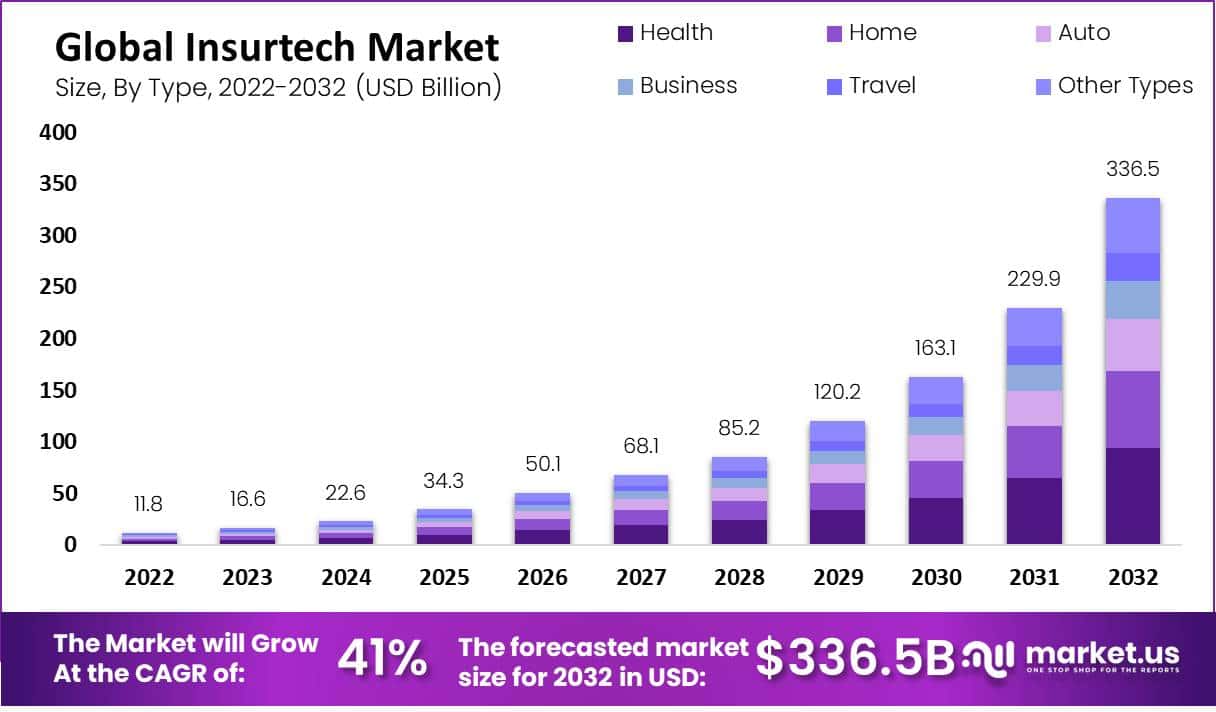

In 2023, the global Insurtech market was valued at USD 16.6 billion, a figure anticipated to surge to USD 336.5 billion by 2032. This exponential growth, with an estimated Compound Annual Growth Rate (CAGR) of 41.0% between 2023 and 2032, underscores the sector’s rapid evolution and expanding influence within the broader insurance industry.

The insurtech sector’s growth is propelled by increasing consumer demand for personalized, convenient insurance solutions, leveraging technology to streamline traditional, often time-consuming insurance processes. Digital platforms and mobile applications have emerged as key facilitators, offering easy access to insurance products and services tailored to individual needs and risk profiles, thereby enhancing customer engagement and satisfaction.

The sector faces challenges, including high investment costs associated with advanced technology and the need for extensive training for employees. Despite these hurdles, the promise of insurtech lies in its potential to disrupt traditional insurance models by offering innovative products and services that cater to evolving customer needs. The rise of insurtech also fosters opportunities for collaboration between startups and established insurance companies, merging agility and innovation with extensive distribution networks, capital, and industry expertise.

Key growth drivers include innovative solutions and rising awareness about insurance, with companies leveraging specialty client interests to develop offerings that enhance market growth. However, restraining factors such as high technology investment costs and the requisite extensive employee training pose significant challenges.

From a services perspective, managed services and support and maintenance segments are poised for growth, reflecting the increasing adoption of advanced technologies and distribution channels by insurance companies. This trend indicates a broader shift towards digital transformation within the industry, aiming to improve business models and adopt best practices.

Regionally, North America leads the insurtech market, attributed to an increase in product purchases and the presence of numerous startups. This prominence is followed by significant growth potential in the Asia Pacific, driven by emerging economies and financial hubs, indicating a global spread and acceptance of insurtech solutions.

Insurtech Statistics

- The Insurtech Market is projected to reach a staggering USD 336.5 billion by 2032, with a promising Compound Annual Growth Rate (CAGR) of 41.0% during the forecast period from 2023 to 2032.

- Cloud computing holds a substantial market share, offering flexibility, deployment simplicity, and resourcefulness, revolutionizing the insurance industry and propelling the growth of the Insurtech market. (Cloud computing revenue share exceeding 22.8% by 2022)

- Managed services account for a significant share, offering insurers expertise and technology to facilitate transformation, improve business models, and adopt best practices, driving growth within the Insurtech market. (Managed services segment accounted for more than 36% of all revenue)

- $4.6 billion was the total insurtech funding in 2023, marking the lowest level since 2017 and representing a 45% decline year over year (YoY) from $8.3 billion in 2022.

- The industry witnessed 455 insurtech deals globally in 2023, the lowest in a 6-year period.

- Property & Casualty (P&C) insurtech deals experienced a 25% YoY decrease, with Life & Health (L&H) insurtech deals declining even further.

- Early-stage insurtech deal sizes remained stable at $3 million in 2023.

- Early-stage deals accounted for 62% of total insurtech deals, the lowest deal share observed in 5 years.

- The United States regained the majority share of insurtech deals among global regions in 2023, surpassing the 50% mark for the first time since 2020.

- By 2024, it is estimated that over 60% of insurance companies will have implemented at least one insurtech solution.

- The adoption of insurtech solutions for automated claims processing is projected to increase by 45% among insurance providers between 2022 and 2024.

- Approximately 55% of insurance companies plan to integrate insurtech solutions for personalized product recommendations and dynamic pricing by the end of 2024.

- Over 65% of insurtech platforms are anticipated to offer embedded insurance capabilities for seamless integration with other products and services by 2024.

- The use of insurtech solutions for fraud detection and prevention is expected to grow by 40% among insurance companies between 2022 and 2024.

- By 2024, over 60% of insurtech deployments are projected to involve the use of artificial intelligence (AI) and machine learning (ML) for risk assessment and underwriting.

- Approximately 50% of insurance companies plan to adopt insurtech solutions for customer engagement and digital self-service capabilities by the end of 2024.

- It’s estimated that by 2024, over 70% of insurtech platforms will offer advanced data analytics and predictive modeling capabilities.

- The adoption of insurtech solutions for usage-based insurance (UBI) and telematics is projected to increase by 35% between 2022 and 2024.

- Over 55% of insurtech deployments are expected to involve the use of blockchain technology for secure data sharing and smart contracts by 2024.

Emerging Trends in Insurtech

- Generative AI Integration: Insurtechs and traditional insurance companies are increasingly planning to integrate generative AI into their offerings. This technology promises to accelerate innovation by combining vast amounts of data and computing power, transforming interactions with insurance carriers and improving financial results.

- Enhanced Connectivity via IoT: The insurance industry is witnessing the broader adoption of IoT, enabling insurers to better understand risks and customer needs in real-time. This is particularly evident in the auto sector with telematics but is expanding into life, health, property, and commercial lines, promising more accurate and dynamic risk assessments.

- Advancements in Process Automation: Emerging technologies are driving next-level automation and virtualization, reshaping insurance products and services. This includes the use of digital twins, 3D printing, and IoT for predictive maintenance, fundamentally transforming the claims experience.

- Focus on Trust Architecture: With insurers handling increasingly sensitive customer information, technologies such as blockchain are becoming pivotal. They enable more effective management of complex customer data, crucial for moving towards a predictive and preventive model of insurance.

Use Cases

- Fraud Detection: Generative AI is being applied to improve fraud detection capabilities, enabling insurance companies to identify and address fraudulent activities more effectively.

- Personalized Customer Services: Insurtechs are utilizing AI to create copilots for faster employee onboarding in claims, underwriting, and customer service, enhancing overall customer experiences.

- Real-time Risk Assessment: IoT and connected devices are being used to provide insurers with real-time data on customer behaviors and environmental conditions, leading to more accurate risk assessments and policy pricing.

- Predictive Maintenance: By monitoring equipment in real-time, industrial IoT is enabling predictive maintenance before claims happen, reducing the frequency and severity of losses.

Major Challenges

- Complexity in Adopting Generative AI: The implementation of generative AI involves navigating compliance issues, ensuring algorithmic outputs meet ethical standards, and training staff, posing significant challenges.

- Technology Debt: As the pace of technological advancement accelerates, insurers need to address foundational system upgrades and reduce technology debt to leverage new tools like generative AI effectively.

- Cybersecurity Concerns: With the increasing reliance on digital technologies, insurers face heightened cybersecurity risks. The evolving nature of cyber threats requires continual updates to security measures and coverage offerings.

- Regulatory Compliance: Navigating the complex regulatory landscape, especially with emerging technologies like blockchain and AI, remains a significant challenge for insurtechs and traditional insurers alike.

Recent Developments

- KFin Technologies:

- April 2023: Partnered with PolicyStreet to offer online insurance distribution platforms.

- August 2023: Launched KFin AI Assist, an AI-powered chatbot for insurance customer support.

- December 2023: Acquired Mindtree, gaining expertise in cloud-based insurance tech solutions.

- Majesco:

- May 2023: Released Majesco CloudPhore, a cloud-based insurance core system platform.

Top 11 Global Companies

The insurtech market is characterized by a dynamic landscape of innovation, with several companies leading the charge through technological advancements, strategic partnerships, and customer-centric solutions. Here’s an overview of the top market leaders in the insurtech space:

- Damco Group: Specializes in offering end-to-end IT and technology services. Damco is known for leveraging technology to provide innovative solutions across various sectors, including insurance, where it aids in digital transformation and operational efficiency.

- DXC Technology Company: A global leader in technology services, DXC offers a range of solutions to the insurance industry, focusing on helping companies navigate digital transformations, improve operations, and enhance customer service through technology.

- KFin Technologies: Primarily known for its services in the financial sector, KFin Technologies provides technology-driven solutions to streamline operations, including those in the insurance domain, facilitating smoother transactions and management.

- Majesco: Majesco stands out for its cloud insurance software solutions. It helps insurers modernize and innovate their businesses to adapt to the changing market, focusing on agility, innovation, and customer centricity.

- Oscar Insurance: Oscar Insurance is recognized for its consumer-focused health insurance, which uses technology and data analytics to simplify the health insurance experience, making healthcare more accessible and manageable for its members.

- OutSystems: Although not exclusively an insurtech company, OutSystems provides a platform for rapid application development, including for the insurance industry, enabling companies to develop, deploy, and manage applications faster and more efficiently.

- Quantemplate: Quantemplate specializes in data analytics and automation for the insurance and reinsurance industry. It offers solutions that streamline data processes, enhance operational efficiencies, and drive business growth through actionable insights.

- Shift Technology: Utilizes AI to offer solutions in insurance fraud detection and claims automation. Shift Technology helps insurers automate the claims process and detect fraudulent activities, thereby improving efficiency and reducing losses.

- Trov Insurance Solutions LLC: Trov is known for its innovation in on-demand insurance technology, enabling businesses and individuals to insure specific items through a digital platform, providing flexibility and personalized insurance solutions.

- Wipro Limited: A global information technology, consulting, and business process services company, Wipro offers comprehensive solutions to the insurance industry, including digital transformation, application services, and business process services to improve efficiency and customer engagement.

- Zhongan Insurance: As a pioneer in online-only insurance, Zhongan leverages big data and artificial intelligence to offer a wide range of customizable insurance products directly to consumers, emphasizing accessibility and innovation.

Conclusion

In conclusion, the insurtech sector stands as a beacon of innovation and growth within the insurance industry, marked by a remarkable trajectory of expansion. While challenges persist, the opportunities for market transformation, enhanced customer experiences, and strategic collaborations between new entrants and established players pave the way for a future where technology and insurance converge more seamlessly than ever before.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)