Table of Contents

Introduction

Insurtech Statistics: Insurtech, a fusion of “insurance” and “technology,” represents a transformative force within the insurance industry. Utilizing cutting-edge technologies like AI, big data analytics, and IoT to revolutionize insurance processes.

This evolution began with online aggregators and has since progressed through phases. Like digital insurance, data-driven decision-making, IoT adoption, blockchain implementation, and AI-driven automation.

Further, Insurtech’s significance lies in its ability to enhance the customer experience, refine risk assessment, reduce costs, foster innovation, and combat fraud. It is a pivotal driver of change, promising continued disruption and innovation in the insurance sector.

Editor’s Choice

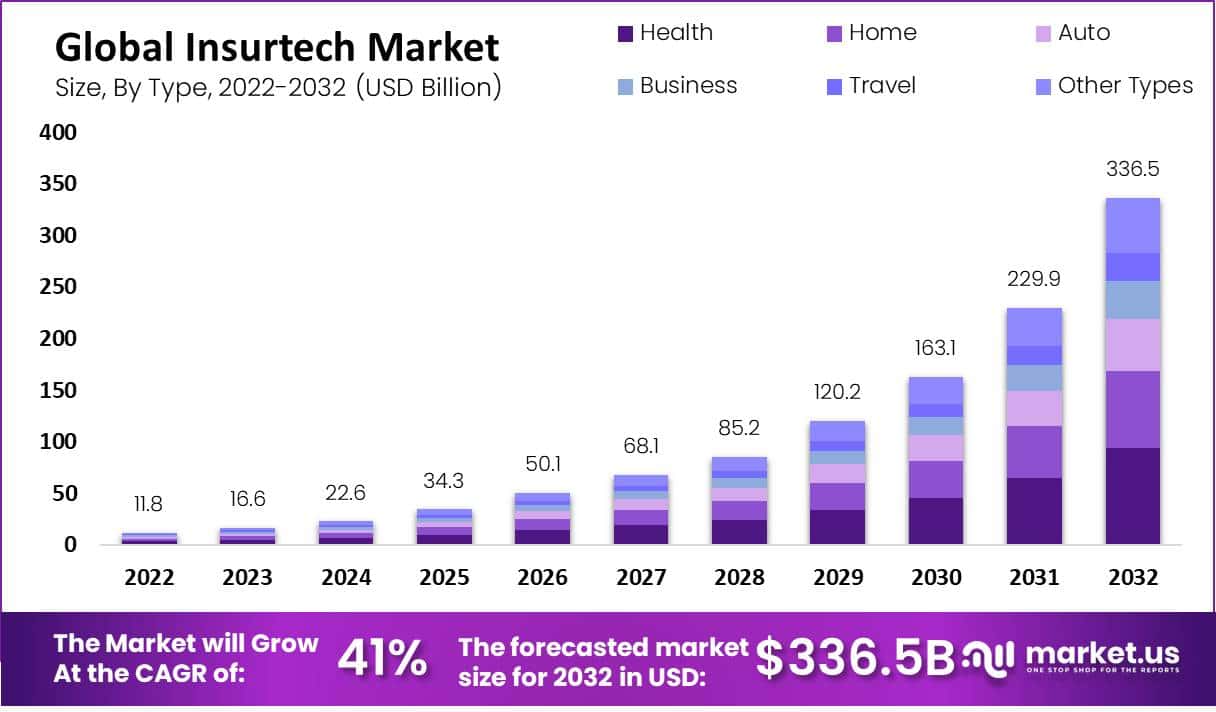

- In 2022, the Insurtech market generated USD 11.8 billion in revenue, which has been on a consistent upward trajectory.

- Looking ahead to 2032, the insurtech market is expected to double its revenue. Reaching a staggering USD 336.5 billion.

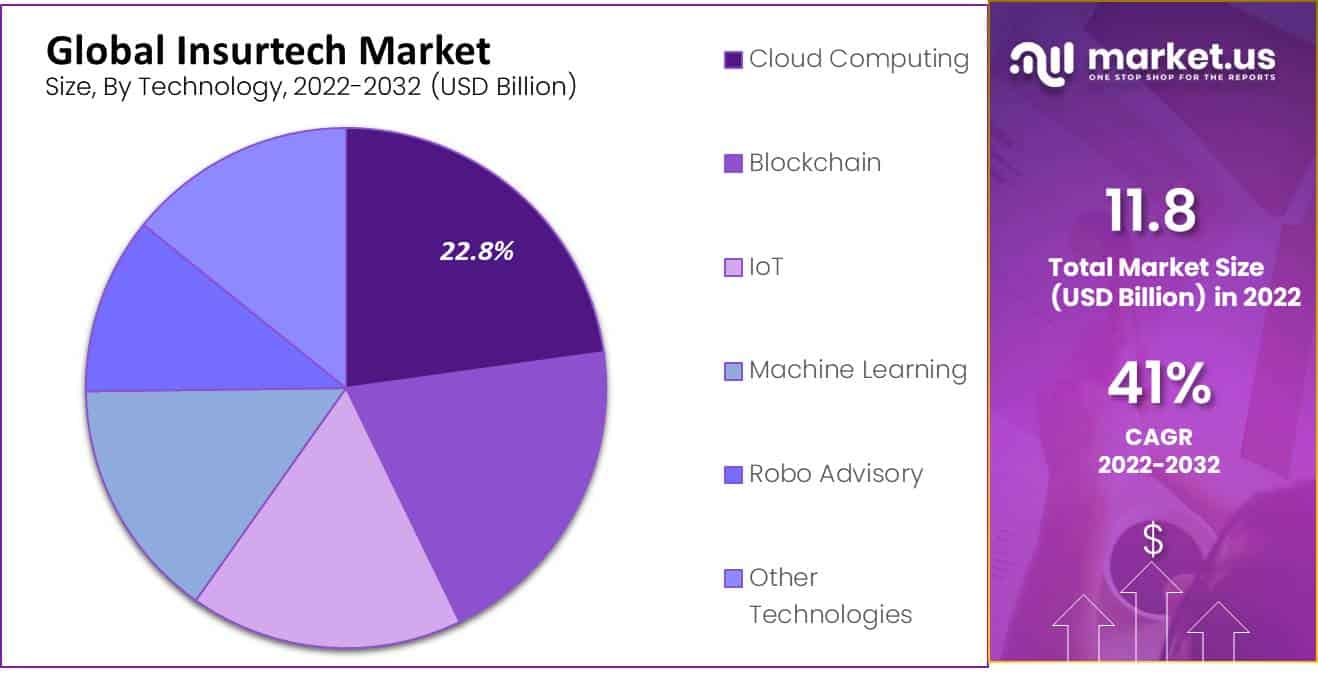

- As of the latest available data, cloud computing is the dominant technology, commanding a substantial market share of 23%.

- In 2022, the North American insurtech market was assessed at USD 2.5 billion. It was anticipated to grow substantially. With a projected compound annual growth rate (CAGR) of 53.2% from 2023 to 2030.

- The insurtech market in the Asia Pacific region is poised for substantial growth. With an expected compound annual growth rate (CAGR) of 39.1% spanning from 2023 to 2030.

- Moreover, Insurtech companies experienced a remarkable surge in funding in 2021. Amassing a record-breaking $15.4 billion, nearly double the levels seen in 2020, with 566 deals completed.

- In 2020, insurtech raised $7.5 billion globally, marking an all-time high in funding. This shows investors are confident in the industry’s growth potential, even amid a pandemic.

- In 2021, a record-breaking 58 insurtech companies were acquired by investors. Four insurtech pursued initial public offerings (IPOs), and another four engaged in deals with special purpose acquisition companies (SPACs).

Insurtech Market Size and Growth Statistics

Global Insurtech Market Size Statistics

- The insurtech market has been experiencing substantial growth over the past decade. At a CAGR of 41.0%, with its revenue steadily increasing yearly.

- In 2022, the market generated USD 11.8 billion in revenue, which has been on a consistent upward trajectory.

- In 2023, the revenue reached USD 16.6 billion, marking a significant jump.

- The trend is expected to continue as we move into the future. With projected revenues of USD 22.6 billion in 2024, USD 34.3 billion in 2025, and USD 50.1 billion in 2026.

- The insurtech market is anticipated to gain even more momentum. Hitting USD 68.1 billion in 2027 and USD 85.2 billion in 2028.

- By 2029, it is projected to cross the USD 100 billion milestone. With an estimated revenue of USD 120.2 billion.

- The growth trajectory remains robust, with revenues forecasted to reach USD 163.1 billion in 2030 and an impressive USD 229.9 billion in 2031.

- Looking ahead to 2032, the insurtech market is expected to double its revenue, reaching a staggering USD 336.5 billion.

- Further, this steady and remarkable growth underscores the increasing significance of insurtech in the global insurance industry. Technology plays a pivotal role in shaping its future landscape.

(Source: Market.us)

Global Insurtech Market Size- By Type Statistics

- According to type, the global insurtech market has witnessed remarkable growth over the years. With its total revenue steadily increasing from 11.8 billion USD in 2022 to an impressive 336.5 billion USD in 2032. This exponential growth can be attributed to various factors and the diversification of insurtech offerings across different sectors.

- In 2022, health insurance technology accounted for 3.3 billion USD. Followed by home insurance technology at 2.6 billion USD and auto insurance technology at 1.8 billion USD.

- Business insurance technology contributed 1.3 billion USD, while travel insurance technology accounted for 0.9 billion USD. Additionally, other types of insurance technology amounted to 1.9 billion USD.

- Fast forward to 2032, and the landscape has evolved significantly. Health insurance technology has surged to a staggering 94.2 billion USD. Showcasing the growing importance of digital solutions in the healthcare sector.

- Home and auto insurance technologies have also experienced substantial growth, reaching 74 billion USD and 50.5 billion USD, respectively. Reflecting the increasing reliance on technology in these domains.

- Business insurance technology has seen robust growth, standing at 37 billion USD. Travel insurance technology and other types have expanded to 26.9 billion USD and 53.8 billion USD, respectively.

- As we look ahead, the insurtech market is poised for continued expansion. Moreover, with the potential to revolutionize the insurance industry across various sectors. Offering innovative solutions and enhanced customer experiences.

- This remarkable growth trajectory underscores the profound impact of technology on the insurance landscape. Shaping how individuals and businesses protect themselves and their assets in an ever-evolving digital world.

(Source: Market.us)

Global Insurtech Market Size – By Technology Statistics

- The global insurtech market exhibits a dynamic landscape in terms of technology adoption.

- As of the latest available data, cloud computing is the dominant technology, commanding a substantial market share of 23%.

- Following closely behind, blockchain technology holds a significant share of 20%. Emphasizing its role in enhancing security and transparency within the insurance industry.

- Internet of Things (IoT) technology, with a 17% market share, plays a pivotal role in data collection and risk assessment.

- At 15%, machine learning is instrumental in data analysis and predictive modeling, contributing to more accurate underwriting and claims processing.

- With an 11% share, Robo advisory services are gaining traction in automating financial planning and investment decisions.

- Additionally, other emerging technologies collectively account for 14%. Reflecting the diverse and innovative approaches insurtech companies employ to reshape the insurance landscape.

- This technology-driven evolution underscores the industry’s commitment to leveraging cutting-edge solutions for improved efficiency, customer experiences, and risk management.

(Source: Market.us)

Regional Analysis of Insurtech Market Statistics

Insurtech is a rapidly growing industry with significant growth potential in various regions worldwide. The following sub-sections provide an overview of the insurtech market in different regions.

North America

- The insurtech sector in North America holds a prominent position as the largest market globally.

- In 2022, the North American insurtech market was assessed at USD 2.5 billion in value and is anticipated to undergo substantial growth. With a projected compound annual growth rate (CAGR) of 53.2% from 2023 to 2030.

- Further, this significant expansion is primarily propelled by the rising utilization of digital technologies and the increasing consumer appetite for tailored insurance offerings within the North American market.

Europe

- Europe is a substantial insurtech market, hosting many startups and well-established entities.

- As outlined, the European insurtech sector has secured a noteworthy portion, accounting for 16.6% of its progress and advancement.

- Within Europe, insurtech enterprises effectively use data analytics and telematics to enhance risk assessment. Streamline underwriting procedures, and provide flexible pricing options.

- Projections indicate that the European insurtech market is poised for significant growth. With an anticipated compound annual growth rate (CAGR) of 33.2% from 2023 to 2030.

Asia Pacific

- The Asia Pacific area is experiencing notable expansion within the insurtech sector. Propelled by the rising embrace of digital technologies and an increasing appetite for insurance offerings.

- The projects that the insurtech market in the Asia Pacific region is poised for substantial growth. With an expected compound annual growth rate (CAGR) of 39.1% spanning from 2023 to 2030.

- This growth trajectory is anticipated to culminate in a market size of USD 56.3 billion by 2030.

- Key drivers of this growth include the pervasive use of smartphones and internet access, alongside an expanding awareness of insurance products. Collectively fostering the development of the insurtech market in this region.

Rest of the World

- Significant growth is evident in the insurtech market across the rest of the world, encompassing regions like Latin America, the Middle East, and Africa.

- As per findings, the insurtech market in this global segment attained a value of USD 0.95 billion in 2022 and is poised for further expansion with an anticipated compound annual growth rate (CAGR) of 48.6% from 2023 to 2030.

- Key drivers of this expansion include the increasing adoption of digital technologies and the growing consumer demand for insurance products. Contributing significantly to the burgeoning insurtech market within these regions.

Insurtech Investment Statistics

- Insurtech companies experienced a remarkable surge in funding in 2021, amassing a record-breaking $15.4 billion, nearly double the levels seen in 2020, with 566 deals completed, as reported by CB Insights.

- However, the bulk of this investment activity was observed in the property and casualty (P&C) sector. Which accounted for a substantial 73% of all insurtech deals throughout the first three quarters of 2021.

- As the insurtech sector matures, there’s a noticeable trend of increasing valuations.

- In 2021, the average funding round amounted to $33 million. A significant rise from the $21 million seen in 2020.

- Furthermore, over a third of the total funding raised in 2021 was directed toward mid- to late-stage deals, ranging from $100 million to an impressive $1.2 billion.

- The landscape of insurtech funding is evolving as well. While insurance companies had a notable presence. They were involved in only 17% of insurtech deals during the first three quarters of 2021, down from 25% in 2020 and 42% in 2019.

- Instead, most funding came from private equity (PE) firms and other strategic investors. Driven by a sustained high level of interest in the insurance industry.

- These investors are attracted by the growth potential of insurtech firms. Their capacity to expand into new markets, and the robust activity surrounding exits.

- In 2021, a record-breaking 58 insurtech companies were acquired by investors. Four insurtech pursued initial public offerings (IPOs), and another four engaged in deals with special purpose acquisition companies (SPACs).

(Source: EY, CB Insights)

Global Insurtech VC Funding Statistics

- The global insurtech landscape has witnessed fluctuating venture capital (VC) funding levels in recent years.

- In the first half of 2018, insurtech ventures secured $1.8 billion in VC funding, indicating a growing interest in this sector.

- By the following year, H1 2019, funding nearly doubled, reaching $3.4 billion, reflecting the increasing confidence and investment in insurtech innovations.

- This momentum continued into H1 2020, with another $3.4 billion invested in insurtech startups.

- However, the sector experienced a significant surge in H1 2021, with a substantial $7.2 billion in VC funding, underscoring the industry’s potential and resilience amid global challenges.

- While H1 2022 saw a dip to $4.4 billion, H1 2023 recorded $2.2 billion in VC funding, indicating ongoing interest in insurtech but with some variability in investment levels.

- These fluctuations in funding illustrate the evolving dynamics and investor sentiment within the insurtech ecosystem.

(Source: MAPFRE)

Global Insurtech VC Investment- By Regional Statistics

- Venture capital (VC) investment in the insurtech sector exhibits a notable regional disparity, with the United States leading substantially.

- In the United States, insurtech ventures attracted a remarkable $1,200 billion in VC funding, reflecting the nation’s position as a global hub for technological innovation.

- Meanwhile, other regions also contributed significantly, albeit to a lesser extent. Further, in Asia, VC investment was prominent in the Rest of Asia and Southeast Asia, with $418 billion and $216 billion, respectively, signifying the growing interest in insurtech across the continent.

- With $341 billion in VC investment, Europe showcased its commitment to fostering insurtech innovation.

- In contrast, Latin America received a more modest $0.079 billion in insurtech VC funding, while the Rest of the World, encompassing Oceania and Africa, secured $0.038 billion.

- These figures illuminate the varying degrees of investment activity across regions, reflecting the diverse global insurtech development and adoption landscape.

(Source: MAPFRE)

Impact of Covid-19 on Insurtech

The Covid-19 pandemic has significantly impacted the insurance industry, leading to an increased need for digital transformation.

Insurtech companies have been at the forefront of this transformation, providing innovative solutions to meet the changing needs of consumers. Here are some key statistics on the impact of Covid-19 on Insurtech:

- In 2020, insurtech raised $7.5 billion globally, marking an all-time high in funding. This shows investors are confident in the industry’s growth potential, even amid a pandemic.

- 2020 saw a pinnacle in insurtech funding, with €6 billion worth of deals.

- This highlights that insurtech companies are becoming increasingly attractive for investments and collaborations with insurers despite the pandemic.

- COVID-19 and its impacts are accelerating the implementation of new mobile apps and other online platforms to meet consumer needs.

- The insurance industry’s upward digitization trajectory has not changed, and insurtech companies play a significant role in this transformation.

- The pandemic-induced upheaval in revenue temporarily impacted the anticipated growth rates for IT and technology spending by property and casualty (P&C) insurers from the first quarter of 2019 to the end of 2020.

- Nevertheless, both P&C and life insurance companies in prominent markets are projected to boost their investments in technology and hasten their digital evolution in the coming years to improve the online user experience.

(Source: BCG, McKinsey, Mondaq)

Recent Developments

Acquisitions and Mergers:

- Swiss Re acquires insurtech firm Zipari: In early 2023, Swiss Re completed its acquisition of Zipari, a customer experience platform for health insurance, for $250 million. This acquisition aims to enhance Swiss Re’s digital offerings and improve customer engagement through advanced analytics and AI.

- Munich Re acquires TechAssure: Munich Re acquired TechAssure, a company specializing in technology-driven insurance solutions, for $150 million in mid-2023. This merger is expected to strengthen Munich Re’s insurtech capabilities and expand its market reach in the digital insurance space.

New Product Launches:

- Lemonade’s Car Insurance: In early 2024, Lemonade launched its new car insurance product, leveraging AI and behavioral economics to offer competitive rates and a seamless customer experience. This product aims to disrupt the traditional car insurance market by providing instant claims processing and personalized policies.

- Next Insurance’s Workers’ Compensation: Next Insurance introduced a workers’ compensation insurance product in mid-2023, targeting small businesses. This product offers flexible coverage options, real-time quotes, and simplified claims management through a user-friendly online platform.

Funding:

- Hippo Insurance raises $350 million: In 2023, Hippo Insurance, a home insurance insurtech, raised $350 million in a Series E funding round to expand its product offerings, enhance its technology platform, and accelerate its growth in new markets.

- Policygenius secures $125 million: Policygenius, an online insurance marketplace, secured $125 million in early 2024 to invest in its technology infrastructure, expand its customer service team, and develop new tools for insurance comparison and purchase.

Technological Advancements:

- AI and Machine Learning in Underwriting: Advances in AI and machine learning are being used to improve underwriting processes. Allowing insurtech companies to assess risks more accurately, streamline policy issuance, and reduce fraud, leading to more efficient operations.

- Blockchain for Claims Processing: The development of blockchain technology is being applied to insurtech solutions. To enhance transparency, security, and efficiency in claims processing, enabling faster and more reliable transactions.

Regulatory and Strategic Developments:

- EU Digital Insurance Directive: The European Union implemented the Digital Insurance Directive in early 2024, aiming to promote innovation, ensure data protection, and enhance consumer trust in digital insurance solutions across member states.

- US National Association of Insurance Commissioners (NAIC) Guidelines: The NAIC issued new guidelines in 2023 to regulate the use of AI and big data in insurance, focusing on ethical considerations, data privacy, and consumer protection.

Research and Development:

- Telematics-Based Insurance: R&D efforts are focusing on developing telematics-based insurance products that use data from connected devices, such as smartphones and car sensors, to offer usage-based insurance policies, providing more accurate risk assessments and personalized pricing.

- Cyber Insurance Solutions: Researchers are exploring new cyber insurance solutions to address the growing threat of cyber attacks, providing businesses with comprehensive coverage, risk assessment tools, and incident response services.

Conclusion

Insurtech Statistics – In conclusion, the insurtech landscape is marked by rapid evolution and substantial growth. This is evident in increasing market revenues, venture capital funding, and expanding adoption across regions.

Moreover, North America, Europe, Asia Pacific, and other global markets are witnessing significant developments in the insurtech sector, driven by digital technology adoption, demand for personalized insurance, and the growing awareness of insurance products.

While the COVID-19 pandemic initially disrupted revenue and investment patterns, it ultimately demonstrated the resilience and attractiveness of insurtech for insurers and investors.

Moreover, as the industry matures, insurtech firms are expected to play an increasingly integral role in reshaping the insurance landscape. With innovative technologies and customer-centric solutions at the forefront of their strategies.

The future promises even greater transformation and collaboration between insurtech and traditional insurance players, benefiting consumers through enhanced services and tailored insurance products.

FAQs

Insurtech is a combination of “insurance” and “technology.” It refers to using innovative technologies, such as AI, data analytics, and blockchain, to revolutionize and enhance various aspects of the insurance industry.

Insurtech is changing the insurance industry by making processes more efficient, improving customer experiences, enabling personalized insurance products, and enhancing risk assessment and fraud detection.

Examples include digital insurance platforms, IoT-based telematics for auto insurance, AI-powered chatbots for customer service, and blockchain-based smart contracts for claims processing.

Insurtech startups are typically funded through venture capital investments, private equity, and partnerships with traditional insurance companies. Crowdfunding and initial public offerings (IPOs) are also funding options.

Insurtech faces challenges related to regulatory compliance, data privacy, cybersecurity, and resistance to change within traditional insurance companies. Market competition and achieving profitability can also be challenging.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)