Table of Contents

Market Overview

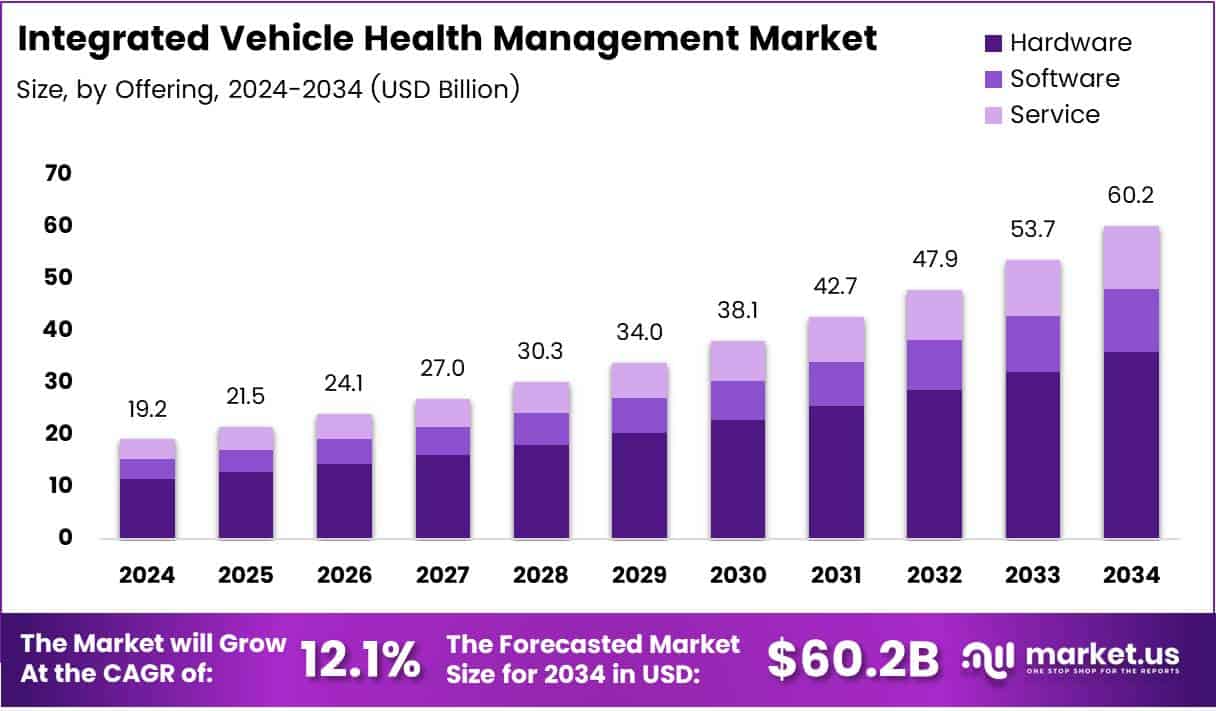

The Global Integrated Vehicle Health Management Market size is expected to be worth around USD 60.2 Billion by 2034, from USD 19.2 Billion in 2024, growing at a CAGR of 12.1% during the forecast period.

The Integrated Vehicle Health Management (IVHM) market is experiencing robust growth, driven by rising demand for predictive maintenance, enhanced safety, and real-time diagnostics. With a projected CAGR of 12.1% from 2025 to 2034, the industry is evolving rapidly across both passenger and commercial vehicle segments. The integration of sensors, advanced telematics, and AI-powered diagnostics is transforming fleet operations and minimizing vehicle downtime. As a result, OEMs and Tier-1 suppliers are investing in scalable IVHM platforms that improve performance and reduce lifecycle costs.

Opportunities are expanding in emerging markets where connected vehicle penetration is increasing. The adoption of electric vehicles is further amplifying demand for advanced health management systems, as EVs require continuous monitoring to ensure battery and system efficiency. Government agencies are also playing a vital role. In fact, the National Highway Traffic Safety Administration (NHTSA) highlights that vehicle health monitoring can reduce crash risks by up to 20%, emphasizing its safety potential.

Moreover, regulatory pressure around emissions, vehicle recalls, and safety compliance is pushing manufacturers to implement intelligent monitoring solutions. Public-private investments, such as smart infrastructure development and R&D grants, are accelerating innovation. Overall, IVHM is not just a technology shift it is a strategic imperative for the future of mobility.

Key Takeaways

- The Global Integrated Vehicle Health Management Market is projected to reach USD 60.2 Billion by 2034, growing at a CAGR of 12.1% from 2025.

- Hardware led the By Offering segment with a market share of 58.2% in 2024.

- Diagnostics dominated the By Application segment in 2024, ensuring proactive fault detection.

- Service Centers topped the By Channel segment in 2024, offering expert vehicle health support.

- Commercial & Defense Aviation held the largest share in the By End Use segment in 2024.

- North America led the market in 2025 with a 31.2% share, valued at USD 5.9 Billion.

Market Drivers

Rising demand for connected vehicles fuels market growth. More autonomous vehicles need smart health systems. Government rules push for safer, cleaner vehicles. This drives IVHM technology adoption.

Fleet operators also boost demand. They use IVHM to reduce downtime. It helps plan repairs before failures. This saves time and money.

Consumer demand for safer cars adds pressure. Buyers want better performance. IVHM meets those needs. It supports proactive maintenance and better driving.

Technology Trends

New tech powers the IVHM market. IoT sensors provide real-time data. Cloud platforms offer remote diagnostics. AI and machine learning predict failures. These tools increase system accuracy and speed.

Edge computing allows faster decisions. Vehicles process data onboard. This cuts delays and boosts safety.

Data dashboards are improving. Drivers and managers get alerts quickly. Mobile apps enhance access and usability.

Market Challenges

High system cost limits adoption. Small fleets often can’t afford IVHM. OEMs must lower costs for wider use.

Cybersecurity is a growing issue. Connected cars face data risks. IVHM systems must protect sensitive information.

Lack of standardization is another challenge. Different OEMs use different protocols. This slows integration and increases costs.

Segmentation

Offering Analysis:

In 2024, hardware led the IVHM market with 58.2% share. Key components like sensors and processors are vital for real-time monitoring and system performance. Hardware remains crucial due to growing demand for IoT-based vehicle systems.

Application Analysis:

Diagnostics was the top application in 2024. It helps detect issues early, ensuring timely repairs and safety. While prognostics is growing, diagnostics remains essential for real-time vehicle monitoring.

Channel Analysis:

Service centers dominated the market in 2024. They offer expert repair and diagnostics, making them the preferred choice over OEMs due to convenience, cost, and quick service.

End Use Analysis:

Aviation led the end-use segment in 2024. High safety standards and strict regulations drive strong demand for health monitoring systems. Other sectors are growing but lag behind aviation in adoption.

Regional Insights

North America

North America leads the IVHM market with a 31.2% share, driven by advanced vehicle tech adoption, strong regulations, and demand for predictive maintenance.

Europe

Europe follows closely, supported by strict emission laws, growing AI/IoT use in vehicles, and strong presence of major automakers like those in Germany and France.

Asia Pacific

Asia Pacific is growing rapidly due to rising car ownership, expanding middle class, and government focus on emission control in China, India, and Japan.

Middle East & Africa

This region sees steady growth from smart city investments and tech adoption, though market penetration is still low compared to others.

Latin America

Latin America is growing slowly, with Brazil and Mexico leading demand, but progress is limited by infrastructure and economic challenges.

Key Players and Competition

The IVHM market is competitive. Top companies invest in R&D. They aim to offer smarter and faster systems.

Strategic partnerships are increasing. Firms work with tech companies and OEMs. These deals help expand market reach.

Innovation is key. Companies focus on mobile alerts, cloud dashboards, and predictive analytics. Many offer modular, scalable solutions.

Autonomous and electric vehicles push further innovation. IVHM must adapt to support self-driving systems and battery health.

Future Outlook

The IVHM market has strong future potential. Vehicles are becoming smarter and more connected. Health management will be critical for all vehicle types.

Predictive maintenance will reduce unexpected failures. Cloud and AI will improve diagnostics and speed.

EVs will drive demand for battery health tools. Self-driving cars will need continuous system checks. IVHM will support this shift.

Companies that invest in innovation will lead. Offering low-cost, reliable, and user-friendly IVHM solutions is key. Growth will come from fleets, EV makers, and smart mobility firms.

Recent Developments

In March 2025, Fleetio acquired Auto Integrate after securing $450 million in funding. This strategic move strengthens Fleetio’s position in the fleet management sector.

Following the acquisition, Fleetio plans to integrate Auto Integrate’s repair and maintenance automation tools. This will streamline operations and expand service offerings for fleet customers globally.

Conclusion

In conclusion, the Integrated Vehicle Health Management (IVHM) market is set for steady growth as vehicles become smarter, connected, and more reliant on predictive systems. With increasing demand for safety, reliability, and cost-effective maintenance, IVHM will play a central role in the future of automotive technology. Continued advancements in AI, IoT, and cloud computing will drive innovation, while rising adoption among fleets and electric vehicles will expand market reach. As regulations tighten and vehicle complexity grows, IVHM solutions will become essential for manufacturers, fleet operators, and end-users worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)